Factors To Consider With REM, REML And Individual mREITs

by Lance BrofmanSummary

- The damage to the agency mREITs resulting from the sudden extreme decline in interest rates is now over.

- All mREITs are trading at deep discounts to book value. That has usually been a good time to buy them.

- If the COVID-19 pandemic ends sooner than many predict, non-agency mREITs could outperform mREITs.

- Diversifying between agency and non-agency mREITs, can provide higher current income along with the possibility of capital gains.

- Deciding between REM, REML or individual mREITs depends on various factors including an investor's borrowing costs and yields on cash equivalents.

Why Buy mREITs?

As an asset class, mortgages are generally less vulnerable to declines in economic activity than many equity securities. The cash flows from mortgages and mortgage-backed securities, usually do not directly correlate to the revenues or profits of the issuing entities. Many companies in the department store, hospitality and tourism industries will probably never recover their losses incurred due to the Covid-19 pandemic. However, mortgages secured by assets held by those companies, will generally be ultimately money-good as long as the value of the assets exceeds the balance on the mortgage. Mortgages and mortgage-backed securities that are guaranteed by agencies or instrumentalities of the federal government have no credit risk. Non-agency mortgages and mortgage-backed securities can default. However, if the value assets that secure the mortgages remain high enough, there generally will not be any reduction in the ultimate cash flow from non-agency mortgages.

The above does not mean there is no risk associated with agency mortgages and mortgage-backed securities. Additionally, even though agency mortgages and mortgage-backed securities have no credit risk, there is risk even in mREITs that own only agency mortgages and mortgage-backed securities.

As I said in "Agency mREITs Set To Soar, But What About The 2X Leveraged ETN":

... To put the agency mREITs' in perspective, a portfolio consisting of only agency mortgage-backed securities would be at an all-time high now. If that portfolio was leveraged it would be even higher. However, agency mREITs whose portfolios consist of agency mortgage-backed securities are near all-time lows. The only reason the pure agency mREITs declined was their unfortunate hedges. The only reason the pure agency mREITs had any margin calls was related to their hedge positions. The mREITs had no significant losses on any of the agency mortgage-backed securities that they held. However, even the "pure" agency mREITs suffered sharp declines in book value. Agency mREITs had their book values decline because of the severe basis moves against them that occurred as their losses on the hedges that utilized swaps, futures and short Treasuries far exceeded any gains they may have had on the agency mortgage-backed securities in their portfolios. The agency mREITs lost significant book value when the Federal Reserve abruptly lowered interest rates by a full 100 basis points. This caused havoc with the mREITs hedges, which were premised on only relatively small 25-basis point movements in interest rates. Without the COVID-19 pandemic, it probably would have been a good assumption that the Federal Reserve would have continued limiting changes to increments of only 25 basis points for many years…

The damage to the agency mREITs resulting from the sudden extreme decline in interest rates is now over. The yields on treasury bills and notes cannot fall another 100+ basis points in a matter of days again for the foreseeable future. Three-month treasury bills are at 0.12% and 10-year treasury notes are at 0.66% now. Unless those rates go significantly negative, the hedges employed by the agency mREITs cannot blow up again in the way that they did in March 2020. Negative rates in the United States are not as unlikely as they were in the past, but are still very unlikely.

Regarding the non-agency mREITs or hybrids of agency and non-agency, they could be evaluated like any other stock in terms of how the COVID-19 pandemic will impact them. Many stocks now are vulnerable to the impact of the COVID-19 shutdowns on their customers, creditors, operations, lenders, supply chains or some combination of all of these. To a greater or lesser extent, that is true for all of the REITs. Some non-agency mREITs are more like businesses than investment companies. These non-agency mREITs originate loans and perform other activities such as servicing mortgages. However, a pure agency mREIT would not seem to be vulnerable to any direct impacts of the COVID-19 pandemic regarding customers, creditors, operations, lenders, supply chains or commodity prices. Furthermore, while mREITs might be reducing their dividends because of the basis-related or other losses, they will not have their dividends reduced or eliminated as a consequence of accepting COVID-19 related aid from the federal government. This could become an important factor for investors seeking current income.

Separate from COVID-19 considerations, there are other reasons to buy mREITs now. Very low short-term interest rates make carry-type investments, such as mREITs, very attractive, particularly for those seeking to maximize current income. Historically, whenever mREITs are trading at significant discounts to book value, they have been a good buy.

Most mortgages and loans not guaranteed by the Federal Government or its agencies and instrumentalities are at varying degrees of risk as economic activity declines. There is a possibility that a medical breakthrough in terms of a vaccine or treatment could end the COVID-19 pandemic sooner than many predict. Even without a medical breakthrough, enough progress in identifying and isolating those infected could also end the COVID-19 pandemic sooner. Were that the case, REITs and non-agency mREITs could do better than agency mREITs. That could suggest diversifying with a portfolio of both agency and non-agency mREITs.

Diversified Plays in mREITs

For those bearish on the economy because they fear that the COVID-19 pandemic and its’ negative impacts on economic activity will persist longer, sticking with agency mREITs would be logical. However, diversifying between agency and non-agency mREITs, can provide higher current income along with the possibility of capital gains if the COVID-19 pandemic impact is less than many fear, or if government policies manage to mitigate the negative effects more than the market consensus.

Unlike many other publicly held companies, the agency mREITs and most of the surviving non-agency mREITs or hybrids of agency and non-agency mREITs are likely to continue to pay dividends, despite incurring massive losses in the first half of 2020. Even at reduced levels, these dividends will produce double-digit yields in many cases, based on the current depressed prices of the mREITs. For those seeking to obtain these yields and are willing to accept the risks inherent in the mREITs, there are some ETFs and ETNs to consider.

Credit Suisse X-Links Monthly Pay 2x Leveraged Mortgage REIT ETN (REML) is based on the FTSE NAREIT All Mortgage Capped Index of mREITs index. It uses leverage to boost its current yield. REML implicitly borrows at LIBOR+0.85% to finance a portfolio that emulates the index. For those that want to avoid the risk of such leverage, iShares Mortgage Real Estate Capped ETF (REM) is a fund that is based on the same index as REML. The VanEck Vectors Mortgage REIT Income ETF (MORT) is another unleveraged ETF and is based on the MVIS US Mortgage REITs Index. Normally, REML would move up or down twice as much as REM or MORT, on a percentage change basis.

For investors seeking leverage and who can borrow at a rate lower than 3-month LIBOR+0.85%, buying REM or MORT on margin would be better than buying REML. Today 3-month LIBOR is 0.37%. Thus, if your margin loan rate is lower than 1.22%, owning REM or MORT on margin is better than REML. Most retail brokerage firms charge more than 1.22%. For example, Fidelity charges a rate based on the amount borrowed. On amounts less than $25,000, today’s interest rate is 8.325%. The rate goes down to 4.00% for amounts above $1,000,000. The current margin rate at Charles Schwab (SCHW) is also 8.325% on amounts less than $25,000. For amounts above $2,500,000, the rate is 4.5%.

What would be inefficient, relative to buying REML, is to buy REM on margin with 50% equity, and paying retail brokerage margin rates. If investor “A” buys $50,000 of REM on margin with 50% equity, thus putting up $25,000 cash; and investor B buys $25,000 of REML, Investor B will do better as long as investor A is paying more than 1.22% on the margin loan.

What would also be inefficient, relative to buying REM, would be to buy REML in an account that also had a large amount of cash or cash equivalents earning a very low interest rate. For example, assume both investors “C” and “D” have more than $50,000 in cash in their accounts earning less than 1.22%. If investor “C” buys $25,000 worth of REML and investor “B” buys $50,000 worth of REM, they would have equal exposure to the FTSE NAREIT All Mortgage Capped Index of mREITs index, in terms of dollar amount of gains or losses for each percentage move in the index. However, investor B would have greater income than investor C. Essentially, investors following B’s route would be implicitly lending $25,000 to themselves to buy REM, at an imputed interest rate equal to what they could receive on the cash in their account. That would be better than buying REML which emulates buying on margin and paying 1.22% margin interest. Obviously, an individual’s liquidity needs, holding periods and the brokerage firm’s policies could be factored into the REM vs. REML question as well, but the above analysis still holds.

Normally, ETNs trade at prices very close to the net indicative (asset) value. That is because they can be redeemed at net indicative (asset) value., by large investors. However, at times that is not the case. In REM, REML And The mREITs Going Forward I said:

…One concern is that recently REML has been trading above net indicative (asset) value. On April 22, 2020, REML closed at $2.72, which was a premium of 7.6% over the net indicative (asset) value of $2.5278. I am generally very reluctant to pay significantly above net indicative (asset) value for a 2X Leveraged ETN. However, paying $1.25 for REML, recently when the net indicative (asset) value was close to zero, has turned out alright, at least so far. I might be much more confident buying REML after the book values of all the mREITs in the index become known…

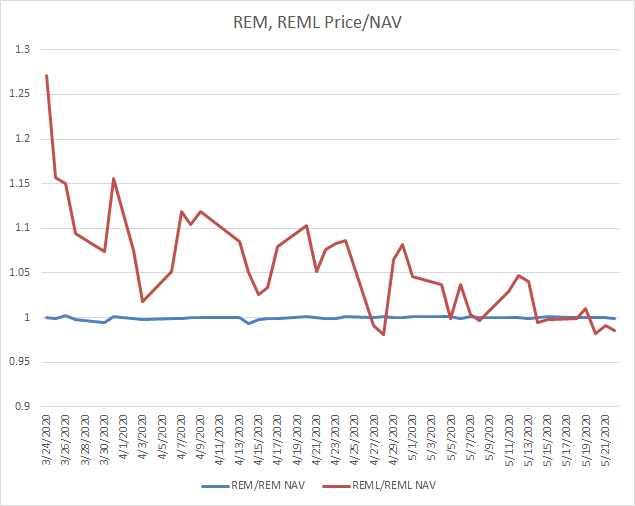

The premium of REML over net indicative (asset) value began during the turmoil in the financial markets in March 2020. REM did not trade significantly above net indicative (asset) value, during that period or since. Thus, at times, I bought REM rather than REML. Recently, the premium for REML over net indicative (asset) value has disappeared. As can be seen in the chart below, REML has actually traded at a slight discount net indicative (asset) value. The orange line shows the ratio of REML/net indicative (asset) value from March 23, 2020 through to May 22, 2020. The blue line shows REM/net indicative (asset) value for the same period.

Analogies Between Covid-19 and World War II May Be Useful For Investors

There are some analogies between the challenges faced and responses to both World War II and Covid-19. The unprecedented peacetime draft in 1940 was an imposition on males of ages 21 to 36. Some of those men surely resented the restrictions on their normal activities that reporting to boot camp caused, as much as some resent the restrictions on their normal activities that the Covid-19 shut-downs have caused in 2020.

One distinct difference between Covid-19 and World War II is the emphasis on bailouts and making people whole today, as compared with then. For the year 1939 the unemployment rate for the United States was 17.2%, in 1940 it was 14.6%. Those were clearly depression levels. In September 1939 World War II began in Europe. Many people employed in the transatlantic travel and tourism industry lost their jobs when the conflict began. Many of their employers went out of business as well. To my knowledge, there were no calls at that time, to have the government bailout or make whole, the employers or employees in the transatlantic travel and tourism industry.

It also might be noted that at the start of World War I, the New York Stock Exchange closed its doors on July 31, 1914, for the longest period in exchange history. It stayed closed until Nov. 28, 1914, when bonds began trading again. Stock trading re-opened Dec. 15, 1914. I am not aware of any federal government aid to those in the brokerage and related industries who became unemployed or their employers, when the stock market closed in 1914.

Today much more money is being spent by governments to compensate individuals and entities impacted by the Covid-19 pandemic, than is being spent trying to solve the problem medically. It is probably good that prior to and during World War II, the United States spent on military preparedness and armaments, rather than compensating compensate employees and firms impacted by the War.

During World War II no new automobiles, were produced for civilian use. Gasoline was severely rationed. Those involved in new car sales lost their jobs, as did many involved with the travel and cruise industries. However, during World War II, no thought was given to those lost jobs. In contrast, today much attention is focuses on the Covid-19 job losses. As the numbers of US military personnel rose from 334,473 in 1939 to 12,209,238 by 1945, and millions more worked in armament plants, unemployment was not much of a concern. However, during the war, there were some who incorrectly predicted a post-war resumption of the Great Depression.

There may be some reasons that much more is being spent in the United States on compensating individuals and entities impacted by the Covid-19 pandemic, than fighting the SARS CoV-2 virus, which is the source of the Covid-19 pandemic. There is the mistaken belief that once the virus was not contained in China, it was inevitable that there would be massive loss of life in the developed countries. Many seem not to be aware of the extent that different leadership in various countries resulted widely disparate impacts from Covid-19.

So far, some developed countries have addressed the challenges posed by Covid-19 much better than others. Taiwan, with a population of 23.8 million, has had only 440 confirmed Covid-19 cases and 7 deaths. Taiwan’s Vice President Chen Chien-jen is an epidemiologist with a PhD from Johns Hopkins. Talk about having the right person in the right place at the right time. At the other extreme, there have been more than 1.6 million confirmed Covid-19 cases and 97,000 deaths in the USA, out of a population of 331 million. Other countries also demonstrated that there was nothing inherent in SARS CoV-2, which meant that hundreds of thousands of deaths in the first world were inevitable. These included Australia, New Zealand, Hong Kong, Denmark and South Korea.

As I said in: REM, REML And The mREITs Going Forward REM, REML And The mREITs Going Forward

…As of April 22, 2020, the USA with about 5% of the world population, is experiencing about 33% of the new daily COVID-19 deaths. Countries such as South Korea, Germany and New Zealand seem to have been much better prepared for COVID-19. Other countries may be able to resume full production sooner than the USA. There even might be a time where travel within and/or to and from the USA is restricted far more, than in the rest of the developed world. The first cases of COVID-19 appeared about simultaneously in the United States and South Korea. As of April 21, 2020, there were a total of 237 COVID-19 deaths in South Korea as compared to 43,200 in the USA. On a per capita basis, South Korea with a population of 51,269,185 had 0.00000462 COVID-19 deaths. For the United States with a population of 331,002,651 the per capita deaths are 0.001305. Thus, the per capita COVID-19 death rate in the United States is 282 times that of South Korea...

Despite China’s unfortunate initial response to the appearance of clusters of a novel infectious disease, countries such as South Korea and others have managed to accomplish much in their efforts to eradicate Covid-19. The existence of the novel virus outbreak became known to intelligence agencies world-wide before the end of 2019. The difference was how various leaders reacted to the information. Countries led by populists have done very poorly.

A possible Covid-19 and World War II analogy could be the roles of vaccines and the atomic bomb. It took about four years from when America entered the war to the development of the bomb, which definitively ended the war. A vaccine could end the Covid-19 pandemic. The shortest time it ever took to develop a commercially available virus vaccine, was four years for the mumps vaccine.

The most useful Covid-19 and World War II analogy could be the extent that extreme mobilization of resources may be the way that “victory” is achieved. Absent a vaccine or similar pharmaceutical solution, containment is the only way to end the pandemic. America overcame the isolationist elements that meant we had to catch-up with regard to military capability after Pearl Harbor. Likewise, the rise in populism, with its’ disdain for intellectual elites and science in particular, means that we now will have to catch-up with regard to the capability to contain Covid-19.

America’s industrial might and technological prowess can eventually supply everything necessary to isolate those infected and ultimately eradicate the SARS CoV-2 virus. It might require millions engaged in contact tracing and other pandemic fighting activities. However, it would likely take less, than the more than the ten million additional military personnel, that ensured victory in World War II. It should also take less than the 41% of GDP, that military spending peaked at during World War II. This would allow stock prices to regain their previous highs and would possibly allow non-agency mREITs to outperform agency mREITs.

It remains to be seen the extent to which efforts by the Federal Reserve and others are able to prevent bankruptcies and defaults are effective. Eventually, the value of non-agency debt held by mREITs will be a function of the collateral. For the pure agency mREITs, there are no credit risks. They have no customers who are not able to buy their products or use their facilities because of the COVID-19 shut-downs. Furthermore, while agency mREITs might be reducing their dividends because of the basis-related losses, they will not have their dividends reduced or eliminated as a consequence of accepting COVID-19 related aid from the government. This could become an important factor for investors seeking current income.

Analysis of the June 2020 REML Dividend Projection

Most of the REML components have paid dividends quarterly, typically with ex-dates in the last month of the quarter and payment dates in the first month of the next quarter. The January, April, October, and July "big month" REML dividends were much larger than the "small month" dividends paid in the other months since very few of the quarterly payers have ex-dividend dates that contribute to the dividends in the "small months." Thus, the June 2020 REML dividend will be a small month dividend. While typically called dividends, the monthly payments from REML and the other 2X-leveraged ETNs are technically distributions of interest payments on the ETN note based on the dividends paid by the underlying closed-end funds that comprise the index, pursuant to the terms of the indenture.

Of the 36 components in the index, 7 have declared dividends with ex-dates in May 2020 and thus should contribute to the June 2020 REML dividend. Most of the components, typically do not pay dividends with ex-dates in May. Some of the components, have declared new dividends after the COVID-19 collapse, iStar Inc. (STAR) actually increased its’ quarterly dividend to $0.11 from the previous $0.10.

So far, some of the components resumed reduced after not paying any in the first quarter of 2020. Invesco Mortgage Capital Inc (IVR) reduced its’ quarterly dividend to $0.05 from the previous $0.50. IVR did not pay any dividend in the first quarter of 2020, the previous $0.50, had an ex-dividend date in December 2019. Anworth Mortgage Asset Corp. (ANH) reduced its’ quarterly dividend to $0.05 from the previous $0.50. ANH did not pay any dividend in the first quarter of 2020, the previous $0.09, had an ex-dividend date in December 2019. Great Ajax Corp (AJX) reduced its’ quarterly dividend to $0.17 from the previous $ 0.309175. AJX did not pay any dividend in the first quarter of 2020, the previous $ 0.309175, had an ex-dividend date in November 2019.

TPG RE Finance Trust Inc (TRTX) declared a $0.43 quarterly dividend with an ex-date in June 2020, thus it will not contribute to the June 2020 REML dividend, but rather to the July 2020 REML dividend. TRTX did not pay a dividend in the first quarter of 2020, the previous $0.43, had an ex-dividend date in December 2019.

Some of the components have explicitly suspended their dividends, or have not made any dividend declaration for the first quarter of 2020 or later. Some components have delayed their dividends. The table below shows the ticker, name, weight, dividend, and ex-date for all of the components. Additionally, the table includes the contribution to the dividend for the 8 REML components that will contribute to the June 2020 dividend. Some of the components that show a first quarter 2020 dividend are unlikely to pay the same dividend in the second quarter of 2020, or may not pay any dividend in the second quarter of 2020.

My projection for the June 2020 REML dividend is $0.0135. This reflects both the sharply lower net indicative (asset) value relative to pre-COVID-19 levels and the impact of some mREITs not paying, lowering or delaying dividends. The weights of the components change as the relative market prices of the components change. As the mREITs that still pay dividends will comprise a larger weight in the index, that should increase future dividends, relative to those calculated using the beginning of May 2020 weights in the table.

The composition of the FTSE NAREIT All Mortgage Capped Index of mREITs index, upon which REML is based, should also change, as a result of quarterly reviews. The relevant portion of The FTSE Nareit US Real Estate Index Series Methodology Overview states that the index is Reviewed quarterly in March, June, September and December with changes implemented on the third Friday of the month.

Conclusions and Recommendations

We will know more about the prospects for some of the mREITs after the second quarter book values are disclosed and dividends are announced. For those we do now have current information on, they are trading at very deep discounts to their book value. This situation cannot persist indefinitely. However, it's always good to remember, as Keynes famously said: "The market can stay irrational longer than you can stay solvent."

For various reasons, agency mREITs at deep discounts to their book value are compelling. Many industrial, retail and transportation stocks will likely cut or eliminate their dividends for COVID-19 pandemic reasons. Thus, agency mREITs' yields, even with somewhat reduced dividends, will look more and more attractive. At some point the larger market participants will look to buy agency mREITs at deep discounts to their book values, for arbitrage purposes. This could include acquiring control of them with the intent of liquidating them at book value and distributing the proceeds to shareholders.

The only 2x mREIT Leveraged ETN remaining is now REML. There are some mREITs that we know are now trading at very steep discounts to book value. Some mREITs have still been silent regarding their current status. The markets may have assumed the worst in those cases. That is reasonable in the current market environment. The only thing that I can be relatively sure of is that the mREITs will not be indefinitely trading at very steep discounts to book value. Either the book values will be much lower than what has currently been published, or the market prices of the mREITs will be much higher than they are now. In the coming month, we should get much more information about the book values of the mREITs that have been silent so far, as their quarterly reports are made available.

Assuming that every position and security held by every REIT is correctly marked at its fair value price (That is determined by what a willing buyer would pay and what a willing seller would sell it for) today. There is now still great variance in what can be expected between agency mREITs, non-agency mREITs and equity REITs. The agency MBS held by mREITs should not fluctuate that much in the near term. Agency MBS trading at a premium can only fall to 100 from prepayment risk. Hedges based on short-term interest rates will not move much unless the Federal Reserve takes rates negative.

A non-agency mortgage or MBS may be fairly priced today, based on today's market perception of the impact of COVID-19 on real estate. However, a significant change could occur in the near-term regarding expectations what will be the future market perception of the impact of COVID-19 on real estate prices. This is even a greater factor in equity REITs.

I still believe that the macroeconomic conditions generally still favor mREITs and especially agency mREITs. Regarding REML, very low short-term interest rates make carry-type investing very attractive, particularly for those seeking to maximize current income. One concern had been that recently REML was been trading above net indicative (asset) value. That is not the case now.

There is a question of whether some of the existing mREITs, who have not fully disclosed their current situation, will be the beneficiaries of these conditions, or that newly created mREITs be the beneficiaries of these conditions. I am still a tentative buyer and have still been buying REML and REM. I have also recently added to positions in agency mREITs: AGNC Investment Corp. (AGNC) and Orchid Island Capital, Inc. (ORC).

At some point in the future, the COVID-19 pandemic will be over. Exogenous events such as the Great Depression, World War II and the 2008 financial crisis all provided tremendous buying opportunities for some investors. However, one does not know when the bottom in the financial markets will be. Generally, stock market bottoms occur before when the economy or the crisis is at its worst. With the COVID-19 pandemic, uncertainty exists as to how much damage will be done by the virus and by the various measures taken by governments in response. This includes but is not limited to the $trillions in debt that will be incurred. If as I fear, the COVID-19 pandemic significantly reduces the position of the United States in the world, agency mREITs may be one of the few places to hide. That is until long-term treasury bond rates spike upwards.

Regarding the various measures taken by the Federal government, there may be some factors that could boost securities markets before the economy recovers from the COVID-19 pandemic. Extremely low risk-free interest rates make risk securities relatively more attractive. The speed at which money is being sent out in the recently enacted legislation means that many of those receiving money have not been negatively impacted financially by, or could actually benefit from, the COVID-19 pandemic.

Employees working from home, and many others who are still receiving their paychecks, will get cash as long as their incomes are less than $100,000 for individuals and $200,000 for families. They are probably not spending as much as usual, on vacations, travel or restaurant meals and entertainment outside the home. Thus, they will have to do something with the extra money they have at the end of each month. Some will surely be invested in securities. Likewise, many collecting the enhanced unemployment compensation, that in some cases, exceeds their previous salaries, might also be buying securities. The small businesses, defined as less than 500 employees, can receive loans that are forgivable as long as they keep their employees on the payroll. Thus, small businesses that suffer losses in revenue can receive loans that are forgivable, if they keep their employees on the payroll, as can businesses that do not suffer losses in revenue, if they also keep their employees on the payroll. This is providing windfalls for small businesses that have not suffered any losses from COVID-19, but qualify for forgivable loans. That might supply some small business owners with funds to invest as well.

REML Components and Contributions to the Dividend

| Ticker | Name | Weight | Price | ex-div | dividend | frequency | contribution |

| NLY | Annaly Capital Management Inc | 21.53% | 3/30/2020 | 0.250 | q | ||

| AGNC | AGNC Investment Corp | 16.67% | 13.17 | 5/28/2020 | 0.12 | m | 0.0090 |

| STWD | Starwood Property Trust Inc | 9.25% | 3/30/2020 | 0.48 | q | ||

| NRZ | New Residential Investment Corp | 6.64% | 4/14/2020 | 0.05 | q | ||

| BXMT | Blackstone Mortgage Trust Inc | 5.77% | 3/30/2020 | 0.62 | q | ||

| HASI | Hannon Armstrong Sustainable Infrastructure Capital Inc | 4.85% | 4/1/2020 | 0.34 | q | ||

| CIM | Chimera Investment Corp | 3.40% | 3/30/2020 | 0.50 | q | ||

| ARI | Apollo Commercial Real Estate Finance Inc | 3.09% | 3/30/2020 | 0.40 | q | ||

| TWO | Two Harbors Investment Corp | 2.84% | 4/15/2020 | 0.050 | q | ||

| PMT | PennyMac Mortgage Investment Trust | 2.56% | 4/14/2020 | 0.25 | q | ||

| LADR | Ladder Capital Corp | 2.16% | 3/9/2020 | 0.34 | |||

| NYMT | New York Mortgage Trust Inc | 1.94% | suspended | ||||

| ABR | Arbor Realty Trust Inc | 1.94% | 6/29/2020 | 0.30 | q | ||

| MFA | MFA Financial Inc | 1.86% | delayed | ||||

| STAR | iStar Inc | 1.50% | 9.93 | 5/29/2020 | 0.11 | q | 0.0010 |

| RWT | Redwood Trust Inc | 1.21% | 3/13/2020 | 0.32 | |||

| ARR | ARMOUR Residential REIT Inc | 1.20% | 6/12/2020 | 0.09 | m | ||

| CMO | Capstead Mortgage Corp | 1.19% | 3/30/2020 | 0.15 | q | ||

| IVR | Invesco Mortgage Capital Inc | 1.17% | 2.77 | 5/20/2020 | 0.05 | q | 0.0012 |

| KREF | KKR Real Estate Finance Trust Inc | 1.05% | 3/30/2020 | 0.43 | q | ||

| EFC | Ellington Financial Inc | 1.05% | 4/29/2020 | 0.080 | m | ||

| TRTX | TPG RE Finance Trust Inc | 0.95% | 6/12/2020 | 0.43 | q | ||

| DX | Dynex Capital Inc | 0.77% | 12.49 | 5/21/2020 | 0.15 | m | 0.0005 |

| JCAP | Jernigan Capital Inc | 0.75% | 3/31/2020 | 0.23 | q | ||

| ORC | Orchid Island Capital Inc | 0.65% | 4.17 | 5/28/2020 | 0.055 | m | 0.0005 |

| GPMT | Granite Point Mortgage Trust Inc | 0.63% | suspended | ||||

| ACRE | Ares Commercial Real Estate Corp | 0.60% | 3/30/2020 | 0.33 | q | ||

| RC | Ready Capital Corp | 0.58% | 3/30/2020 | 0.4 80% stock | 0.4 80% stock | ||

| ANH | Anworth Mortgage Asset Corp | 0.42% | 1.55 | 5/11/2020 | 0.05 | q | 0.0008 |

| AJX | Great Ajax Corp | 0.36% | 8.13 | 5/14/2020 | 0.17 | q | 0.0004 |

| WMC | Western Asset Mortgage Capital Corp | 0.31% | suspended | ||||

| CHMI | Cherry Hill Mortgage Investment Corp | 0.27% | 3/12/2020 | 0.40 | q part in shares | ||

| AI | Arlington Asset Investment Corp | 0.25% | suspended | ||||

| EARN | Ellington Residential Mortgage REIT | 0.21% | 3/30/2020 | 0.28 | q | ||

| XAN | Exantas Capital Corp | 0.20% | suspended | ||||

| MITT | AG Mortgage Investment Trust Inc | 0.18% | suspended |

Disclosure: I am/we are long REML, REM, AGNC, ORC, ARR, CIM, SMHD,ARR, TWO, LMLB, HDLB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.