Auto companies stare at bleak wholesale numbers in May

After zero sales in April, auto companies are going through a dull May.

by Lijee Philip

MUMBAI: After zero sales in April, auto companies are going through a dull May.

Early indications show this month could be a washout, with auto majors such as Maruti Suzuki, Hero Motocorp, Mahindra & Mahindra, and Tata Motors likely to manage just one-tenth of average monthly wholesale sale numbers, and experts warn of a prolonged crisis due to economic slowdown and poor consumer sentiment.

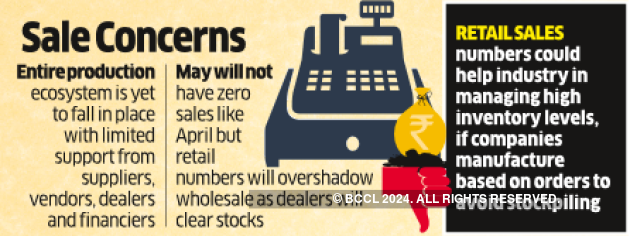

While most auto manufacturers have opened their plants after lockdown, the entire production ecosystem is yet to fall in place as support from their suppliers, vendors, dealers and financiers remains limited, industry insiders said.

“With banks tightening credit norms and customer evaluation getting tough, banks are not yet forthcoming to offer finance,” said Shashank Srivastava, executive director for marketing and sales at Maruti Suzuki.

He, however, said retail numbers will be much better than those of wholesale this month “as dealers are clearing stocks”.

Veejay Nakra, chief executive of Mahindra’s automotive business, said it would be incorrect to say either demand is back or billings are lower this month because the pace of ramping up “was different all across”.

“While May will not have zero sales like April, clearly retail will overshadow wholesale numbers,” he said.

Tarun Garg, director, sales & marketing, at Hyundai Motor India, said there are some positive signs, but the industry is far from normalcy. "Since the last few days we have been getting 850-900 bookings a day, which was at 1,500 during pre-Covid days,” he said, adding that the company has so far retailed 5,600 units this month.

A leading dealer of Tata Motors’ passenger vehicles in the north, however, said there is hardly any retail sales, as RTOs are not registering vehicles and finance companies are not giving finance. The dealer said it's yet to get delivery of the vehicles ordered for in March from the company.

Hero Motocorp is expected to sell less than 100,000 units this month against its normal monthly average of 550,000, dealer sources told ET.

A Hero Motocorp spokesperson said dealerships that have opened so far after the lockdown contribute nearly 70% of its retail sales by volume.

The auto industry employs more than 40 million people directly and indirectly, and contributes over 7% to the country’s GDP and 15% to the government’s tax collection.

It would be an achievement if the industry is back to running in three months, including putting the supply chain in order and dealer dispatches, experts said.

They also expect a shift in the way the industry functions with companies likely to limit production based on orders, at least for the next several months, to avoid stockpiling.

“Finance companies have liquidity but with extension in moratorium, no collections are happening and as finance companies depend on collections, it's choking their cashflows,” said a senior official of a finance company.

Companies like Maruti Suzuki and Hyundai are now offering specially curated flexi-EMI financing schemes to push sales. The top two carmakers said they have a month’s inventory, which is normal.

Nikunj Sanghi, an automotive dealer, said, “Customers have developed a fear psychosis on the word lockdown, thereby avoiding going to dealerships.”