Harvest Health: Licking Its Wounds

by Jonathan CooperSummary

- Focus on core markets.

- Cost-cutting and liquidity.

- Disappointing growth prospects.

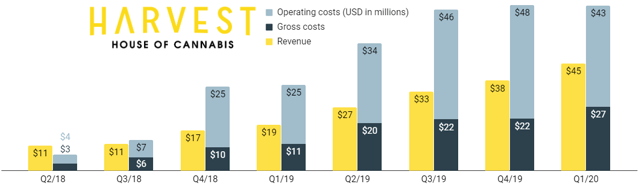

Source: Harvest Health.

Summary

Harvest Health (OTCQX:HRVSF) is licking its wounds and rebuilding after a rough year. Last year, they were focused on a land grab mentality and suggesting up to $1 billion in 2020 pro forma revenue. Now, the company is focusing on its core markets, cutting costs, divesting non-core assets, and hoping for $200 million in 2020 revenue.

That revenue target is surprising given that analysts were expecting $234 million of revenue prior to Harvest's earnings call. Part of this shortfall is because Harvest has a deal to sell some California assets, although even then, this implies a significant slowdown in revenue growth.

Harvest Health trades for multiples similar to peers including Green Thumb and Trulieve. Owing to its larger leverage, Harvest Health offers larger potential returns than those competitors if management can turn the company profitable. For my part, however, I would prefer to own the relatively safer companies which both trade at reasonable multiples.

Focus on core markets

"Our footprint growth is important. This is a landgrab, and there are a discrete number of prime license opportunities." -Steve White, CEO of Harvest Health, April 2019

Last year, Harvest Health was one of the main proponents of the "landgrab" mentality followed by many U.S. cannabis companies. These businesses tried to expand as quickly as possible through acquisitions and organic growth, looking to establish an enormous footprint. This tactic is very expensive because cannabis cannot be shipped across state lines, making it very difficult to build up economies of scale when you're spread thin.

Today, cannabis companies are constrained by capital. Investors have tired of writing blank checks to companies that are burning cash. Investors want to see profitability rather than growth and cash burn. Harvest's shares have felt the impact of this sea change: They are down 80% over the past year.

"Our improved financial results during the first quarter demonstrate progress toward our primary goal of returning to profitability through cost reduction measures and investments in core markets Arizona, Florida, Maryland, and Pennsylvania." -Steve White, CEO of Harvest Health, May 2020

Harvest Health's management has heard this call and they are singing a new song: Harvest Health will no longer pursue transformation M&A and will instead look to become adjusted EBITDA profitable during the back half of the year.

Rather that growing horizontally, Harvest Health will focus on building depth in its four core markets: Arizona (with 14 dispensaries), Florida (6 dispensaries), Pennsylvania (5 dispensaries), and Maryland (3 dispensaries). These markets were responsible for 80% of Harvest's revenue during the first quarter.

So far this year, Harvest has purchased three new dispensaries in Arizona and added a cultivation facility in Pennsylvania. The company has licenses to build one additional dispensary in Maryland, ten additional dispensaries in Pennsylvania, and as many dispensaries as they would like in Florida, limited by their cultivation capacity due to the state's ban on wholesale cannabis sales.

While focusing on its core markets, Harvest is moving away from other markets. Harvest has walked away from the $850 million acquisition of Verano Holdings, citing regulatory delays. Harvest is also selling thirteen retail assets, including two Harvest-branded dispensaries, in California to High Times. That deal will net Harvest $5 million in cash and $75 million in equity and debt from privately-held High Times.

Cost-cutting and liquidity

Harvest Health has been working to reduce operating costs while revenue continues to grow. Source: Author based on company filings.

Harvest Health is working to improve the sustainability of its business by cutting costs and improving their balance sheet. Last year, Harvest burned through $209 million in free cash while generating $117 million in sales. That is hardly a recipe for a sustainable business, especially in light of an oppressive tax regime for federally-illegal cannabis businesses.

Harvest is taking cost-cutting measures aimed at improving this cash flow. To date, the company has trimmed $24 million in annual SG&A costs--approximately a 20% reduction from fourth quarter cost levels. The company believe that this will put them on a path for adjusted EBITDA profitability in the back half of 2020. Investors should be cautious, however, about proclaiming the company profitable. Adjusted EBITDA is a forgiving metric which ignores that Harvest spent $14 million on share-based compensation last quarter, ignores that Harvest may pay $40 million in debt servicing costs this year, and ignores that Harvest is liable for federal taxes on all its gross income, rather than only on its earnings before tax.

As of May 2020, Harvest Health has about $70 million in cash and about $290 million of debt. During the first quarter, Harvest raised $100 million through selling $59 million of equity and $41 million of debt. This equity sale diluted shareholders by approximately 11%. Harvest expects to spent up to $40 million of this capital on debt servicing and to spend $10 to $30 million on capital expenditures for the remainder of the year. This spending will be partly offset by $10 to $30 million of incoming capital including notes receivable, new and extended financing arrangements, and divestitures of non-core assets. Money remains tight.

Disappointing growth prospects

Harvest Health announced earnings on May 20, 2020. The company beat its own guidance by several percentage points: They had anticipated first quarter growth to be in line with fourth quarter sequential growth (i.e., 14% growth), but first quarter growth was 19%. This also beat analyst estimates. Despite that beat, shares fell 4% the next day due to disappointing 2020 forecasts.

Harvest Health forecast $200 million of revenue in 2020. This was significantly below the $234 million which analysts had forecast prior to the earnings call, never mind the $900 million to $1 billion of pro forma revenue that Harvest confidently expect a year ago.

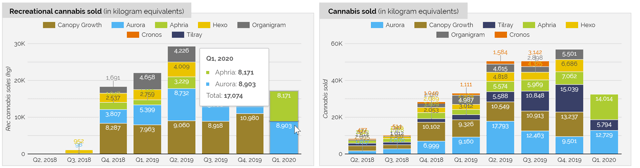

Harvest reported $45 million of revenue in the first quarter. Revenue was up 19% sequentially while same store sales growth was up 30% from last year. Both of these figures are lower than those reported by Green Thumb Industries earlier this month: GTI had 29% sequential growth with 75% same store sales growth.

| Q4/18 | Q1/19 | Q2/19 | Q3/19 | Q4/19 | Q1/20 | Forecast | |

| Revenue growth QoQ | 52% | 14% | 38% | 25% | 14% | 19% | 7% |

Source: Author's estimates.

Harvest Health's growth forecasts call for growth to slow down to about 7% sequentially for the remaining quarters of the year. This is significantly slower than previous revenue growth rates. Part of this slowdown will be due to potentially selling California assets (depending when that deal closes), although these effects should be offset by full quarters of revenue from Have a Heart dispensaries, Arizona Natural Selections dispensaries, and Franklin Labs cultivation.

It is unclear what is leading to this potential slow-down. Analysts on the earnings call also seemed confused: No fewer than five analysts asked for clarification on this revenue forecast. Harvest's answers seemed to offer little clarity, although the company did note that this forecast could be met in different scenarios whether or not the High Times divestiture closes.

Thoughts

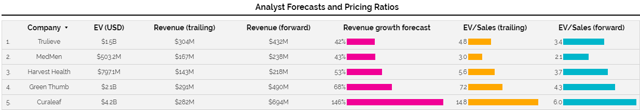

Harvest trades at an average prices compared to its peers. Source: The Growth Operation U.S. MSO Comparison.

Analysts expect Harvest Health to generate $218 million of sales over the next twelve months with $13 million of adjusted EBITDA profits. This reflects a 3.7x forward sales ratio and a 59x forward EBITDA ratio. This sales ratio is comparable to Harvest's peers while the EBITDA ratio is very high due to only becoming EBITDA profitable in the third quarter under analyst models.

I like Harvest Health's direction but I am not ready to take a position in the company. I appreciate management's focus on cutting costs, but I am put off by reduced guidance, a past history of questionable decisions (e.g., claiming to be minority-run in Ohio license application), and by shaky financial performance compared to peers. Given the similar pricing ratios of companies like Green Thumb and Trulieve, I would prefer to hold those companies, both of which delivered free cash flow profitability last quarter.

That said, Harvest is likely to be attractive to investors seeking a risky, turn-around story. Harvest's poor cash flow and their high debt give investors the chance to capitalize on this leverage to earn over-sized returns in the company can cut costs and become profitable. That investment is not suitable for my more conservative investing style, but bolder investors may like what they see.

Happy investing!

Make better cannabis investments with better information

The Growth Operation is the largest community of cannabis investors on Seeking Alpha. During difficult market conditions, our active chat room and daily news updates help investors make sense of the rapidly-evolving cannabis market. The Growth Operation includes interactive data, illustrating market sales trends and highlighting companies with best-of-breed performance.

Disclosure: I am/we are long TRULIEVE, GREEN THUMB, CURALEAF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.