First Majestic Silver Is A Great Bet On Higher Silver Prices

by Brent HechtSummary

- If silver prices rise, First Majestic is well-positioned among major silver producers to see strong share performance.

- First Majestic has been improving operations through technology upgrades.

- We address concerns others have raised concerning share dilution.

- We analyze the current valuation and make conservative revenue and operating income projections if silver prices rise.

First Majestic Silver (AG) is one of several major silver producers available to invest in on the major stock exchanges. Today, I'm writing about First Majestic Silver, because I expect silver prices to rise over the next 2 to 4 years and I think First Majestic is one of the better ways to play it. Here's an article I wrote about the outlook for silver prices for more information about my opinion.

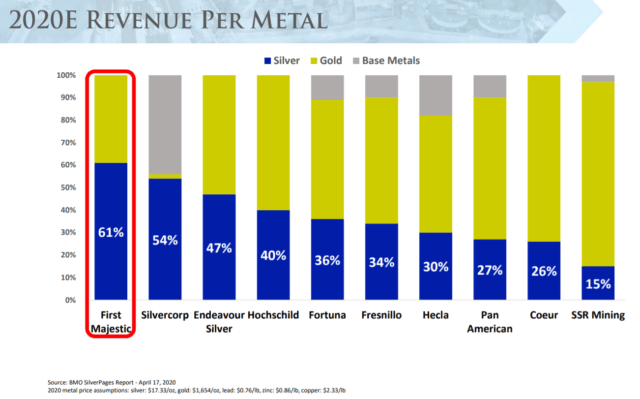

The first thing that caught my eye when it comes to First Majestic was this slide from their presentation deck. This chart highlights that of the silver producers in the public markets, First Majestic has the largest percentage of revenues from silver. These numbers are according to an independent research report from BMO.

This chart doesn't necessarily mean that First Majestic is the largest silver producer. It simply means as a percentage of their total revenue; they have the most substantial proportion coming from silver. I also like that the rest of their revenue comes from gold rather than another base metal. In this macro-environment, I'm not as much investing in silver for its industrial demand as its historical store of value. Although long term, the industrial uses for silver keep expanding.

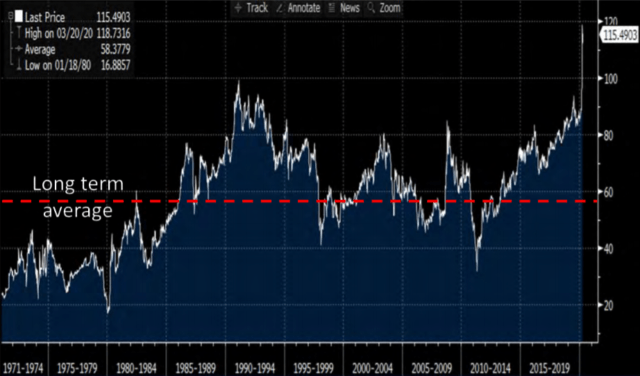

You might ask, "why not just find a good gold mining stock if you want gold and something as a store of value?" The reason is that I'm looking for a silver miner that happens to produce gold and not the other way around. In my opinion, gold has already made a significant move higher while silver has lagged. And if the gold-to-silver ratio (see graph below) is any indication, silver has some catching up to do relative to gold. Not to mention, silver prices are historically more volatile than gold prices, which could mean relatively more upside in price when the time comes. However, I'm also diversifying my bets and purchasing gold stocks, such as the one I highlighted in this article.

Source: Bloomberg

This brings me back to First Majestic. First Majestic was started in 2002 by the still current CEO Keith Neumeyer. Keith today owns a little over 3.5 million shares of the company, putting his stake of the company at 1.7%. It's good to see Mr. Neumeyer putting that many chips into First Majestic as well as the fact that he started the company and has had two decades of proven success.

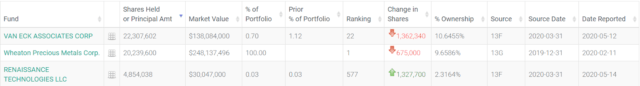

Also, as a vote of confidence in First Majestic, as well as the future of silver prices, Renaissance Technologies owns 3.8 million shares, making them the 3rd largest shareholder as of 3/31/20. For those that don't know about Renaissance Technologies, they are owned by the legendary investor Jim Simons. RenTech's Medallion fund outperforms the market by a significant margin year in and year out.

Source: Whale Wisdom

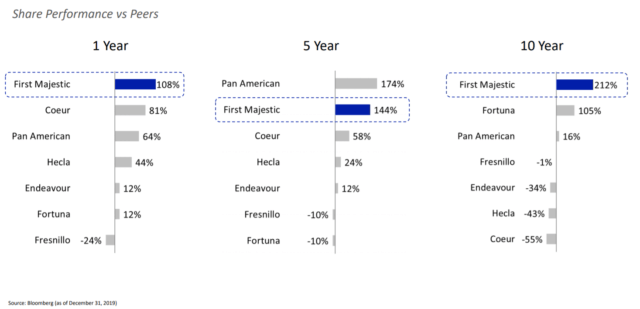

Next, I think it is important to see how First Majestic's stock has performed relative to its peers over historical time frames.

Source: First Majestic Quarterly Presentation

Even though I'm only worried about what happens with future share prices, historical share prices can sometimes give great confidence to inform the future. What this tells me is that the management team at First Majestic has consistently made better decisions, relative to their peers, and this has been rewarded in their share price. Given that the management team is still in place with Keith Neumeyer as CEO, I would expect this to continue. It should also get acknowledged that not all of these companies are the same size, and it is harder for larger companies to grow as fast as smaller companies. However, First Majestic is the second-largest company by market cap on this list as of this writing.

Improving Operations

First Majestic had a record-breaking year in 2019. Their recoveries of silver equivalent ounces as a percentage of the available minerals in the raw tonnage was 86 percent.

Here's an excerpt from their 2019 financial statements highlighting the improvements made in 2019 and the improvements yet forthcoming.

During the year, the company also achieved record consolidated silver recoveries of 86%, the highest in its 17-year history. The most significant improvements were attributed to La Encantada and Santa Elena. At Santa Elena, annual silver recoveries improved to 91% compared to 88% in the previous year. The recovery rate is a new record following the successful start-up of the new 3,000 tpd HIG mill. The company also plans to install a new 3,000 tpd HIG mill circuit and an AG grinding mill at San Dimas in the second half of 2020 to further improve consolidated recoveries and reduce overall operating costs. At La Encantada, silver recoveries increased from 66% in the first half of the year to 80% in the second half, following a revised throughput methodology, which included stockpiling and the focus on finer grinding.

It is encouraging to see a 17-year-old company continue to improve and become more efficient. It looks like more improvement will be made in 2020, so it will be interesting to see the results.

Share Dilution

Next, let's dig into the financials a bit and address some of the controversial topics about First Majestic's financial reports. First, let it be said that First Majestic is a serial diluter of their shares; however, most of it is for beneficial reasons that add value to shareholders. Here's the share dilution that's happened since 2017.

2017

- Started the year at 164,461,567 shares outstanding and ended with 165,824,164

- 1,292,206 shares added for stock options

- 70,391 shares added for settlement of liabilities

2018

- Started the year with 165,824,164 shares outstanding and ended with 193,873,335

- 973,948 shares added for stock options

- 92,110 shares added for settlement of liabilities

- 27,333,184 shares added for the purchase of Primero

- 350,071 shares were repurchased for various reasons

2019

- Started the year with 193,873,335 shares outstanding and ended with 208,112,072

- 2,918,518 shares added for stock options

- 11,172,982 shares added for at-the-market distributions

- 145,576 shares added for settlement of restricted share units

As a shareholder, First Majestic is liberal with their stock options or incentive-based pay. This is a double-edged sword as it can help motivate employees, but it also dilutes shares. Although I understand the concern, I wouldn't consider the number of stock options issued each year at a level that makes the stock unattractive to use to bet on higher silver prices.

Second, the 27 million shares issued in 2018 were used to acquire Primero, which is where First Majestic acquired the San Dimas mine. The San Dimas mine is First Majestic's best-performing asset in their mine portfolio. They purchased Primero for $187M, and for the year ended 2019, the San Dimas mine produced about $186M in revenue and $60M of income after operating expenses. Of their operating expenses, $28M were non-cash expenses. If all of First Majestic's acquisitions go that well, they should rinse and repeat all day.

The large 11,172,982 shares added in 2019 were part of a pre-existing shelf offering and used to support operations and to keep the capital structure in line with expectations. That program was finished in the first quarter of 2020, although they can always begin a new one. They cut this program short of the approved $100 million, so I might conclude that they don't expect to continue issuing new shares in this manner in the future.

Convertible Debentures

In 2018, the company issued debt of $156M, which gave the debt holders the option to convert to equity if the price of shares reached above $9.59 per share. This could be a potential share dilution of $16 million shares. The company has the right to redeem the unconverted debt after March 2021 if they so choose.

Some argue that this creates almost assured dilution, and to a certain extent, they are right. However, this capital has been working for First Majestic shareholders since it was received in 2018. Whether it gets converted to equity or not, it does not mean that something was given away for nothing. This is new capital that new and existing shareholders are hopefully receiving a rate of return from.

Not to mention that the interest rate on this debt was extremely low at 1.875% per year. I can only assume the low interest rate was the reward for allowing the debt to be convertible to equity. So it's likely the company saved a substantial amount of interest expense by allowing the debt to convert. All-in-all, this is not a red flag in my eyes but rather a creative method of capital financing that keeps cost of capital low. If silver prices rise, I could see First Majestic redeeming this debt if it isn't converted to equity before then.

Valuation

In the full year 2019, First Majestic had total revenues of $363M compared to $300M in 2018. They had an operating loss of $31M in 2019 compared to a loss of $263M in 2018. These losses may seem negative, and they aren't great, but it's essential to understand these losses are primarily due to non-cash expenses such as depletion expenses in both years and a significant asset impairment in 2018.

To get a clearer picture of operations, we should look at the cash flow statement, which factors out non-cash expenses. The cash flow generated from operations was $140M in 2019, up significantly from $33M in 2018. With the company trading at a market cap of $1.9B, the valuation relative to operating cash flow is 13.5 times.

The book value of the company is about $662 million, so it is trading at about 3x book value.

Silver Price Sensitivity Analysis

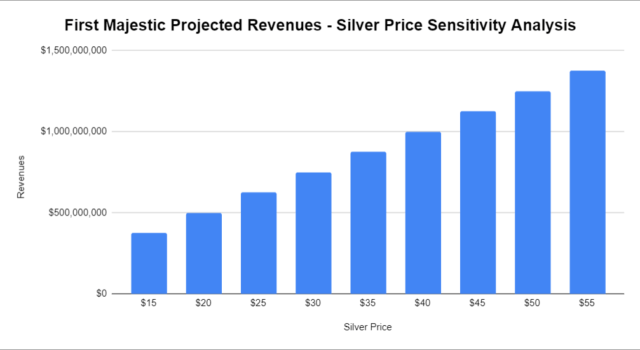

These numbers are all fine, and the company's valuation isn't cheap, but it isn't overly expensive either in my opinion. However, I'm more concerned with what the company could be valued at if silver prices rise to $25/oz or $35/oz or $55/oz. Since I think these prices are in the realm of possibilities, I'd like to understand how much revenue, income, and cash flow they could generate at these prices.

In 2019, the company produced a total of 25,554,288 ounces of silver equivalents, which generated revenue of $364M. That means they received an average price of $14.24/oz of silver for their product.

Through the first quarter of 2020, the company has produced 6.2 million silver equivalent ounces, which is almost precisely equal to the 4th quarter of 2019. Given the challenges that COVID-19 presented in Q1, it's nice to see they kept production the same quarter-over-quarter. It remains to be seen if they can continue this in Q2 2020.

Based on this, we will assume the 2020 production will be the same as 2019, around 25 million ounces of silver equivalents. In the following chart, we demonstrate potential revenues for every $5 increase in silver prices, with the company producing 25 million ounces.

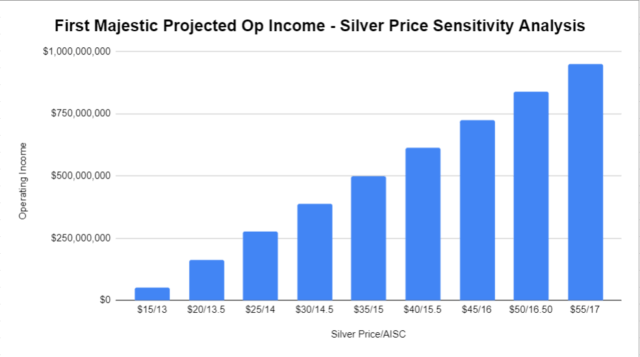

In 2019, the company's all-in-sustaining-cost (AISC)/oz was about $13/oz. If you are unclear what AISC is, here's an excellent place to start learning.

Here's a chart using prospective silver prices, and using an AISC that starts at $13 and moves up fifty cents for each $5 increase in silver prices. This chart projects operating income up to a silver price of $55, which is slightly above the $50 high from 2011.

When we look at these two charts projecting revenue and operating income, it begins to paint a picture of the value of First Majestic if we were to achieve even incrementally higher silver prices. But if First Majestic were to be in a $50 price environment and was reaching revenues above $1 billion at current production, then it would likely triple or quadruple the current share price simply based upon revenue multiples.

The magic happens when we experience an extreme increase in operating income and operating cash flow. When the price of silver increases faster than the AISC, the operating income grows much faster than the revenue. For example, with silver at $20 and AISC of $13.50, operating income is $163M. If silver prices are $50 and AISC is $16.50, then operating income is $838M, which multiplies operating income by about 5 times. Therefore, if silver prices reach $50, I believe it is conservative to say First Majestic shares will trade at least 5 times higher in price than where it is trading today at $9/share. And to assign a broad range to the share price, I wouldn't be surprised to see it somewhere between $50 and $100 per share.

I believe this may be conservative because if silver prices reach $50/oz, First Majestic will be finding ways to increase silver production to max capacity. This likely means bringing online some of their higher cost silver production. Nonetheless, silver production will increase, thus increasing revenue and operating income alike.

Granted, to have silver prices at $50 is a big "what-if." However, First Majestic is on solid enough footing that I'm comfortable holding their shares while waiting to find out if and how high silver prices will go.

Conclusion

First Majestic Silver is well-positioned to take advantage of a rise in silver prices. We know that the macro environment is set up well for silver price appreciation. However, if silver prices don't rise or rise slower than expected, an investor needs to be confident and knowledgeable enough about the company to be able to hold on to shares through a silver price decline. It's only knowledge that can keep a person from buying high and selling low. Knowledge is the cure for investing with your emotions.

First Majestic is on solid footing. Here's a summary of the points made above.

- First Majestic gets the largest percentage of their revenue from silver relative to other silver producers. This makes the company best positioned for a rise in silver prices.

- First Majestic's share price has outperformed their peers' over 1-year, 5-year, and 10-year time frames.

- For those concerned with share dilution, the largest issuance of shares during the past 3 years was used to purchase their San Dimas silver mine. San Dimas is their best performing asset and has generated an incredible return for shareholders to date.

- The convertible debentures have the potential to continue to dilute shareholders. However, this capital has already been working for shareholders since 2018. The interest rate was only 1.875%. Further, First Majestic can begin redeeming this debt after March 2021.

- First Majestic continues to find ways to become more efficient in their operations. Last year, they recovered a record 86% of silver from the raw tonnage and also had higher grams per ton. They credit this to some technology upgrades. They plan to implement these upgrades at their San Dimas mine in 2020.

- First Majestic's valuation at current silver prices and financial performance is reasonable.

- Silver price appreciation presents a significant opportunity for First Majestic's share price. Even a moderate increase in silver prices will increase First Majestic's bottom line by a multiple greater than the increase in silver prices itself.

- First Majestic has a CEO who started the company 17 years ago in Keith Neumeyer. He has a proven track record in a historically challenging business.

Disclosure: I am/we are long AG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.