Occidental Petroleum - Africa Asset Sales Collapse, What's Next?

by The Value PortfolioSummary

- Roughly $4 billion in Occidental Petroleum's planned asset sales haven't panned out in Africa. These asset sales were supposed to pay down debt.

- Fortunately, crude oil prices have already begun to recover significantly. Prices are near the $40 WTI breakeven on the company's old dividend.

- We expect the company's cash flow to remain strong enough to survive this crisis and shareholder rewards to resume.

Occidental Petroleum (NYSE: OXY) acquired Anadarko Petroleum almost a year ago, focused on becoming a giant of the U.S. shale basins. As a result of the expensive acquisition, the company decided it would focus on significant asset sales. The company planned on $10-15 billion of asset sales, starting by divesting Africa assets for $8.8 billion.

Occidental Petroleum - Wyoming Public Radio

Occidental Petroleum Africa Sale Terms

Occidental Petroleum announced $8.8 billion in asset sales with Africa before the start of the acquisition.

Occidental Petroleum Sale Plan - Occidental Petroleum Investor Presentation

Occidental Petroleum announced an original binding agreement with Total to divest assets in Algeria, Ghana, Mozambique, and South Africa. The total price was $8.8 billion. The most significant asset out of these are the company's Mozambique assets for a $3.9 billion total. That portion of the sale was completed in September 2019.

The company also, at some point in the 6 months in between, completed the sale of the South African assets. Although it's worth noting that the specific price wasn't specified. However, the assets weren't particularly noteworthy, so we'll assume that their valuation would be less than $1 billion.

Occidental Petroleum Africa Sale Results

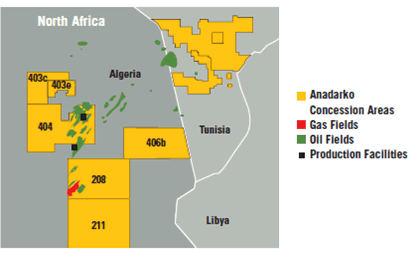

However, what happened with the company's Algerian and Ghana assets is more interesting.

Occidental Petroleum - Houston Chronicle

Occidental Petroleum has run into two key roadblocks around selling its Algerian and Ghana assets for what we estimate to be almost $4 billion. The company's Algerian asset sales were blocked by the minister of energy, due to concerns over Total (NYSE: TOT) association with France - the former colonial power of the country.

Simultaneously, the company's acquisition of Ghana assets was put on hold after arguments over a $500 million capital gains tax bill. The halt in both of these acquisitions pushed them past the COVID-19 related oil price collapse in prices. That has resulted in Total backing out of both the Ghana and the Algeria asset sales.

The purchase and sale agreement provided that the sale of the Ghana assets was conditional upon the completion of the Algeria assets’ sale. Occidental has informed Total that, as part of an understanding with the Algerian authorities on the transfer of Anadarko’s interests to Occidental, Occidental would not be in a position to sell its interests in Algeria to Total. Total has informed Occidental that it is not interested in purchasing Anadarko’s interests in Ghana in the current circumstances. Because the purchase and sale agreement expires in September, Total and Occidental have executed a waiver of the obligation to purchase and sell the Ghana assets, so that Occidental can begin marketing the sale of the Ghana assets to other third parties. These assets in Ghana are world class and function economically well at low oil prices with upside potential over the long term. - Occidental Petroleum Press Release

The halt in these acquisitions mean that Occidental Petroleum loses out on $4 billion, roughly, that it truly needed, and continues to need to hold onto those assets.

Broader Corporate Effects

Let's take a look at the effects from these lack of sales. The first is that Occidental Petroleum is losing out on $4 billion. The company will instead have to leave that money borrowed. We'll discuss that in more detail later, in terms of the company's cash flow, and debt pay downs.

Let's assume the company chooses to issue a 2-year bond to handle the downturn until the asset is fairly priced again. Based on the company's other 2-year bonds, the yield to maturity will be near 9%. That'll cost the company roughly $350 million in annual interest expenses.

Anadarko Petroleum Algeria - Anadarko Petroleum Investor Presentation

Now to value these assets and their expenses, we have to take a trickier approach. The assets use roughly $200 million in capital expenditures per year, utilizing Anadarko Petroleum's recent guidance. At the same time, the assets have an operating expenditure cost of roughly $10 / barrel with depreciation at roughly $22 / barrel based on operator Tullow Oil.

The assets consist of roughly 260 thousand barrels / day of production in Algeria and another 50-60 thousand barrels / day of production in Ghana. At $35 Brent, that means roughly $3 billion in pure annual cash flow. Assuming the depreciation reflects financial obligations that means more like $300 million in annual cash flow.

The specifics of whether the $200 million in capital expenditures or $3 billion in depreciation best reflect the costs of the asset remain to be seen. However, what's clear is that in the immediate term the company should earn enough cash flow to justify holding the assets.

What's Next For Asset Sales

So what's next for Occidental Petroleum's asset sales? Well the company still holds some incredibly good assets in a good market. The company still holds $4 billion in its Ghana and Algerian assets. Additionally, the company owns $2 billion in Wes Midstream (NYSE: WES), however, in a normal market (mid-2019) that's worth more like $7 billion.

Occidental Petroleum has a substantial $40 billion debt load which means it'll continue to sell assets as it can. The company has already re-marketed its Ghana assets, so I recommend paying close attention to the potential for additional asset sales.

Occidental Petroleum Cash Flow

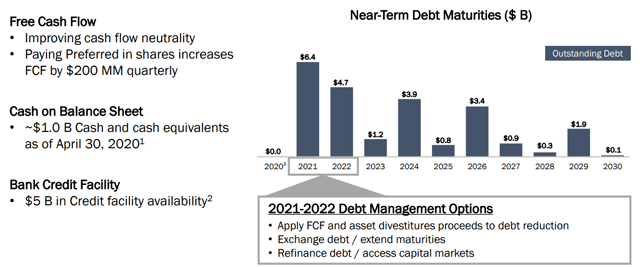

What matters most for Occidental Petroleum shareholders is the company's cash flow and whether the company can handle near term debt maturities.

Occidental Petroleum Near-Term Debt Maturities - Occidental Petroleum Investor Presentation

Occidental Petroleum has roughly $1 billion in cash and cash equivalents with $11.1 billion in debt maturities over 2021-2022. The company has chosen to start paying its obligations to Warren Buffett's preferred stocks with equity instead of stock, increasing the company's FCF by $200 million on a quarterly basis.

At the same time, the company has $5 billion in a credit facility availability. The company's credit facility expires at the end of January 2023, at a quality interest rate and a minimal amount of withdrawals remaining. So the company can partially push off its debt obligations, however, it can't push them back by much.

However, what matters for the company is its cash flow.

Occidental Petroleum 2Q 2020 Results - Occidental Petroleum Investor Presentation

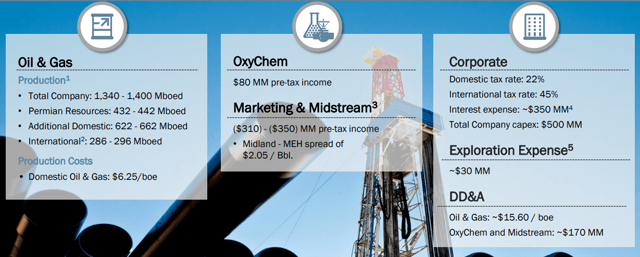

Occidental Petroleum is focused on keeping production strong with 1.37 million barrels of production at a $6.25 / barrel cost. It's worth noting here the company still has $2.5 billion in annualized capital expenditures coming out to roughly $5 / barrel produced. However, the company has already spent a significant % of this in the first year so its remaining obligations are less.

The company is also expecting a net loss of ~$250 million from its OxyChem + marketing + midstream businesses (~$2 / barrel). Interest expenses will cost the company ~$1.4 billion annualized (~$3 / barrel). Putting this all together, the company's raw cash obligations are roughly $16.25 / barrel. Overhead operating expenses knock this up towards $20 billion a barrel.

WTI crude oil prices have recovered significantly to almost $34 / barrel.

For the remaining 3 quarters of 2020 and the 4 quarters of 2021, assuming these numbers hold true, the company's cash flow will be almost $15 billion. DD&A expenses will be able to cover a significant % of that minimizing the company's tax obligations. So on paper, that's enough to cover the company's raw debt obligations.

However, it's worth noting that this doesn't count the company's dividend ($1 / barrel annualized) and capital expenditures to maintain production (~$3 / barrel). The company is currently minimizing capital expenditures to maintain cash flow. Still in the immediate term it appears that Occidental Petroleum has the cash flow to handle the worst of the crash.

The Recovery

Investing in Occidental Petroleum is not about a play on the company's current asset base it's about a play on a recovery in prices.

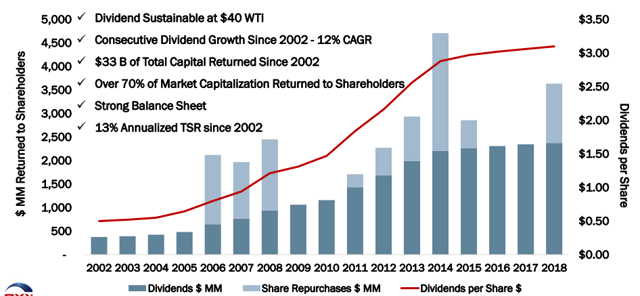

Occidental Petroleum Shareholder Returns - Occidental Petroleum Investor Presentation

Occidental Petroleum's old dividend, which would be a more than 20% yield on cost for those who invest today, was sustainable at $40 / barrel WTI. Current crude oil prices are at $33.77 / barrel WTI. That's already a significant recovery off of their lows, which the market hadn't priced in, and it means with an 18% recovery in oil prices, that dividend is once again feasible.

Occidental Petroleum's current breakeven price is <$30 / barrel. Going towards $40 WTI we start to see significant profit.

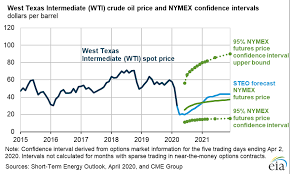

WTI Price Forecast - EIA

Looking at the above confidence range, prices are expected to to increase above $40 / barrel WTI by early 2021 and start increasing towards $50 / barrel. If that happens, that means the potential for quick double-digit shareholder rewards. That shareholder rewards can reward those who invest today significantly.

Occidental Petroleum Risk

Occidental Petroleum's only significant risk worth paying attention to is that prices remain lower for longer.

Above, we discussed EIA forecasts for WTI crude oil prices and the potential effects that they'll have. The company is capable of >20% shareholder rewards in a market where WTI prices only recover by 18% from their currently already low levels. However, if prices recover further, the company's ability to reward shareholders will improve dramatically.

Given the potential for shareholder rewards, despite asset sale issues, we recommend taking advantage of current prices to invest.

Conclusion

Occidental Petroleum has an impressive portfolio of assets, many of which they acquired after their acquisition of Anadarko Petroleum. Unfortunately, however, the collapse in oil prices slowed down the company's planned asset sales which it was going to use to payback debt. In most investors views, that put the company in a tough position.

Fortunately, however, the company is well on the path to a recovery. It hasn't been reflected in the company's share price, however, WTI crude oil prices have already recovered by more than 50% from their lows. In the event that they recover by another 18%, the company will be able to return to its >20% dividend yield. That highlights the financial strength of its portfolio.

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long OXY, TOT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.