My Top New England Bank Pick For The 2020s

by Richard J. ParsonsSummary

- Earlier this month, I had the opportunity to talk with Curtis Simard, President/CEO of Bar Harbor Bank & Trust, a $3.67 billion bank operating in Maine, Vermont, New Hampshire.

- Our 90-minute discussion covered a wide-range of topics, including the bank's valuation, strategy, marketplace dynamics, loan demand, and PPP.

- This post offers three models that forecast BHB's earnings over the next decade provided the bank maintains its excellent history of credit quality.

- Though the bank's stock has lagged peers since buying Lake Sunapee in 2016, BHB is positioned to be the leading Northern New England bank and brand over the next decade.

- By 2030, each BHB share should generate a total return of at least 200% (price appreciation of 125%+ and accumulative dividends of 60-75%), assuming a purchase price of $18/share.

May 2020 Interview With Bar Harbor Bank & Trust's CEO

Since becoming a buy-and-hold investor an Bar Harbor Bankshares (NYSEMKT:BHB), I speak with the bank's CEO, Curtis Simard, once or twice a year. Earlier this month, I had the opportunity to catch up with Simard. In our conversation, he shared his current thoughts across a wide range of topics.

This post reflects Simard's insights as well as my own analysis drawn from the conversation, the bank's recent performance, bank reports, and my experience as a bank investor and banker. This post will address:

- Valuation

- Buybacks

- Paycheck Protection Program/PPP

- Growth

- Accounting for Loan Lease Loss Allowance/CECL

- New England Market Conditions, Maine Competitors

- Strategy: Talent

- Strategy: Relationship Banking

- Strategy: Lake Sunapee Bank Acquisition

- Earnings Potential 2020s

- Five Critical Metrics

- Risks

Valuation

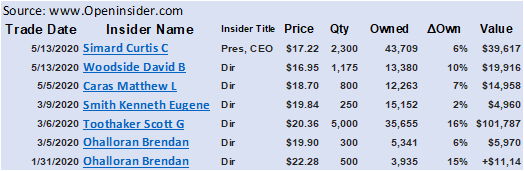

Simard stated point blank, "we feel we are significantly undervalued." Within days of our conversation, Simard joined five other insiders who have bought BHB shares in 2020. Prices range from a low of $16.95 to a high of $22.48 as shown in Table 1.

Table 1

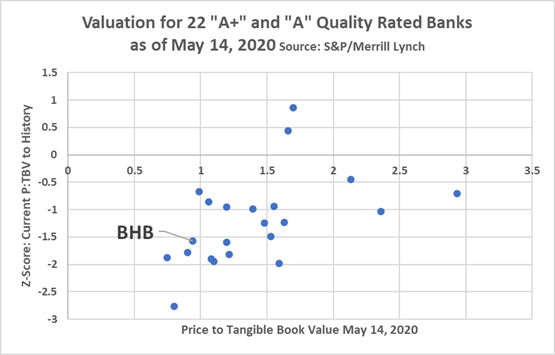

Chart 1 (below) reinforces Simard's observation about BHB's valuation. This chart shows the May 14 Price to Tangible Book Value (x-axis) for 22 US banks that S&P identifies as "A" or "A+" Quality. It also compares the May 14 Price:TBV to each bank's historic average P:TBV (y-axis).

All but two of the banks show a current P:TBV below historic averages, which reflects the investment community's current low regard of bank stocks. In BHB's case, the bank's valuation in May has hovered around 1.0, a ratio (statistically) significantly below its average since 2004 of 1.40.

It is this fact combined with my confidence in BHB's board and management that motivated me recently to accumulate more BHB shares in my long-term bank investment portfolio. For further insights about BHB's valuation, see my recent article, "Insiders at Quality, Reliable Dividend-Paying Banks Buying Shares."

Chart 1

Buybacks

Further evidence of the board's view that BHB shares are undervalued came on March 12th of this year when BHB issued a press release announcing plans "to repurchase up to 5% of the bank's shares, representing about 781,000 shares."

I asked Simard about the status of the buyback, noting that I saw no evidence in the 1st quarter earnings report of a reduction in shares. Simard referred me to the bank's first quarter 2020 10-Q which he expected to be released within days of our conversation. My subsequent review of the 10Q indicated no reduction in shares; therefore, no repurchases appear to have been conducted between March 13 and March 31.

It is possible that the bank's primary regulator, and this is total speculation on my part, delayed the buyback plan, given justifiably heightened regulatory concerns related to COVID-19. On March 15, three days after BHB's repurchase announcement, the megabanks announced plans to suspend their buybacks; the fact that they all released the buyback suspension on the same day, no doubt, indicates regulatory influence.

Investors will need to wait until July to see if the bank was able to buy shares in 2Q. BHB has 15.53 million shares outstanding and has traded on average 44,000 shares a day in 2020. Therefore, even if BHB is buying its stock, it is unlikely it could buy more than 4,000 shares a day. Any buyback effort will take some time to complete and not significantly influence price in the short term. My analysis of BHB's future earnings, stock price, and dividend growth is not dependent on stock buybacks.

Paycheck Protection Program/PPP/Lending During COVID-19

Simard spoke at length about his pride in his teammates who stood up the bank's Payment Protection Program in a matter of days. Many of the bank's employees worked 18-hour days to respond to nearly 2,000 loan applications that came into the bank in April and early May. BHB provided clients with same day decisions and next-day closings. Round 1 of PPP showed the average loan to be just over $200,000. Round 2 has resulted so far in 900 additional applications at an average loan size of $26,000. Round 2 has given BHB and other banks an expanded opportunity to meet the needs of sole proprietors and small business owners.

To put all these numbers in perspective, Simard said that BHB normally closes about 70 loans per month. To scale his team to handle 2,000 applications in 30 days, BHB ran 3 shifts (3rd shift: 10 pm - 4 am) and redeployed 53 employees from the bank's branches into other parts of the bank, including ten into PPP.

Simard observed that "PPP is a reminder that community banks have a competitive advantage (over larger banks) because community banks know their customers." He thinks PPP is a defining moment for small business owners across the US who have been served well by a local community bank during a time of crisis. His bank's ability to proactively reach out to clients and prospects during April and early May stands in contrast to many banks that struggled just to answer incoming calls from clients.

To be clear, Simard has enormous respect for large banks. As a former senior banker at a large regional bank, Simard knows the strengths and weaknesses of big banks. In his view, small business owners today have a much greater appreciation of the enhanced service made possible when banking with smaller, more nimble banks like BHB that value personal relationships.

When I asked Simard about the local economy, he noted when we spoke that Maine's governor would not allow hotels to open until July 1. He hoped that date might be moved up. Since summer tourism is the number one industry in Bar Harbor, Simard recognizes that many local businesses will continue to be impacted by COVID-19. Long-time investors in BHB know that the bank's deposits peak during the summer/fall seasons and fall during winter/spring. Since tourist revenue is likely to fall significantly in 2020, bank investors need to monitor BHB's credit and deposit metrics even more closely than usual over the next few quarters.

Simard offered one other interesting observation about lending during shelter-in-place. Usually, BHB has a $30-40 million loan pipeline. However, because of low interest rates and the fact that appraisers cannot get into properties, the pipeline has mushroomed to $100 million. Assuming these are mostly good loans, the size of the pipeline is encouraging.

Growth: "Not Growth for Growth's Sake"

Speaking of lending, I have enormous respect for bank CEOs who achieve quality earnings through the ups and downs of the business cycles. Sadly, as evidenced by 3,500 bank failures in the US since the mid-1980s, achieving high quality earnings over time is extremely difficult. Many investors in banks have been burned by their failure to discern the skills of their bank's management and board.

Having spoken at length with Simard several times since 2015, my sense is that he is among the bankers in the country who understand quite well that banking is a low margin business with little room for error. Like Aesop's fable about the turtle and the hare, the best bankers know that "steady as you go" beats "flash-in-the-pan" growth over the long haul.

During the interview, Simard's emphasized BHB's plans to grow responsibly, "not growth for growth's sake." His quality growth message has been a constant drumbeat of BHB since at least 2014 as evidenced by these comments drawn from annual reports.

- "… our model of balancing growth with earnings." 2014 Annual Report

- "… embracing our model of balancing growth with earnings." 2015 Annual Report

- "… unafraid to search for and address blind spots as we set a course that creates long-term value by balancing growth and earnings." 2016 Annual Report.

- "… ensuring that we deliver on our model of balancing growth with earnings." 2017 Annual Report

- "… focused on creating the type of bank that can deliver profitable growth in varying economic environments." 2018 Annual Report

- "… focus on our meaningful evolution and the need to balance growth with earnings." 2019 Annual Report

Investors in BHB can expect a steady but not spectacular long-term growth trajectory. The board and management have put in place risk management guardrails "to maintain a moderate-to-low risk profile" (2015 annual report) and to ensure "profitable growth that is within our risk appetite" (2016 annual report). BHB is committed to "prudent investment in risk management that starts with credit" (2017 annual report), "an unwavering commitment to risk management" (2018 annual report), and the "judicious capital deployment with unwavering disciplines in risk and balance sheet management" (2019 annual report).

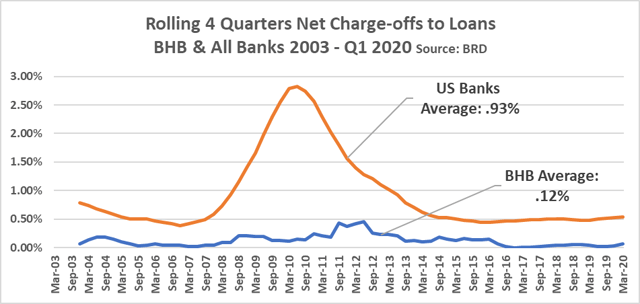

Bankers like to talk about responsible growth and risk management, but the proof is seen in loan loss numbers over good and bad business cycles. A look-back at BHB's loan loss history shows that BHB's record for Net Loan Charge-offs (charge-offs minus recoveries) since 2003 is among the best in the industry as seen in chart 2.

My rule of thumb is that a community bank cannot afford to lose more than 0.50% of loans over time (i.e., 50 cents per $100 of loans). In BHB's case, net charge-offs since 2003 have been 12 cents per $100 of loans. As an investor interested in only investing in community banks that generate superior Risk-Adjusted Returns on Equity (RARoE), I will take 0.12% over 0.50% every day of the year.

Chart 2

CECL

I asked Simard about the BHB's decision to defer the implementation of CECL (a new and controversial model for determining Allowance for Loan and Lease Losses). He informed me that BHB is running CECL and the old model (incurred loss) in parallel. While many banks proceeded with implementing CECL during the first quarter, BHB chose to take advantage of the CARES Act provision that gave banks the ability to continue to use the incurred loss model. The delay was granted as regulators recognized that COVID-19 disaster activities required total management focus as the first quarter closed.

Since BHB's current Allowance is 0.58% of loans, a number lower than most banks, it seems likely, but not certain, that CECL will result in BHB making a one-time increase to its Provision expense to fund the Allowance. (The one-time adjustment will be offset by a commensurate reduction in equity.) Because there is no set accounting formula or even precise regulatory guidance for exactly what factors determine the Allowance under CECL, it is anyone's guess what the bank and its outside audit firm will determine is most appropriate for BHB. One reason to think CECL may not require a large increase in BHB's Allowance can be seen in chart 2 above. The bank's excellent credit history (as well as the similar excellent credit history of the bank it acquired in 2016) should inform CECL numbers.

My best guess is that BHB will adjust its Allowance to between 0.75% and possibly as high as 1.0%. The current price of BHB ($19.29 on May 22) should reflect the expected ALLL change.

Market Conditions: Lending Standards, Deposit Pricing

Simard can talk "big picture" about the industry and the economy as well as get into the weeds of local market details like loan covenant and pricing trends. The subject of lending activity and underwriting standards comes up in all my discussions with Simard.

He believes underwriting quality in New Hampshire, Vermont, and Maine has been consistently sound in recent years. His bigger concern has been overly aggressive pricing on both loans and deposits.

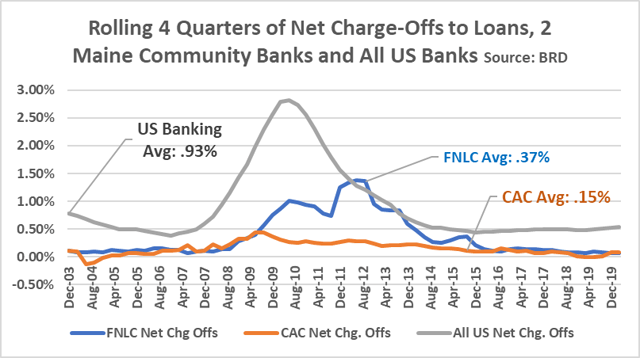

My experience as a banker and bank investor is that it is far better to compete in and invest in banks whose competitors are smart bankers. Specific to Maine, BHB's two principal competitors have a history of sound lending practices since 2003 as seen in chart 3.

Camden National Corporation (CAC) at $4.44 billion is slightly larger in asset size than $3.67 billion BHB and $2.1 billion First Bancorp, Inc. (FNLC). Unlike BHB, its two main community bank competitors do business exclusively in Maine. At an average Net Loan Charge-off rate of 0.15%, CAC has a proven history of excellent credit management. FNLC's bad loan peak of 1%+ between 2010 and 2013 pulls the bank's average Net Loan Loss Ratio up to 0.37%.

Chart 3

The COVID-19 economy is the next test of underwriting standards in NH-VT-ME. Time will tell, but historic credit quality trends in Maine are encouraging.

There is industry data reinforcing Simard's concern that banks in New England are pricing loans and deposits too aggressively.

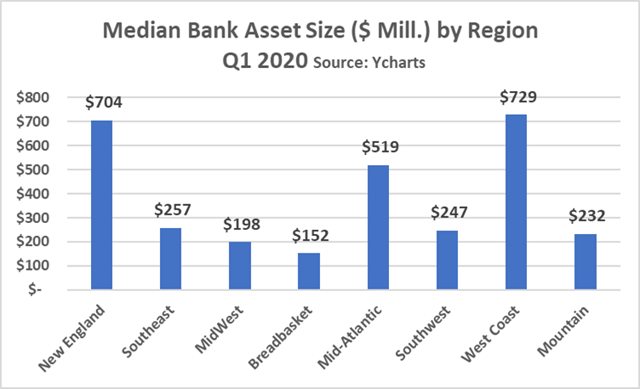

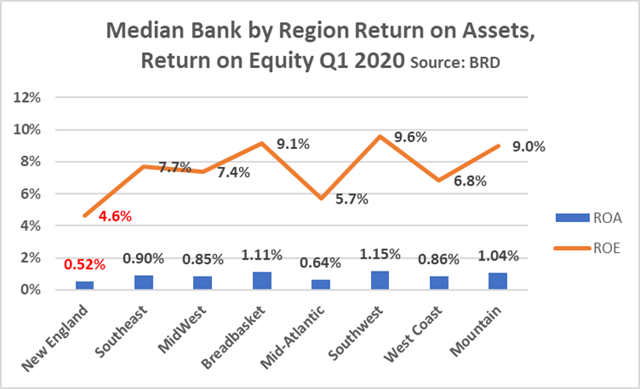

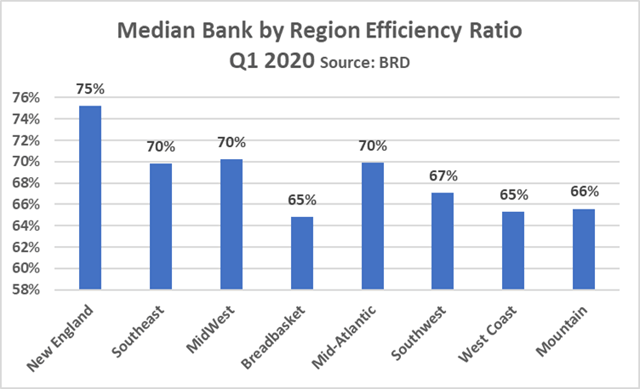

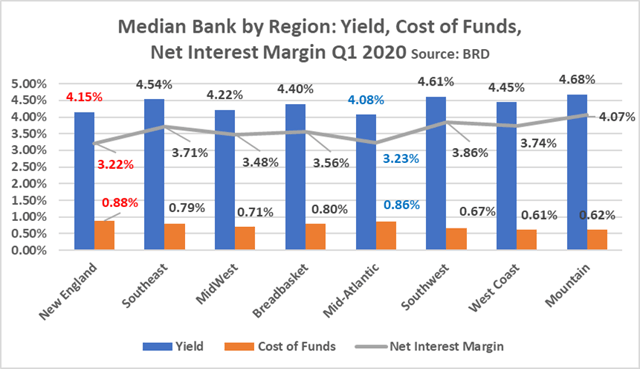

Charts 4-8 are drawn from FDIC Call Reports (for bank subsidiaries, not holding companies) as compiled and reported at BankRegData (described as "BRD" on charts). These charts show that New England banks earn less money (based on ROE, ROA), pay more for deposits (cost of funds), and are less efficient than peer banks around the country.

The gaps between New England and the rest of the country are possibly understated because the average size of New England community banks is much larger than other regions, and this is relevant because size in banking is correlated to Efficiency, and Efficiency to profitability. See chart 4 for a comparison of median banks by region of the country.

Chart 4

My research indicates there is no more important metric for determining long-term total shareholder returns than bank profitability (as measured by Return on Equity and Return on Assets). Chart 5 warns investors in New England banks that the region's profitability lags the rest of the country.

Chart 5

The unfavorable profitability comparison is largely influenced by New England's unfavorable (higher) Efficiency ratios as reflected in chart 6. A low Efficiency ratio is preferred as the ratio measures how much revenue is produced per dollar of expense.

Chart 6

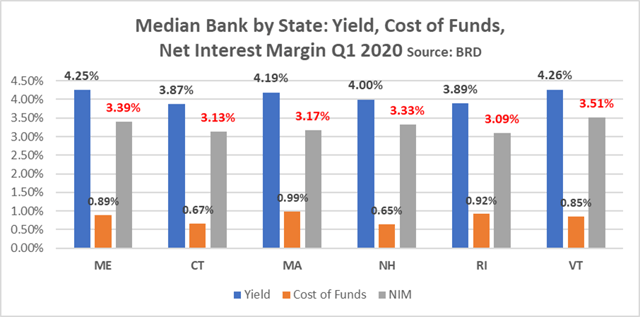

The Efficiency challenge for New England banks is two-fold. First, as chart 7 shows, New England banks have the lowest Net Interest Margin in the country. This is because the region's banks pay the highest rate of interest for deposits and earn the next-to-lowest yields on earning assets. The combination of high cost of funds and low yields is an enormous headwind for New England banks. The second challenge facing New England banks is that labor costs are the highest in the country as measured by compensation per employee.

Chart 7

Chart 8 shows Net Interest Margin for New England states. Look carefully at chart 8 and note that the three states in which BHB competes have markedly better Net Interest Margins than Connecticut, Massachusetts, and Rhode Island. While New England is a difficult place for banks to earn returns in excess of a bank's cost of capital, the challenge is most acute in the three states with urban centers where banks encounter tough competition from not only community banks but also the megabanks that tend to soak up the lowest cost deposits in the big cities.

A further challenge unique to New England is the fact that the region is home to mutual savings banks that have the odd advantage of not having to earn a profit since they do not have shareholders. As a result, no surprise, "mutuals" as a group are the least profitable banks in the country. While their small size limits their ability to compete, data show that mutuals often use their advantage of not having to share profits with shareholders to pay higher compensation to its employees (when compared to banks of similar size). This pay factor influences compensation practices across New England.

New England banks have high compensation costs when compared to banks of similar size across the US. Relatively high compensation costs are a contributing factor to the relatively unfavorable Efficiency ratios of New England banks.

Unfortunately, New England banks' high compensation costs are not offset by lower funding costs or higher yields. Chart 8 shows the Q1 2020 median bank by state cost of funds, yield, and net interest margin for the six New England banks.

One important implication of chart 8 to BHB shareholders is that the bank is today doing business in the three New England states with the best numbers: VT-ME-NH. Simard understands the economics of New England banking quite well and has expressed to me on several occasions that BHB is best suited to compete in Northern New England.

Should BHB venture into Massachusetts, I would be among the first shareholders to sell my shares. There are some excellent bankers in the Boston region whose banks struggle to generate consistent returns close to cost of capital.

Chart 8

There is a third factor that explains the major difference between New England banks and those in the rest of the US. The difference has to do with lending practices. New England banks devote a much larger percentage of their balance sheets to 1-4 family mortgage loans than banks in the rest of the US.

Simard reminded me during our discussion that 1-4 family loans tend to be a commodity product subject to commodity pricing. At BHB, 1-4 family loans are 46% of total loans on the balance sheet, down from 50% five years earlier. Simard said the bank sells some of its 1-4 family production and keeps on the balance sheet short-duration and Jumbo mortgages.

The high 1-4 family lending also partly explains why New England banks have so many banks with loan-to-deposit ratios greater than 100%. Banks with high loan-to-deposit often try to make up for margin pressures by booking more loans that bring higher yields today than securities. This practice is not without risk.

Simard and BHB are focused intently on gaining core deposits and lowering the bank's loan-to-deposit ratio (it has steadily declined in recent quarters, falling to 0.99% in Q1). When asked his goal for the ratio, Simard responded, "get as low as I can get." In my view, this is the right answer but easier said than done because bank CEOs often find themselves balancing EPS targets (which fund dividends) with profitability metrics (ROA and ROE which drive share price).

High loan-to-deposit ratios create two problems for banks. The first is that it puts pressure on banks to outbid each other to attract deposits needed to fund loans. The second problem can be more acute during times of economic stress. High loan-to-deposit ratios can create liquidity events, i.e., banks lack the liquidity to meet normal (and abnormal) customer demands for cash.

In BHB's case, the bank keeps an exceptionally low level of cash on the balance sheet. When I asked Simard his justification for holding so little cash, he responded that he was confident the bank could access the Federal Home Loan Bank for liquidity if needed. He is certainly right during "normal" times, but this is clearly a topic bank Asset-Liability Committees must debate when the economy shifts downward and loan losses potentially mount. I view the bank's liquidity and funding costs as two principal risks at BHB.

(As an aside, there are certainly readers of this post who will point out that Hingham Institution for Savings (HIFS) has achieved extraordinary returns for its shareholders over the past decade despite being located in Massachusetts, and having a very high cost of funds and a loan portfolio heavily comprised of 1-4 family mortgages. In addition, HIFS has maintained one of the highest Loan-to-Deposit ratios of any bank in the country. There is no doubt HIFS has been the top New England bank in recent years based on its performance. The key to this performance has been the bank's superior Efficiency ratio, which is enabled by superior productivity as measured by Assets/FTE and Net Income/$ of Compensation. HIFS has a niche around real estate lending, notably centered on larger size multi-family and non-owner-occupied real estate. The bank's decision to expand into Washington DC suggests HIFS recognizes the limitations to profitable growth in the Boston area. The most recent Seeking Alpha article covering HIFS can be found here.)

BHB Strategy Begins with Talent Acquisition

The board's decision to hire Simard in 2013 was likely a first step in the board's decision to begin the process of transforming BHB from a highly efficient 14-branch bank focused on serving the needs of a moderately-affluent coastal community.

One reason I was attracted to BHB in the first place was my desire to invest in a rural community bank willing to devote capital and build processes necessary for the bank to compete in the decades ahead. It is to the board's credit that they were willing to change when so many community banks found it easier to sell. Since 2013, slightly more than 2,000 community banks have sold in mergers. The overall count of community banks has shrunk between 4% and 5% each year from 2013 to 2019. Much to my chagrin, my last favorite New England bank was sold in 2016: Merchants Bank of Vermont (symbol was MBVT).

The reasons for bank mergers are many, but four have been key drivers in New England as well as some other regions of the US:

- High funding costs/dearth of "core" deposits that exacerbate yield curve concerns

- High Loan-to-Deposit ratios that trigger liquidity worries

- Heavy dependence on a commodity loan product (1-4 family mortgage lending)

- A management team nearing retirement

In addition to those common challenges, Simard told me this month that BHB's board had grown concerned in 2013-15 about concentration risk. This risk speaks to a common concern among community banks that do all their lending in one market. The board recognized that the bank's success was tied entirely to a local economy dependent on tourist traffic generated largely by Acadia National Park. This risk became real in March when the nation's national parks closed access to visitors.

At the time of Simard's hiring, he was the second oldest CEO of a publicly traded bank in the country. He remains one of the youngest at age 48 in 2020. (The only CEO younger than Simard in 2013 eventually lost his job a few years later when his bank imploded, the result of rapid double-digit loan growth enabled by hare-brained expansion into non-traditional lending and investments.)

Simard is a born and bred Mainer. He has extensive Commercial/Corporate banking experience in New England community and large regional banks. These two attributes made him a great fit for a Maine bank determined to navigate the uncertain future of the banking industry.

He told me in our recent conversation that young bankers with Northern New England's three biggest banks (The Toronto-Dominion Bank (TD), KeyBank (KEY), and Citizens Financial Group, Inc. (CFG)) are often confronted with the need to move to big cities to further their careers. Simard himself was confronted with this dilemma when he was approached with the opportunity to join BHB. Ultimately, Simard agreed with BHB's board that there was untapped opportunity for community banks in rural markets.

BHB's assessment of the profitability opportunity in rural markets matches my data that shows select community banks operating in rural markets earn some of the best risk-adjusted returns in the industry. Having convinced himself of the opportunity at BHB and rural banking, Simard has been focused on attracting top talent to BHB since. In every call I have had with Simard, he enjoys touting the skills of the team of bankers BHB has assembled.

Strategy: Relationship Banking

The centerpiece of BHB's customer strategy is Relationship Banking.

Many banks talk about relationships but executing it as strategy is difficult. My extensive data and first-hand knowledge about community banks with the best long-term shareholder returns indicate that these banks win in the marketplace based on having the best skilled bankers with the deepest local market knowledge. These top banks tend to be niche banks whose bankers possess greater knowledge about C&I services (e.g., Treasury Management, Interest Rate Strategies), local real estate dynamics and superior expertise in services rendered to affluent households, like wealth management and trust services and custom-designed personal loan programs. Excellent community banks win with talent and culture. BHB's board and executive management seem to understand these truths.

Simard and the board know that long-term success depends on the bank's ability to pull more earnings levers than just Net Interest Margin. They seek to build a trusted brand, a "true community bank where every team member matters" (2016 annual report) that strives to "deepen our relationships every day" (2018 annual report). In practice, this means acquiring skilled bankers who are not "order takers" but bankers who operate in the "right culture" to build "long relationships with customers" (2019 annual report).

BHB selects and trains bankers who build long-term advisory relationships with clients and targeted prospects who include business owners, small and mid-sized businesses, and individuals and families who can benefit from customized wealth management services. The COVID-19 economy and PPP have given BHB and Simard the ability to prove the value of a relationship manager who knows each borrower's situation is unique and that "one size fits all" solutions do not fit all borrowers.

Strategy in Execution: 2016 Acquisition of Lake Sunapee Bank

BHB's first big strategic move was the acquisition of Lake Sunapee Bank Group in New Hampshire in May 2016 (former symbol, LSBG).

Lake Sunapee met several goals for BHB. Simard told me in early May that the merger was motivated by the benefit of geographic diversification into a rural market that shared many of the socio-economic characteristics of Bar Harbor. The bank's September 2016 "Joint Proxy Statement/Proposal" identified the compatibility of cultures between the two banks. (Having been involved personally in more than 25 bank mergers, there is no doubt that culture matters when two banks are merged.)

Initial investor reaction to the merger in May 2016 was not all positive. Within two weeks, BHB's stock price fell 10.5%, while the SPDR Regional Banking ETF (KRE) was down less than 1%. Likely, long-time BHB investors reacted skeptically to the board's decision to enter a market 340 miles from Bar Harbor. In fairness, this skepticism was warranted, and the decline in stock price should not have been unexpected for at least three reasons.

First, Lake Sunapee Bank was BHB's equal in asset size. Research that I have conducted on behalf of The Risk Management Association shows that acquiring banks' shareholders experience better 1, 2, and 3-three total returns when an acquisition is smaller than larger relative to the acquirer.

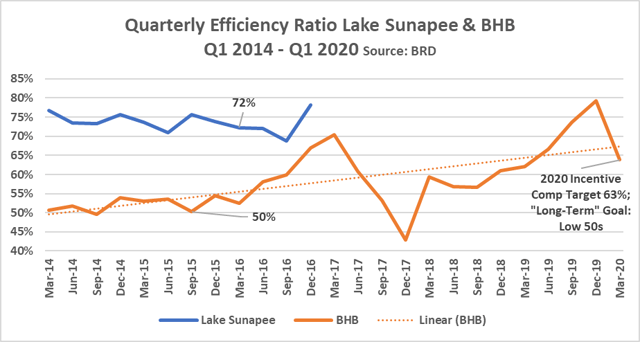

Second, though Lake Sunapee Bank's balance sheet looked like BHB's, its operating model failed to produce similar results. The next two charts highlight the relative performance of the two banks. Chart 10 shows that BHB entered the marriage as the more efficient of the two banks by a good margin.

Chart 9 also shows that BHB's history of an Efficiency ratio of 50% has trended up since the January 2017 closing. Note the two spikes, the first coming in the aftermath of the merger as one-time costs drove expenses. Efficiency declined in 2019 when BHB incurred a second round of one-time expenses associated with acquisition and restructuring ($8.3 million).

Chart 9

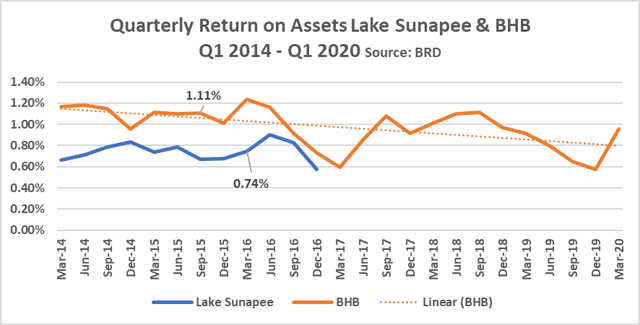

Chart 10 shows the ROA of Lake Sunapee Bank from 2003 through 2016 as well as BHB's through Q1 2020. (All data is bank subsidiary, not holding company.) Chart 10 also shows the declining run rate of BHB's ROA since the merger.

Chart 10

The third reason for skepticism about the merger undoubtedly centered on the banking industry's long history of overpaying for acquisitions that dilute the ownership interests of the acquiring bank's shareholder. This article is not the place to analyze the purchase price of a transaction that occurred more than three years ago, but the personal research I have done on this topic indicates that BHB did not acquire Lake Sunapee at a bargain basement price but, on the other hand, did not exorbitantly overpay either.

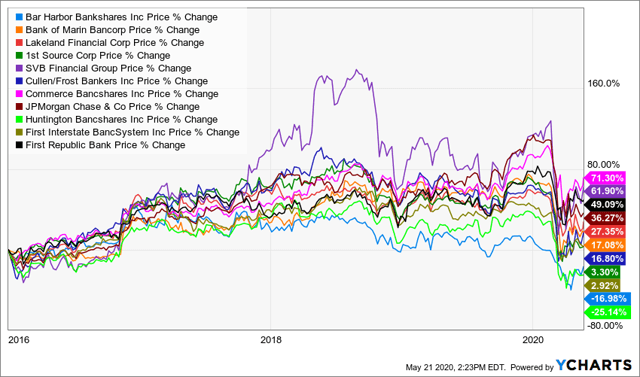

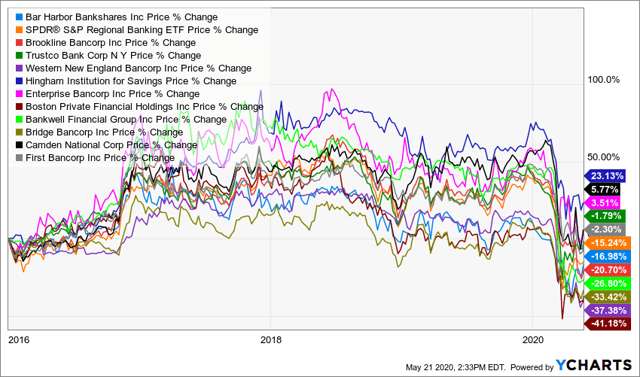

Chart 11 shows the change in stock price of the 11 banks in my long-term buy-and-hold bank portfolio since YE 2015 (four months before merger was announced) as of May 21, 2020. As the chart indicates, BHB's -17% price drop over this time is a drag on my portfolio's overall return.

Chart 11

Some investors will reasonably argue that a better stock price comparison for BHB is to peer New England banks. (I would disagree since most bank investors are not limited in their investment selection to just banks in a region.) The banks shown on chart 12 are banks identified as peers in BHB's 2018 proxy. It also includes the KRE ETF. On this comparison, BHB's -17% change in stock price looks to be in line with the SPDR S&P Regional ETF (-15%), but modestly behind the performance of Maine competitors, CAC and FNLC.

Chart 12

Earnings Potential 2020s

As a patient buy-and-hold bank investor, my goal is to identify and invest alongside top bank teams that understand the nuts-and-bolts of bank profitability and strategy. Such bankers produce consistent risk-adjusted returns on my shareholder equity that exceed the cost of the bank's capital. As a rule, I look for a ROE from the bank's I invest in to produce a consistent ROE of 8-12% over time. This number is not a high bar when times are good, but it is a challenge to produce over the ups and downs of the business cycle.

Great bankers cannot control their bank's stock price, but they can largely influence and control their bank's ROE over time. BHB has an 8%+ RARoE over the past 16 years. This success explains to a large measure why BHB is one of only 31 publicly traded banks that has increased its dividend every year since 2003.

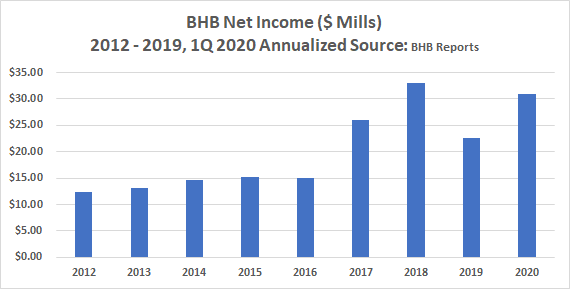

Chart 13 shows BHB's earnings since 2012. Note that 2020 earnings are calculated by extrapolating 1Q earnings that were announced at the end of April.

Chart 13

Four observations can be made from the prior chart.

First, prior to the merger with Lake Sunapee, BHB's earnings were beginning to flatten, perhaps a factor influencing the board to expanding outside of its Bar Harbor footprint.

Second, 2019 on the surface appears to have been a lost year as earnings declined $10 million from 2018. This drop is disconcerting, but justifiable in my view because the one-time expenses that lowered 2019 net income enable long-term improvement in the bank's operating expense run rate and cost of funds. (However, to be clear, bank investors do not like to see their banks get into the habit of booking big "one-time" expenses.)

Third, Q1 2020 earnings were "clean" in the respect that it shows what BHB can produce in today's low rate world where the yield curve and margin compression challenge all banks. It is worth noting that BHB was among a small number of banks that saw its net interest margin improve in Q1 thanks to the critical balance sheet actions taken in 2020.

Fourth, BHB's tangible book value is $17.70. When the bank's stock price sells for less than $18, as it has recently, investors can acquire BHB shares at tangible book value or better.

Three Future Earnings Pictures

Curtis Simard, like most New Englanders I know, loves the New England Patriots (an American football team based in Boston). To translate my forecast of BHB earnings assumptions into the language of New England Patriots' fans, I offer three models for the potential trajectory of BHB's earnings, stock price, and dividend over the next ten years.

It is important to note that all three models assume BHB maintains its tradition as an excellent lender. Net Loan Losses as a % of Loans should remain below .20%. If credit quality were to deteriorate and the bank forced to spike provision expense, shareholders can expect the market to punish BHB by pushing the bank's valuation (as measured by Price to TBV) to the low-end of its historic range.

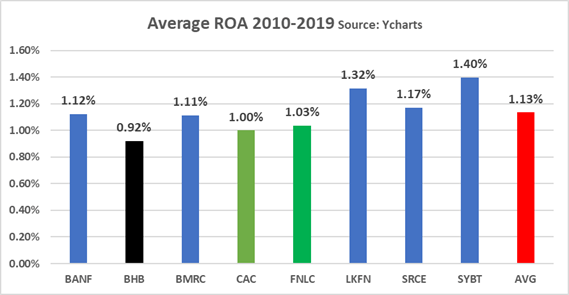

The most critical assumption used for the three models is determining the bank's future Return on Assets, "ROA."

Chart 14 shows the average ROA of BHB, its two Maine competitors, and five top community banks located in other parts of the country. Note that the Maine banks have a 10-year average ROA average about 10 basis points higher than BHB. There is no reason to believe BHB cannot improve its ROA to 1.0-1.20% over the next two years provided the economy does not tank from COVID-19. Longer term, an ROA of 1.10-1.25% should be expected as BHB proves itself the top New England community bank.

Chart 14

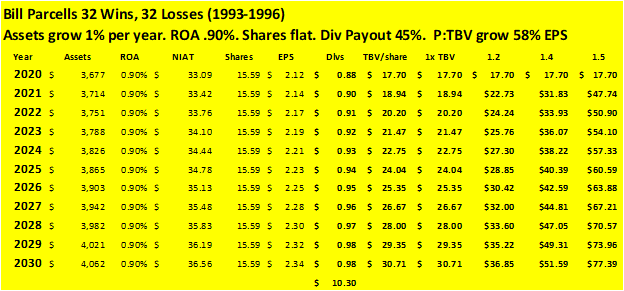

Bill Parcells coached the New England Patriots from 1993 to 1996. During that time, the team won 32 games and lost 32 games. Table 2 translates the Parcells era of Patriots football into BHB.

In the Bill Parcells Model, the assumption is that BHB stays on its current path. This model forecasts a slow Northern New England economy that grows only 1% a year, and therefore, BHB's assets grow just 1% annually. It assumes the ROA remains at the 0.90% average of the decade. It also assumes a dividend payout ratio of 45% of bank earnings. Tangible book value is forecast to grow annually by 55% of bank earnings.

The last four columns show four different forecasts of the bank's valuation (tangible book per share) based on four alternative Price to TBV ratios.

If BHB produces in the 2020s as Bill Parcells did for the Patriots in the 1990s, BHB shareholders can expect ok performance. Dividends should grow by a penny or so a year and total $10.30 by 2030. The stock price will depend on the bank's valuation multiple. If the bank achieves a ROA of 0.90%, the most likely case is that BHB's P:TBV will be 1.2x during the decade, producing a share price of around $37 in 2030. See Table 2.

Table 2

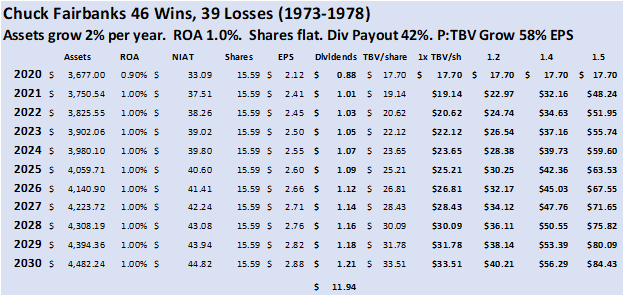

The second model assumes BHB over the next decade performs more like the Chuck Fairbanks era of Patriots football from 1973 to 1978. In this case, the bank grows assets 2% a year (consistent with US economy), improves ROA to 1.0%, and reduces its dividend payout to 42%, a level closer to history prior to 2019. The Chuck Fairbanks Model will produce $11.94 in cash dividends between now and 2030. The expected 2030 stock price would likely be between $40 and $56, which assumes a P:TBV of between 1.2-1.4x. See Table 3.

Table 3

While both the Chuck Fairbanks Model and the Bill Parcells Model put BHB on the path of meaningful shareholder value creation over the next decade, neither positions the bank to be New England's best community banks.

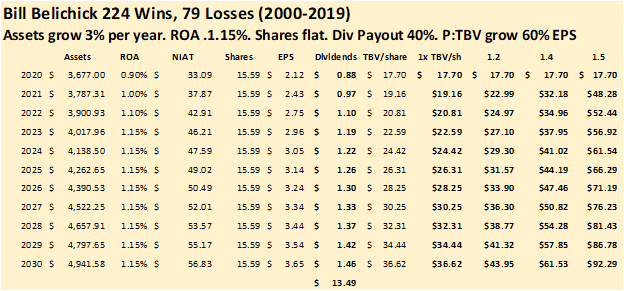

The Bill Belichick Model is based on the performance of the New England Patriots for the 20 years under the leadership of Belichick. During this time, the Patriots established themselves as the best team in professional football.

Here is interesting fact: At 48 years of age, Simard in 2020 is the same age as when Belichick got started with the Patriots.

The Bill Belichick Model assumes a 3% annual balance sheet growth rate (requires gaining market share from competitors), a robust 1.15% ROA, and a more conservative dividend payout ratio of 40%. In this model, dividends total $13.49 over the next ten years and the projected 2030 stock price of $61.53, which assumes a P:TBV of 1.4x (historic average). See Table 4.

It is also worth noting that the Belichick Model likely produces a meaningful share buyback opportunity that would have a salutary effect on share price beyond what is shown in Table 4.

Table 4

Five Critical Metrics

Page 35 of BHB's 2020 Proxy addresses the performance goals for the bank's executive management. This list includes a profitability metric ("Adjusted" Net Income), credit metric (NPL/Loans), Efficiency Ratio (0.63), and Strategic Initiatives.

As an investor in BHB, I would like to see the bank tweak the performance goals to align to performance factors associated with the highest performing community banks. These would include:

- ROE (target consistent 9.0% to 10% over next decade)

- ROA (stair step from 0.90% to 1.0% to 1.15%)

- Efficiency (show path to low 50s starting with 2020 goal of 0.60)

- Net Income to Compensation/Benefits (Goal is $1.00+ which indicates shareholders and employees share equally in the bank's earnings and is consistent with what top-performing banks achieve)

- Credit Quality (NPL/Loans, Provision % Loans, Net Losses/Loans).

Risks

There are myriad risks associated with investing in BHB as well as much of the banking industry in the 2020s.

- Loss of key talent

- COVID-19 severely damages Northern New England economy which does not recover for several years

- Liquidity pressure from high loan-to-deposit ratio

- Unfavorable yield curve trends create even greater net interest margin challenges

- Failure to effectively execute the Relationship Management Strategy

- Expense control, especially personnel, relative to revenue growth

- Negative interest rates

- Access to low cost core deposits needed to grow balance sheet profitably

- Breakdown in risk management discipline

- Rapid rise in inflation that raises the cost of liabilities faster than the growth in asset revenue; see pages 70-71 of 10-Q issued May 8

- When BHB adopts CECL, through Provision could increase materially (assumes Loan Loss Reserve increases to 0.75-1.00% of loans), which in turn, decreases equity, thus reducing tangible book value.

Offsetting these risks, BHB has in recent years taken several critical actions to position the bank to be the top performing and leading brand Northern New England bank over the next decade.

- Hiring of key management talent

- Addition of critical skills to the board

- Lake Sunapee acquisition that reduces concentration risk and expands opportunities for developing a regional brand

- The Peoples' branch/deposit/loan acquisition that enhanced core funding and improved net interest margin

- Issuance of an oversubscribed $40 million subordinated debt instrument that materially reduces funding costs and sets the bank up to buy back shares

- Strong trends in Fee Income, most notably in Q1 2020, a nice improvement in Trust/Wealth Management income which had been flat for three years

In addition, the bank has an opportunity to:

- Expand C&I, CRE relationships

- Expand Trust & Wealth Management business (see Stock Yards Bank & Trust Co. as best example of how a $3.8 billion community bank can earn $25 million+ from trust and wealth management services)

- Negotiate with large banks as it did with Peoples to develop a win-win for both banks

- Continue to hone the bank's client, branch, and banker profitability models to identify cost savings and revenue enhancement opportunities

- Ability to partner with key suppliers to expand product offerings and enhance revenue

Conclusion

BHB is my top New England bank pick for the next decade. I will add to my position in BHB at or near tangible book value.

Disclosure: I am/we are long BHB, SYBT, SRCE, LKFN, BMRC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.