Deere: Might Be Best To Look To 2021 Already

by Quad 7 CapitalSummary

- Shares of DE fell mightily with the broader market, and we have encouraged avoiding shares just before this major selloff.

- With the stock rebounding, it is prudent to investigate shares and projections at present levels.

- While EPS was expected to be pressured from a year ago, it was much better than expected.

- We have ratcheted down fiscal 2020 expectations and shares are clearly overvalued, but based on fiscal 2021 preliminary numbers, shares are mildly attractive.

Prepared by Tara, Senior Analyst at BAD BEAT Investing

Deere (DE) stock has rebounded off of the lows from the COVID-19 selling crisis. This is a name we have followed high and low. Back in November, we locked in some trading profits on Deere (DE) in the $170's. We were comfortable locking in that profit there, and turned mildly bearish on the stock. Right before the big fall in stocks, we put out a bearish piece on the stock and predicted shares could fall to $130-$140 based on expected earnings declines and fair valuation. Now, we stand by the call that it would fall in share price, but it was certainly accelerated by global market chaos, make no mistake. Brave buyers stepped in below $110. We were not one of them, but we let the stock fall, and we were hoping for less than $100. We didn't get the chance It is only now that we have a little clarity on market expectations, and have data inputs that impact Deere's outlook, that we feel we can talk about it with any reasonable viewpoint. The stock is fairly valued, to slightly expensive here again in the $150's, but another pullback could offer a buying opportunity. In this column, we discuss the recent quarter, and offer our projections for fiscal 2020.

Forward-looking thesis

We still believe that agricultural activity will continue to expand this decade, but recent months, and the next few, should see declines. But even before COVID reduced activity, the growth looked slower than expected and downturns in certain crops already occurred. Of course, other crops have seen strong output. There has been increased demand from food manufacturers, but reduced demand from commerce/restaurant demand. However, as the global economy starts to open up, demand for crops will normalize. When we couple this with a growing population globally, and the key geographies in which Deere operates, and we have a recipe for success long-term in the stock, but you should still be selective in your entry. One concern is that with stalled growth in some key areas, and of course with the bit of recession we are in, farmers have become hesitant to invest further at the moment. Many farmers have become cautious about making major investments in new equipment. The most recent quarter was ahead of consensus, albeit the difficulty handicapping the quarter was astounding.

Top-line contraction

To put things in perspective, shares have recovered to the top end of our fair value range based on our expectations for declining sales and EPS. Much of the rally was thanks to a broader market push, but also thanks to the decent earnings report, despite a bit of a weak outlook. With weakness from COVID-19 offset somewhat by strength in the company's international operations being driven in part by organic sales increases and in large part by the Wirtgen Group acquisition a while back, we thought sales would fall, but by more than they did. So it was a positive result. In the most recent quarter, sales came in above expectations at $9.25 billion, though as expected, fell from a year ago, when total net sales were $11.3 billion.

These sales actually were above our expectations, which were much more conservative than the Street consensus. We were looking for $9 billion, as we felt that equipment operations and agriculture sales would both fall as high as 20%, with construction sales down as much as 30% as well. That said, sales surpassed our estimates by over $250 million and surpassed the Street consensus as well. Overall there was a 13% fall year-over-year, which is impressive given we were expecting much worse. Let us look more into segment performance.

Segment specifics

Most of the company's sales stem from its agriculture and turf equipment lines. Net sales in the equipment operations were down 20% to $8.22 billion, from $10.27 billion last year. This was about what we had expected, frankly. Agriculture and Turf net sales dropped 18%, a bit better than we expected, coming in at $5.97 billion, from $7.28 billion a year ago. Construction and forestry sales took a hit in the quarter as expected, though less so than we had anticipated. Sales in this segment were down 23% to $2.26 billion, falling from $2.99 billion last year. Make no mistake, this was due to a poor operating environment where volumes were significantly reduced. This was partially offset on the operating profit end by cost controls and price realization, but the pain was noticeable. But this segment even without COVID-19 was something that we predicted last year would get hammered this year. Down 23% was much better than expected.

Deere's worldwide sales of construction and forestry equipment were anticipated to be down 10-15% for 2020, with foreign-currency rates having an unfavorable translation effect of 2%, but are now expected to be down 30-40% versus 2019. Ouch. The outlook reflects slowing construction activity as well as the company's efforts to manage dealer inventory levels. For the year in the forestry side of things, global industry sales are expected to be down 15-20%. To ensure profit, we need to watch expenses.

Cutting expenses

With sales falling in the quarter dramatically, though a bit better than expected, it comes down to expenses as the one risk that we want to watch to ensure profit is being maintained. With such a hit to sales, we expected there was no way profit could hold up and deliver growth over last year. In other words, we want expected that even with strong margins the reduced sales would hit earnings hard. So, it is critical that we look at things like the cost of sales.

When we looked at Q2 2020, we expected that expenses would decline in every key category given the huge fall in revenues. Cost of sales was $6.29 billion vs. $7.76 billion last year. Here is the key. While sales were down 13%, the fall in cost of sales was closer to 19%. On an absolute dollar basis, this means that gross profit fell, but margins were strong. They were better than we expected frankly.

With the fall in revenue, if these costs were high, it could lead to lower earnings than we were expecting, especially when combined with other key expenses like research & development, as well as general/administrative costs. When we factor in extra expenses, net income widened. Research & development costs fell to to $406 million from $457 million. Selling, general & administrative expenses were down to $906 million, while "other" expenses were up slightly to $377 million. Interest expenses were down $9 million.

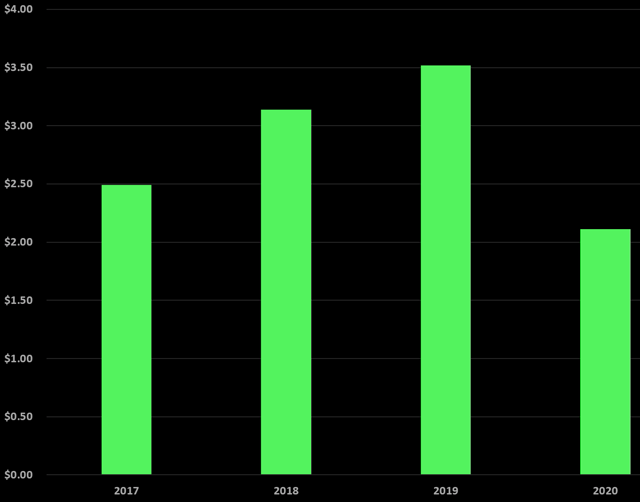

When we combine this total operating expense data with total revenue data, we see net income fell sharply to $666 million from $1.47 billion a year ago. While this is a huge hit, it was better than expected. While EPS was expected to be pressured from a year ago, EPS was much better than expected, though fell mightily:

Source: SEC filings, graphics by BAD BEAT Investing

This EPS resut was largely unexpected, but was a result of higher than expected revenues and lower than expected expenses. This beat our expectations by $0.40, driven by better than expected revenue. EPS was well above consensus, surpassing those estimates by $0.49. However, the quarterly results and the expected pain in Q3 2020 will of course weigh on overall 2020 expectations.

Bringing down 2020 projections

Make no mistake, trying to forecast activity in the agricultural sector can be pretty difficult, without the impact of a global pandemic. You have to factor in expected crop activity, look at government subsidies, gamble on weather, and consider politics. Now factor in that huge shifts in farmer behavior, consumer patterns, stay at home issues, closed restaurants, and global recession, even if it is temporary. All of this means that outlooks are constantly in flux, and has now been exacerbated by the pandemic and of course this is a U.S. Presidential election year.

With everything happening in the world, we really think that farmers will be hesitant to make major purchases. There are just so many risks, but it of course varies by the sector/industry we are looking at. For years, Deere has continued to experience strong increases in demand, most notably in North America. International sales remain strong, but contraction is now here. Shares seem overvalued based on our new projections.

Based on the current trajectory of the company and its segments, with massive declines anticipated across all segments, we are handicapping equipment sales falling more toward the higher end of management. Management can help protect profit by slashing expenses, but we now see earnings falling about 30-40% as well, and will look for net income to fall from $3.25 billion to $1.75-$2.25 billion this year. It is not that growth is slowing, it is that growth is gone. However, the Q2 results were encouraging as EPS was better than expected.

Still we remain mildly bearish. Based on these numbers, we now expect adjusted EPS of $5.70-7.00 for the year. With a price tag of $150 we are at 26.3X FWD earnings at the low end here, and at the high end we are at 21.4X FWD earnings. When we lowered our price target and were bearish, we were pricing shares at the historic 15-16X EPS. Using the high end (16X and $7.00 in EPS), that would suggest a price target of $112. That seems low, so we factor in preliminary 2021 guidance. While we have no clarity on 2021, we anticipate more economic activity than we are seeing in fiscal 2020. Using a very wide $7-$10 expectation in EPS for 2021, a fair price target at the high end here would be $160. On that outlook, shares are mildly attractive, but, we much prefer you wait for another pullback.

Take-home

We are big fans of Deere, and think management is pretty decent. But it is a tough sector, in a very tough time for the global economy. We still love this company, but based on forward earnings calculations at this time, even if they are wide, we are neutral here and strongly believe you need a more sizable pullback before pulling the trigger.

Quad 7 Capital is a leading contributor with Seeking Alpha, so if you like the material and want to see more, scroll to the top of the article and hit "Follow."

We turn losers into winners

Like our thought process? Stop wasting time and join the community of 100's of traders at BAD BEAT Investing.

We're available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

- Deep value situations identified through proprietary analysis

- Stocks, options, trades, dividends and one-on-one portfolio reviews

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.