Playing Chicken With An Aeroplane

by James CherrySummary

- Of the three companies, LATAM, who just filed for chapter 11, is the only one with enough cash to cover their expenses for this year.

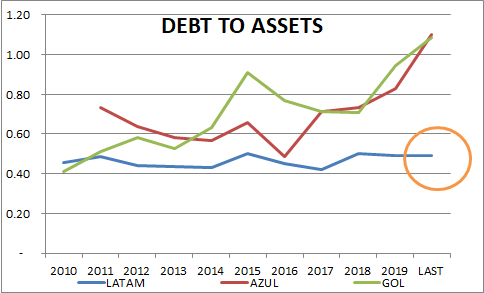

- The debt to asset ratios demonstrates that Azul and Gol are not as financially leveraged as LATAM even before the results of 1Q20.

- I am very bearish on AZUL and GOL as their financial leverage is just as high as that of LATAM, and they too have a considerable amount of debt expiring.

Are investors allowing the fear of missing out (FOMO) to get the best of them? Yesterday afternoon, I was watching a retail portfolio manager give an interview about how he was managing his client's portfolio. He stated that he is keeping a lot of cash on hand to invest in opportunities while at the same time refusing to go on a buying spree. He went on to mention that he believes a lot of the recovery in the US stock market is because of FOMO purchases and not based on fundamentals. I understand his point of view, but at the time, I did not fully agree with it.

"Volaris leads Latin American airline sector higher" than this headline flashed across my screen, and my curiosity and a little FOMO kicked in. In the article, it mentions that LATAM Airlines group filed for chapter 11 bankruptcy last night and that the stock prices for the rest of the Latin American Airlines are now higher due to this news. As I enter into my home broker, the words of what that gentleman said during his interview began repeating itself in my head (I will get professional help for this soon).

I have only invested in indices with airlines in them, but never have I invested directly in an airline. There was a period of my life when I flew at least once a week in Brazil or internationally, and I disliked my flying experience with every airline. I would never invest in a company that produces something that I do not like.

Scenario Azul And Gol Stock Prices Increase

At the time of writing this article, GOL and AZUL were up by 4.2% and 2.4%, respectively. I entered into the Seeking Alpha platform and began downloading the balance sheets and income statements for the LATAM airlines group (LTM), and GOL and AZUL, too. There is one issue with this analysis, and that is the fact that we do not have LTM's 1Q20 results while we do have them for the other two companies.

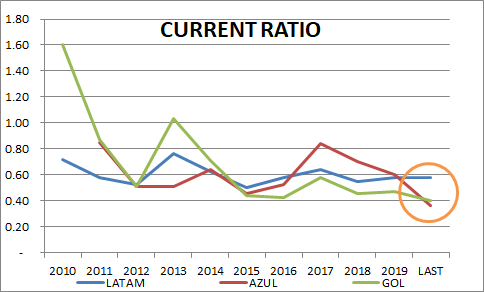

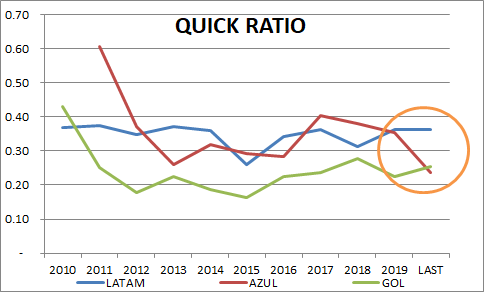

Just a reminder, for the current ratio, quick ratio, and the Debt to Asset ratio, the higher the number, the better is the basic idea, but in no way do these ratios predict if a company will go bankrupt.

Source: Seeking Alpha Key Data for each company

Based on my current ratio analysis, LTM is the least leveraged of the three leading Brazilian airlines. Azul's current ratio was 0.84 in 2017, and 1Q20, it was 0.37. In 2019, Azul had a higher current ratio than LATAM, and GOL's was lower than the two.

Source: Seeking Alpha Key Data for each company

In 2019, Gol and Azul both had a quick ratio slightly lower than LATAM. In 1Q20, Gol's liquidity improved while Azul's declined. It appears in the above graph that LATAM and Azul kept their quick ratio at an average of 0.35 while Gol consistently stayed at an average below 0.30.

Source: Seeking Alpha Key Data for each company

The debt to asset ratio chart demonstrates that Azul and Gol are not as financially leveraged as LATAM even before the results of 1Q20.

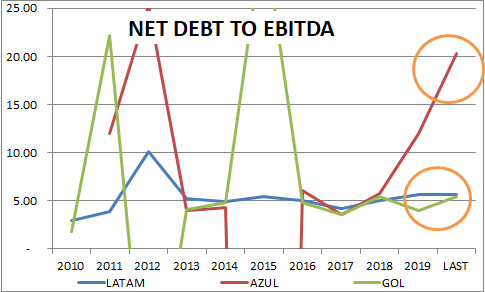

Source: Seeking Alpha Key Data for each company

Azul has the highest Net Debt to EBITDA ratio, meaning that at the current rate that it generates EBITDA, it will need to generate 20 times its current EBITDA to pay off its net debt. Gol and LATAM will need to generate their current EBITDA five times to pay off their total net debt.

Source: Companies' last financial statement

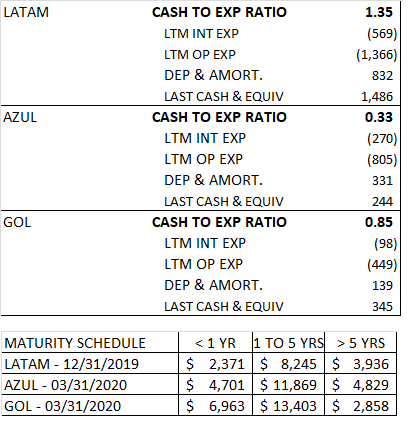

I created a ratio of my own to see how much cash is available to cover AZUL's, LTM's, and GOL's interest and operating expenses. This analysis assumes that this year's expenses will be the same as their last twelve months' expenses. I am not taking into consideration any of the expense reductions that may have been executed by the companies. Of the three companies, LATAM, who just filed for chapter 11, is the only one with enough cash to cover their expenses for this year. Gol has enough cash to cover almost ten months of its costs, and Azul has enough for nearly four months.

Azul and Gol both have substantial amounts of liabilities expiring in less than a year. LATAM also had a large amount of debt principal expiring in less than one year, probably one of the contributing factors to its bankruptcy.

Conclusion

I remember reading a saying once that applies to my conclusion, which was, "sometimes it is best to miss the train than to get on the wrong one." I understand the logic behind investing in the remaining Brazilian airlines as they will probably absorb the market share of LATAM throughout its chapter 11 process. But I encourage you to think about this, AZUL and GOL are as leveraged, if not more, than LATAM. Do not let FOMO get the best of you and leave the speculation up to the big dogs. I am very bearish on AZUL and GOL as their financial leverage is just as high as that of LATAM, and they too have a considerable amount of debt expiring soon.

Please follow me via Seeking Alpha for analysis of Brazilian and Food Industry Stocks.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in AZUL, GOL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.