Vertex Energy's Transformation Continues

by Jenks JumpsSummary

- Vertex Energy began migrating its end-products toward higher-margin markets in 2018 - higher-purity base oils and IMO 2020-compliant marine fuel.

- The company reported first-quarter results on May 14th. Gross profit more than doubled. As 2020 began, the transformation was proceeding well.

- But like almost every other company, the pandemic caused a negative impact, as did the supply/demand imbalance in the oil & gas industry. The second quarter will be ugly.

- With one exception, it would seem reasonable to consider each factor impacting the second quarter as temporary.

For Vertex Energy (VTNR), size matters. The UMO (used motor oil) re-refiner is a smaller player in the oil and gas industry. When the industry struggles, Vertex Energy's share price typically gets pummeled simply because it is a smaller player.

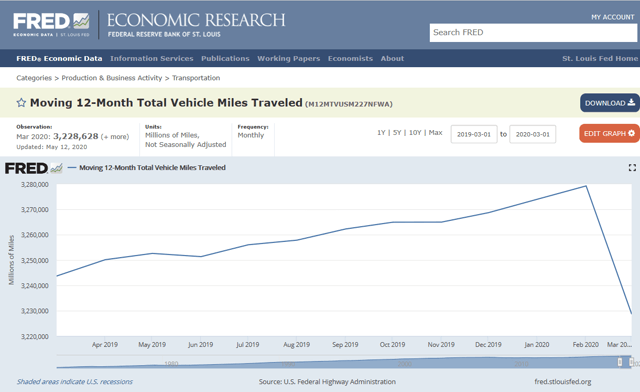

Declaration of the COVID-19 pandemic in March 2020 prompted quarantines and stay-at-home orders. Travel halted. Demand for oil and gas products dropped globally. In the U.S., the decline in demand began to materialize even before Americans settled into their homes for weeks on end.

(Source)

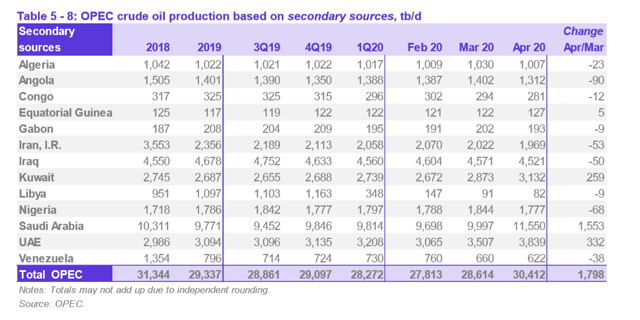

In the 2020 first quarter, OPEC (Organization of the Petroleum Exporting Countries) increased production. Supply soared. As the supply/demand imbalance intensified, product prices were cut to approximately 1/3rd their previous high.

(Source)

Vertex Energy's beginnings are rooted in re-refining used motor oil. Its revenue generation depends on the spread between its feedstock cost and the price of its end-product. Used motor oil is typically priced similarly to HSFO (High Sulfur Fuel Oil), also known as Gulf Coast #6 fuel oil, heavy fuel oil or marine fuel. Vertex purchases feedstock at a price discounted from HSFO as the base.

In 2018, Vertex Energy purposely began migrating its end-products toward higher-margin markets - higher-purity base oils and IMO 2020-compliant marine fuel. As 2020 began, this transformation was proceeding well.

Vertex Energy History

When 2014 began, Vertex Energy had a re-refining capacity of less than 30 million gallons of UMO. In March 2014, it acquired Omega Holdings, inclusive of three facilities: Marrero (Louisiana), Myrtle Grove (Louisiana) and Bango (Nevada). The transaction added capacity of over 80 million gallons, to create a combined capacity of nearly 110 million gallons.

By June 2014, Vertex Energy owed over $40 million and faced a June 30, 2015 maturity date for $9.1 million. Since crude oil prices were more than $100 per barrel at the time, meeting the maturity date seemed feasible. Yet, by early 2015, crude oil prices had been cut in half and it seemed the company was in peril.

In June 2015, the company raised $25 million by issuing approximately 8.1 million shares of Series B preferred stock. The proceeds were used to pay down $15.1 million of its debt.

In February, 2016, Vertex announced the sale of the Bango base plant in Nevada - originally acquired in the Omega Holdings acquisition - to Safety-Kleen Systems, a subsidiary of Clean Harbors (CLH), for $35 million. It used approximately $16 million of the proceeds to further pay down long-term debt.

In May 2016, the company announced a private placement of preferred stock and raised approximately $19.3 million. The first use of the proceeds was to repurchase and retire $11.2 million worth of the Series B preferred stock issued in June 2015. The remainder of the proceeds, approximately $8.1 million, was used to pay down debt and for working capital needs. Total outstanding debt now stood at $14.2 million.

In February 2017, Vertex entered into a term loan and a revolving note with Encina Business Capital and closed out previous credit agreements. Both Encina credit agreements were to mature in February 2020.

By March 2018, Vertex Energy was already working on a new financing solution. In addition to addressing debt, it also needed capital to increase production capacity. In a 2018 interview with the Houston Business Journal, the total need was estimated at approximately $87 million for three unfinished projects: Myrtle Grove, Louisiana, Houston (Baytown), Texas and Columbus (Heartland), Ohio.

The financing transaction finally came to fruition in July 2019. The company announced a partnership with Tensile Capital Management. The venture would fund a pilot project to develop higher-purity base oils at the Myrtle Grove refinery and prove development of the Heartland refinery. The Tensile partnership provided both a cash infusion and enabled a twelve-month extension on the credit agreement maturity date. Completion of the pilot project by calendar year-end would transform the company's balance sheet.

We view the successful completion of the pilot test related to a phase 2 closing with Tensile Capital as a liquidity event that has the potential to transform our business, both reducing net leverage and by providing capital for long-term growth.

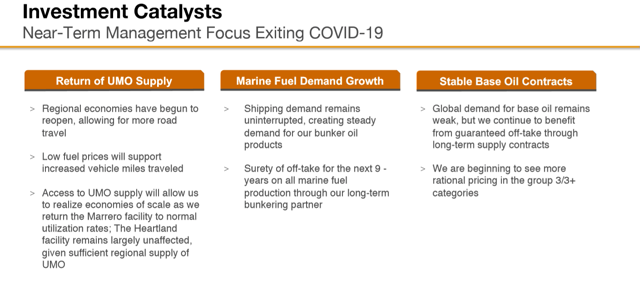

In January 2020, Vertex Energy and Tensile Capital announced completion of the pilot, which triggered another phase focused on the Heartland facility. The company was also producing IMO 2020-compliant marine fuel. It signed a strategic agreement with Bunker One USA, a physical fuel supply network with global operations. Bunker One has the exclusive right to purchase 100% of the marine fuel produced at Vertex's Marrero refinery through December 2029.

This relationship not only ensures a long-term sales and marketing channel for 100% of our current marine fuel production at fair market prices, it also provides us surety of off-take for incremental marine fuel production in future years, while allowing us to participate as a minority partner in Bunker One's entire North American marine fuel bunkering business.

On January 22, 2020, Vertex share price hit a 52-week high of $1.95.

When the company reported 2019 fourth-quarter results in early March, product spreads had been at a near-record level and its Marrero and Heartland facilities were producing at 100% and 103% capacity, respectively. Vertex's street collection volume increased to 37% in 2019.

Regardless of the improvements in its business, global economic conditions were impacting the share price. Shares closed at $1.17 on March 4th but dropped to $0.45 two weeks later.

First-Quarter Results

Vertex Energy experienced the negative impacts of the COVID-19 pandemic and oil and gas supply/demand imbalance only slightly in the 2020 first quarter. In late March, like many companies, it withdrew its full-year guidance.

When it reported on May 14th, both Marrero and Heartland had produced at peak capacity during the first quarter at 98% and 102%, respectively. Revenue declined slightly from $39.3 million in the 2019 first quarter to $36.2 million. Gross profit, however, more than doubled, from $4.48 million to $9.37 million. Several factors contributed to the improvement.

During the fourth quarter 2019, we built inventory of lower-priced used motor oil feedstock that allowed us to operate our refineries at normal rates well into April 2020, while others in the re-refining industry shuttered their facilities due to insufficient supplies of UMO feedstock.

UMO collections represented approximately 41% of overall feedstock processed at the Company's refineries in the first quarter of 2020.

The Marrero refinery operated at elevated rates during the first quarter of 2020, given a more than 15% year-over-year increase in the production of middle distillates used in the marine bunker fuel market.

In the months leading up to the emergence of COVID-19, we entered into derivatives contracts that allowed us to lock-in the favorable margins that existed in the market at that time, effectively shielding much of our business from the volatility that followed. We monetized this hedge position during the first quarter, resulting in a near-record quarter of profitability for the Company.

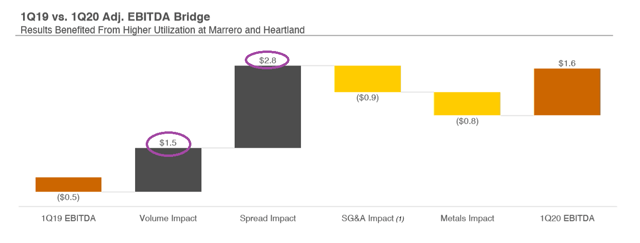

From an EBITDA perspective, the spread had nearly double the impact of the increase in production volume.

(Source: Company Q1 2020 Conference Call Presentation)

Net income attributable to the company was positive at $2.79 million. However, a net loss was attributable to shareholders of $9.45 million. The net loss was primarily a result of an adjustment to the carrying amount of the non-controlling interest due to the changes in ownership interest at Myrtle Grove and Heartland relative to the Tensile Capital partnership. Vertex Energy received $21 million in the quarter. The loss for shareholders equated to $0.21 per common share.

The amount of accretion of redeemable noncontrolling interest to redemption value of $10,966,349 presented on the consolidated statements of operations represents the MG SPV and Heartland SPV accretion of redeemable noncontrolling interest to redemption value combined at March 31,2020.

The share price recovered to the $0.60+ range.

Ongoing Impact

By the beginning of the second quarter, negative impacts resulting from the pandemic, subsequent shutdowns and supply/demand imbalance were evident. Vertex Energy reported the availability of UMO feedstock declined “as deep as 60% off normal volumes” and the demand for base oils “came to a dead stop”. The company has “throttled” production at its Heartland facility. On May 20th, Vertex filed a prospectus for the proposed resale of an additional 5.9 million shares from selling shareholders.

On the other hand, the company has reported the demand for marine fuel “remains strong” and its off-take agreements are being utilized. It also decided to accelerate its planned maintenance at Marrero to May 10th.

Vertex Energy will definitely have increased dividend obligation in the latter half of 2020. Its Series B and Series B1 stock have a redemption date of June 24, 2020. The company had anticipated it may not be able to redeem and, obviously, will not be able to redeem this stock now. Therefore, the dividend rate will increase from 6% to 10% annually on these shares effective June 24, 2020. In the 2020 first quarter, the dividend distribution on these shares was $344.5 million. The dividend is paid through the issuance of in-kind equity. The distribution should increase minimally $230 million per quarter in the second half of 2020. The company expects to continue to pay the dividend through the issuance of in-kind equity.

In reaction to the pandemic, the company secured another extension from Encina on its credit facility. The maturity date is now February 1, 2022. At the end of the first quarter, Vertex Energy had $20.3 million in cash and available liquidity. It received an additional $4.2 million from the Small Business Administration's PPP (Paycheck Protection Program) funding in May.

Takeaway

Akin to the majority of companies, it's almost guaranteed Vertex Energy will report an ugly second quarter. Its input volumes have been compromised, its spread is thinner, demand for some of its end-products has declined and the company's production capacity will not be at peak as it uses the downtime to perform maintenance.

Yet, there has already been some recovery in UMO feedstock availability in May - “to a 70% level of our normal volumes in most of our markets”.

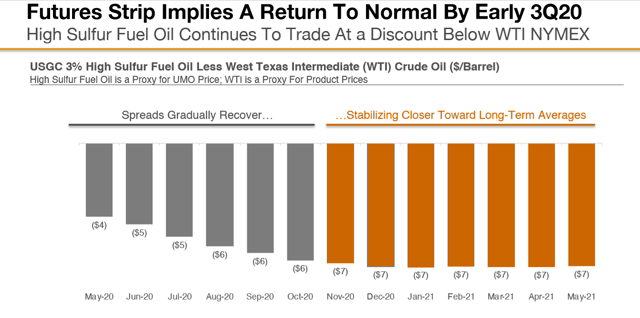

The CME Group is projecting a return to average spread later in 2020.

(Source: Company Q1 2020 Conference Call Presentation)

Bunker One will continue to purchase the company's marine fuel. Vertex has multi-year contracts for a portion of its base oil production. And in the long term, the demand for higher-purity base oils should resume its growth trend.

(Source: Company Q1 2020 Conference Call Presentation)

It's also possible the impact from the pandemic could benefit Vertex Energy as smaller collection routes become available for acquisition. And self-collected feedstock volumes are more profitable than purchased feedstock from third parties.

It would seem reasonable to consider each factor impacting the second quarter as temporary, with the exception of the possibility of an increased outstanding share count. Certainly, the pandemic and supply/demand imbalance created obstacles. Still, its transformation continues.

Disclosure: I am/we are long VTNR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I belong to an investment club that owns shares in VTNR.