Pound-to-Australian Dollar Downtrend Intact and Set to Endure as Support Comes Under Pressure

by Gary Howes

- Technicals: GBP/AUD looks set for further losses

- AUD bid in current 'risk on' market

- Investors showing increased confidence in global recovery

- GBP/AUD spot rate at time of writing: 1.8538

- Bank transfer rates (indicative guide): 1.7889-1.8019

- FX specialist rates (indicative guide): 1.8111-1.8370

- For more on specialist rates, please see here

The British Pound's multi-week downtrend against the Australian Dollar looks set to remain in place for the foreseeable future says a noted foreign exchange analyst we follow.

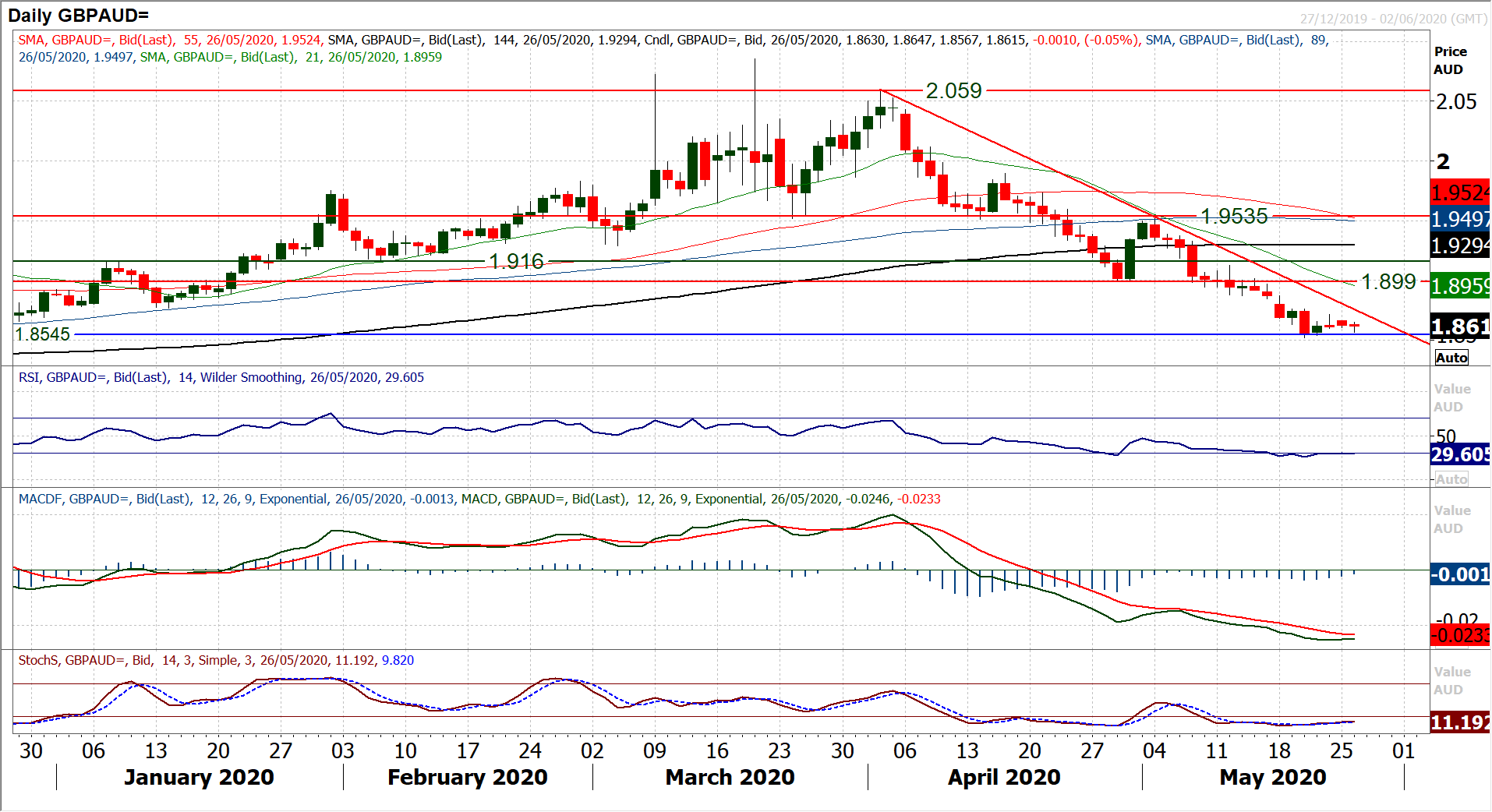

Richard Perry at Hantec Markets has taken a fresh look at the Pound-to-Australian Dollar exchange rate and notes a market that is in a downtrend, forecasting that any bounces in the value of Sterling should be short-lived as traders will inevitably consider them to be a chance to sell.

"Of all the forex majors, the prospects of sterling look the most concerning. On the flipside, we continue to be happy with the way the Aussie is performing as prospects of a long economic recovery take hold," says Perry. "Subsequently, we see a strong downtrend on GBP/AUD forming."

The Pound had rallied to a a multi-year high against the Australian Dollar in March, when the GBP/AUD exchange rate reached 2.06. The advance was driven by a broad-based market sell-off in response to the rapidly spreading covid-19 virus, confirming the Australian Dollar remains particularly prone to broader market sentiment.

The recovery in sentiment since early April has understandably favoured the Australian Dollar, owing to this correlation remaining intact and signs that the world's economy is unlocking as the covid-19 virus fades has seen the currency's advance extend of late.

Concerning the outlook for GBP/AUD, Perry says the support at 1.8545 (the old November low) held an initial test last week, "but we expect that this will come under further pressure in the coming days and rallies should be a chance to sell. After a rebound from 1.8520 last Wednesday, candlesticks have been underwhelming in recovery."

"This is reflected in the lack of conviction in recovery on momentum indicators and with the seven week fast approaching, this looks like an opportunity to sell. There is resistance built up between 1.8715/1.8760 from last week, whilst the downtrend falls around 1.8770 today," adds Perry.

The analyst adds that a closing breach of 1.8545 would leave a retreat to 1.8070/1.8095 as the next test. The bears would be in control at least until 1.8890/1.9125 were broken.

The Australian Dollar has extended its recovery over the course of the past 24 hours courtesy of an ongoing rally in global equity markets and commodity prices.

Australia's economy relies heavily on the export of raw materials to China, and therefore the overall state of the world economy, the Chinese economy and trade matter for the Aussie Dollar.

For now investors continue to be influenced by a view that the world's economy is firmly on track to reopen over the next two months and it therefore makes sense to snap up discounted assets in advance.

How long this trade can extend is important for the Aussie Dollar which will remain prone to any setbacks in the reopening narrative.

"Once again there is a feeling that traders are wearing blinkers as we head higher, with markets disregarding the faltering hopes that hydroxychloroquine, Remdesivir, or Moderna’s mRNA-1273 will shorten the length of this crisis. As stock markets continue to close the gap created by this crisis, questions over quite when this rebound will end become more prominent that ever," says Joshua Mahony, Senior Market Analyst at IG.

Markets enjoyed a sizeable rally on Tuesday after traders returned from a holiday in the U.S. and UK, with stocks in the battered travel sector looking to be in demand.

"The outperformance of those within the travel and tourism space highlights the influence the impending lockdown easing is having upon market sentiment. To some extent it feels like we are turning things on their head, with risk-on sentiment driving those riskier and heavily sold stocks such as IAG, Carnival, and Rolls-Royce into huge double digit gains<" says Mahony.

The analyst adds that the outperformance from the hard-hit travel and tourism sector highlights how we appear to be shifting towards a phase where traders seek out value rather than security.

Time to move your money? The Global Reach Best Exchange Rate Guarantee maximises your currency purchasing power. Find out more.

Brexit will impact your UK pension if you are living in the EU. Capital Rock Wealth have developed a comprehensive guide to help you navigate the uncertainty ahead.

Find out more

Invest in Spanish Property. A selection of discounted properties due to the covid-19 crisis, online viewings and transactions possible. Download the guide. Download the Guide