Nothing Natural About Low Rates

by William BlairSummary

- While an interest rate in the absence of both central banks and money may seem hard to imagine, the natural rate concept is commonly referred to in discussions about where central banks should set rates.

- Most studies that measure the natural rate use data going back a few decades. With a longer perspective, there is good reason to believe that the natural rate declines.

- We need to look closer at the incentives and functioning of the central banks to understand the modern dynamic of interest rates.

As discussed in "Navigating the Low-Rate Environment," artificially low rates are causing multiple price distortions and pockets of heightened risks. But there is nothing natural about this.

The so-called "natural rate" serves as a common goalpost for forecasters of inflation. The concept was coined by Swedish economist Knut Wicksell, and today can often be found at the center of discussions about monetary policy.

In Wicksell's words, the natural rate is "the rate of interest which would be determined by supply and demand if no use were made of money and all lending were effected in the form of real capital goods."1

While an interest rate in the absence of both central banks and money may seem hard to imagine, the natural rate concept is commonly referred to in discussions about where central banks should set rates.

A popular way to measure the natural rate is to take account of historical statistical relationships between real interest rates on the one hand, and gross domestic product (GDP) output gap and other macroeconomic variables on the other.2 By controlling for the cyclical output gaps, economists assess how the real interest rate would evolve in their absence.

Economists have applied this methodology to several studies to measure the natural rate in different countries.3 There have also been some more statistically complicated models using changes in macroeconomic variables to measure the natural rate.4 A general conclusion is that the natural rate is declining.

The problem with these measurements of the natural rate is that while they control for business cycles, they do not control for any longer-term pressure on rates. As such, if central banks hold rates down for a couple of decades, this will be interpreted as a fall in the natural rate by these models.

Most studies that measure the natural rate use data going back a few decades. With a longer perspective, there is good reason to believe that the natural rate declines.

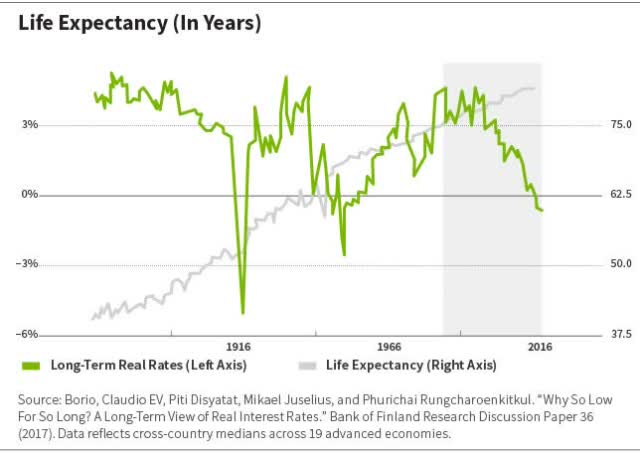

The world has seen a slow and negative trend in both nominal and real rates since the 12th century,5 which is most likely due to factors like better financial intermediation, more international integration, and longer life spans. Rates could have also come down as inflation expectations became part of price setting, which made bonds less risky in real terms.6

The long-term decline in the natural rate, however, cannot explain the rapid fall in rates we have seen in much of the wealthy world since the 1980s.

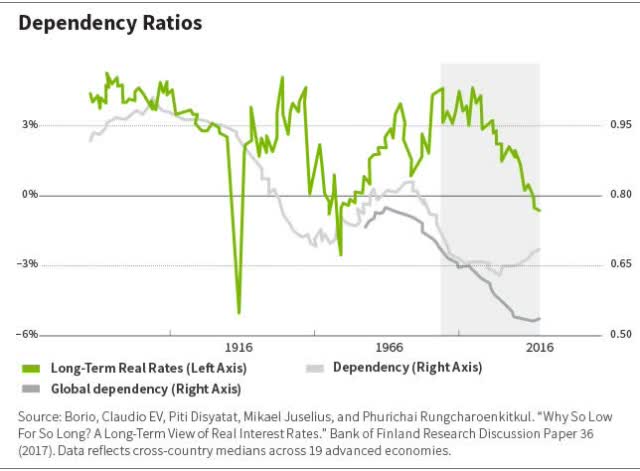

The perception of rapidly falling natural rates is prompting economists to look for fundamental reasons for why this is happening. Common explanations include lower economic growth7 and related lower return on capital.8 Others look for explanations in higher demand for safe assets and liquidity.9 Demographics is another popular rationale. A falling dependency ratio (a rising percentage of the population classified as working age) means higher net savings and, thus, lower rates.10

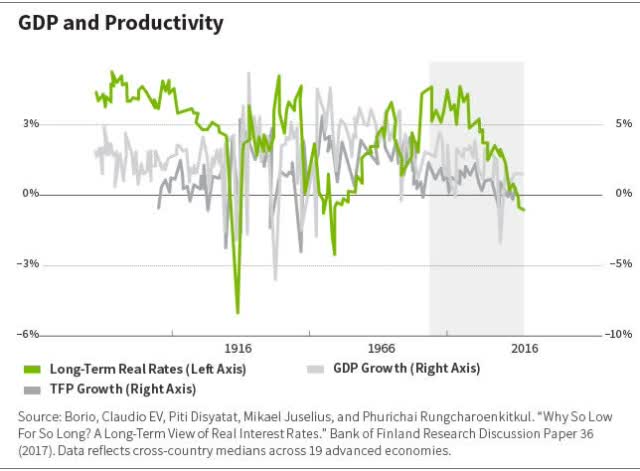

Some studies observe, for instance, that the decline in rates since the 1980s coincided with falling growth, productivity, or dependency ratio. However, these explanations lack support from a long-term perspective.

Borio, et al. (2017) used data covering 19 advanced economies starting in 1870 and showed that only dependency ratio and life expectancy have a statistically significant correlation with real rates, but that this relationship disappears when the variables are used in a joint regression.

And while life expectancy correlates with falling rates since the 1980s, this can be explained by a simple linear trend line. If all variables consistently move in the same direction, one cannot conclude any causal relationships, as the charts below illustrate.11

This same study does find that interest rates can be explained over the long term by the type of prevailing monetary regime, which is contrary to the common view of central banks as reacting to changes in the natural rate. As real economic factors like productivity and demographics lower the natural rate, the argument goes, banks must cut rates to avoid artificially suppressing economic growth. However, it seems that central banks should not be let off the hook so easily.

We conclude that while natural rates probably have fallen in the past few centuries, this does not mean that the steep falls in rates since the 1980s are in any way part of this dynamic. It certainly does not mean that it is natural for Europe and Japan to have negative rates.

Instead, we need to look closer at the incentives and functioning of the central banks to understand the modern dynamic of interest rates. We do that in the next post in this series.

1 Wicksell 1936: 32.

2 Holston, Laubach, and Williams 2017.

3 See e.g. Garnier and Wilhelmsen 2005; Selgin et al. 2011; Laubach aånd Williams 2015. Also Rachel and Summers (2019) using the model to measure the effect of government debt and other policies on rates in industrialized economies.

4 See e.g. Lubik and Matthews (2015), applying a time-varying parameter vector autoregressive (TVP VAR) model and Arestis and Chortareas (2008), applying a dynamic stochastic general equilibrium (DSGE) model.

5 Schmelzing 2020.

6 Schmelzing 2020.

7 See e.g. e.g. Kaplan 2018.

8 Howe and Pigott 1991.

9 Kaplan 2018; Del Negro et al 2017: 241; Bernanke et al. 2011; Caballero and Krishnamurthy 2009; Caballero 2010; Caballero and Farhi 2017; Caballero, Farhi, and Gourinchas 2016; Gourinchas and Rey 2016.

10 See e.g. Carvalho et al 2016; Favero et al 2012; Ikeda and Saito 2012; Furceri 2014.

11 Borio et al. 2017.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.