Don't Get Ambushed By The FANG/FANMAG Factor

by Marc GersteinSummary

- ETFs are supposed to be top-down portfolios oriented toward an asset class, a region, a line of business or a general combination of these.

- Holders of ETF shares should not expect to have to engage in company/stock-specific research.

- Did you know that some of the most popular ETFs out there today require holders to do just that? You should, because it’s true.

- The FANG/FANMAG phenomenon is more than just a cute acronym. It's a serious factor that requires more of ETF holders than they may realize or be willing to give.

It’s been said time and again that one of the advantages of owning shares of an ETF is the one-trade access it provides to a diversified portfolio. Whether the ETF is oriented toward an asset class, a region, a line of business or a general combination of these, we should at least be expecting the ETF to be implementing a “top-down” view of some sort of defined “market” and spare us the burden of obsessing over the unique - idiosyncratic - characteristics of specific securities. Be careful, though, about ETFs that are, in fact, requiring investors to do the exact thing they assume they don’t have to do: company/stock-specific research.

© Can Stock Photo/kunertus

The FANG/FANMAG Factor

Market commentators often speak about breadth, and measure it through such means as advancing issues versus decliners, etc. When one hears a rally characterized as having poor breadth, it’s usually understood to mean something like: “The market has been strong, but that’s only because a small number of stocks have been very very strong, while most have been just OK or worse.” That might make you feel less like a failure if, say, the S&P rose 4% last month but your portfolio only gained 2.5%. “Oh those stocks, they’re going to get slammed soon,” you might say. “I’m glad I don’t own them and I’ll take a bit of underperformance any day if it keeps me clear of them.”

Issues of breadth in today’s stock market are well known. Many refer to it as the FANG, which is Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Alphabet (NASDAQ:GOOG) (GOOGL), a name change that is about as largely ignored as when Sixth Avenue in New York City was changed to Avenue of the Americas, so like the rest of the world; I still say Sixth Avenue and I still say Google. This group was ultimately broadened to FANMAG which is FANG + Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL). (Note: For convenience, I’ll discuss FANMAG as defined here. But if you want to make some substitutions, such as reverting back to traditional FANG or perhaps including some others such as Cisco (NASDAQ:CSCO) or Tesla (NASDAQ:TSLA), that’s OK. Universal or nearly-universal love for the stock is the main requirement.)

In this environment, the key to success is not to be found in the size factor, the value factor or any of the academic favorites. It’s about the FANMAG factor model (or in strictly quant parlance, FANMAG-versus-WHATEVER with a skew toward the former). Here’s the logic (I’ll leave it to you to translate to C++, R, Python, etc.):

- FANMAG = (FB, AMZN, NFLX, MSFT, AAPL, GOOGL)

- If Ticker not in Portfolio and Ticker not in FANMAG then Ignore

- IF Ticker in Portfolio and Ticker in FANMAG then Hold

- If Ticker not in Portfolio and Ticker in FANMAG then Buy

- If Ticker in Portfolio and Ticker not in FANMAG then Sell

This model, which confines your portfolio to FANMAG and ignores the 494 S&P 500 also-rans has been pounding the supposedly unbeatable index into the dust. Sorry Burton Malkiel, sorry John Bogle. Stock returns are not random and there’s no need to index. Sorry Graham, sorry Dodd: Ratios? What ratios?

Do You Dare?

If your goal is to produce a spectacular set of backtested results, then yes, absolutely, positively. Of course, you base your strategy on the FANMAG factor.

If, on the other hand, you understand that the expression “past performance does not assure future outcomes” is not just legal boilerplate but the actual truth, then the problem becomes more challenging.

- Had I posed the do-you-dare question several years ago and had you ignored the past-performance warning, you’d be well ahead of the game today had you said “Yes, I dare.” (For the record, the strategy returned 31.3% annually over the past five years, with an annual alpha of 19.6%.)

- And that may well be the case a year or two from now if you say “Yes” right now.

- Then again, as often as “yes” would have been the right answer, it’s possible that the answer today should be “No.”

I honestly don’t know what the right answer is now. But at least I do know how to go about making a reasonable assumption one way or the other: It’s all about stock/company-specific analysis, by whichever fundamental, technical or combination method you like.

Speaking for myself, I have stock selection roots that go back 40 years to when I started at Value Line and continue right through to the present with the Chaikin Power Gauge stock ranks and Chaikin Analytics stock pages. So I’m happy to evaluate the FANMAG stocks one at a time and make thoughtful choices. And considering where this post is appearing, I expect that many, if not most or even all, readers are also comfortable doing that.

But there’s one huge pre-condition: You should be aware that you’re doing this and making a deliberate choice to do it (and then following through). But, but, but...

Be Careful About Having The Choice To Dare Being Unknowingly Thrust Upon You

Suppose you’re not into stock-specific analysis and just want to allocate a portion of your portfolio to the Equities asset class (or, perhaps, to U.S. Equities). OK. Quick decision, no more than a nano-second: What do you buy?

Chances are you picked the SPDR S&P 500 ETF (SPY) (ETF Home), the penultimate “passive” buy-the-market equity investment. It holds about 500 stocks (503 actually at 4/30/20) spread across all sectors of the economy. That was easy. Right?

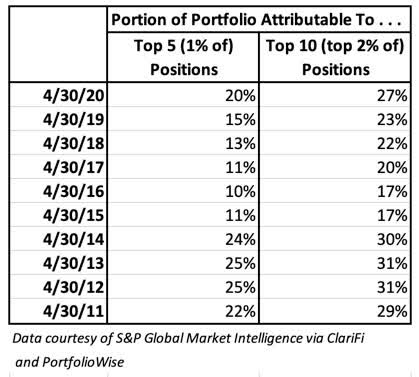

Well, consider Table 1, which shows the percent of portfolio assets in the five largest positions and the 10 biggest holdings (in situations where the ETF owns more than one share class from the same issuer, I counted the issuer as just one and combined the stakes in the various classes.)

Table 1

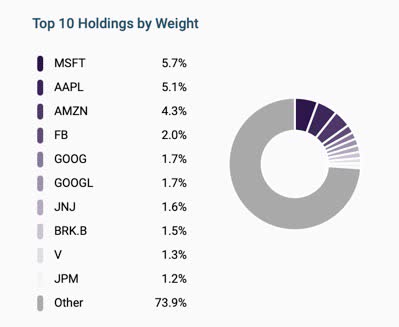

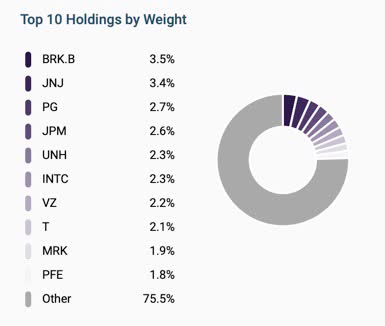

Does it take much imagination to guess what stocks are in the upper echelon within the SPY portfolio? But lest there be any doubt, here, subject to decimal rounding discrepancies, is the latest from PortfolioWise:

(Again, it’s not necessarily about the specific stocks in the FANMAG group I’m using, A FANMAG-like group is fine.)

Perhaps you did a fancy “attribution analysis” and can compute specific coefficients for large-versus-small, value-versus-growth, quality-versus-junk, etc. But unless the tool you used computed something for FANMAG-versus-WHATEVER, your analysis will have come up short.

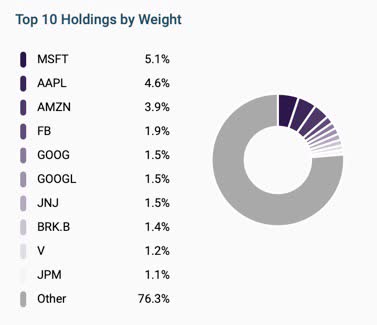

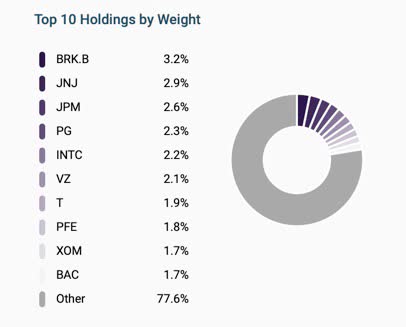

SPY is by no means alone when it comes to being heavily influenced by the FANMAG Factor. If you think you might get better diversification from the iShares Russell 1000 ETF (IWB) (ETF Home), which has 1,000 positions instead of a “mere” 500, think again. The IWB top 5 (amounting to just 0.5% of the approximate 1,000 stock total) comprises 19% of the portfolio and the top 10 (just 1% of the number of positions) accounts for 25% of the invested money. And I wouldn’t blame you if you were to think the image below, which shows the top IWB positions, is an erroneous repeat of the SPY image - it’s not (look carefully; squint if you have to).

And it’s not going to look all that different if we stretch beyond Large Cap Blend and look at some broader equity ETFs, such as the iShares Russell 3000 ETF (IWV) (ETF Home), the Vanguard Total Stock Market ETF (VTI) (ETF Home) or the iShares Core S&P Total U.S. Stock Market ETF (ITOT) (ETF Home).

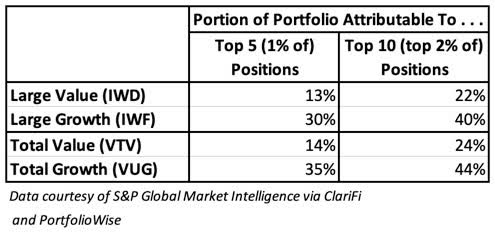

And, by the way, this solves the conundrum of value’s poor performance of late relative to growth. It’s all about the top-heavy portfolios weighted heavily in the FANMAG Factor. We can see this in Table 2, which compares Value to Growth within the large cap area through the iShares Russell 1000 Value ETF (IWD) (ETF Home) versus the iShares Russell 1000 Growth ETF (IWF) (ETF Home), and on a total-market basis through the Vanguard Value ETF (VTV) (ETF Home) versus the Vanguard Growth ETF (VUG) (ETF Home).

Table 2

Exacerbating the challenge for the Value ETFs, is that the concentrations, such as they are, come up on the wrong end of the FANMAG-versus-WHATEVER factor scale (i.e. Value ETFs show a strongly positive coefficient in the “WHATEVER” factor).

Here’s the top of the 319-stock VTV portfolio:

And here’s the top of the 753-stock IWD portfolio:

How We Got Here

How these ETFs got here is no mystery. The cult of popularity is obviously a contributing factor, but don’t underestimate the impact of the blessing-or-curse (your choice) of market capitalization weighting.

Essentially, there is good logic behind the idea of allocating portfolio assets on the basis of market capitalization. It makes it possible to have many large funds without creating liquidity problems in the market. Imagine if every mutual fund, ETF pension fund or insurance company portfolio tried to allocate money equally to MSFT (market cap: $1.4 Trillion) and, say, Acordia Therapeutics (ACOR), with its market capitalization of $36 million! (For those who aren’t yet going “Yikes!” the problem is that there aren’t nearly enough ACOR shares to satisfy even a puny portion of the potential buy orders because the company is too darned small.)

But we pay a price for this sort liquidity management. Over time, the impact of stock price trends within a portfolio get double-counted. Obviously, we count the extent of the stock’s price change. But there’s more:

- If ABC is 10% of a portfolio and it rises 25% and everything else holds steady, the portfolio will have risen by 2.5%. (A 25% gain on 10% of a portfolio is computed as .25 * .10, which is equal to .025.)

- Suppose, in the next period, ABC again rises by 25%. Does the portfolio grow again by 2.5%?

- No. The security that rises by 25% had a 10% weighting the first time around, but at the start of Period 2, its weighting was 12.5%. so now, the portfolio rises by 3.1%. (A 25% gain on 12.5% of a portfolio is computed as .25 * .125, which is equal to .031.)

- Going into the next period, ABC’s weight in the portfolio is 15.6%, so the next 25% gain pulls the portfolio up by 3.9%, and so on. For a more detailed explanation, click here.

By the way, this “shadow momentum” effect works analogously on the downside, so as much as holders of cap-weighted funds may love it when the market is rising, they may come to hate it when things turn sour.

This example is obviously contrived to show as much as possible as quickly as possible. But it is a very valid explanation for what we’re seeing in real life. This is exactly why the FANMAG-heavy indexes and ETFs have been performing so magnificently and why the portfolios, which weren’t initially designed to be so FANMAG heavy now are.

This is crucial: Neither the Standard & Poor’s Index Committee nor any other index committee or creator examined the stocks and concluded that they were exceptional and should be an especially large part of the S&P 500. It happened solely through mathematical inertia.

© Can Stock Photo / alphaspirit

Still, FANMAG Stocks Are The Best So They Should Dominate A Portfolio - Right?

An important argument in favor of extreme FANMAG or FANMAG-like portfolio top-heaviness. AMZN, MSFT, GOOGL, etc. aren’t just parts of the business world or even necessarily strong parts. These companies are growing to the point where it might be said that they are the economy, or are at least well on their way to becoming the economy. So yes, it makes sense that they should, in essence, become the portfolio.

That is, in fact, a very good argument. Taking a passive stake in the business world is fine and in many cases, a terrific way to do what passive investors really want to do.

The problem lies in the execution. Don’t be so sure that ETFs like SPY or IWB or even IWV are really delivering on that. (Anecdotal expectations are great, but data is better.)

Continuing On

If you decide you hate shadow momentum, mathematical inertia, and market-proxy ETFs being so top-heavy and need to swap out immediately, you can park money in the Invesco S&P 500 Equal Weight ETF (RSP) (ETF Home) — so long as you aren’t worried about booking taxable gains in what you’d be selling.

But although Hollywood and hardware vendors pushing machines that work ever faster, tend to portray the investing world as a place where everyone is in an insane hurry and loathe to waste a single nano-second, don’t underestimate the real-world virtues of taking your time and thinking things through. Although RSP is a perfectly reasonable ETF to own, there are other interesting choices out there.

For now, I think you have time to consider your stance regarding the FANMAG-like stocks and whether the big name market-proxy ETFs so heavily tied to them are funds you want to continue to hold. These companies continue to do generally well, and there’s no immediate indication that the FANMAG factor is about to blow up. Three of the FANMAG stocks, FB, MSFT and NFLX have Bullish ranks in the Chaikin Power Gauge model and the others AMZN, AAPL, and GOOGL, Neutral now, would likely be Bullish if their valuation metrics weren’t so high - and it's not as if the market has been punishing high ratios lately or seems likely to start doing so in the next few weeks.

So stay tuned. My next post will discuss alternative (to market cap weighting) approaches to ETF construction.

Disclosure: I am/we are long SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Thinking seriously about rotating out of SPY, for reasons discussed in the article.