Nexstar Media Group Is A Buy

by Patrick DoyleSummary

- I think the shares of Nexstar Media Group are trading at a significant discount, given the sustainability of the dividend.

- With apologies to Taleb, I think this company is "Anti-Fragile" in that it's benefiting from the current high demand for news.

- For those nervous about buying shares at the moment, I recommend a short put strategy that is a "win-win" trade in my estimation.

Since I wrote my bullish piece on Nexstar Media Group Inc. (NXST) just under 2 years ago, the shares are up just under 7% against a gain of just under 6% for the S&P 500. Much has happened since then, obviously, so I thought I'd look in on the name again. I'll try to determine whether the shares represent good value or not by looking at both the financial history here, and by looking at the stock itself as a thing distinct from the underlying business. In particular, I want to focus in on the sustainability of the dividend. I think that's important because a sustainable dividend will offer some support to the stock, and a dividend that will likely be cut will eventually crater the shares. In addition, I'll offer what I consider to be a reasonable options trade here. Finally, I will offer some commentary on recent insider activity. For those who missed the title of this article, and who are too impatient to read through my stuff, I'll leap to the point. I think Nexstar is a buy at current levels based on the dividend sustainability and valuation.

Financial Snapshot

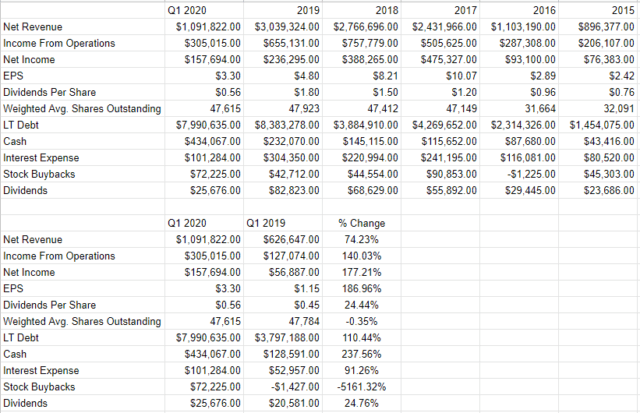

The financial history here indicates that Nexstar is a growth company. In particular, over the past five years, revenue and net income have grown at CAGRs of 27.6% and 25.3% respectively. This has caused earnings per share to grow at a CAGR of just under 15%. Most importantly in my view is the fact that management has treated shareholders very well, in that since 2015 they have returned just over $286 million to investors in the form of ever growing dividends. This has caused dividends per share to grow at a CAGR of about 19%.

It also seems that the growth story is intact when comparing the first three months of 2020 to the same period a year ago. The topline and bottom lines were up just over 74% and 177% respectively.

Dividend Sustainability

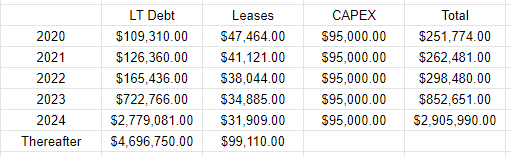

At the moment, I think investors are particularly interested in whether or not a dividend is sustainable. If a dividend can be maintained at the moment, the shares will likely hold up against further capital loss. If there's a better than average chance that the company's financial obligations will swamp the firm, the dividend will be cut and the shares will react inevitably badly. For that reason, I want to focus entirely on whether the dividend can be maintained at current levels. In order to do that, I'll compare the size and timing of upcoming obligations to the resources available to the firm. For your enjoyment and edification, I've compiled a list of the three largest uses of cash in the table below. Please note that CAPEX is an estimate based on the actual capital expenditures over the past four years, so this figure is more flexible. While CAPEX is variable, it is the outflow that is the least obligatory from the company's perspective, so this imprecision isn't the end of the world in my view.

Anyway, the table suggests that the company will need to make payments of just over $251 million in 2020, and will need to make another $262 million next year. Against this, Nexstar has about $434 million of cash on the balance sheet. In addition, the company has generated cash from operations of about $417 million over the past year. Although the pandemic has impacted many companies negatively, it seems that it has actually helped this business as the demand for news has increased during the pandemic. Given all of this, I think the dividend is quite sustainable at these levels. I'd be quite comfortable buying these future dividends at the right price.

Source: Latest 10-K

Source: Company filings

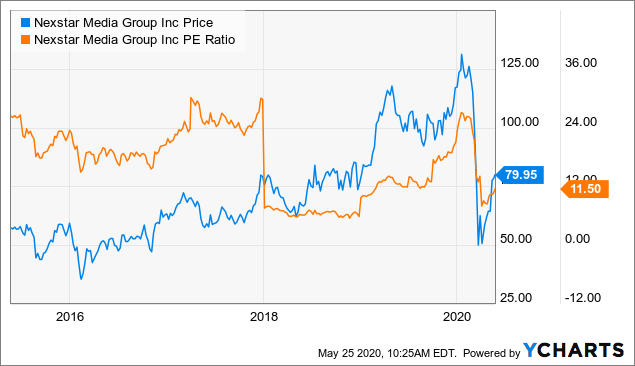

The Stock

"At the right price" is a critically important sentence in my view. I'd be happy to buy this company if it isn't overpriced. For that reason, I need to spend some time writing about the stock as a thing distinct from the underlying business. In particular, before I buy, I want to make sure that the stock is trading at a reasonable valuation. I judge whether or not shares are reasonably priced in a few ways. First, I look at the ratio of price to some measure of economic value (like earnings, free cash flow, and the like). I want to see that the shares are trading at a discount to both the overall market and to the company's own history. At the moment, it seems that the shares are trading on the low end of their historical range, which I like a great deal.

Data by YCharts

Source: YCharts

In addition to looking at the ratio of price to economic value, I want to also try to understand what the market is assuming about the future based on the current stock price. In order to do that, I employ the methodology described by Professor Stephen Penman in his book "Accounting for Value." In this book, Penman walks an investor through how they can use a standard finance formula (and the magic of high school algebra) to isolate the "g" (growth) variable to work out what the market must be thinking about the long term prospects for the firm. Applying this to Nextsar suggests the market is assuming a perpetual growth rate here of ~1%. In my estimation, that is an extraordinarily pessimistic assessment of the future here, which makes me quite comfortable owning the shares.

Options As Alternative

I can certainly understand if some investors might be somewhat gun shy about buying stocks at the moment. Such people have a choice to make in my estimation. They can tell themselves that they'll wait for shares to drop to a more reasonable level from here. I think the problem is that in when shares do drop to a better entry price, there will be even more great reasons to not invest at that point, and the investor will let the opportunity slip away. I therefore think short put options make sense as an alternative, and create a "win-win" trade in my view. If the shares remain above the strike price, the investor simply pockets the premium, which is never a hardship. If the shares drop in price, the investor will be obliged to buy, but will do so at a price that they think represents a good entry price for the equity.

At the moment, my preferred short puts here are the January 2021 duration with a strike of $60. These are currently bid-asked at $5.60-$7.40. If the investor simply takes the bid here, and is subsequently exercised, they'll be obliged to buy at a price ~32% below the current market price for the shares. Holding all else constant, that works out to a dividend yield of over 4%. In my view, that's a great entry point for a company that has a history of raising its dividends so dramatically.

I really hope that I've gotten you somewhat excited about the "win-win" profit potential of put options, dear reader, because I'm about to absolutely destroy the mood. Investing, like life, involves making choices among a host of imperfect trade-offs. There is no 'risk-free' option. We do our best to navigate the world by exchanging one pair of risk-reward trade-offs for another. For example, holding cash presents the risk of erosion of purchasing power via inflation and the reward of preserving capital at times of extreme volatility. The risk-reward trade-off of buying shares should be self-evident in early 2020.

I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices.

Puts are distinct from stocks in that some put writers don't want to actually buy the stock; they simply want to collect premia. Such investors care more about maximizing their income and will, therefore, be less discriminating about which stock they sell puts on. These people don't want to own the underlying security. For my part, I'm too much of a coward to sell puts on anything other than companies I'm willing to buy at prices I'm willing to pay. For that reason, being exercised isn't the hardship for me that it might be for many other put writers. My advice, dear reader, is that if you are considering this strategy yourself, you would be wise to only ever write puts on companies you'd be happy to own.

In my view, put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I'll conclude by beating the proverbial dead horse. I'll use the trade I'm currently recommending as an example. An investor can choose to buy the shares of Nexstar today at a price of ~$80. Alternatively, they can generate a credit for their accounts immediately by selling put options that oblige them - under the worst possible circumstance - to buy the shares at a net price 32% below today's level. Buying the same asset for a near ⅓ discount is the definition of lower risk in my view.

Insider Activity

I've variously whispered it, shouted it, said it, and written it before, and I'll likely do the same again many times, as it's one of my many tedious mantras: not all investors are created equal. Some people are better at this because they have a team of analysts at their disposal. Some people are better at investing in a given company because they are insiders, and thus know more about the business than any Wall Street analyst ever will. With that in mind, I'd point out that there were some material insider buys during the first quarter of 2020. In mid-March of this year, Director John Muse purchased 16,025 shares for ~$604,000 and EVP Gary Weitman purchased 1,100 shares for just under $70,000. In my view, when people who know the business better than anyone outside the company ever will put their own capital to work in the company, the rest of us should at least take notice. The fact that I'm "on the same side of the table" as knowledgeable insiders gives me some added comfort here.

Conclusion

I think there's much to like about this company. The shares are very reasonably priced based on their historical performance, and I think the dividend is very well covered. Additionally, I like the fact that insiders seem to be confirming my bullishness with their actions. For those who are nervous about buying anything at the moment, I suggest selling the puts I recommend above, as these represent a win-win trade in my opinion. I think price and value can remain unmoored for some time, but sooner or later they will meet. I think investors would be wise to buy at current levels before price rises to match value.

Disclosure: I am/we are long NXST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: In addition to buying a few more shares, I'll be selling 8 of the puts described in this article this week.