Buy Carrier Global As Potential Asset Sales Will Reduce Debt

by Trembling With GreedSummary

- Recent trading multiple compression due to the coronavirus.

- Potential asset sales to reduce indebtedness.

- Strong trends in the residential HVAC replacement cycle due to housing starts occurring over 15 years.

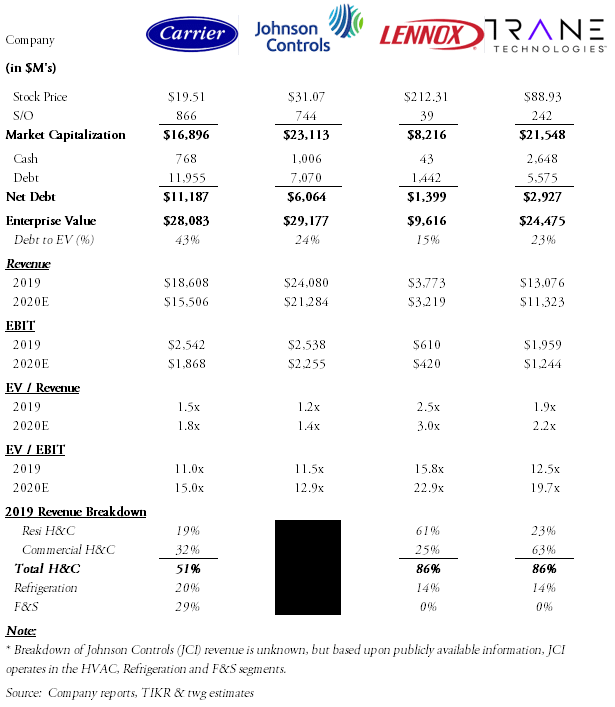

Labels matter, descriptions matter. Carrier Global (CARR) is an HVAC and Refrigeration company, but it has a third line of business: Fire & Security. Comparing Carrier Global to pure-play HVAC and refrigeration companies such as Lennox International (LII) and Trane Technologies (TT) is possible, but these companies are not the true “comps” to Carrier Global; Johnson Controls (JCI) is Carrier Global’s true comp, as its businesses are in HVAC, Refrigeration and Fire & Security.

Looking at the table below, Carrier Global trades at a discount to its pure-play HVAC and Refrigeration peers (Lennox and Trane); however, Carrier Global trades on par with Johnson Controls, which is its closest comp, since Johnson Controls’ portfolio is the most similar to Carrier Global’s portfolio. While not discussed, Daikin Industries (OTCPK:DKILF) trades for ~17X last twelve months (LTM) EBIT and generates ~90% of its revenue from the sale of HVAC equipment and services due to Daikin’s $3.7 billion acquisition of Goodman Global in 2012. At the time of the acquisition, Goodman Global had $2.1 billion in revenue.

Carrier Global should be bought for the following reasons:

- Recent trading multiple compression due to the coronavirus

- Potential asset sales to reduce debt

- Strong trends in the residential HVAC replacement cycle due to housing starts occurring over 15 years ago

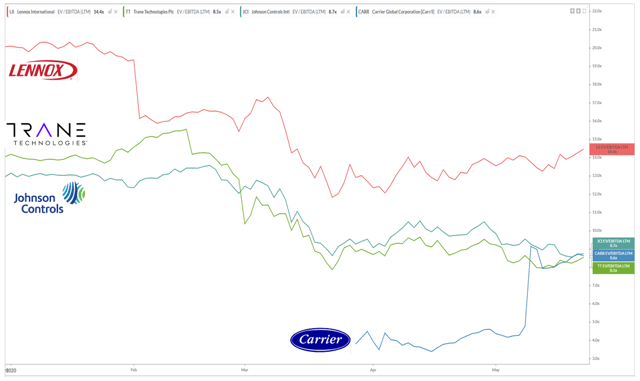

Trading Multiple Compression across the Industry

Currently trading at $19.53 per share and 11X 2019 EBIT, Carrier Global is no longer cheap compared to its peers, as the stock has appreciated over 50% off of its 52-week low; however, since March, trading multiples for this industry have compressed, driven by fears of COVID-19. Drilling into the peer group further, Carrier Global, Johnson Controls and Trane Technologies all trade in a tight cluster, whereas Lennox is higher. While a “deep dive” into the operations of Carrier will be provided, my thoughts are that the market is selling off highly indebted companies like Carrier Global and, also, companies focused on the commercial space due to the work from home trend.

Source: Koyfin

Asset Sales to Reduce debt

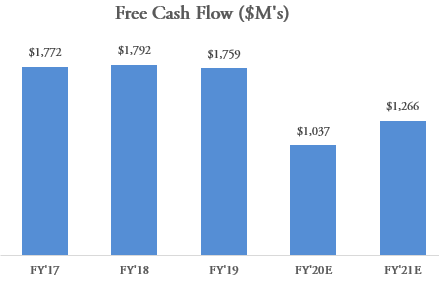

When spun off from United Technologies, ~$11 billion of debt was placed on Carrier Global’s balance sheet, and those proceeds were distributed to United Technologies. As a result, Net Debt-to-Capitalization stands at over 40%, which is higher than its peer group. The good news is that Carrier has no debt maturities until 2023, and also has a revolver of $2 billion that is available. Management is guiding for Free Cash Flow of greater than $1 billion, and this can be used to repay debt.

Source: Company reports and TIKR

During its Investor Day, management guided for Dividends to be ~$550 million per year; however, the company’s dividend policy has been delayed. In view of Free Cash Flow projections of ~$1 billion in FY’20 and ~$1.3 billion in FY’21, Carrier Global can retire some of its debt; however, I expect the company to divest some operations.

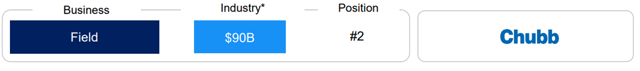

For example, potential asset sales may include Chubb (CB) in Fire & Security and/or Commercial Refrigeration. According to management, Chubb is the #2 player in a $90 billion industry with ~$2 billion in revenue. In view of Chubb’s market share of ~2%, this implies that the industry is highly fragmented, which enables a “roll-up” strategy of various assets. Commercial Refrigeration, on the other hand, with a presence in Europe and Asia, may be a better asset for Panasonic (OTCPK:PCRFY), since Panasonic acquired the Commercial Refrigeration assets from Clayton, Dubilier & Rice and Traine Technologies for $1.55 billion in 2015, and based upon Dun & Bradstreet information, Hussmann has ~$500M in revenue. Therefore, given that Commercial Refrigeration generates $1.2 billion in annual revenue, this business alone may be worth more than $3 billion in the marketplace. While the two potential divestitures are illustrative, non-core asset sales will be the path to reduce Carrier Global’s debt.

Overview

Carrier Global spun off from United Technologies in 2020, and shareholders of United Technologies received 1 share of Carrier Global for every share of United Technologies they held. Spin-offs as of late have not performed well in the marketplace. Honeywell (HON) spun off two divisions, Resideo Technologies (REZI) and Garrett Motion (GTX), and both are down well over 70% from original trading levels even before the “Coronavirus Contagion” that impacted the stock market. However, United Technologies spin-offs such as Carrier Global and Otis Worldwide (OTIS) have performed well, and to learn more about Otis Worldwide, you can read my analysis of the company here.

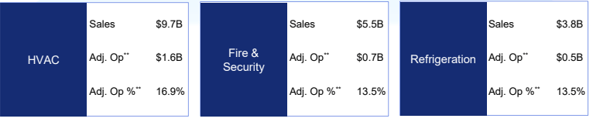

Carrier Global has ~$19 billion in revenue across the globe and is aligned across three segments: HVAC, Refrigeration and Fire & Security. Carrier generates double-digit margins across its lines of business, and in HVAC, ~40% of revenue is residential and ~60% of revenue is commercial. While the majority of its revenue is in the Americas, the company recognizes almost 50% of its revenue in EMEA and APAC.

Source: Carrier Global Investor Day

Thus, the thesis is that Carrier Global should not have an EBITDA multiple comparable to Trane Technologies or Lennox International, as Carrier Global is not a pure-play HVAC and Refrigeration company like the others; rather, the company also has a Fire & Security division, which makes it closest comp to be Johnson Controls.

HVAC

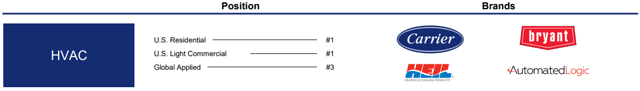

The HVAC segment generates ~$10 billion per year and spans both Residential and Commercial segments, where the Commercial segment (which includes service) drives ~60% of HVAC revenue, with the balance driven by Residential. Unlike its peers Lennox International (which owns its own distribution) and Trane Technologies (which has a mixture of company owned and independent distribution), Carrier’s products are sold through independent distributors, and its major distributor, Watsco (WSO), was formed through a joint venture in July 2009.

Putting distribution aside compared to its peers, Carrier Global has a leading position for HVAC in the United States

Source: Carrier Global Investor Day

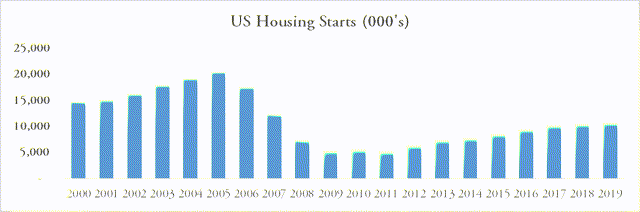

For Residential HVAC, the company generates 30% of its revenue from New Construction and 70% of its revenue from Replacement. In the industry, it is widely assumed that the replacement cycle for HVACs occur at 18 years. As a result, Housing starts continued to grow in the early to mid-2000s, and these units should need to be replaced.

[O]ur mean average life of a system is about 17.5 to 18 years. And so, when you think about that, the average life is around 14 but it gets extended. It pushes to the right because a lot of consumers, they don't just replace their system, they actually fix their system. And so, it pushes the mean out to about 17.5 years on average.

Source: Carrier Global Analyst Day

In other words, the mean time before failure of a HVAC system is 14 years, but rather than replacing the HVAC system, consumers often choose to repair their systems. As a result and, using 18 years, we are on the cusp of another replacement cycle for Carrier Global. In other words, the growth in HVAC systems due to this replacement cycle should last until 2023.

Source: Federal Reserve Economic Data

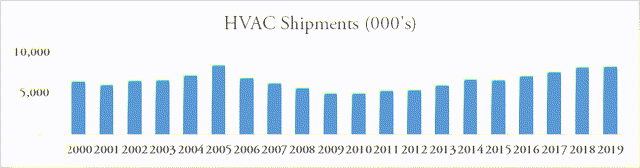

According to the Air-Conditioning, Heating, and Refrigeration Institute (AHRI), shipments of HVAC equipment, which include heat pumps, unitary air conditioners and furnaces, are growing, and the average level of shipments over the past three years is in line with average levels of shipments from 2000 to 2005. With Carrier being the #1 player in both Residential and Light Commercial, it will benefit from these industry tailwinds. Moreover, being an independent company, it may have the financial flexibility to gain additional share in new home construction.

(Source: Central Air Conditioners and Air-Source Heat Pumps)

From a Commercial standpoint which drives 60% of the revenue, one of the key drivers for future growth is to improve Carrier Global’s positioning in the Service & Aftermarket segment of Commercial HVAC.

Source: Carrier Global Investor Day

According to company management, service and aftermarket is a large and profitable segment with a presence across more than 40 countries with hundreds of service branches worldwide. Even though Carrier’s installed base has been growing, the attach rate for services is at 25%, which is half that of its peers. The strategy to drive the services’ attach rate higher will be driven by offering tiered service offerings from basic to platinum (or a good, better, best product strategy) and grow its applied product offerings, since the applied products possess the greatest opportunity for recurring services revenue. The benefit of driving increased service revenue adoption will also be felt on the bottom line, since service and aftermarket revenue carries margins that are greater than the commercial segment’s margins.

However, there are risks to this strategy, as Carrier Global is a “leading player” in the applied product category but not the clear leader. The good news is that the gap in market share between #1 and #3 is only a few hundred basis points of market share. As a result, the strategy to become the leading player is not “aspirational”, but requires 50bps of market share gain every year.

Source: Carrier Global Investor Day

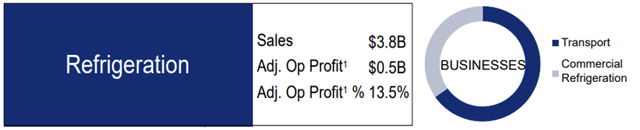

Refrigeration

Source: Carrier Global Investor Day

Refrigeration is Carrier Global’s second division that comprises 20% of its revenue, and this division is twice the size of Trane’s Refrigeration business and over seven times larger than Lennox. Transport comprises two-thirds of the segment’s revenue, and Carrier is the leader in all three segments of this business (North American truck trailer, European truck trailer and the container business). During the company's Analyst Day meetings, management provided color that the North American and European truck trailer divisions will be down in 2020, and in the Commercial Refrigeration segment there is room to improve profitability.

Commercial Refrigeration drives ~$1.2 billion of the segment’s FY’19 revenue (roughly one-third of Refrigeration revenue), and the business is predominantly focused in Europe.

This segment is volatile and highly sensitive to the economic cycle. While Carrier Global’s revenue declined 9% YoY in 1Q, Refrigeration declined 16% YoY. The Services business should provide some stability to revenue, but given that services of ~$1 billion drives ~25% of FY’19 Refrigeration revenue, any stability will be overcome by the larger and volatile equipment, i.e., trailers and containers. Ideally, weakness in Refrigeration could be offset by the Residential HVAC replacement cycle as discussed above.

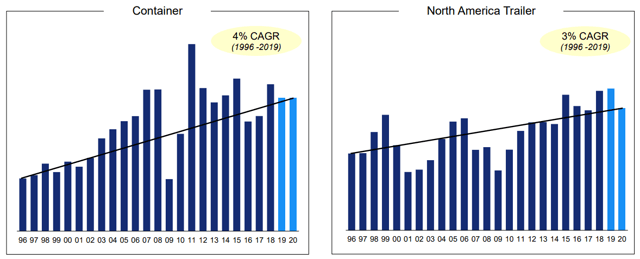

Given the volatility in Refrigeration and Carrier Global’s leadership in the category, this is one of the reasons why the company trades at a discount to peers Trane and Lennox. Below one can see the volatility in the Trailer and Container segments.

Source: Carrier Global Investor Day

Fire & Security

Fire & Security represents Carrier Global’s third line of business, and while this business is the second largest in its portfolio, in my opinion, the company spent the least amount of time discussing it. This segment is also the reason why Johnson Controls is Carrier Global’s closest comp and not Lennox and Trane. Additionally, while HVAC and Refrigeration are “focused” businesses, Fire & Security appears to be a segment with a portfolio of businesses.

Source: Carrier Global Investor Day

With $5.5 billion of revenue in 2019, where 40% of the revenue is considered to be Field and the balance is selling products. Field revenue of ~$2 billion is Chubb, where it has more than 1.3 million sites under service and more than 800K commercial monitoring lines where it installs, services and monitors.

Source: Carrier Global Investor Day

Being the #2 player in a $90 billion industry indicates that this business is highly fragmented industry with the second-largest player only having ~2% market share. To learn more about the security monitoring business, please read my article on ADT Inc. (ADT) which describes in detail the company's commercial operations.

If you like what you read, please feel free to like the article and "Follow" me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.