Sterling Bancorp: Deposit Repricing To Counter High Credit Costs, Yield Decline

by Sheen Bay ResearchSummary

- Provision expense will likely be higher than normal in the second quarter due to the deterioration in the economic outlook.

- The maturity of expensive deposits and FHLB advances will ease the pressure on the net interest margin.

- Paycheck Protection Program and the Main Street Lending Program will likely support earnings.

- The riskiness of the stock diminishes the attractive valuation.

Earnings of Sterling Bancorp (STL) plunged by 88% sequentially in the first quarter to $0.06 per share due to a surge in provision expense and net interest margin compression. On an adjusted basis, the company reported a loss of $0.02 per share. After the decline in the first quarter, earnings will likely improve in the remainder of the year but remain below last year’s earnings. Provision expense will likely remain high in the second quarter before trending downwards to a normal level in the second half of the year. Additionally, the net interest margin will likely compress further due to the decline in LIBOR. However, the margin will likely receive some support from the repricing of a large number of expensive deposits. Moreover, the Paycheck Protection Program and the upcoming Main Street Lending Program will support earnings. Overall, I’m expecting earnings to decline by 47% year over year in 2020 to $1.08 per share. The probability of an earnings miss is above average this year due to the uncertainties surrounding the COVID-19 pandemic. The December 2020 target price suggests a high upside from the current market price. However, I’m adopting a neutral rating on STL due to the risks and uncertainties.

Deposit Repricing to Soften the Blow from LIBOR Decline

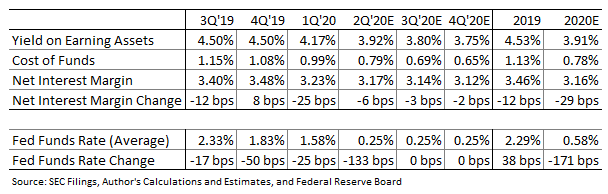

The net interest margin (NIM) will likely contract further in the second quarter due to the plunge in LIBOR this month following the Federal Funds rate cut in March. The fall in interest rates will pressurize the yields on $6.8 billion worth of variable-rate loans, representing 31% of total loans. However, deposit repricing in the remainder of the year will counter the yield decline. As mentioned in the first quarter’s conference call, around $1 billion worth of certificates of deposits, representing 4% of total deposits, will mature in the second quarter. Additionally, $500 million worth of FHLB advances will mature in the second quarter. The management is targeting to reduce the cost of funds to 35-45bps by the fourth quarter from 81bps at the end of the first quarter, as mentioned in the latest investor presentation. Considering these factors, I’m expecting NIM to decline by 6bps in the second quarter, and by 29bps in the full year. The following table shows my estimates for yield, cost, and NIM.

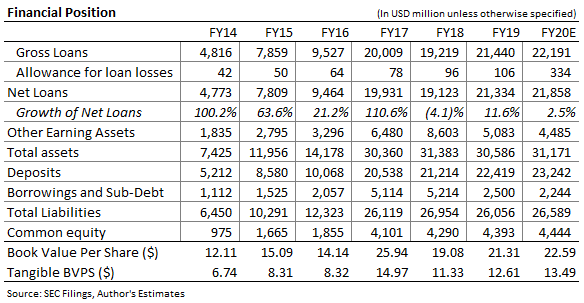

STL’s participation in the Paycheck Protection Program (PPP) will likely drive up loan balances by around $500 million in the second quarter, as mentioned in the conference call. Moreover, STL intends to participate in the Main Street Lending Program, which will further drive up loan balances. The Main Street Lending Program should start in two weeks, according to news sources. The management expects around 75% of PPP loans to get forgiven in the third quarter; therefore, the year-end loan balance will only partially reflect the loan growth during the year. Overall, I’m expecting loans to grow by 2.5% in the second quarter before declining by 1.75% in the third quarter, on a linked-quarter basis. Further, I’m expecting the year-end balance to be 2.5% higher than the loan balance at the end of 2019. The following table shows my estimates for loans and other balance sheet items.

Provision Expense Likely to Remain High in the Second Quarter Before Trending Downwards

STL’s provision expense surged to $138 million in the first quarter from $11 million in the last quarter of 2019. The management used a blend of Moody’s scenarios, reflecting moderate and severe recessions, to determine the reserve level for loan losses. The management’s base case assumed GDP contraction of 18% in the second quarter, as mentioned in the conference call. Further, the base case assumed that GDP would not return to prior levels of production until 2022. While the assumption of a prolonged economic recovery appears reasonable under the current economic outlook, the assumption of 18% GDP contraction appears too optimistic. The Federal Reserve Bank of Atlanta’s GDP nowcast points to a contraction of 41.9% in the second quarter. Therefore, I’m expecting STL to make another sizable reserve build in the second quarter, which will raise provision expense on a year-over-year basis. I’m expecting provision expense to trend downwards to a normal level in the second half of the year.

STL’s exposure to COVID-19 sensitive industries will likely drive provision expense in the second quarter. Around 1.1% of total loans are to the restaurant franchise business, which has been one of the hardest-hit industries in the lockdown. STL has modified around 32% of the franchise portfolio, which shows the extent of the problems in the industry. Further, hospital and retail commercial real estate altogether make up around 8.1% of total loans; however, the exposure to these industries is not very disconcerting because the loan-to-value ratios are quite low, between 50-55%. Considering these factors, I’m expecting STL’s provision expense to increase to $243 million in 2020 from $46 million in 2019.

Expecting Earnings per Share of $1.08 in 2020

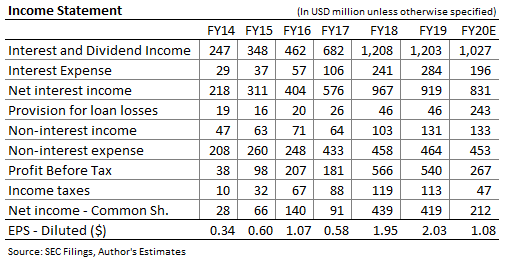

Earnings will likely improve in the remaining three quarters compared to the first quarter due to lower provision expense, loan growth, and deposit repricing. For the full year, earnings will likely remain lower than last year’s level because of high provision expense and NIM contraction. Loan growth will likely support earnings this year. Overall, I’m expecting earnings per share to decrease by 47% year over year to $1.08 per share. The following table shows my income statement estimates.

The probability of a negative earnings surprise is higher than average in 2020 due to the uncertainties related to COVID-19. The actual provision expense can differ materially from estimates if the economic downturn is more severe and lasts longer than expected. Additionally, the net interest income can miss its estimate for 2020 if less than expected PPP loans get forgiven by the end of the year. STL will book the unamortized PPP fees at the time of loan forgiveness; therefore, a delay in loan forgiveness can reduce the fee booked under net interest income this year. These risks and uncertainties make STL a high-risk investment.

I’m expecting STL to maintain its quarterly dividend at the current level of $0.07 per share in the remainder of 2020. There is very little risk of a dividend cut because the earnings and dividend estimates suggest a payout ratio of 26%, which is easily affordable. The dividend estimate for 2020 implies a dividend yield of 2.3%.

Risks Tarnish the Attractive Valuation

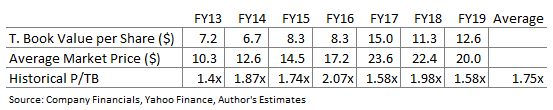

I'm using the historical price-to-tangible-book value multiple, P/TB, to value STL. The stock has traded at an average P/TB multiple of 1.75 in the past, as shown below.

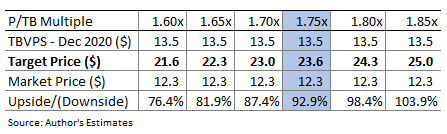

Multiplying this P/TB ratio with the forecast tangible book value per share of $13.5 gives a target price of $23.6 for December 2020. This target price implies a significant upside of 93% from STL's May 26 closing price. The following table shows the sensitivity of the target price to the P/TB multiple.

The attractive valuation is countered by the high riskiness of the stock. As mentioned above, the probability of an earnings surprise is unusually high this year due to the uncertain economic environment. The uncertainties pose risks to the valuation; hence, I’m adopting a neutral rating on STL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.