FX Weekly: Calling For Chinese Help

by Rothko ResearchSummary

- The FANG+ stocks trade is getting crowded as the index is trading back to pre-COVID-19 highs.

- The recovery will take longer than governments expect due to social distancing, implying that debt and money creation will continue to grow.

- Interestingly, China's participation to the "global fiscal stimulus" has been almost non-existent. Will (and can) China "save" the world again?

Macro News

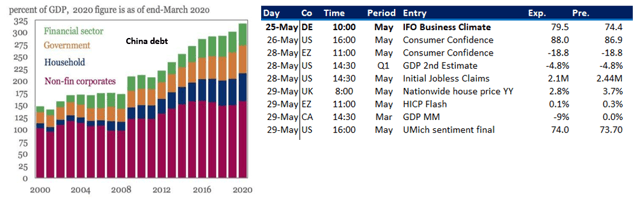

Global: In order to avoid a deflationary depression, countries around the world have run aggressive monetary and fiscal stimuli, as the constant extension of the lockdowns has left a significant proportion of jobs at risk in all the economies. Surprisingly, the fiscal policy response in China has been almost non-existent, and the world may not be able to count on the People’s Republic of China to come up with a massive stimulus package as an attempt to minimize the impact of the COVID-19 crisis. One of the major reasons is that Chinese debt was already high before the crisis; Figure 1 (left frame) shows that China’s total debt-to-GDP ratio was standing at a record high of 317% in the end of the first quarter of this year. Chinese officials are aware that the lower carry and weakening growth, combined with additional debt, will continue to weigh on the Chinese yuan, making the debt borrowed in the past cycle more expensive. We saw that the PBoC fixed the USDCNY midpoint rate at 7.1209, its lowest since 2008, and the CNY is now trading at a record low against gold.

US: While the S&P 500 struggles to break through its psychological resistance at 3,000, tech stocks have fully recovered and the FANG+ index is currently trading at its February highs as investors continue to pile into their favorite "VIP" growth stocks, with Amazon (AMZN) coming at the top of the list. The default rates are now expected to surge in the US, as we saw that the speed of corporate sub-investment-grade ratings downgrades has been unprecedented; we know that two major variables used to predict default rates are the commercial and industrial loans and the proportion from upgrades to downgrades. Sell-side institutions are expecting high yield default rates to exceed 10 percent in the coming months.

Japan: After the BoJ decided to double its purchases of Japanese corporate bonds, it is not surprising to see that the central bank has come as the biggest buyer of corporate bonds last month, questioning the existence of a market without the BoJ interventions. After falling by 3.4% in the first quarter (annualized), real GDP growth is expected to plummet by over 20% in Q2, the deepest contraction since the inception of the official data in 1955.

Euro: We remain bearish on the euro area as the lack of "solidarity," weaker-than-expected "recovery," poor liquidity and the political uncertainty are all factors that will weigh on European risky assets such as equities and the euro in the medium term.

Figure 1

Source: IIF, Eikon Reuters

US Treasuries Net Specs

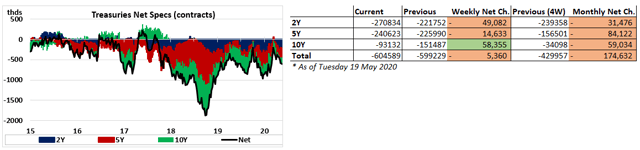

Net short specs on US Treasuries have remained steady in the week ended May 19, up by a mere 5.3K to 605K contracts. We decided to remove the net specs for the 30Y Treasuries and focus on the main 3 issuances (2Y, 5Y and 10Y). We expect the 2Y10Y yield curve to continue to steepen in the medium term on the back of a higher term premium, as the uncertainty over inflation expectations should continue to rise.

Figure 2

Source: CFTC

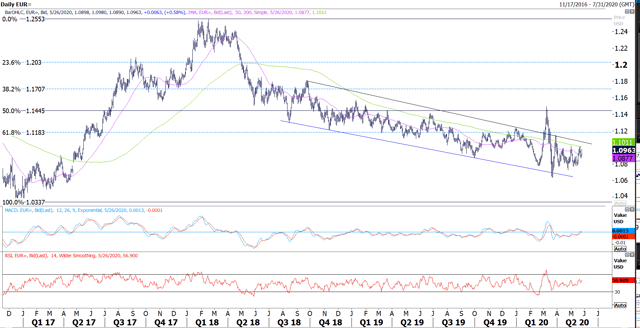

FX Positioning

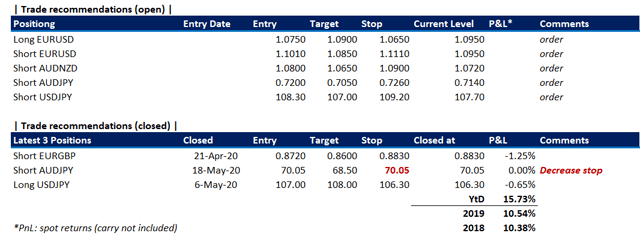

EUR/USD: The pair continues to trade within its narrow 300-pip range between 1.0750 and 1.1050. Even though we expect the bearish momentum to continue on the EURUSD exchange rate in the medium term, we will continue to trade the range and try to sell the pair at 1.1010 (which corresponds to the 200-day SMA).

Figure 3

Source: Eikon Reuters

EUR/GBP: The pair did not manage to break through its psychological resistance at 0.90 and has been consolidating in the past few days amid sterling gaining some momentum due to lower volatility. Even though some traders are betting that the "golden cross" formation could send the pair to new highs, we would wait for lower levels to enter a long position. The consolidation may continue in the short run.

Figure 4

Source: Eikon Reuters

USD/JPY: The yen has been slightly weakening against the major crosses, and USDJPY is slowly approaching a strong resistance at 108.30 (corresponds to the intersection of the 100-day and 200-day SMA). We will try to sell some at that level, keeping a stop above 109.15 (50% Fibo of the 99.60-118.70 range). We will also try to sell AUDJPY again at 72 (200-day SMA), keeping a tight stop at 72.60 with a first target at 70.50.

USD/CHF: The implied volatility on the pair keeps reaching new lows, as USDCHF has been trading within a 40-pip range in the past few days. We are waiting for the formation of a clear trend to start trading the pair again.

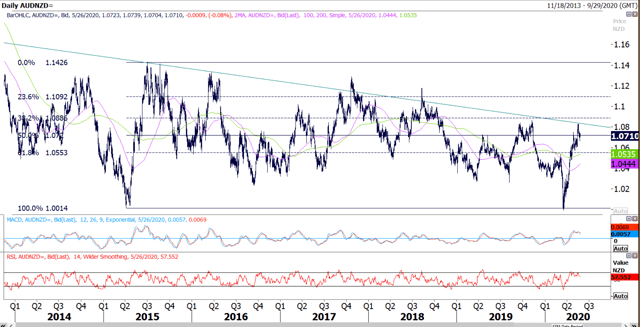

AUD/NZD: We still have not managed to enter our short order on AUDNZD at 1.08, but we keep it in our book, as we are highly convinced that the pair will experience a little consolidation in the near term.

Figure 5

Source: Eikon Reuters

Chart Of The Week

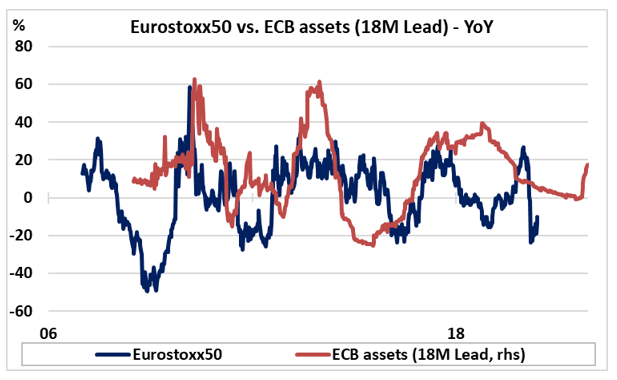

One striking observation in the euro area is that despite the NIRP policy and the EUR 3.5 trillion increase in the ECB balance sheet since the start of the QE in 2015, equities are flat, with the EURO STOXX 50 index currently flirting with the 3,000 level. On the other hand, the S&P 500 has generated over 60% in total return to its investors, significantly increasing the divergence between US and European equities that has occurred in the past decade. Poor growth, negative interest rates, a cheap euro, political uncertainty and low liquidity have constantly pushed investors away from euro equities, and it does not seem that the significant recent increase in the ECB balance sheet will be enough to levitate stocks in the medium term.

Euro equities are a "dead" market, and the longer-than-expected recovery will continue to weigh on bank stocks despite their ultra-cheap valuations. We do expect non-performing loans to rise sharply in the coming quarters, and we suggest the European leaders agreeing to a coordinated plan very soon to offset the effect of the COVID-19 crisis, otherwise the "union" could break apart this time.

Figure 6

Source: Eikon Reuters

Did you like this?

Please click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in AUDNZD, AUDJPY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.