Cuts of €6-€14 billion until 2025 needed to recover from Covid-19 pandemic, Fiscal Council warns

There will be ‘almost historic highs’ of debt ratios in Ireland as a result of Covid-19, the Fiscal Council’s report states.

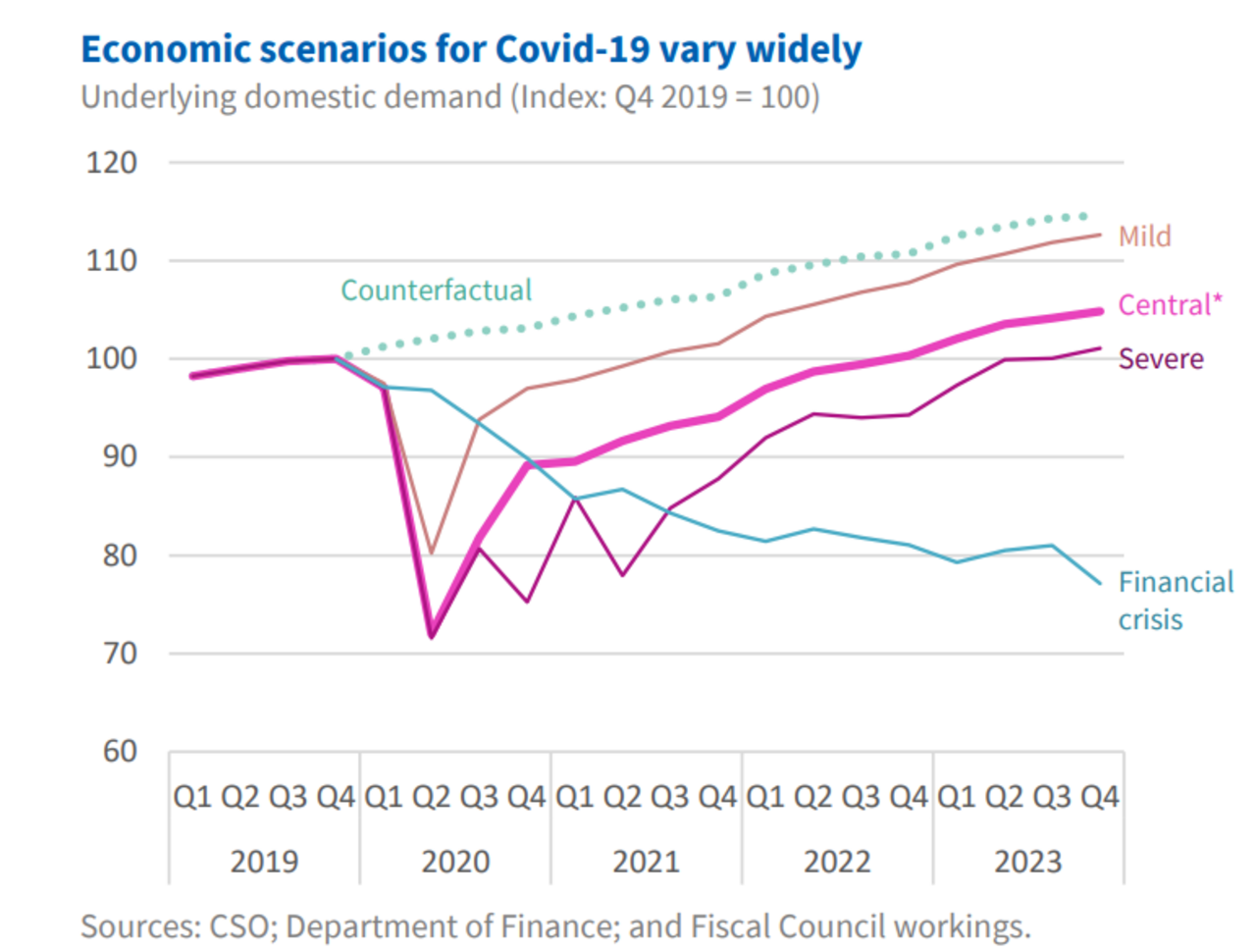

by Gráinne Ní AodhaTHE FISCAL ADVISORY Council has outlined the three different scenarios in which the Covid-19 pandemic and lockdown could impact the Irish economy.

Their report, released today, notes that “adjustments of €6–€14 billion over 2023–2025″ could be required – which means cuts in government expenditure. It adds that severe fiscal adjustments “should be possible to avoid”.

“Even in the ‘Severe’ scenario, adjustments are less than half the size of those made after the financial crisis [which amounted to around €30 billion],” the report states.

Scenarios mapped out in the report suggest that we could have debt ratios ranging from 114-160% in 2021, up from 99% in 2019. This high debt will leave the Irish economy more vulnerable to future shocks, it said.

The Fiscal Advisory Council is an independent statutory body set up after the 2008/2009 financial crash to ensure oversight of government spending and public finances.

The acting chair of the Fiscal Advisory Council Sebastian Barns told Newstalk:

We’ve done a lot of different scenarios and calculations – and our sense is that fiscal adjustment will be required, the debt ratio will be very high – almost at historic highs – and there will be a big deficit, perhaps around 3% still by 2025.

A government deficit of at least €23 billion is now likely for 2020; in January, the government expected a surplus of €2.6 billion this year.

“The deficit should improve next year if the economy recovers and supports are scaled back as assumed. But the deficit is still projected to remain large at €13 billion in 2021,” the report said.

In a report, the Fiscal Advisory Council modelled three possible scenarios, up until 2025, for the Irish economy, with the middle scenario the most likely for Ireland to follow.

#Open journalism No news is bad news Support The Journal

Your contributions will help us continue to deliver the stories that are important to you

Support us now

The report predicts high unemployment, where a fiscal package would be needed to support people and businesses; while also admitting that there would need to be some tax increases and spending cuts, but the scale shouldn’t be the same as in 2009.

“The next government will need to make difficult decisions about taxes and spending to achieve its objectives, while reducing debt to safer level,” the report notes.

It could take 2–3½ years to return to pre-crisis levels of activity. By contrast, the Irish economy took 11 years to recover after the 2008/09 financial crash.

Sebastian Barnes said that the recovery phase of the crisis “would warrant a sizeable fiscal stimulus”.

While some fiscal adjustment is likely to be needed in the third phase – when the economy settles on a new growth path – severe austerity can be avoided.

You can find the report here.