Enagás: COVID-Resistant Regulated Utility But Spanish Exposure Is Sub-Optimal

by Mare Evidence LabSummary

- Enagás is a regulated Spanish utility for transmission of gas and gas storage.

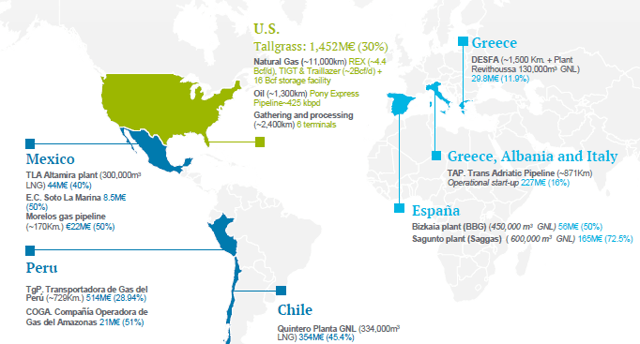

- It has several interesting investments in affiliates, diversifying its income across geographies in pipeline assets.

- Although we like the gas transmission networks and their preordained economics, the primary exposure to Spain is unattractive as there is a lot of regulatory volatility.

- We prefer Snam as our prime dividend and value pick.

In light of our recent deep-dive into the European regulated utilities sector, we decided to initiate the coverage of Enagás, S.A. (OTCPK:ENGGF) (OTCPK:ENGGY), a company that engages in the development and maintenance of gas infrastructures and in the operation and management of complex gas networks. It operates around 12,000 km of gas pipelines, three underground storage facilities in Serrablo, Gaviota and Yela and four regasification plants in Barcelona, Huelva, Cartagena, and Gijón. Like Snam (OTCPK:SNMRF) (OTCPK:SNMRY), the company has a diversified international portfolio of gas transmission assets and the management aims to repatriate 233 million euros in dividends from its affiliates in 2020, thanks to its assets-regulated compensation scheme.

(Source: Enagás FY 2019 results - Investor Presentation)

We think Enagás could be interesting for income-oriented investors, as even in the COVID-19 environment, the economics of this business are regulatory in nature and entirely secure. However, we would not recommend this company over Snam, as Enagás' exposure to the Spanish government's framework means that it has a fickle master with power over 75% of Enagás income. So, although it is attractive as an income proposition with 7.47% dividend yield, Snam is definitely our preferred pick due to its safer geographic exposure.

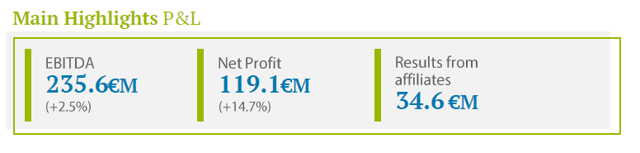

Solid Q1 results

The company has implemented its COVID-19 contingency plan but so far the Spanish Gas System is operating normally. Natural gas supplies are arriving as scheduled and natural gas tank and storage stock levels are on track. Despite that, the total demand for natural gas in Spain declined by 2.4% in the first quarter of the year, mainly driven by lower industrial demand. Enagás generated net profit of 119.1 million euros in line with the company targets established for the whole year. This result is mainly due to the good progress of the contribution of the affiliates and non-recurrent positive income of 18.4 million euros due to exchange rate differences. At the closure of the first quarter’s results, the company was maintaining its estimate of net profits for the end of the year and the payment of expected dividends.

(Source: Enagás Q1 2020 results - Investor Presentation)

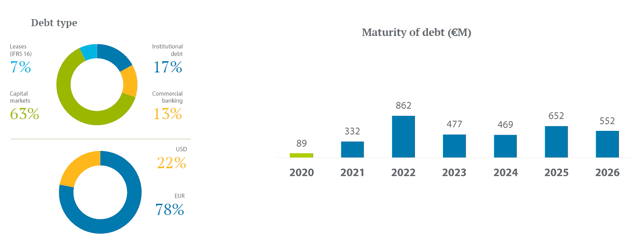

Moreover, the company has a robust financial structure and high liquidity position, with no significant maturities until 2022.

(Source: Enagás Q1 2020 results - Investor Presentation)

International Exposure

Beyond its main transmission business in Spain, Enagás has continued to make moves to expand its international exposure. The Trans Adriatic Pipeline (TAP) project, which links Turkey with Italy via Greece and Albania, is 94.1% complete and the underwater gas pipeline between Albania and Italy has already been completed. Enagás has a 16% stake in this key infrastructure, along with Snam and others, for the security of Europe's energy supply.

On April 17, as scheduled, the take-private transaction (purchase of shares from Tallgrass Energy (NYSE:TGE)) was concluded by the consortium formed by Enagás, Blackstone Infrastructure Partners, GIC (Singapore Sovereign Wealth Fund), NPS, USS and other minority shareholders. With this transaction, approved by the Tallgrass General Shareholders' Meeting and subject to final approval by the competition authorities, Enagás has increased its indirect stake in the US company, Tallgrass Equity, to approximately 30.2% of its share capital. This company gives Enagás exposure to an affiliate with a substantial pipeline network that spans part of the Midwest.

Another interesting news from Enagás is the recent partnership to launch an Energy Transition Fund with Alantra, an asset manager with expertise and solid track record. The Fund, named Clima Energy Transition Fund, will take minority stakes in late and growth stage companies operating in the green hydrogen, biogas, energy efficiency, decarbonization, sustainable mobility and digitalization for energy transition segments. Similar to Snam, these moves insulate it from the remote possibility the status quo changes with some optionality.

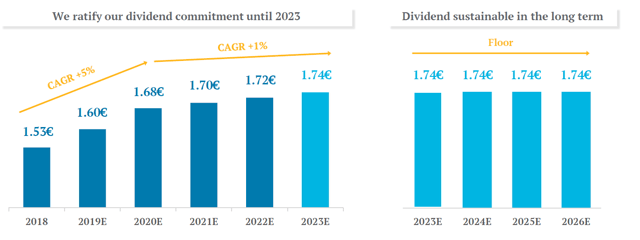

Dividend talks

Despite the 5% equity ticket from the Spanish Government, in July 2019, the CNMC - Spain’s competition regulator - proposed cutting fixed rates of return on the transport and distribution of gas and electricity. Again in September, the 10-member board of the CNMC regulator stated that most likely the previous proposal is going to be more favorable for Enagás. Although the dividend has been solid, and likely will, there is high regulatory volatility, which is not playing in favour of institutional and retail investors. With more polarity between the socialist and conservative parties, investor friendliness is periodically a concern around elections. Even though elections were recent, and the situation is stable for now, it is generally concerning and a negative for the company.

(Source: Enagás Q1 2020 results - Investor Presentation)

Risks and Concluding Remarks

Enagás is positioned as one of the world's most advanced companies in sustainability and environmental management in its sector for its performance and transparency in terms of emission reduction, risk management and opportunities arising from climate change, and promotion of a low carbon economy. For this reason, the company has been included in the CDP Climate Change A List after obtaining the highest rating in its sector. The company will play a major role in the energy transition with projects for the decarbonization of the various economic sectors. Unfortunately, CNMC is a Sword of Damocles; so, although we are confident in Enagás, we prefer Snam with the same toll-road economics but without these regulatory concerns.

Disclosure: I am/we are long SNMRF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.