Favourable Mix And Input Deflation Bolster Michelin Until An Aftermarket Recovery

by Mare Evidence LabSummary

- Automotive is a rough industry in the COVID-19 environment due to its cyclical nature and ability for customers to defer auto purchases.

- However, tire sales might do fine, since autos will be used, even if not newly purchased, with people avoiding public transport and air travel.

- The Q2 will be tough, as it contains the outcomes from lockdowns in Europe, but favourable mix trends and input price tailwinds will help Michelin avoid drawing down on facilities.

- The seasonal change in tires mandated in most markets by law will also sustain Michelin's turnover towards the winter.

- Overall, with the aftermarket likely to recover far ahead of automobile manufacturers, which dominate the sector by value, we overweight the sector along with Michelin.

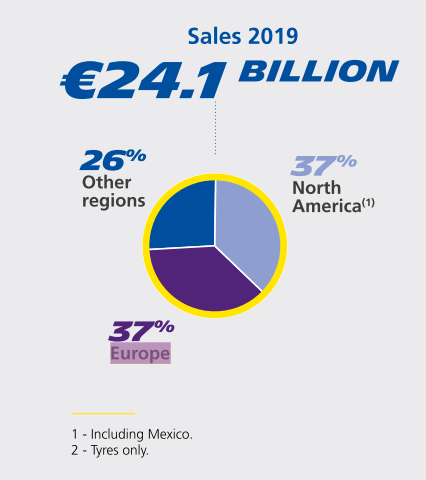

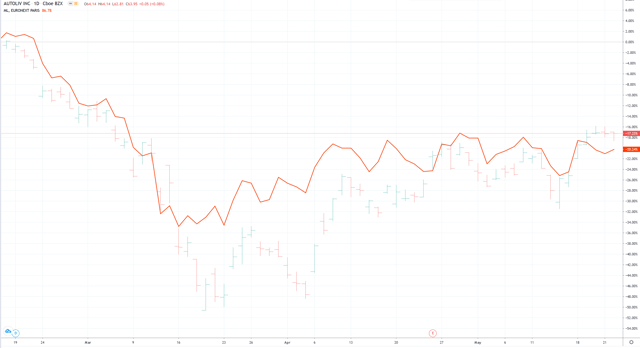

We think that within automotive, the only investments that can be justified from a risk management perspective due to the unknown length and depth of the pandemic are companies that produce for the aftermarket. We have already investigated Autoliv (ALV), whose sales we speculate might recover quickly if crashes keep happening at similar rates and severity as before, but we also like more straightforward companies like tire company Michelin (OTCPK:MGDDF). Michelin is exposed in equal part to Europe and North America, and to a lesser extent other regions, including Asia, so some of its markets are coming out of lockdown, while others are in the middle of them.

(Source: Michelin FY 2019 Registration Document)

Together with this geographic diversity, we think that the fact that end-markets in specialised tires like agriculture and mining showed resilience will be enough to keep Michelin's cash generation sufficient to avoid heavy reliance, or reliance at all on credit facilities. Moreover, we think Michelin is attractive in a recovery as people opt for use of personal vehicles over public transportation. With the added benefit that on the change of seasons, tire turnover will be maintained by mandated winter tire switching, the timing of the crisis could have been much worse for the company. Finally, input prices of butadiene and oil have fallen substantially, providing a cost offset in this tough volume environment. Because Michelin is less speculative, we think that compared to Autoliv, which has been discounted less, Michelin is rather attractive.

Positive Price Mix and Seasonal Boon

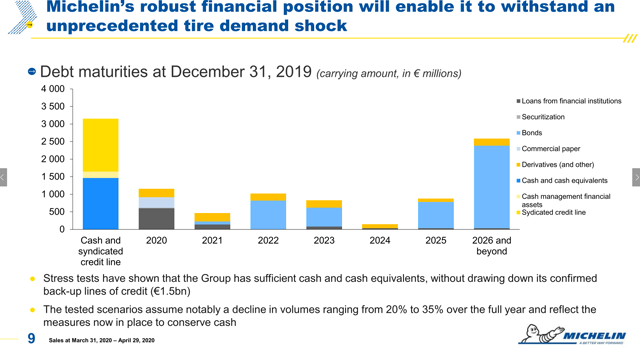

Michelin came into this situation with a strong balance sheet and a rather forgiving maturity schedule. A fathom for how resilient the company is will be whether or not it needs to draw down on credit facilities. According to stress tests, even a 35% drop in volume for the full year can be managed without drawing down the facility. There are several reasons why Michelin might be able to pull this off.

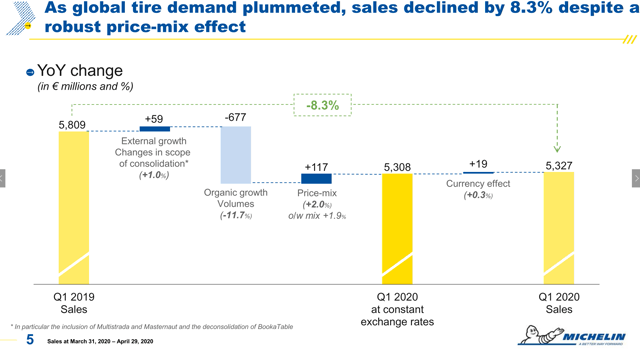

The first relates to the product mix. So far, there has been favourable mix developments towards higher-priced products that attenuated volume declines. With an 11% decline in volumes, sales only saw an 8.3% decline as of the closing of the balances on March 31st.

(Source: Michelin Q1 2020 Presentation)

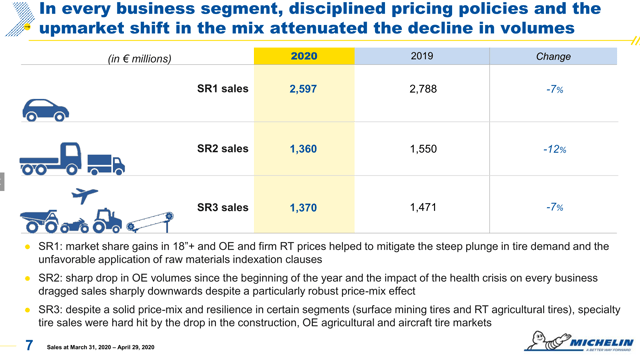

In SR2, strength came from resilience in heavy-duty freight, whose trucks require more costly tires. In SR3, there were offsetting impacts from agriculture and mining, whose specialty tire requirements command high prices. Mining was especially resilient, as the company's activity hasn't slowed, even if the COVID-19 environment has forced its margins down. These favourable price developments in SR3 offset negative impacts from construction and equipment tires as well as aircraft tires, meaning a rather limited 7% decline in sales.

(Source: Michelin Q1 2020 Presentation)

Considering that construction is likely to see a modest rebound for the second half of the year, the only real drags in SR3 are likely to be aviation tires. Although we do not have exact disclosures of Michelin's exposure, according to comparable Goodyear (GT), which is also a major aircraft tire manufacturer, Michelin's exposure should not be more than 12% of revenue, of which maybe 40% is military and resilient going by market-level data. Because of what we believe to be a limited exposure to aircraft tires, and a rebound in construction as well as other industrial processes that would require Michelin tires and conveyor belts, we think that with the rebound and exaggeration of car activity after lockdowns, the company should be able to avoid a >35% volume decline. With the additional fact that winter tires are soon going to become mandated, turnover should be maintained during the second half of the year, with the low use of summer tires this year likely to materialise negatively next H1 only, at which point Michelin's operations will be on safer ground.

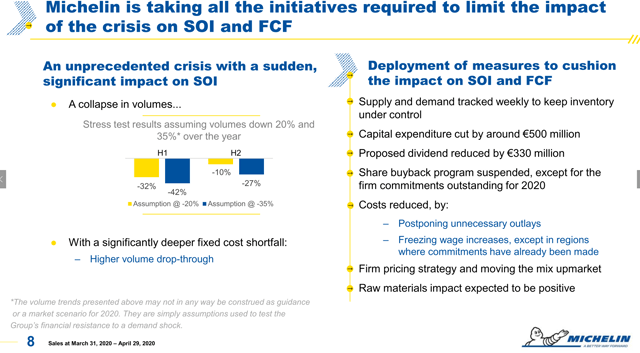

(Source: Michelin Q1 2020 Presentation)

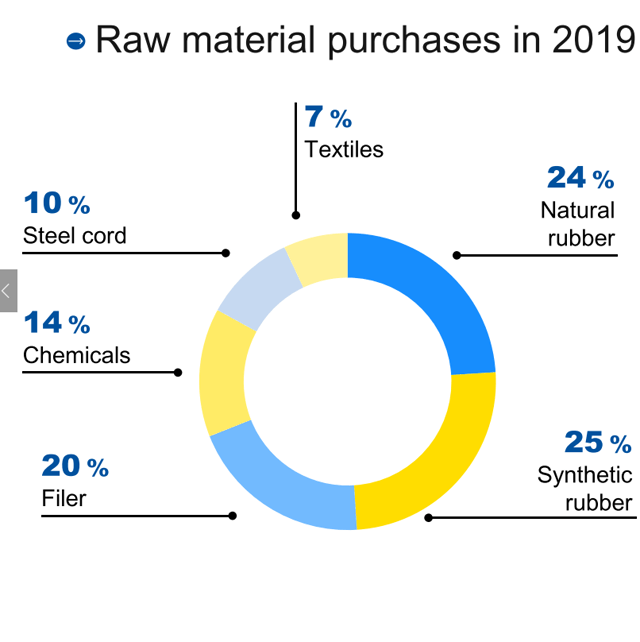

Input Price Tailwind

Although the economic slowdown and total lockdown in many key markets is a stressor on the company, there is the offset that prices for inputs will concurrently fall as well. Indeed, oil crashed entirely compounded by political developments, but also butadiene, an important molecule for synthetic rubber, will have likely declined in price with the rest of the beleaguered chemicals industry. Moreover, rubber prices themselves have fallen rather substantially by almost 20%. Steel has also fallen quite a lot, meaning that over 50% of Michelin's input spend will be reduced in the double digits.

(Source: Michelin Q1 2020 Presentation)

Along with substantial measures to preserve cash, such as 500 million EUR in CAPEX cuts, the halving of the dividend and suspending share buybacks, Michelin's cash generation should remain sufficiently favourable to fund the 1 billion EUR of incoming 2020 maturities, of which 800 million EUR was already covered by cash on hand in March.

(Source: Michelin Q1 2020 Presentation)

Risks and Concluding Remarks

The risks to Michelin are clear. We know Q2 will be bad, but it is unsure how far a favourable price mix will able to mitigate volume declines in afflicted categories. Moreover, if driving activity doesn't properly rebound as we expect, the recovery environment will be far more depressed and the current price entirely justified.

However, it stands to reason that cars will be more in vogue now, and the more they're used, the more turnover we should see in the main tire end-market of SR1. Besides SR1, we should expect decent recovery and continued resilience in SR2 and SR3, as most industrial activity will come back on-line. Moreover, there will be cost offsets in the input markets as well to mitigate this weak period, thereby helping Michelin avoid having to increase its debt burden (although even that would not be a disaster).

(Source: TradingView)

Considering that compared to Autoliv, which relies on similar crash rates in the post-COVID-19 world (perhaps not likely due to remote working etc.), Michelin has traded down further from pre-COVID-19 levels, we conclude that the less speculative nature of tire use in a recovery environment makes the company relatively attractive. Assuming a substantial recovery to pre-COVID-19 levels, where erroneous discounting from higher-risk premiums is removed, we see upside between 20% and 25% from current levels, of which is a cash payout at a 2.3% dividend yield.

Disclosure: I am/we are long BRDCF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.