Microsoft: Entering Another Lost Decade

by Stone Fox CapitalSummary

- Microsoft rallied after solid FQ3 results.

- The company pulled forward revenues with less-than-impressive results forecast for FQ4.

- The stock is set up for another lost decade with Microsoft again, trading at over 30x forward EPS estimates.

Following the coronavirus collapse, the tech giants have soared back to previous highs. One of the stocks that best epitomizes the ups and downs of the tech sector is Microsoft (MSFT). The stock might be trading near all-time highs now, but investors appear to forget the tech giant spent the 2000s decade with negative stock returns. My previous research from last September warned of the lost decade prior to the virus crash, and the recent rally brings up these concerns again.

Image Source: Microsoft website

Virus Pull-Forward

Microsoft has quickly rebounded from a virus low of $135 to over $180. The stock is only a few dollars from an all-time high of $190 with the market cap soaring back to $1.4 trillion.

The tech giant reported a phenomenal FQ3 report. Microsoft saw revenues surge 14.4% despite the COVID-19 economic shutdown. Revenues actually beat analyst estimates by $1.3 billion and accelerated from the 13.7% growth rate in the prior quarter.

Like other tech companies, Microsoft saw some pull-forward in cloud and computer demand from stay-at-home workers. Due to some one-time benefits, the company didn't provide anything special, with the FQ4 guidance mainly due to this point of view of CEO Satya Nadella on the FQ3 earnings call:

As COVID-19 impacts every aspect of our work and life, we have seen 2 years' worth of digital transformation in two months.

Microsoft guided to quarterly revenues of $35.85-36.80 billion. The numbers were actually below consensus of $36.52 billion. Analysts were only forecasting 8.3% growth.

The earnings story isn't much better. Analysts forecast Microsoft earning $6.20 per share in FY21 for only 8.7% growth. The trend line is for 10-15% EPS growth over the next few years.

Despite the highest market cap in history, Microsoft trades at nearly 32x FY20 EPS estimates. Analysts even forecast the company only generating about 25% of growth in FY21, where the stock trades at nearly 30x FY21 EPS estimates.

The stock has clearly lost touch with reality. Microsoft is impressively growing revenues by over 10% annually. The feat is hard to duplicate for a company with $140 billion in annual revenues, but it doesn't mean that investors should own the stock at these levels.

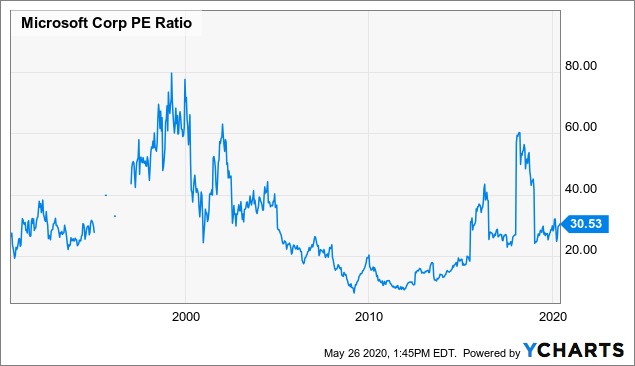

The trailing P/E ratio provides a great indication of where the stock trades in relation to history. While the number isn't the best indicator of value and the numbers utilized don't appear to adjust out one-time charges, the chart below still provides a great lesson.

Microsoft traded above 60x trailing earnings back in the 2000 internet bubble. The end result was a lost decade for anybody holding the stock, as decent growth never supported the rich valuation. Now, the stock is back trading towards those rich valuations. Microsoft isn't anywhere near as expensive as 2000, but the stock is now far more expensive than when it was a solid deal around the 2010 lows.

Data by YCharts

Volatile History

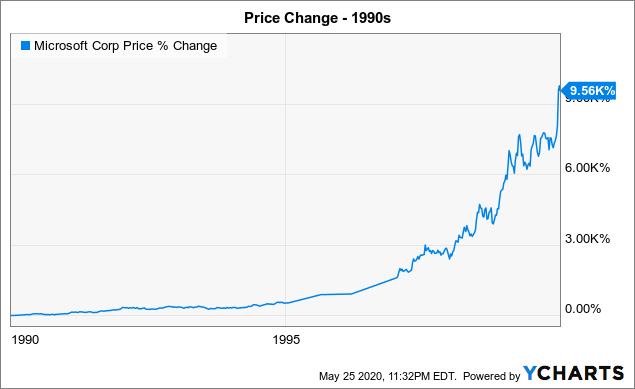

Microsoft has had a volatile history because the market routinely overpaid and underpaid for the stock. The tech company had an incredible '90s decade with a nearly 10,000% gain when growth in PCs were off the chart.

Data by YCharts

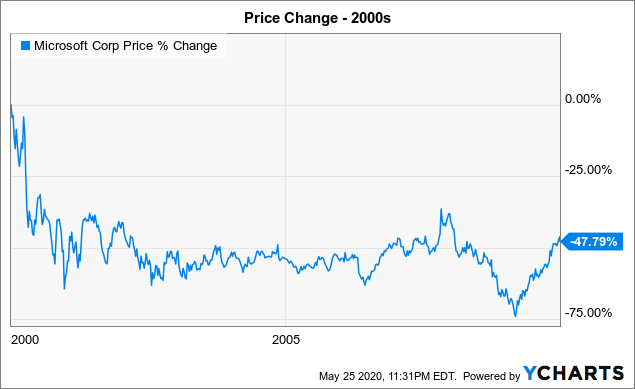

The problem here is that the market paid far too much for the stock at the 2000 peak. Microsoft spent the next decade going nowhere despite the business growing and expanding profits. The stock lost nearly 50% during the 2010s.

Data by YCharts

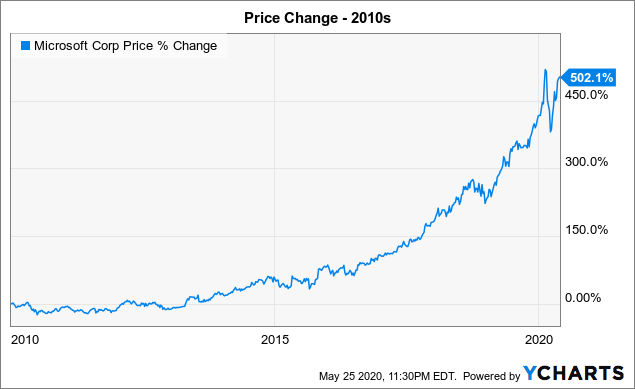

Now, Microsoft has nearly repeated the 1990s in the 2010s. The company saw the stock soar in the last half of the decade, producing an overall 500% gain up to this point.

Data by YCharts

The issue now is that the market has repeated some of the issues in 2000 leading to the lost decade. The tech giant isn't going to generate much more than 10% revenue growth, but the market has the stock valued as if revenues are growing at a 20% clip.

Analysts don't peg the company earning over $10 per share until FY25, yet Microsoft already trades at $183. The stock has already priced in the next 5 years of growth at the current prices.

Microsoft can definitely head higher. Any break of the recent $190 high would signal a breakout to new all-time highs. A richly priced stock can always trade at even higher valuations.

Takeaway

The key investor takeaway is that valuation matters and Microsoft will eventually revert back to the mean. Investors should now look to rotate out of expensive tech giants after a strong decade, as the 2020s could easily become a repeat of the 2000s.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.