Intuitive Surgical: The Growth Leader In Surgical Robotics

by Andres Cardenal, CFASummary

- Intuitive Surgical is the global leader in surgical robotics.

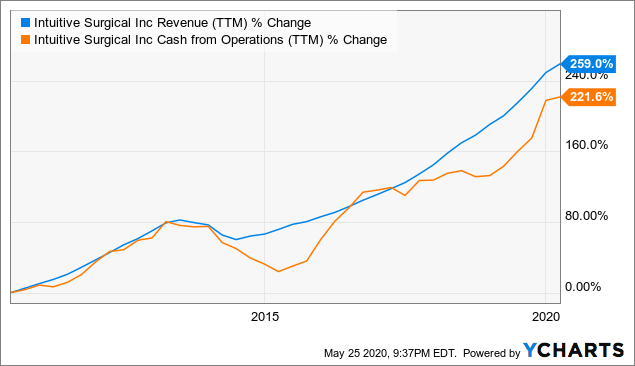

- The company has produced outstanding growth rates in both revenue and cash flow over the years.

- Intuitive surgical has a proven business model and abundant room for future growth.

- The stock is not cheap at all, and rising competitive pressure is an important risk factor to watch.

- All in all, the risk and reward trade-off looks attractive over the long term.

Surgical robotics is a remarkably promising market with enormous opportunities for growth, and no company is better positioned to capitalize on such opportunities than Intuitive Surgical (ISRG). The stock is not cheap at all, and increasing competition is a major risk factor to watch. However, the risk and reward trade-off in Intuitive Surgical looks quite attractive over the long term.

An Outstanding Growth Business

Intuitive Surgical designs, manufactures, and sells the da Vinci surgical system and related instruments and accessories. The da Vinci system is a robot-assisted surgical system that enables minimally-invasive surgery to reduce the trauma associated with open surgery. This creates plenty of benefits for both patients and surgeons, improving the healthcare outcome and creating all kinds of efficiencies.

Intuitive surgical has been the market leader in this area over the past two decades, and the company has benefitted from sustained growth in both revenue and cash flow in the long term.

Data by YCharts

The company has been widely successful at gaining acceptance from both patients and healthcare professionals. Management considers that a major driving force behind this consistently strong growth is the introduction of electronic health records into many health systems. It is one thing to publish research showing the benefits of the da Vinci system, and a far more tangible argument to show how the system improves both healthcare and economic outcomes in a specific environment.

The company has been actively working with hospitals to combine its robotic surgery data with their electronic health records in order to enable management to assess and measure clinical outcomes, efficiency metrics, and direct and indirect costs for open surgery, laparoscopic surgery, and da Vinci robotic-assisted surgery in their own settings, with their own patient populations, care teams, and reimbursements.

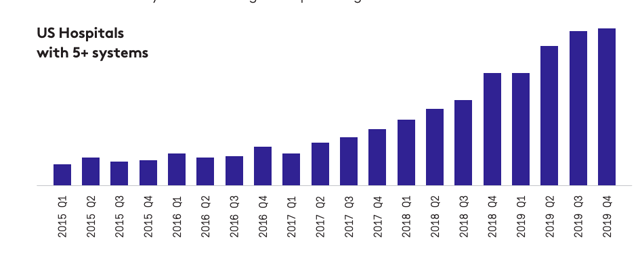

This has been a major driving force for the business, and over the past three years the number of hospitals that are operating five or more da Vinci systems at a single campus has grown more than 400%.

Source: Intuitive Surgical

Management explained in the 2019 annual report:

We believe there are three primary drivers for this trend. First, our ecosystem of products and services provides the support necessary to enable an effective robotic surgery program at scale. Second, surgeons find value in using our products and personally advocate to use them. And third, local, hospital-specific data analysis is showing that outcomes, efficiency and hospital profitability enabled by da Vinci surgical systems supports the use and expansion of their programs.

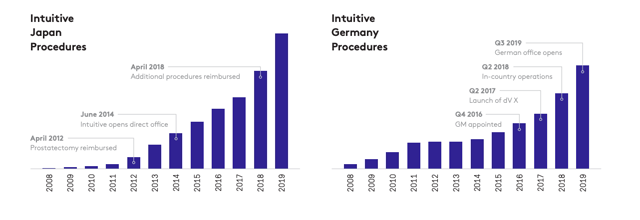

Importantly, the company is demonstrating an ability to successfully implement this playbook in different countries. Growth metrics in Japan and Germany are clearly promising, and they reflect Intuitive Surgical's ability to succeed in different markets.

Source: Intuitive Surgical

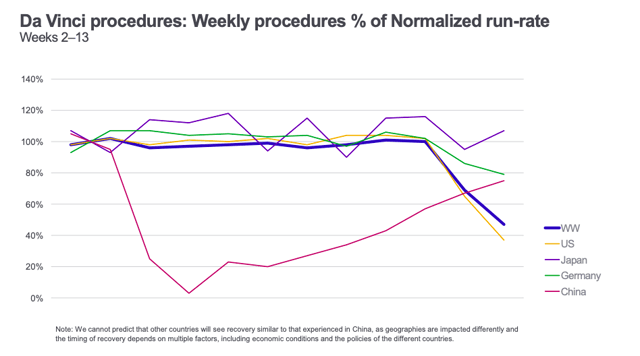

Financial performance during most of the first quarter of 2020 was above management expectations until COVID-19 appeared on the horizon. The company then registered a decline in elective procedures in different countries as many elective surgeries were postponed. The quick recovery in China and Japan can provide reasons for optimism, although it is still too early to tell how the data in Europe and the U.S. will evolve.

Price Action And Valuation

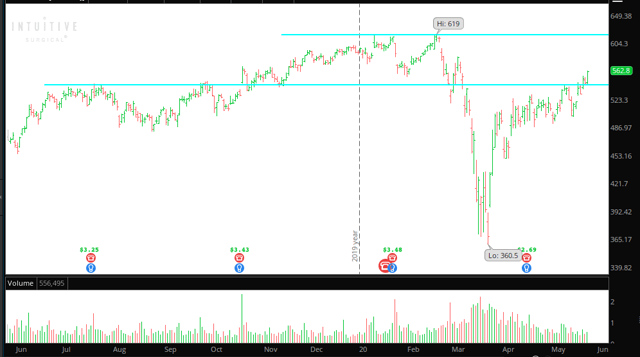

The stock crashed with the rest of the market in March, and then it made an impressive recovery, mostly following a similar path to that of other high growth stocks in the technology and healthcare sectors. The most recent earnings report was a positive driver for the stock price, since both revenue and earnings came in ahead of Wall Street expectations in the first quarter.

Source: TOS

In terms of valuation, the stock is obviously not as cheap as it was at the end of March, but it is not overvalued either when considering the company's long term growth prospects.

Shares of Intuitive Surgical have always traded at relatively expensive valuation levels, and this has not stopped the stock from delivering huge returns for shareholders over the long term. After all, valuation levels reflect growth expectations, and Intuitive Surgical has more than justified its demanding valuation ratios with consistent growth over time.

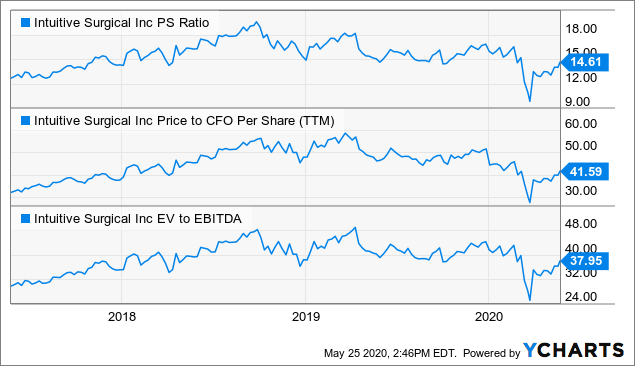

The price to operating cash flow ratio is still quite demanding at nearly 41.6. However, when we look at different valuation ratios such as price to sales, price to operating cash flow, and EV to EBITDA, valuation levels look relatively attractive in comparison to the company's history over the past few years.

Data by YCharts

Risk And Reward Going Forward

Intuitive Surgical still has plenty of opportunities for growth. The market for robot-assisted surgeries will continue growing at a compelling speed in the years ahead, and the COVID-19 pandemic will most probably accelerate the trends towards technology investments and efficiency optimization in the healthcare sector on a global scale.

The da Vinci systems can be used in different kinds of surgeries, and the more surgeries are performed with da Vinci, the more revenue the company makes in instruments and accessories too. Instruments and accessories have particularly attractive profit margins, so this growth venue should have a double impact on earnings, producing both increased revenue and a larger share of revenue being retained as profits.

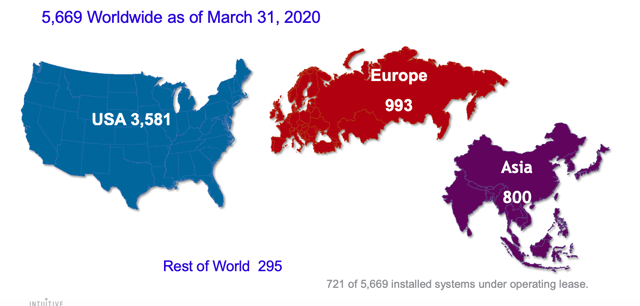

Intuitive Surgical has plenty of room for international expansion, and the company has proven that it has the capability to successfully enter new countries over time.

Source: Intuitive Surgical

Besides, major industry trends such as Artificial Intelligence for clinical applications, diagnostic support, and operational efficiency will drive plenty of opportunities for growth and innovation in the years ahead.

The company will be facing increased competitive pressure in the middle term, not only in lower-cost robotic-assisted surgery but also from industry giants such as Medtronic (MDT) and Johnson & Johnson (JNJ) with abundant financial resources and plenty of technical capabilities. This is arguably the main risk factor to watch when assessing a position in Intuitive Surgical.

The market opportunity should be large enough for multiple players to do well, and Intuitive Surgical comes second to none in terms of competitive strengths. In fact, increased presence from large healthcare corporations could provide more validation to robot-assisted surgeries, enlarging the size of the total market and benefitting the different players involved.

However, rising competitive pressure is always an important risk factor to watch, especially when investing in a company that is priced for aggressive growth expectations. The impact of more competition on overall revenue growth should be rather contained due to the overall market growth, but competition could generate pricing pressure, which would have a negative impact on margins.

Overall, Intuitive Surgical is a well-established leader in an area with plenty of potential for growth in the long term. The stock is not cheap at all, and increasing competition is a major risk factor to watch. However, there is a good chance that investors in Intuitive Surgical will be rewarded with attractive returns in the next 3 to 5 years.

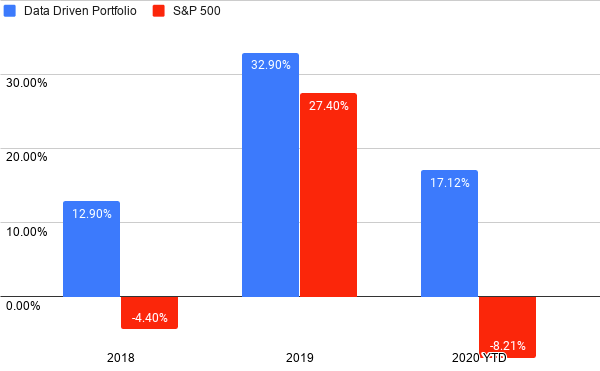

Capitalize on the power of data and technology to make better investment decisions with superior performance over the long term. A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on quantitative factors. Our portfolios have outperformed the market by a considerable margin over time, and they are built on the basis of solid quantitative research and statistical evidence. Click here to get your free trial now, you have nothing to lose and a lot to win!

Performance as of May 24, 2020

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ISRG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.