The Indian Express

Sensex settles nearly 1,000 points higher, Nifty ends at 9,315 led by banking, financial stocks

The S&P BSE Sensex surged 995.92 points (3.25 per cent) to settle at 31,605.22, while the broader Nifty 50 ended at 9,314.95, up 285.90 points (3.17 per cent).

by Express Web DeskThe benchmark equity indices on the BSE and National Stock Exchange (NSE) settled over 3 per cent higher on Wednesday ahead of the expiry of May-series futures and options (F&O) contracts on Thursday. The gains were primarily led by banking and financial stocks.

The S&P BSE Sensex surged 995.92 points (3.25 per cent) to settle at 31,605.22, while the broader Nifty 50 ended at 9,314.95, up 285.90 points (3.17 per cent). Both the indices had opened over 0.5 per cent higher earlier in the day and surged higher as the day progressed.

As many as 24 of the 30 Sensex stocks ended in the green. Gains on the BSE benchmark on Wednesday were led by Axis Bank, ICICI Bank, HDFC Bank, IndusInd Bank, Bajaj Finance and Kotak Mahindra Bank. On the other hand, Sun Pharmaceutical Industries, Ultratech Cement, Titan Company, Asian Paints, Maruti Suzuki India and Power Grid were the top drags. (see heatmap below)

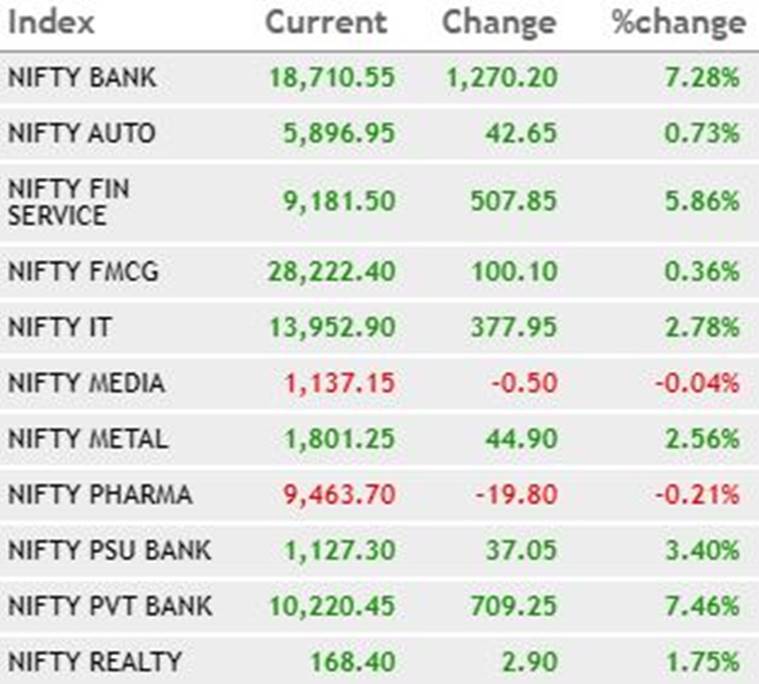

Among the sectoral indices on NSE, the Nifty Bank rose 7.28 per cent led by Axis Bank, ICICI Bank, Bandhan Bank and RBL Bank. The Nifty Financial Services index also rose 5.86 per cent led by Axis Bank, Cholamandalam Investment and Finance Company and ICICI Bank.

Here’s how the sectoral indices performed:

In the broader market, the S&P BSE MidCap index closed at 11,467.83, up 61.25 points (0.54 per cent), while the S&P BSE SmallCap index ended at 10,619.01, up 28.59 points (0.27 per cent).

“The benchmark indices staged an intraday rally in sync with global cues, as some pockets of value buying emerged. Inspite of rising number of infections, markets expect slow return to normalcy, when lockdown 4.0 ends this week. All sectoral indices were in the green and Institutional buying in banking stocks helped the bank index gain by over 7%. The volatility is expected to continue, ahead of tomorrow’s F&O expiry,” Vinod Nair, Head of Research at Geojit Financial Services said in a statement.

Rupee

The rupee depreciated 5 paise to settle at 75.71 against the US dollar on Wednesday, as market participants were concerned about rising tensions between the US and China amid coronavirus pandemic, news agency PTI reported.

At the interbank forex market, the rupee opened strong at 75.72 and gained marginal ground to finally closed at 75.71, down 5 paise over its last close. It had settled at 75.66 against the greenback on Tuesday.

During the session, the local currency witnessed an intra-day high of 75.57 and a low of 75.74.

Global markets

Unrest in Hong Kong over Beijing’s proposed national security laws weighed on global shares and oil prices on Wednesday, offsetting optimism about the re-opening of the world economy.

Riot police fired pepper pellets on protesters in Hong Kong’s main business district, rekindling concern about the protests seen last year that hit the territory’s economy.

MSCI’s ex-Japan Asia-Pacific index fell 0.4 per cent, as Hong Kong and mainland China shares extended declines. Hong Kong’s Hang Seng fell 1.0 per cent and mainland shares were down 0.8 per cent, amid fears the protests would worsen tensions between the United States and China.

MSCI’s index of the world’s 49 stock markets was flat but still close to two-and-a-half-month highs reached on hopes of economic recovery in the developed world as countries ease social restrictions.

– with global market inputs from Reuters