Advance Auto Parts: Resilient 'DIY' Market Balanced By A Weaker Growth Outlook

by BOOX ResearchSummary

- Advance Auto Parts reported Q1 earnings highlighted by weak sales despite most stores remaining open as an essential business through the coronavirus pandemic.

- The company is seeing improving conditions since April supported by do-it-yourself customers, which has outperformed the professional segment.

- A slowdown in the broader auto industry highlights ongoing challenges for the company's growth outlook.

Advance Auto Parts Inc. (AAP) is one of the largest automotive parts, tools, and accessories retailers in North America operating over 5,000 stores, servicing both professional and do-it-yourself ("DIY") customers. The company just reported its latest Q1 earnings, which showed a major disruption to the business as the coronavirus pandemic forced nationwide stay-at-home orders at the end of March through April. AAP is down by 17% in 2020, although rebounding significantly higher from lows in March with investors looking ahead to conditions normalizing. While auto parts are relatively more resilient to ongoing macro weaknesses and challenges in retail, we take a cautious outlook on shares and expect renewed volatility considering a more difficult growth outlook.

(Source: Finviz)

AAP Q1 Earnings Release

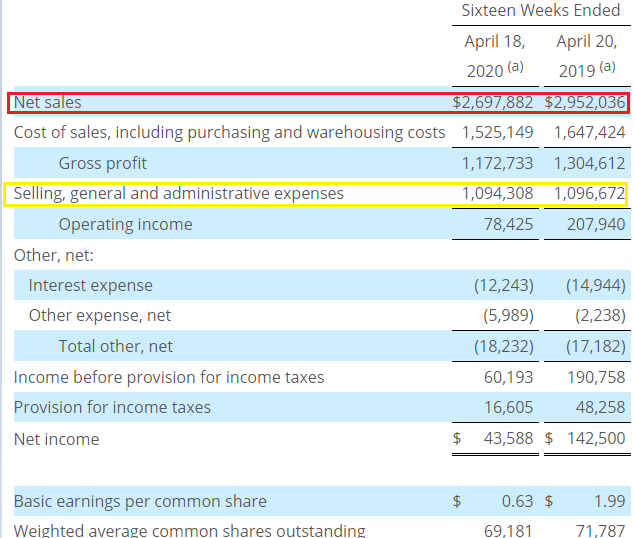

Advance Auto Parts reported its fiscal 2020 Q1 earnings report on May 19th with non-GAAP EPS of $0.91, which missed estimates by $0.68. GAAP EPS of $0.63 was $0.98 below expectations. Revenue of $2.7 billion in the quarter was down by 8.5% year over year but favorably above the consensus.

A couple of points are important for placing the numbers into context. First, the fiscal quarter represented 16 weeks through April 18th. In contrast to most other companies that have a quarter-end on March 31st, the mid-April quarter-end for AAP captures the bulk of the economic shutdown between mid-March and April in most parts of the country. By this measure, Q1 for the company represented a low point in terms of its operating environment.

Second, as an auto parts retailer, the company maintained most stores open as an "essential business" in a period when many other types of retailers closed. That being said, the 8.5% drop in sales for the quarter reflects significantly reduced store traffic as consumers stayed home and more limited sales to "professional" customers like auto repair and dealerships, which themselves observed weak demand.

(Source: Company IR)

AAP added emergency pay for employees, while providing necessary PPE equipment and sick leave benefits. Steps taken to preserve its financial position included cutting the remaining 2020 planned investments by 50% and also making discretionary cuts to operating expenses like marketing and in-store costs. Overall, flat SG&A growth on a year-over-year basis against the drop in sales led to a 63% drop in the operating income to $78 million compared to $207 million in Q1 2019. All things considered, the company was able to maintain profitability through this period, which is a positive.

During the quarter, AAP drew down $500 million from its revolving credit facility, while also issuing and additional $500 million in debt due in 2030 through a private placement. The combined actions adding $1 billion in liquidity to its balance allowed the regular quarterly dividend of $0.25 to be maintained, with the next record date for shareholders on June 19th. On the other hand, the share repurchasing program was suspended. The company ended the quarter with $1.3 billion in cash against $1.7 billion in financial debt. The adjusted debt (which includes operating leases) to adjusted EBITDAR over the past year reached 2.9x compared to 2.0x at the end of 2019. The overall liquidity position and solvency ratios remain stable.

Management Comments

In terms of the outlook for Q2 and the rest of the year, management formally pulled previous guidance but did offer some encouraging comments during the earnings conference call supporting a more positive outlook.

On a positive note, (Q1) represented the low point of the pandemic impact for AAP to-date and our sales have been improving sequentially each week. Through the first four weeks of Q2, our comparable store sales are approximately in-line with the prior year, and our DIY omni-channel business is growing double-digits, significantly outperforming professional. While there are a number of factors here, from an industry perspective, the DIY business tends to perform well during economic downturn, as unemployment increases, new car sales declined, the car park ages and more customers do their own maintenance and repairs. We also believe the combination of stimulus benefits and the strong execution of our DIY marketing and sales plans have been two additional drivers helping our recent sales performance.

The company is seeing sequential improvement during the first four weeks of Q2, with comp sales in line with 2019 trends. Management notes that DIY car care and car maintenance is relatively more resilient during an economic slowdown compared to the broader automobile industry. There is also a thought that the government stimulus efforts through the "CARES Act" is having a positive impact on the recovery process.

Our Analysis and Forward-Looking Commentary

We sense that some of the strength AAP observed in the first few weeks of its fiscal Q2 according to management comments may have been more related to pent-up demand, so the next earnings release will be important to confirm underlying trends. Our concern for AAP comes down to its growth outlook, which we believe has been structurally pressured and remains tepid.

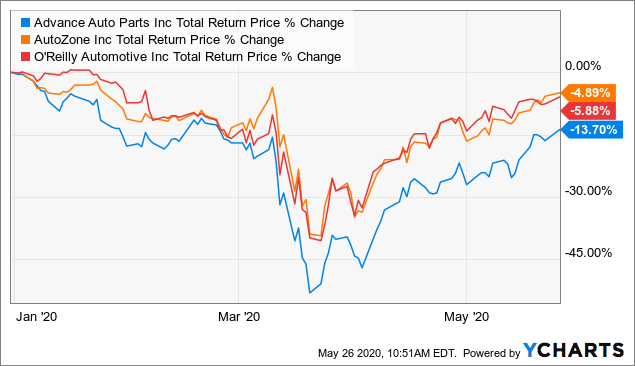

It's important to recognize that AAP has a higher exposure to the professional auto parts segment compared to competitors like AutoZone Inc. (AZO) and O'Reilly Automotive (ORLY). AAP operates various brands focused on professional customers like "Autopart International", "WorldPac", and "CarQuest" with replacement OEM parts. Indeed, AAP is underperforming both AZO and ORLY this year, which we believe is due to this dynamic.

While AAP is down by 14% in 2020, AZO and ORLY have presented more modest 5% and 6% declines, each respectively year to date. By this measure, AAP may be more challenged going forward with longer-lasting weakness in the professional segment that is more exposed to cyclical trends and broader pressures to the automotive industry.

Data by YCharts

Data suggests U.S. auto sales are set to decline by 27% this year with more consumers staying home as travel options are more limited. The challenge as we see it is that consumers upgrading to new vehicles in some ways may drive demand for auto parts and necessary repairs. Anecdotally, when you buy a new car with a trade-in, the dealer takes that used car and performs necessary maintenance and replaces parts for the vehicle to be resold in its optimal condition. By this measure, a decline in auto sales can drive weakness across the entire automotive industry verticals, including auto parts.

Whether more cars on the road are new or used, a smaller pie limits demand for auto parts overall. There is also thought that increasing adoption of work-from-home and telecommuting as a consequence of social distancing and the ongoing pandemic could structurally pressure growth beyond this year. The result is that going forward, AAP may require a lower growth trajectory of new store locations and a reset of expectations.

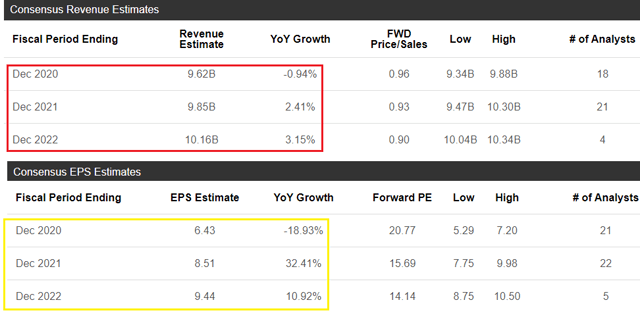

According to consensus estimates, AAP is expected to see a decline in sales this year of 1%, while earnings may decline by 19% to $6.43 per share. For 2021, sales growth is estimated to rebound to a relatively tepid 2.4%, while EPS recovery towards $8.51 would only represent a 4% upside compared to the 2019 EPS of $8.19.

(Source: Seeking Alpha Premium)

In terms of valuation, AAP trading at a forward P/E of 21x, compared to a 10-year average for the stock at 22x. Looking ahead, a rebound in earnings for 2021 at the consensus expectations implies a 1-year forward P/E of 15.7x.

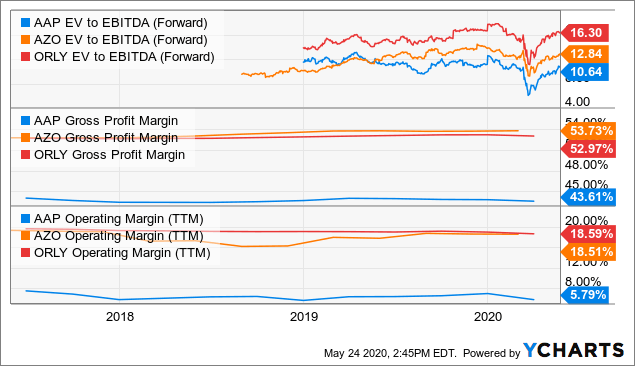

AAP is also trading at a forward EV-to-EBITDA multiple of 10.6x, which compares to 12.8x for AZO and 16.3x for ORLY. We believe the discount here and across other valuation ratios compared to AZO and ORLY are justified considering AAP's weaker growth and structurally lower profitability given its higher exposure to the lower-margin "professional" segment. AZO and ORLY also have a larger international business which is seen as offering higher growth potential. AZO and ORLY regularly obtain a gross margin above 50%, compared to under 45% for AAP. Similarly, AAP's average operating margin at 5.8% over the past year is lower than the 18.5% average for both AZO and ORLY.

Data by YCharts

Our point here is that AAP does not necessarily stand out as having exceptional value at current levels. The market consensus outlook for revenue growth averaging just 1.5% per year through 2022 leaves a lot to be desired. We see some downside risks to the estimates through 2021 based on our expectation of an overall weaker-than-expected economic recovery, along with the challenging conditions for the broader automotive sector.

Verdict

We take a neutral view on the stock and rate shares of AAP as a Hold, balancing its discount to competitors in the auto parts segment against weak growth outlook and ongoing risks. The next quarter's earnings release will be important to gauge underlying trends in the business as conditions normalize. To the upside, a faster-than-expected rebound in economic growth, possibly driven by a quick containment of the coronavirus pandemic, could support more positive sentiment towards the stock.

Are you interested to learn how this idea can fit within a diversified portfolio? With the Core-Satellite Dossier marketplace service, we sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks / ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.