Euro-Area Economy Closer to ECB’s Worst-Case Estimates, Lagarde Says

by Carolynn Look- President Lagarde speaks in online Q&A session for youth

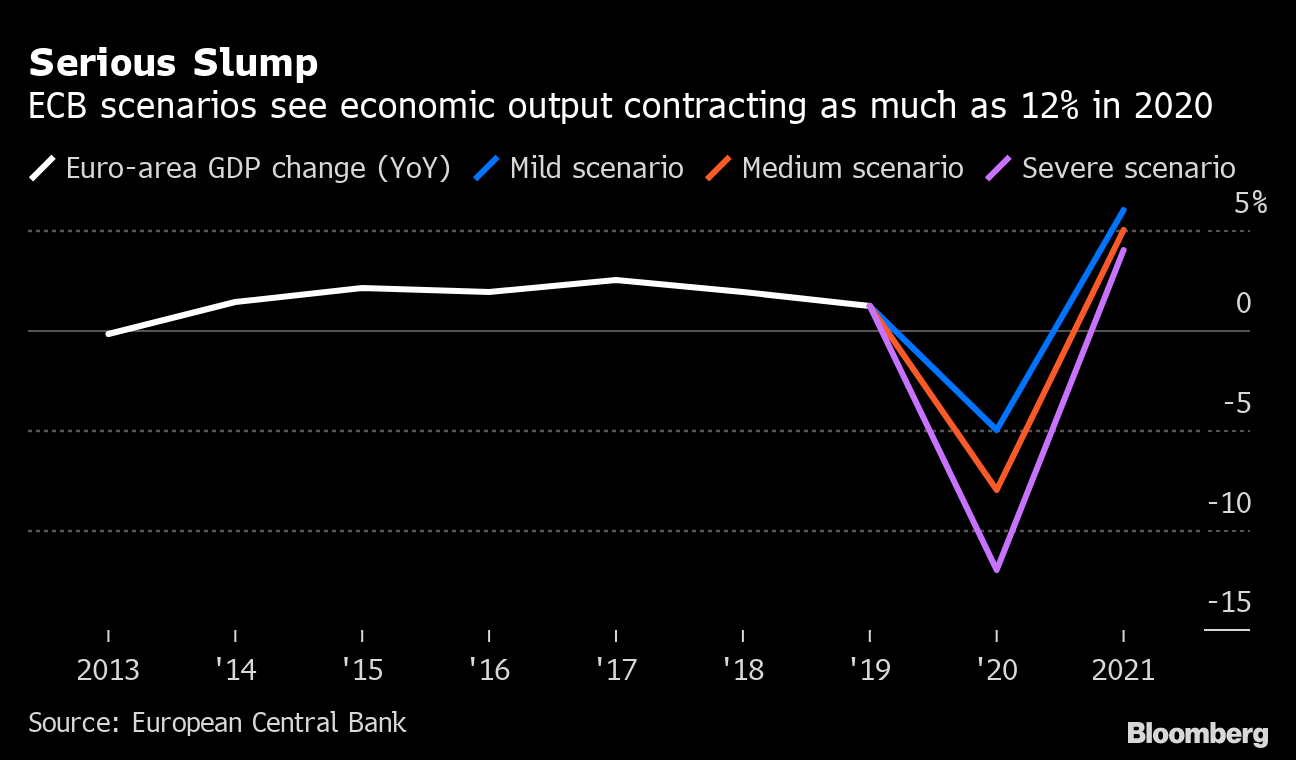

- Economic contraction in 2020 to be in range of 8% to 12%

The euro-area economy is faring worse than hoped, facing a recession as bad as the European Central Bank’s more pessimistic forecasts.

Output is set to shrink between 8% and 12%, ECB President Christine Lagarde and Vice President Luis De Guindos both said on Wednesday, calling a milder scenario out of date. The remarks highlight the severity of the repercussions for Europe after businesses were forced to close because of the coronavirus pandemic, costing hundreds of thousands of jobs and furloughing millions more.

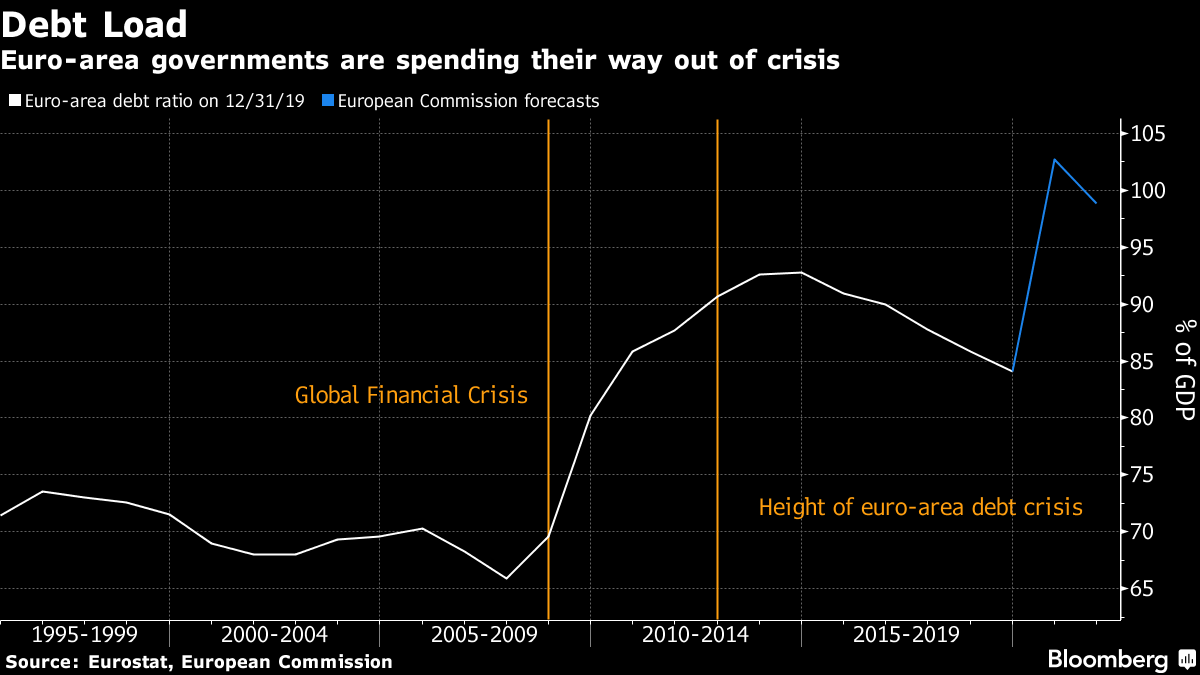

The central bank and governments have ramped up spending to offer companies and households support, and the ECB chiefs spoke shortly before the European Commission proposed a new fiscal stimulus package that could be worth as much as 750 billion euros ($825 billion).

“We’ll have a better sense in a few days as we publish our numbers in early June, but it’s likely we will be in between the medium and severe scenarios,” Lagarde said when asked about the outlook in an online question-and-answer session.

The ECB is set to update its official projections for growth and inflation next, when the Governing Council also decides on policy. The central bank launched a 750-billion euro emergency asset-purchase program in March, and economists are increasingly predicting it’ll be boosted at the June 4 session.

The asset-buying has helped rein in borrowing costs and made it easier for governments to fund stimulus.

Bond yields fell further when the EU Commission unveiled its proposal for the recovery fund, which aims to underwrite the worst-hit parts of the bloc such as Italy and Spain with grants and cheap loans.

The program, which still needs to win the backing of member states, would be funded by joint debt issuance in a significant step toward closer financial integration, according to details posted on the commission’s website.

What Bloomberg’s Economists Say

“Whether the proposal can withstand scrutiny from the European Union’s more frugal members remains to be seen. If it does, the support will be material. But, more than that, it will set an important precedent for mutualizing the cost of the pandemic.”

-Jamie Rush and Maeva Cousin. Read their EUROPE INSIGHT

Lagarde expressed confidence that higher public spending won’t result in a new debt crisis in the euro area. Debt-servicing costs are “extremely low,” she said, adding that if economies are transformed to be made more efficient, productive and sustainable, then spending should be encouraged.

“All countries around the world had to respond, and as a result of that had to increase their debt,” she said. In the face of the pandemic, “use of debt is not only recommended, it’s the way to go.”

The president, 64, also had some advice for young people embarking on their careers in such challenging times.

In the virtual event, which was targeted at European youth, she encouraged viewers to embrace the “beauty of the course of changes we are seeing” by acquiring new skills and being “prepared to do all sorts of jobs.”

— With assistance by Piotr Skolimowski, Alexander Weber, Jill Ward, and Catherine Bosley

(Updates with EU plan starting in third paragraph)