Tracking Dan Loeb's Third Point Portfolio - Q1 2020 Update

by John VincentSummary

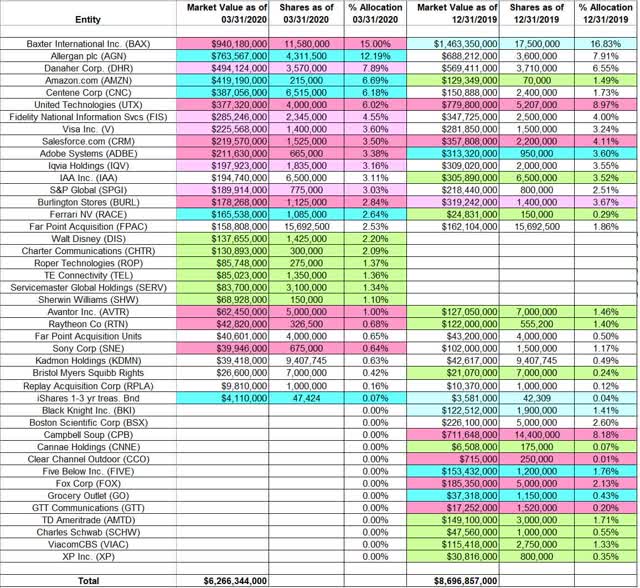

- Dan Loeb's 13F portfolio value decreased from $8.70B to $6.27B this quarter. The number of positions decreased from 37 to 30.

- Third Point increased Amazon and Centene while dropping Campbell Soup.

- The top three positions are at just over one-third of the portfolio: Baxter International, Allergan plc, and Danaher.

This article is part of a series that provides an ongoing analysis of the changes made to Dan Loeb’s 13F stock portfolio on a quarterly basis. It is based on Third Point’s regulatory 13F Form filed on 05/15/2020. Please visit our Tracking Dan Loeb’s Third Point Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q4 2019.

The 13F portfolio is very concentrated with the top three holdings accounting for ~35% of the entire portfolio. Recent 13F reports show around 35 long positions. This quarter, Loeb’s 13F portfolio value decreased ~28% from $8.70B to $6.27B. The number of holdings decreased from 37 to 30. The largest five individual stock positions are Baxter International, Allergan plc, Danaher Corp., Amazon.com, and Centene Corp.

Third Point lost 10.4% through April this year compared to a negative 9.3% return for the S&P 500 Index. Annualized returns since December 1996 inception are at 13.5% compared to 7.4% for the S&P 500 Index. AUM is distributed among several strategies of which the long/short equity portion accounts for ~40%. In addition to partner stakes, Third Point also invests the float of Third Point Reinsurance (TPRE) and capital from London listed closed-end fund Third Point Offshore (OTC:TPNTF). To know more about Dan Loeb's Third Point, check out his letters to shareholders at their site. His activist investing style is covered in the book, "The Alpha Masters: Unlocking the genius of the world's top hedge funds".

Note: Large equity investments not in the 13F report include Sony (SNE), EssilorLuxottica (OTCPK:ESLOY), and Nestle (OTCPK:NSRGY). All three are activist stakes. SNE is a $1.5B investment made in June 2019 when the stock was trading at around $50 per share. It is currently at ~$62. The ESLOY investment was made in early 2019 when the stock was trading at ~$62.50 per share. It currently trades at ~$61. The NSRGY position is from 2017 and the stock has rallied over 50% since.

New Stakes:

Walt Disney (DIS) and Charter Communications (CHTR): DIS is a 2.20% of the portfolio position purchased at prices between $85 and $148 and the stock currently trades at ~$121. The ~2% CHTR position was established at prices between $372 and $543 and it is now at ~$510.

Roper Technologies (ROP), TE Connectivity (TEL), ServiceMaster Global Holdings (SERV), and Sherwin-Williams (SHW): These are small (less than ~1.5% of the portfolio each) new positions established this quarter. ROP is a 1.37% of the portfolio position purchased at prices between $254 and $393 and it currently trades at ~$370. The 1.36% TEL stake was established at prices between $53 and $100 and it is now at $80.62. SERV is a 1.34% of the portfolio position purchased at prices between $20.25 and $38.75 and it currently goes for $30.12. The 1.10% SHW stake was established at prices between $397 and $597 and it is now at ~$583.

Stake Disposals:

Campbell Soup (CPB): The large (top three) ~8% CPB stake was established in Q2 and Q3 2018 at prices between $35 and $42. There was a ~17% stake increase in Q1 2019 at prices between $32 and $41. Last three quarters had seen a one-third reduction at prices between $35.80 and $49.50. The disposal this quarter was at prices between $41.40 and $53.85. The stock is now at $47.36.

Note: CPB position was an activist stake. Third Point initially pursued the replacement of the entire 12-member board. They succeeded in replacing three board members and top management (CEO and CFO).

Boston Scientific Corp. (BSX): The 2.60% BSX stake was established in Q1 2019 at prices between $33 and $41. There was a ~10% stake increase in Q2 2019 while last quarter saw similar trimming. The position was eliminated this quarter at prices between $25.85 and $45.75. The stock is now at $36.19.

Five Below (FIVE): FIVE was a 1.76% of the portfolio stake purchased in Q3 2019 at prices between $104 and $135. Last quarter saw the position increased by ~40% at prices between $123 and $134. The stake was disposed this quarter at prices between $52.50 and $128. The stock is currently at ~$100.

Fox Corp. (FOX): FOX was a ~2% of the portfolio position purchased in Q1 2019 at prices between $28.75 and $39.55. Last two quarters had seen a ~50% selling at prices between $30 and $38. That was followed with the elimination this quarter at prices between $20 and $38. The stock is now at ~$29.

Black Knight Inc. (BKI), Cannae Holdings (CNNE), Charles Schwab (SCHW), Clear Channel Outdoor (CCO), GTT Communications (GTT), Grocery Outlet (GO), TD Ameritrade (AMTD), ViacomCBS (VIAC), and XP Inc. (XP): These small (less than ~1.5% of the portfolio each) positions were disposed during the quarter.

Stake Increases:

Allergan plc (AGN): AGN was a large (top five) merger arbitrage stake established in Q3 2019 at prices between $156 and $170. This quarter saw a ~20% stake increase. Last June, AbbVie (ABBV) agreed to acquire Allergan in a cash-and-stock ($120.30 per share cash and 0.8660 shares of ABBV for each share of AGN held) and that transaction closed earlier this month.

Amazon.com (AMZN): AMZN is a large 6.69% of the portfolio position purchased last quarter at prices between $1,705 and $1,870. The stake saw a ~200% increase this quarter at prices between $1,677 and $2,170. The stock is now well above those ranges at ~$2422.

Centene Corp. (CNC): The large 6.18% CNC stake was purchased in May 2019 at around ~$55 per share compared to the current price of $64.49. This quarter saw a ~170% stake increase at prices between $45.55 and $68.

Note: On Centene, it was reported that Third Point had wanted the company to consider selling itself before spending $15.3B for the acquisition of WellCare Health. That transaction closed in January.

Ferrari NV (RACE): RACE is now a 2.64% of the portfolio position. A small position was purchased last quarter. This quarter saw the stake built at prices between ~$130 and ~$180. The stock currently trades at ~$163.

iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY): The minutely small 0.07% position was increased during the quarter.

Stake Decreases:

Baxter International (BAX): BAX is Loeb’s largest position at ~15% of the 13F portfolio. The stake was established in Q2 2015 and increased substantially the following quarter. Recent activity follows: December 2018 saw a ~22% selling (8M shares) at $68.62 and that was followed with another ~18% selling (5M shares) in Q2 2019 at $76.37. Both these were block trades. Q3 2019 saw a ~27% selling at prices between $81 and $90. That was followed with another one-third selling this quarter at prices between $71.50 and $93.30. The stock currently trades at ~$85. Loeb’s cost-basis on BAX is ~$40.

Danaher Corp. (DHR): The top three ~8% DHR stake was established in Q3 2015 at prices between $60.90 and $71.50 and increased by two-thirds in Q1 2016 at prices between $62 and $74. It currently trades well above those ranges at ~$159. There was a ~20% stake increase in Q1 2019 at prices between $98 and $132. This quarter saw a ~4% trimming.

Note: The prices quoted above are adjusted for the Fortive (FTV) spin-off in July 2016.

United Technologies (UTX): UTX was a large ~6% of the portfolio position established in Q1 2019 at prices between $104 and $129. Q2 2019 saw a ~7% trimming while last quarter there was a ~13% stake increase. There was a ~23% reduction this quarter. The merger of United Technologies with Raytheon and the separation from Carrier (CARR) and Otis (OTIS) closed last month. The new entity is Raytheon Technologies (RTX) which currently trades at ~$65. Terms called for United Technologies to be renamed Raytheon Technologies and for UTX shareholders to receive one share of CARR and 0.5 shares of OTIS for each share held. CARR currently trades at $19.51 and OTIS at $50.89.

Fidelity National Information Services (FIS): The 4.55% FIS position came about as a result of FIS acquiring WorldPay in a cash-and-stock transaction (0.9287 FIS shares and $11 cash for each share held) that closed in July 2019. Third Point had a ~3% of the portfolio (2.2M shares) position in WorldPay. It was established in the 2017-2018 time frame at a cost-basis of ~$70 per share. The resultant FIS stake was also increased by ~25% in Q3 2019 at prices between $125 and $140. It currently trades at ~$137. This quarter saw a ~6% trimming.

Visa Inc. (V): The 3.60% V stake was established in Q2 2018 at prices between $118 and $136. The stock is now well above that range at ~$193. This quarter saw a ~7% trimming.

Salesforce.com (CRM): The 3.50% CRM position was more than doubled in Q4 2018 at prices between $121 and $160. Q3 2019 saw the position almost doubled again at prices between $140 and $160. The stock is now at ~$177. This quarter saw a ~12% trimming.

Adobe Inc. (ADBE): ADBE is a 3.38% stake that saw a ~75% increase in Q2 2018 at prices between $212 and $258 and another ~30% increase next quarter at prices between $242 and $275. There was a ~30% selling this quarter at prices between $285 and $383. The stock is now at ~$377.

IQVIA Holdings (IQV): The 3.16% IQV position was purchased in Q3 2018 at prices between $99 and $131 and increased by ~25% in Q3 2019 at prices between $143 and $162. The stock currently trades at ~$144. This quarter saw an ~8% trimming.

S&P Global (SPGI): SPGI is a ~3% position established in Q2 2016 at prices between $96 and $128. The position has wavered. Recent activity follows: the five quarters through Q1 2019 saw a combined ~60% selling at prices between $164 and $213. Since then, the activity has been minor. The stock is now at ~$312.

Burlington Stores (BURL): The 2.84% portfolio stake in BURL was established in Q2 2019 at prices between $146 and $177. The position saw a ~115% stake increase next quarter at prices between $168 and $205. This quarter saw a ~20% selling at prices between $121 and $248. The stock currently trades at ~$209.

Avantor Inc. (AVTR) and Raytheon (RTN): These very small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

IAA Inc. (IAA): IAA is a medium-sized ~3% of the portfolio stake established last quarter at prices between $36 and $47. IAA is a June 2019 spinoff of the salvage auction business of KAR Auction (KAR). It started trading at ~$40 and currently goes for $39.26.

Far Point Acquisition (FPAC) & Units: The 2.53% position established in Q2 2018 has since been kept steady.

Note: Far Point Acquisition is a SPAC that Third Point co-sponsored. They control 24.9% of the business. In January, FPAC merged with Global Blue in a $2.6B deal. Ex-NYSE (Intercontinental Exchange subsidiary) President Tom Farley is CEO.

Kadmon Holdings (KDMN): The very small 0.63% stake in KDMN was kept steady this quarter.

Note: The bulk of the stake in Kadmon Holdings is from prior to its IPO in July 2016 (PE investment). The biopharma was founded in 2010 by Sam Waksal (ImClone insider trading conviction and 7-year prison term infamy, circa 2003). Loeb controls ~8% of Kadmon Holdings.

Bristol-Myers Squibb Rights (BMY.RT) and Replay Acquisition Corp (NYSE:RPLA.U): These very small (less than 0.5% of the portfolio each) positions were kept steady during the quarter.

The spreadsheet below highlights changes to Loeb’s 13F stock holdings in Q1 2020:

Disclosure: I am/we are long ABBV, AMZN, VIAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.