DRDGold Remains Undervalued Despite Stellar Performance

by Harrison SchwartzSummary

- DRDGold is one of the top-performing gold mining stocks over the past year due to successful exploration efforts and Sibanye's acquisition.

- Using P&P reserves, production targets, and production costs, the company's fair value DCF valuation appears to be between $1.2B-$1.5B.

- This valuation implies the stock has around 70% in upside before it reaches fair value.

- DRD's growth will depend on Sibanye Stillwater's efforts to leverage its significant surface resources.

- Despite its growth potential, the stock may see a short-term pullback as its momentum recently faded.

DRDGold (DRD) is among the top-performing gold producers over the past year. Exactly one year ago, DRD was at $1.74, today it is worth $9.10. The company has benefited by ramping up production during the beginning of the new gold bull market. Additionally, it is able to produce gold at a lower AISC than most of roughly $750-900/oz. Of course, DRD is a South African company so this is subject to the Rand exchange rate (lower the better).

To make matters better, DRD has significant proven and probable gold reserves that total 5.8Moz which was almost twice as high as it was in 2018. The company is also an acquisition target of Sibanye (SBSW) which currently owns over half of the company.

Now, all this good news has caused the stock to see an extreme rise. All gold miners have risen, but DRD quite a bit more than others. This has made it the subject of high investor interest but also creates the risk of overvaluation.

Is DRDGold Overvalued?

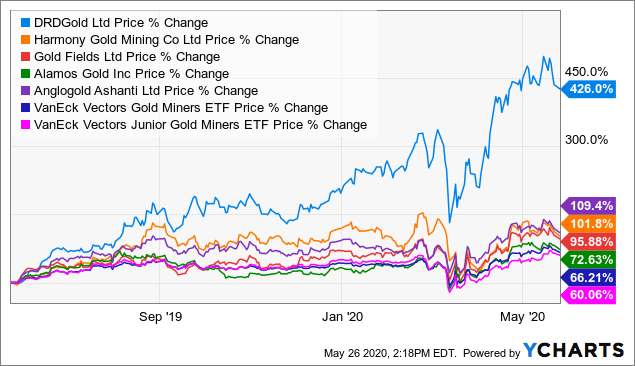

To begin, take a look at DRD's performance compared to that of its peers Harmony Gold (HMY), Gold Fields (GFI), Alamos (AGI), and AngloGold (AU) as well as the gold miner ETF (GDX) and junior gold miner ETF (GDXJ):

Data by YCharts

As you can see, DRD has left its peers in the dust. DRD is actually the smallest of the bunch at a market capitalization of $792M while most of the others have a $1-10B capitalization. Generally, smaller miners have more upside potential since they have greater risk and are prone to be acquired.

The company is currently producing around 175K oz per year at an AISC of roughly $864/oz. At a gold price of $1700 today, this implies an expected annual profit of $146M. Further, the company has 5.8Moz of reserves (proven and probable) as well as 9.8Moz in measured, indicated, and inferred resources. Using the 5.8Moz figure, we come to a total life potential profit of around $4.8B over the course of 33 years (5.8M reserves/175K oz per year).

If we assume AISC, the price of gold and production levels is constant as well as a 10% discount rate, we come to an enterprise valuation of $1.4B using DCF. This valuation drops to $950M with a 15% discount rate.

Of course, DRD is likely to ramp up production in the future. While we cannot know with certainty, most producers produce at a maximum rate of 10% of P&P per year. So, let's assume DRD increases production from 175K to 400K at a constant rate of increase until 2028 and maintains that production rate until depletion. If so, we come to a higher DCF of $2.1B at a 10% discount rate and $1.5B at a 15% discount rate.

Obviously, there are many assumptions here that may not pan out, but this gives us a general guideline that DRDGold's fair value today is around $1.2B-$1.5B. We can use different discount rates and different production levels, but it is clear by all valuations that the company is worth quite a bit more than its current EV of $750M.

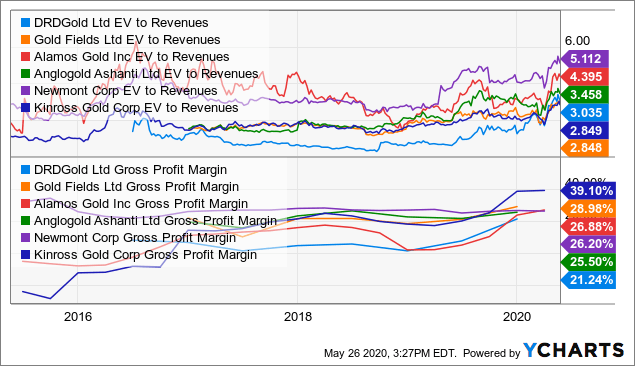

The primary difference between DRD and its peers is that DRD is transitioning into the development stage while many others are producing. If we assume the company will rapidly increase production, it is very undervalued compared to peers. However, if we assume it will stay at current levels (it is currently going to struggle to increase production due to COVID), it is valued roughly in-line with peers. This is based on the EV/Revenue valuation metric below compared to larger peers:

Data by YCharts

Sibanye Stillwater Is Key For DRDGold's Growth

The major reason I like DRDGold is the PGM/gold producer Sibanye Stillwater's foothold on the company. Sibanye is a much larger company with an EV of $6.4B and has increased its ownership of DRD to 50.1%. This gives SBSW control over DRD and the ability to fuel its growth. Sibanye's goal is to expand the company's surface operations strategy by leveraging Sibanye's operations and infrastructure into DRD's assets.

Both companies have dominant operations in South Africa which have been under strict COVID-19 lockdowns this year. The lockdowns have resulted in a temporary production halt which is now over and has lowered both companies' 2020 production targets. That said, it still appears that the long-term plans from Sibanye to rapidly ramp up DRD's production are likely to pay off.

The Bottom Line

There are a few other factors to like about DRD. It has no debt and around $40M in cash reserves which bring its enterprise value below its market capitalization. The stock also has a forward dividend rate of $1 which equates to a dividend yield of about 11%. This is a very high yield for a rapidly-growing company.

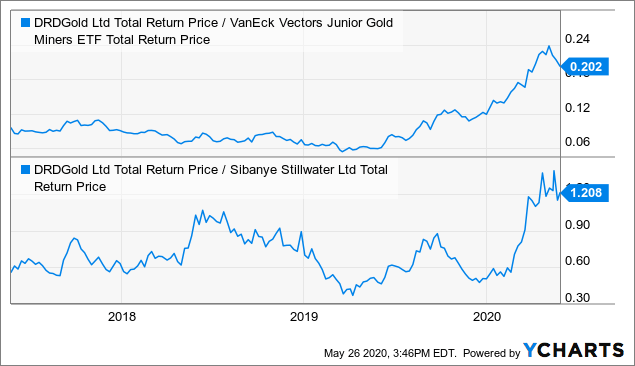

Overall, my current price target for DRD is $15 per share which equates to the DCF EV valuation of $1.3B. However, this does not mean outperformance will continue in the short run. The stock currently has a lot of momentum as you can see below in the performance ratios compared to the junior gold miner ETF and Sibanye:

Data by YCharts

As you can see, DRD's outperformance momentum has been extremely strong over the past few months and has recently hit resistance. This may imply that DRD is due for a pullback or prolonged period of stagnation. While I firmly believe DRD is undervalued from a long-term perspective (even excluding my higher gold price target), its extreme performance this year is likely to spur some profit-takers.

I am not currently long DRD directly, but I am via ownership in SBSW. If DRD sees another 10-20% pullback, I'll be a buyer. The most significant risks to the company are a significant drop in the price of gold and production issues in South Africa. If either occurs, I would no longer be bullish on DRD.

Interested In More Commodity Research?

I run the Core-Satellite Dossier here on Seeking Alpha. I run our growing research into commodity markets. This includes a weekly update on commodity markets, a commodity "buy and hold" portfolio, and in-depth research into a few of my favorite commodity-producer "Alpha-Picks."

As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. You can learn about what we can do for you here.

Disclosure: I am/we are long SBSW,KGC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: My go long DRD in next 72 hrs.