Are new car sales about to boom?

by Leith van OnselenAccording to Robert Gottliebsen, new car sales may be about to boom:

Google searches for new and used cars have risen rapidly in recent weeks and this could signal that demand for new and used cars has finally turned…

The car industry should benefit from further COVID-19 relaxations. Australians have been slashing their expenditure on cars for many months and the COVID-19 restrictions did further damage to the industry because car travel was curtailed.

But the sort of people who are spending money on their homes are also potential buyers of cars and with public transport less safe, car travel is going to increase. In addition, airlines are out of action so holiday tourism is going to be directed towards country areas within easy driving range of capital cities.

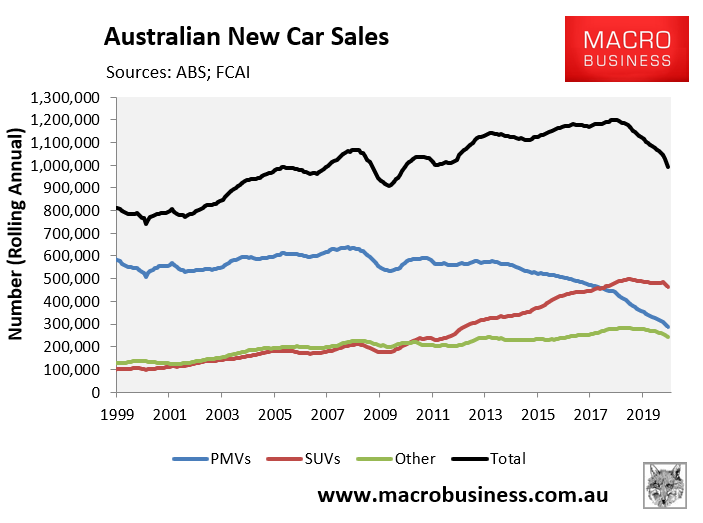

New car sales collapsed to their lowest level since March 2010 in April after falling for 25 consecutive months:

As noted by the Federal Chamber of Automotive Industries:

The Australian new vehicle market has been under stress for some time, with April 2020 representing the 25th consecutive month of declining sales on a year-on-year basis (for example April 2020 compared to April 2019). Environmental, economic and political factors, along with tight credit lending restrictions, have all contributed to this fall.

While a rebound is inevitable at some point after such heavy falls, it’s hard to see how there will be a quick turnaround.

Middle-Australia is hurting financially, meaning now is probably not the time to splash cash on a new set of wheels when the existing ones do the job. Also, immigration will collapse over the next year or so, meaning there will be fewer new buyers coming into the market.

Remember, only one month ago, car dealerships were warning of imminent collapse and demanding taxpayer support.

These aren’t signs of a recovering industry.

Leith van Onselen

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.

Latest posts by Leith van Onselen (see all)

- Property locusts swarm as first home buyers strike - May 28, 2020

- Actual capex falls less than expected in Q1 - May 28, 2020

- CIS demands austerity from states - May 28, 2020