Don't Gamble In The Markets, Look At These 2 Blue Chip Healthcare Names Instead

by Nicholas WardSummary

- Bristol-Myers Squibb and AbbVie offer rare clarity in today's market.

- Both names have reaffirmed 2020 guidance and are calling for strong growth.

- Both names are cheap and offer safe dividends and attractive dividend growth prospects.

I'm well aware that at this point I'm beginning to sound like a broken record, but I'll say it again: without an adequate degree of clarity with regard to future fundamentals, investors putting cash to work in today's stock market are exposing themselves to a very high degree of risk due to the speculation of such trades/investments.

I've said all of this before, but I'll say it again because I think it all bears repeating...

All equity investing comes with risk. Stock prices are based upon estimations of future cash flows, and being that no one knows the future, speculation is an inherent part of portfolio management. However, during normal times, investors have well-regarded opinions to consider when considering the risk they're willing to take on. Company management provides forward-looking guidance, and analysts provide estimates which are compiled into a consensus which is typically fairly accurate. However, these are not normal times.

Just about every company that I follow has pulled forward-looking guidance for 2020 and even 2021. There are still analyst consensus numbers floating around; however, these change on a near-daily basis due to the high volatility in the markets, the rampant news cycle, and the low levels of conviction associated with estimates.

Without high-conviction estimates of future cash flows, I believe it's impossible to arrive at accurate fair value estimates. And without accurate fair value estimates, it's possible to understand the margins of safety (or lack thereof) that an investor is locking in when making equity purchases.

Personally, I don't feel compelled to put capital at risk without an idea of the margin of safety that I am receiving. This is why I have been very cautious in recent months. I have had little interest in buying the recent rally that we've experienced, because to me it appears to be fueled by stimulus-inspired exuberance and the fear of missing out (which is just another way to say greed).

For what it's worth, I also didn't sell much during the February and March crash, because doing so would have hurt my passive income stream. My overall equity weighting was sitting at roughly 90% coming into the crash, and today, that figure hasn't changed all that much. Right now, my equity position sits at roughly 93%.

Simply put, during highly volatile times like this, I believe that the best course of action to take, when you own a portfolio like mine that is focused on the highest-quality, blue-chip names, is to simply do nothing. Throughout 2020, my passive income continues to increase, and I can use these dividends as an anchor to hold onto during the market's storm, keeping my mind at ease.

I admit that it is no fun sitting on the sidelines. This is especially the case when you're a dividend growth investor, because it means that you're not actively making moves that increase your share counts and, therefore, your dividend stream.

It's especially painful to sit on the sidelines when I see a handful of high-quality names that appear to be trading at attractive valuations (even after the market's major rally off of the March 23rd lows). However, like I said before, without forward-looking clarity, there is no way to know whether or not these valuations are true.

I'm not interested in gambling in the markets. Being that I'm so heavily invested and cash is a finite resource, I'd rather wait for more clarity than reduce my cash position, even if this means that I'm missing out on what might turn out to be fabulous opportunities. Dry powder is important during volatile times, and I'd rather save it until times when the prices provided by the market seem too good to be true. Here, up 30% from the March lows, I don't believe that's the case.

Thankfully, recent earnings reports have provided a bit of clarity. As I said before, the vast majority of the stocks that I follow have pulled 2020 guidance. This includes names that have posted fantastic Q1 results. Just today, Lowe's (LOW) posted a huge top and bottom line beat with same-store sales figures that crushed analyst estimates, but even so, its management could not provide insight into full-year sales and earnings projections. But there have been a few notable names that have confirmed previously provided guidance. In today's article, I'll be talking about two of them: Bristol-Myers Squibb (BMY) and AbbVie (ABBV).

Bristol-Myers Squibb

Bristol-Myers has turned itself into the world's leading oncology company with its Celgene acquisition last year. Celgene added to BMY's already well-diversified drug portfolio, augmented its pipeline, and immediately added to its cash flow potential. Furthermore, during BMY's most recent earnings conference call, management noted that the company is on track to deliver $2.5 billion in synergies by 2022. These cost savings should fall to the bottom line, adding to the accretive nature of this deal.

The sad truth of the matter is that cancer will continue to rear its ugly head throughout the COVID-19 crisis, and these patients will continue to receive treatments. With this in mind, BMY was confident enough to reaffirm previously provided guidance for both 2020 and 2021.

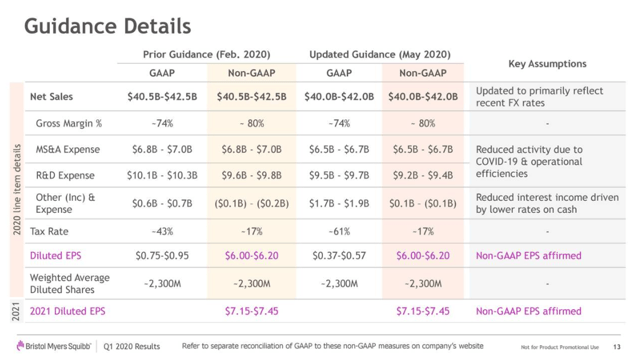

(Source: Q1 CC Presentation)

These guidance figures above represent roughly 30% EPS growth in 2020 and another 20% on top of that in 2021. It's rare to see such bullish bottom line compounding potential in the near term in the COVID-19 market. Most of the high-quality DGI names that I track are slated for negative EPS growth in 2020.

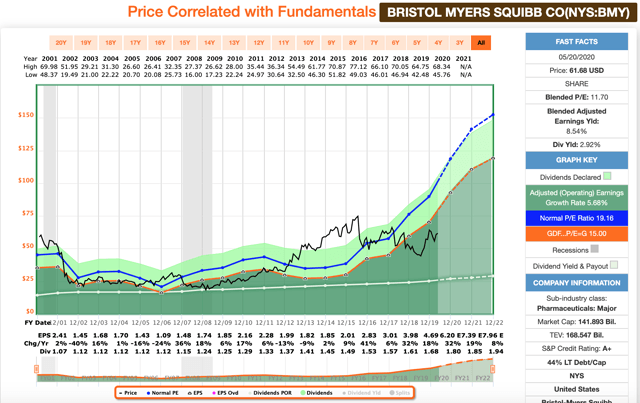

With this guidance in mind, even though BMY shares have rallied some 35% off of their March lows in the mid-$40s, shares still appear to be cheap on a forward-looking basis. BMY shares ended the trading session today selling for $61.68. At this price point, we're talking about a 10.1x multiple compared to the mid-point of management's 2020 EPS guidance and an 8.45x multiple on the mid-point of the recently provided 2021 EPS guidance. 35% rally or not, these are cheap multiples. For comparison's sake, BMY's long-term average P/E ratio is more than 19x, and as you can see on the F.A.S.T. Graph below, BMY's growth prospects today are greater than they have been for much, if not all, of the last 20 years.

(Source: F.A.S.T. Graphs)

With this in mind, shares should not be trading at a discount... they should be trading with a premium valuation attached to them. Yet, they aren't. It appears as though the market is offering investors an irrational discount here, and these situations don't usually last for very long.

What's more, BMY isn't just an appealing value play. After its generous 2019 dividend increase, the company has become one of the more attractive dividend growth plays in the healthcare space.

Although BMY significantly increased its debt load to make the Celgene move, I continue to like its balance sheet. At the end of Q1, the company had roughly $19 billion in cash/cash equivalents on hand and total debt of approximately $47 billion, leading to a net debt position of $28 billion or so. BMY has $12.9 billion in debt maturates coming due between now and the end of 2023. However, its cash flows remain strong.

Looking back over the last 5 years, BMY's free cash flows have increased significantly on an annual basis.

| 2015 | 2016 | 2017 | 2018 | 2019 | TTM | |

| Free Cash Flows (millions) | $1,012 | $1,635 | $4,220 | $4,989 | $7,231 | $9,753 |

In Q1, the company's cash flows from operations came in at nearly $4 billion. Even with the COVID-19 headwind in place, I expect this positive FCF trend to continue into the coming years. This means that BMY should not only be able to cover its debt maturities, but also continue down the path of generous shareholder returns via strong dividend increases that it embarked upon in 2019.

While its dividend safety has rarely come into question, BMY has been somewhat of a disappointment with regard to dividend growth. For years, the company was known for low-single digit dividend growth. However, at all changed after the Celgene acquisition last year. In 2019, management provided investors with a 9.8% dividend increase. And in recent earnings reports, they have noted that they remain committed towards the dividend and dividend growth.

Due to the strong EPS growth expectations that management and analysts alike are calling for in the coming years, I expect to see BMY's high-single digit/low-double digit dividend growth trajectory continue. With this in mind, the company offers investors the opportunity to buy a blue-chip name with an attractive valuation, strong growth prospects, a nearly 3% yield, and potentially double-digit dividend growth prospects. What's not to like about that proposition?

AbbVie

ABBV is another big-cap healthcare name that is benefitting from 2019 M&A action. For years, ABBV has produced solid top and bottom line growth, as well as dividend growth. However, the market hasn't rewarded this performance with a valuation premium to match the growth because of concerns related to the upcoming patent cliff on ABBV's biggest drug: Humira.

Humira is the world's leader in sales, with nearly $20 billion in annual sales. What's more, the drug's sales continue to grow (in Q1, Humira's sales were up 5.8% to $4.7 billion). But the patent cliff is coming due in 2023, and this creates a lot of unknown for the company due to the fact that historically, Humira has made up the lion's share of ABBV's sales.

Yet, this changed when ABBV announced that it was buying Allergan last year. Prior to that deal, Humira represented roughly 60% of ABBV's sales. However, Humira's share of the revenue pie dropped to roughly 40% of the pro forma company. This is still a large portion, for sure, but now the upcoming cliff represents much less of a problem.

Furthermore, it's not as if Humira's sales are going to drop from $20 billion to $0.00 annually simply because of generic competition. I remember reading an interesting study posted by the European Pharmaceutical Review late last year that estimated the top drug sales figures 5 years into the future. This study estimated that Humira would still be generating $10.3 billion in sales in 2025. While this calls for a significant haircut compared to 2019's total sales of $19.1 billion, but it means that ABBV has time to continue to diversify itself with its pipeline and M&A, if need be. Humira's cash flows should be intact for the foreseeable future, and these, combined with the strong cash flows provided by Allergan's portfolio, make ABBV an attractive investment opportunity, to my mind.

Like BMY, ABBV's management team reaffirmed 2020 EPS guidance in the company's Q1 report as well. The business was exceeding expectations heading into the COVID environment, and management said they were confident that they could hit full-year numbers. Management expects to see 2020 EPS come in somewhere in the $9.61-9.71/share range. The represents high-single digit growth compared to 2019's full-year figure.

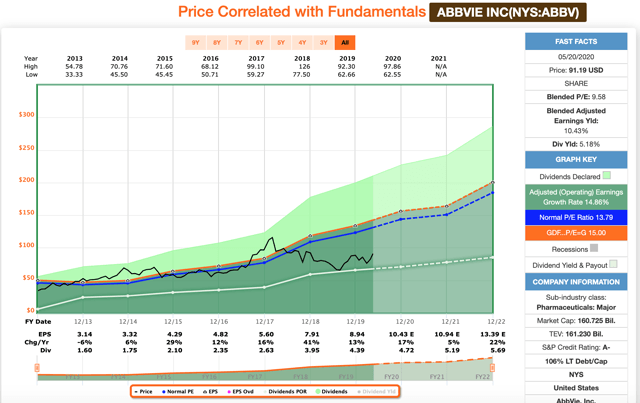

ABBV shares ended the trading session today at $91.19. This means that the mid-point of the 2020 guidance represents a 9.4x forward P/E multiple.

(Source: F.A.S.T. Graphs)

Once again, I think it's important to note that there are very few names on my entire watch list, which includes blue chips from just about every second and industry, that are expected to grow their bottom lines in 2020. The Humira patent cliff headwind or not, this company is not taking a year off in 2020 with regard to growth. ABBV yields 5.18%, has a history of double-digit dividend increases, and has the fundamental growth metrics to support that trend moving forward.

Give me a blue-chip name trading with a single digit P/E multiple, a 5%+ yield, and double-digit dividend growth potential any day.

Conclusion

Instead of gambling with highly beaten-down names in today's market, I prefer the idea of investing in high-quality stocks with predictable sales, earnings, cash flows and, ultimately, dividend safety.

I'm still being cautious in today's market because of the macro concerns expressed at the beginning of this piece, but both BMY and ABBV meet these standards, which is why both names have risen towards the top of my buy list.

BMY is my largest healthcare name, making up 3.05% of my portfolio. ABBV is a smaller position, representing 1.38% of my portfolio.

Because of BMY's overweight nature, I did not add shares during the March sell-off. However, I did add to ABBV, buying shares at $79.16 on March 12th. Now that both of these names have provided a bit of rare fundamental clarity, I hope to add to both in the near future.

Right now, I'm hoping for BMY to dip a bit. I'd love to add below the $60 threshold, which would mean locking in a dividend yield greater than 3%. I believe BMY is worth approximately $70/share, meaning that today's ~$62 share price represents a discount of roughly 13.5% relative to my fair value estimate.

My fair value estimate for ABBV sits at roughly $110/share. At ~$91/share, it is offering a discount of roughly 20.5% from that level.

This article was previously published for subscribers to The Dividend Kings.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our four model portfolios

- 30 exclusive articles per month

- Our upcoming weekly podcast

- 20% discount to F.A.S.T Graphs

- real-time chatroom support

- exclusive access to two preferred stock portfolios

- exclusive updates to David Fish's (now run by Justin Law) Dividend Champion list

- exclusive weekly updates to all my retirement portfolio trades

- Our "Learn How To Invest Better" Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.

Disclosure: I am/we are long ABBV, BMY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.