Agenus 1181 Is A Potential Cancer Game Changer

by William MeyersSummary

- Agenus AGEN1181 may work better than Yervoy.

- More data is expected Friday, May 29, at ASCO.

- iNKT cell therapy also looks promising.

Agenus (AGEN) is a pharmaceutical company focused on immunotherapies. Its current lead candidates are balstilimab, which has the same target, PD-1, as Opdivo and Keytruda, and zalifrelimab, which has the same CTLA-4 target as Yervoy. Agenus can claim to have a larger cancer immunotherapy pipeline than any other pharmaceutical company. While risks of failure exist until the company can demonstrate Phase 3 or equivalent results acceptable to the FDA, I see Agenus as likely becoming vastly more valuable in this decade.

I covered zalifrelimab and balstilimab in Agenus Reveals Improved Cancer Immunotherapy Results. In this article, I will take a deeper look at AGEN1181 because it looks very promising, and new data will be released on Friday, March 29, at ASCO. I will also briefly introduce the new iNKT cell therapy AGENT-797. I believe that with all the excitement around COVID-19, many investors are overlooking the high rewards that can come from approvals of new cancer therapies, leading to Agenus being undervalued.

AGEN1181

AGEN1181 is a CTLA-4 moderator, giving it the same basic target as zalifrelimab and Yervoy. It can be used as a monotherapy or in combination with balstilimab. It is Agenus's second-generation CTLA-4 moderator, following zalifrelimab. I will use Yervoy, which is sold by Bristol-Myers (BMY) as a baseline. Yervoy was approved by the FDA in 2011 for the treatment of melanoma. It is an artificial antibody that works by downregulating the CTLA-4 checkpoint, which in turn allows Cytotoxic T cells to recognize certain mutated cancer cells and destroy them. In Q1 2020, Yervoy generated $396 million in sales for Bristol-Myers. It is currently approved in the U.S. for melanoma and (in combination with Opdivo) for renal cell carcinoma. The FDA recently approved Yervoy in combination with Opdivo for first line Non-Small Cell Lung Cancer and separately for liver cancer. It is being tested in clinical trials for bladder cancer, mesothelioma and prostate cancer. Yervoy works best on cancers with a high mutation burden, of which melanoma is the best example. Attempts to get it to be effective with other types of cancer, alone or in combination, have been less successful.

Currently, Yervoy is the only CTLA-4 checkpoint inhibitor on the market, but several are being developed. Because Yervoy is an antibody, which is a complex protein that adheres to another complex protein, it is possible that, with a different amino acid sequence in the active region, an antibody might get better results. These results might be reflected in monotherapies or in combination with PD-1 inhibitors or other therapeutic agents. In theory, AGEN1181 has been engineered as such an improvement on Yervoy, but that needs to be proven in clinical trials. Although exactly how it was done has not been revealed, Agenus claims 1181's active region has:

increased immunogenicity, increased T-cell activation, beyond which we see with first-generation CTLA-4. Superior combination with PD-1, as you see on slide 4, as well as important potential safety benefits such as a reduction in endocrinopathies for patients treated. And we expect to increase or broaden the patient population of responders: patients who are unlikely to respond to a first generation CTLA-4 due to a genetic polymorphism, that impacts about 40% of the population. — Dr. Jennifer Buell at Q1 2020 analyst conference.

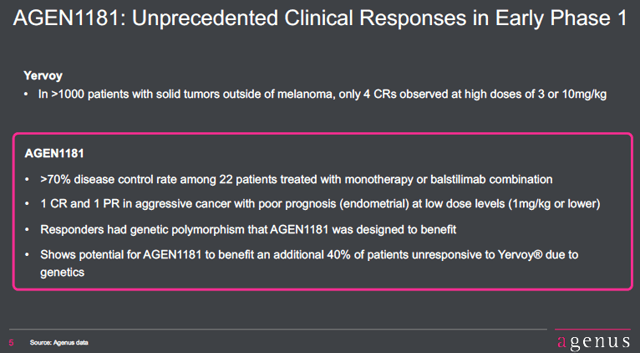

While I wish to emphasize that this is still early data from a small number of patients, the results so far are impressive, as shown on this slide:

Source: Agenus Q1 2020 presentation, Slide 5

Agenus asserted 1181 can benefit 3X more patients than Yervoy. That said, it might take years to get to commercial revenue even if 1181 is on track for success. Then it would need to compete with a well-established brand, Yervoy, and perhaps other CTLA-4 agents. It will take time to expand the label to cancers beyond the initial indication chosen. But it is a good guess that over time sales could ramp up to $1 billion per year or more, based on the current Yervoy run rate of about $1.6 billion per year.

The next data point will be on May 29, when 1181 updated data will be presented at ASCO. It may only show an incremental change from prior data, or it could be a stock-mover.

AGENT-797

The Agenus pipeline is deep, including several therapies licensed to well-established companies. The latest to head to clinical trials is AGENT-797, which is a cell therapy. More specifically, it is an iNKT, or Invariant Natural Killer T cell, therapy. Two targets have been chosen: COVID-19 and cancers. On May 13, Agenus and its subsidiary AgenTus reported the acceptance of the IND for AGENT-797 for cancer by the FDA. The Phase 1 trial should start later this year. It is too early to say much more about it. It is being developed by AgenTus, which Agenus is considering spinning off to be a separate company. Stockholders would receive AgenTus stock as a dividend.

The Agenus immunotherapy generation machine

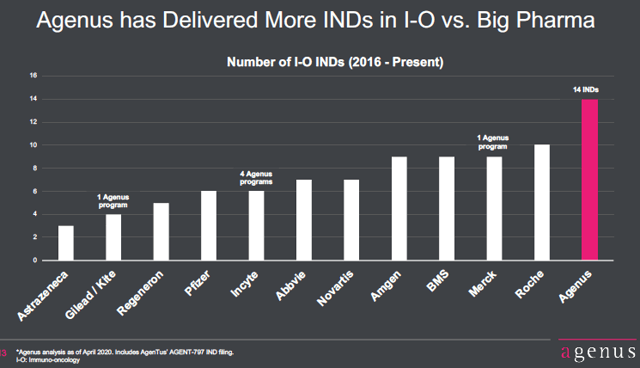

Source: Agenus Q1 2020 presentation, Slide 13

Agenus has filed 14 INDs, applications for human testing of new drugs, with the FDA since 2016. All are immuno-oncology therapies. This is more I-O therapies than any one of the larger commercial companies. Agenus has been able to do this because it has long been specializing in I-O. Its QS-21 is a component of GSK's successful Shingrix vaccine. Agenus added to its expertise in antibodies by acquiring other small but nimble companies. Its pipeline now includes 23 potential therapies if known preclinical agents are included. It has generated cash by licensing some of its discoveries to companies like Gilead (GILD) and Incyte (INCY).

Cash and Caveats

That said, Agenus has not been a darling of Wall Street. At the end of Q1 2020 it had a cash balance of $92 million, a bit thin for a company with so much to develop. Net loss in the quarter was $45 million, with $32 million cash burn, so at that rate cash would run out in Q4. However, Agenus has taken steps to reduce cash burn by $50 million per year. It is expecting about $45 million in milestone payments. If it looks like data for balstilimab and zalifrelimab will lead to FDA approval and commercialization, that should boost the stock price. With a higher stock price cash could be raised with less share dilution than if the share price stays at the current level. In addition, Agenus is in term sheet discussions with two different pharmaceutical companies that could result in cash infusions in 2020.

Aside from potential cash difficulties or share dilution, the usual rules for clinical-stage assets could apply. New data could reveal safety or efficacy problems. FDA approval is never assured. Pricing of commercial products is uncertain, they may not excite prescribers, or may be unable to get traction against competition.

Conclusion

I think Agenus has been overlooked this year because of the COVID-19 epidemic and investor money flowing into companies developing vaccines and therapies for that. Cancer is not going away. Current treatments can be approved upon. Submissions of balstilimab and zalifrelimab data to the FDA for potential approval may be just around the corner (before year-end 2020). AGEN1181 looks like it might be objectively better than Yervoy as a therapy. Beyond that the pipeline is broad. Agenus seems to have at least as much insight into the human immune system as any other company, and those insights and the therapies developed from them appear to be about to bear fruit. Agenus closed at $2.54 on May 26, giving it a market cap of $431 million. That is about equal to revenue from one quarter of Yervoy. Nothing is guaranteed, but the data looks good, so I think Agenus investors should start pricing in some success with balstilimab, zalifrelimab, and 1181.

Disclosure: I am/we are long AGEN, GILD,BMY,INCY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.