Von der Leyen seeks to rally Europe behind ‘next generation’ recovery plan

European Commission president to pitch for a huge increase in spending power

by Jim Brunsden, Sam Fleming, Richard MilneBrussels will boldly go on Wednesday where no European Commission has gone before, with plans for an unprecedented borrowing spree aimed at funding the post-coronavirus recovery.

The plans will be unveiled before the European Parliament this afternoon by commission president Ursula von der Leyen, who will advocate an EU-level effort to pump money into regions that have suffered the most from the health and economic emergency, tying the fund and the next EU budget together in a recovery package.

The package has been branded “Next Generation EU” by the commission, whose president appears to have a soft spot for sci-fi terminology, having previously dubbed the EU budget the “mothership” of Europe’s economic rebound.

Ms von der Leyen has been clear that the EU’s long-term survival depends on how it responds to the crisis. The same fears stalk the corridors of power in Paris and Berlin. Italy, Spain and other countries on the frontline are watching closely for what Europe delivers in their moment of need.

But the package will have to be a political balancing act that also keeps on board “frugal” northerns wary of ramped-up EU spending, as well as central and eastern European countries that do not want to see large amounts of funds redirected at their expense.

Ms von der Leyen will get to her feet in the European Parliament at around 1.30pm Brussels time. According to people familiar with the plans, she will propose a recovery fund that more than matches Franco-German proposals from earlier this month for €500bn of EU borrowing on capital markets to finance grants. On top of this will be further borrowing to finance loans to member states — with discussions around €200bn.

As reported by the FT, the commission hopes it can convince member states to rally behind new taxes to raise revenue for the EU budget, helping it pay off its debts over the years to come.

One bright spot for Ms von der Leyen is that over the past couple of days both Denmark and Sweden have said that they are prepared to negotiate when it comes to the recovery fund — signalling a potential softening among the EU’s budget hawks. The two countries, along with the Netherlands and Austria, form the “frugal four” of EU budget hardliners. The group cosigned a paper over the weekend calling for the recovery fund to be limited to providing loans.

Sweden’s finance minister Magdalena Andersson told the FT on Tuesday that the “discussion has only just started”.

“It wasn’t like the French-German proposal was embraced by everyone in the European Union, and neither was our proposal embraced by everyone,” she said. “I think that’s a very common start of discussion in the European Union. And then at the end of the day, you would agree on something.”

But the recovery fund is only part of what is at stake. There is also the matter of the EU’s next seven-year, €1tn budget, which must be agreed for the recovery fund to become operational. EU leaders already spent a frustrating two days in February holed up in Brussels trying and failing to get a budget deal, not least because of the complications of filling the financial hole left behind by Brexit.

Speaking to reporters on Tuesday, Amélie de Montchalin, France’s Europe minister, said Paris was wary that the frugals could seek to rein in the EU budget as a quid pro quo for yielding on the recovery fund. The four countries have balked at everything from the proposed abolition of their national budget rebates to attempts to increase the EU’s spending pot as a percentage of gross national income.

“We will not rob Peter to pay Paul,” Ms de Montchalin said, stressing that both parts of the package were vital. “What I don’t want is an arbitrage between the two tools: the recovery fund and the budget.”

“The real risk is that Europe fragments if we do not invest in our future,” she said. “The crisis has shown that previous arguments in favour of budget cuts do not hold . . . heavy cuts can no longer be defended.”

Star Trek’s signature board game is three-dimensional chess. It’s good training for negotiating about money in Brussels.

jim.brunsden@ft.com; @jimbrunsden

sam.fleming@ft.com; @Sam1Fleming

richard.milne@ft.com;@rmilneNordic

Recommended reading

- The current pandemic is only the latest of a series of unnecessary catastrophes. Next one up? Climate change (Foreign Affairs)

- The lack of a proper and reliable system to count the victims of the pandemic will only add to the tragedy of our times (New York Times)

- Even as vaccines for the virus are seen as the last hope for a return to the old normal, disinformation about them is spreading (The Atlantic)

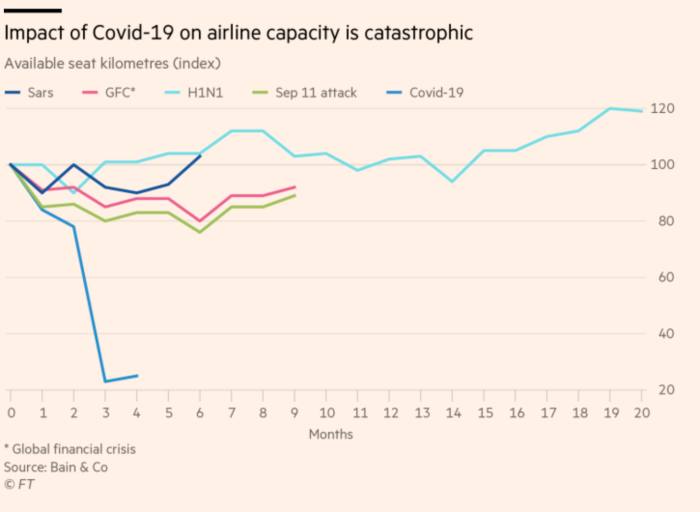

Chart du jour: the new summer

Your summer holiday may look very different in the post-Covid era. The aviation sector is making sweeping changes to the way people travel to adapt to new health and safety guidelines aimed at containing the virus. Expect temperature checks before flights as part of fresh efforts to renew passenger confidence. (chart via FT)

Planet Europe

Animal spirits are back

All rise. European and world stocks pushed higher on Tuesday on hopes that restrictions associated with the coronavirus pandemic were being relaxed.

The rally came as countries in Europe display signs of a shift towards some kind of normality. Germany, for example, announced that it would allow its citizens to travel freely within the continent from next month.

Shares in British Airways owner IAG, and Tui, the world’s largest tour operator, jumped almost 20 per cent following the news that would be a reprieve for the continent’s embattled travel industry. EasyJet, InterContinental Hotels Group and Whitbread shares rose more than 10 per cent.

Countries such as Italy and Spain, where Germans tend to go for summer holidays, will be relieved. Still, not all countries are opening at the same pace, leading to fragmentation within the EU single market. (FT, L’Echo)

EU déjà vu

The European Central Bank has warned that soaring government debt levels threaten to make investors reassess the continent’s sovereign risk and could reignite pressures on more vulnerable countries in the bloc.

The ECB’s financial stability review said in a statement: “The pandemic represents a medium-term challenge to the sustainability of public finances.” (FT)

Separately, ECB board member Isabel Schnabel said in an interview with the Financial Times that the institution intended to shrug off the German constitutional court’s ruling against its flagship bond-buying policy and expected the legal impasse to be resolved. (FT)

Something’s gotta give

German carrier Lufthansa is set to benefit from a €9bn bailout as the airline sector faces the worst crisis in years. But not so fast: EU regulators want Lufthansa to part ways with some coveted slots at Frankfurt and Munich airports.

To complicate matters further, low-cost airline Ryanair has said it is planning to lodge an appeal against the rescue package, which he said would “further strengthen Lufthansa’s monopoly-like grip on the German air travel market”. (FT)

China crunch

European Council president Charles Michel insisted on Tuesday that the EU is “not naive” about Beijing’s behaviour, as bloc foreign ministers prepare for talks on Friday on China and its crackdown on Hong Kong. Mr Michel called for Beijing to maintain Hong Kong’s autonomy under the “one country, two systems” model. He was speaking after he and Ms von der Leyen held an online summit with Shinzo Abe, Japan’s prime minister, as part of efforts to create an international coalition of like-minded powers to bolster the ailing multilateral order.

Back on its feet

France will launch an €8bn plan to revive the country’s motor industry, which has been crippled by loss of sales and production during the coronavirus pandemic and the tough lockdowns aimed at curbing the spread of the disease. French president Emmanuel Macron said the goal was to “relocalise” manufacturing in France and “to make France the leading country in Europe for the production of clean vehicles”, with an output target of 1m a year by 2025. (FT, Le Monde)

Coming up on Wednesday

European Commission president Ursula von der Leyen is set to unveil the bloc’s recovery fund to the European Parliament and then the media.