OFS Capital: Vote No

by Darren McCammonSummary

- OFS Capital Corp. is a Business Development Company that provides capital solutions to U.S.-based middle-market companies.

- BDCs rely on leverage to “juice up” returns. With recent market volatility, back-end funding dried up and some leveraged firms like BDCs and mREITs received margin calls.

- While OFS didn't have margin difficulties, it was close, and the company did find it necessary to write down its portfolio significantly.

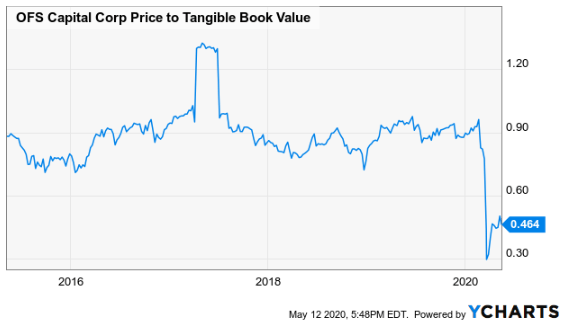

- OFS now trades at less than 50% of Net Asset Value.

- A "no" vote on the proposal allowing management to sell shares below NAV is encouraged.

Background

The ramifications of closing large segments of the world economy in response to COVID-19 won’t be completely understood for some time to come. But there are plenty of difficulties that are readily apparent, and sometimes it pays to look at where the problems are when seeking out opportunity.

When businesses were forced to alter their operations in response to COVID-19, revenues and income were reduced or, in some cases, even eliminated. The forward-looking value of many companies were then called into question and demanded reassessment by the market. As a result, instruments across the financial structure (common stock, preferred stock, bonds, secured loans, etc.) saw significant reductions in valuations. Along with the turmoil, back-end funding dried up and some leveraged firms, like BDCs and mREITs, received margin calls from the institutions providing them with capital.

There are some complexities associated with BDCs that make it difficult to quickly reassess valuations. Investors in BDCs should be aware that the assets owned by BDCs are illiquid. They don’t hold stocks or bonds that are readily traded on the major exchanges and that can be quickly converted to cash. BDCs are invested for the long term and have relationships with the companies that they are invested in. So, if a margin call comes in, it presents a challenge that has to be met by measures other than selling a liquid asset at a quoted price. This caused me to put a pause on evaluating many of these firms or putting them on the Best Opportunities list until Q1 book values could be reported.

The determination and reporting of “fair value” for BDCs can be complex. Since no quote is usually available on underlying holdings, value is therefore determined in good faith by management and the board of directors of the company. This can to some extent be subjective and imprecise due to the illiquid nature of the assets. Nevertheless, it is management's responsibility to report and account for the portfolio fairly. Thus, one’s opinion of BDC management and their alignment with investors is even more important than with normal C-corps.

So, the challenge (and opportunity) is to determine if the proverbial baby has been thrown out with the bathwater. Whether OFS Capital (OFS) selling at more than a 50% discount to NAV is likely to be an accurate representation and/or an opportunity created by market fear and overreaction.

The Company

OFS Capital is a small-cap ($65 million market cap) that has about $477 million in assets under management (AUM). It’s externally managed by OFS Management, which specializes in debt financing and has $30 billion AUM. Though OFS itself is small, the firm managing it is large and very experienced. Additionally, while external management can result in misalignment issues, in this case management is well-aligned because it owns 22% of the common shares outstanding. Any judgement call management makes in its own best interest is likely to also be in individual shareholders' interests because it has such a large holding in the firm. OFS focuses on small to mid-size companies and mostly avoids cyclical plays such as energy. The current OFS investment portfolio includes investments in 77 different companies in the following business sectors:

- Transportation/Logistics

- Value-added Distribution

- Business Services

- Industrial and Niche Manufacturing

- Specialty Chemicals

- Health Care Services

- Consumer Products and Services

- Aerospace and Defense

- Food and Beveridge

The company specializes in custom financing, developing arrangements that include mostly debt vehicles, but that also sometimes have equity kickers.

The Portfolio

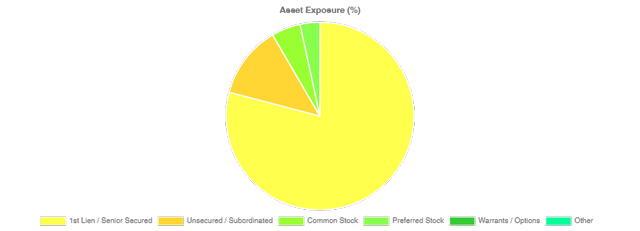

The current portfolio has been purposefully migrated toward a higher percent of senior secured loans, and as of March 31, 2020, 91% of the loan portfolio was senior secured. Two years ago, only 76% of the loan portfolio was senior secured. 88% of portfolio loans are floating-rate, and 87% of those loans have LIBOR floors averaging 1.15%. The remaining loans are fixed-rate.

(Source: CEFdata.com)

OFS is quite diversified, as it holds investments in 77 different mid-size companies, with an average investment of about $6 million.

Recent Performance

On May 8, 2020, OFS announced financial results for the quarter ended March 31. NAV per share decreased 22%, from $12.46 at December 31, 2019 to $9.71 at March 31, 2020. The majority of the change was due to unrealized losses to fair value. In other words, the company significantly marked down the value of its existing portfolio due to uncertainties and problems its client borrowers were having because of COVID-19.

OFS produced net investment income (NII) of $3.97 million, or $0.30 per share, in Q1. This was down 4% from the previous quarter, largely due to lower interest income and declining LIBOR rates, an additional non-accrual account, missed income from conservation of capital, and income missed from the sale of $31.5 million of loans sold at cost at the onset of the COVID-19 event. In hindsight, management referred to the sale as “a prudent decision” during the investor conference call. It was indeed prudent, as it likely prevented forced “margin call” sales at less than cost from occurring later in the quarter.

OFS Capital recently announced that the dividend payout for Q2 would be reduced by 50% to $0.17. The company did this in order to conserve cash for the presumably rocky road ahead and because the lower book value will naturally be less able to produce income. While OFS reported $0.30 per share in NII for Q1, one should expect Q2 income to decline, if for no other reason than the base of assets earning income is reduced. The quarterly dividend being paid out had been $0.34. So, the 50% cut in dividend relative to a 22% decline in book value seems conservative and prudent. Q1 NII was insufficient to cover the planned payout, and Q2 NII is likely to be lower. With shares trading at $4.61 and a dividend of $0.17, the stock is currently yielding around 14.8%, covered 1.7X, for an NII yield exceeding 25%.

As of March 31, 1.6% of the portfolio was in non-accrual (5.5% of the portfolio at cost). One loan was added to the non-accrual ranks during the quarter.

Funding and Interest Rates

As of May 8, OFS had approximately $2 million of cash and additional $45 million capacity on its revolving corporate credit line and senior loan facility. The senior loan facility doesn’t come due until 2024, is non-recourse, and has no LIBOR floor. Also, there are no mark-to-market provisions concerning the credit line.

The majority (93%) of OFS debt matures in 2024 or beyond, with 44% of outstanding debt unsecured. The company has approximately $153 million in unsecured bonds that mature in 2025 and beyond. In addition, it has $134 million of SBA debentures.

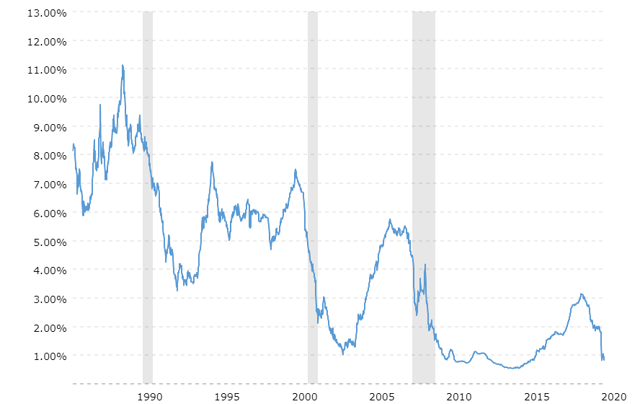

The prevailing direction of LIBOR rates has an impact on the bottom line, as falling rates reduce margins. An historical chart of interest rates begs many questions, including when will rates begin to rise and to what degree? The world’s central banks seem determined to keep rates low for the foreseeable future.

(Source: Macrotrends)

However, in our opinion, the $2.2 trillion worth of stimulus released so far plus the $3 trillion of Fed asset buying should increase inflationary pressure over the intermediate and long term.

The Balance Sheet

Total investments at fair value shrank from $517 million to $466 million, with an overall 22% decline in book value. This is a result of the 7.1% write-down in value of the average asset times the leverage employed. On the surface, that leverage makes it appear that the firm is bumping up against the 2:1 BDC Debt / Equity limit; however, SBA loans don’t count against that limit. So, the actual ratio is reasonably within bounds at 1.7x. At quarter end, there was only $2.2 million in cash, but management let us know that cash had increased to $47.2 million by the time of the conference call, in part due to them putting a freeze on any new investments. It appears that there has been no forced fire-sale of assets due to margin calls during Q1, nor is there likely to be in Q2. OFS can be characterized as having de-risked the financial aspect of the portfolio and hunkered down somewhat by selling some assets, freezing new loans, and cutting the dividend in order to ride out future turmoil caused by COVID-19.

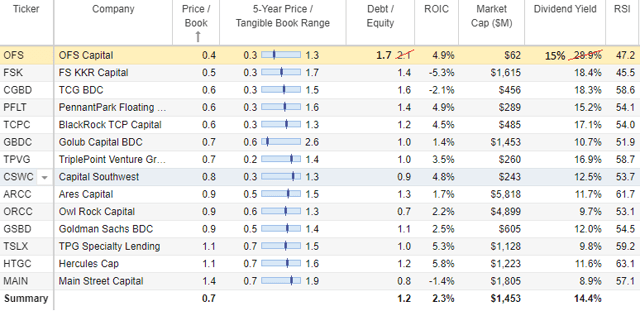

(Source: Stock Rover)

The Risk and Reward

A comparison of OFS to a few of its larger, more well-known peers demonstrates the current volatility and risk. The market clearly perceives that OFS as a riskier bet than Ares Capital (ARCC), TPG Specialty Lending (TSLX), or Gladstone Investment (GAIN), assigning it a much larger discount to NAV. At the same time, its recent markdown of NAV did significantly exceed that of its peers.

| Ticker | Share Price | NAV | Discount / Premium | NAV YTD Change | Current Yield | NII Yield |

| OFS | $4.61 | $9.71 | -49% | -22% | 14% | 29.50% |

| ARCC | $13.81 | $15.58 | -11% | -10% | 11.5% | 14.27% |

| TSLX | $16.87 | $15.57 | 8% | -7% | 11.0% | 7.80% |

| GAIN | $11.02 | $12.51 | -12% | 0% | 7.4% | 8.35% |

(Source: BDCInvestor.com)

Again, to some extent these markdowns of portfolio value can be a management call. I have no reason to cast doubt on the appropriateness of these markdowns for any of these four firms, so I take them at face value. Doing so, I can only judge OFS as a higher-risk and higher-reward opportunity.

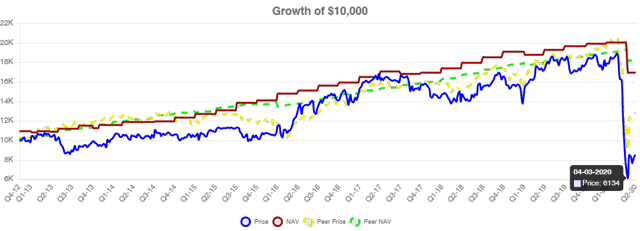

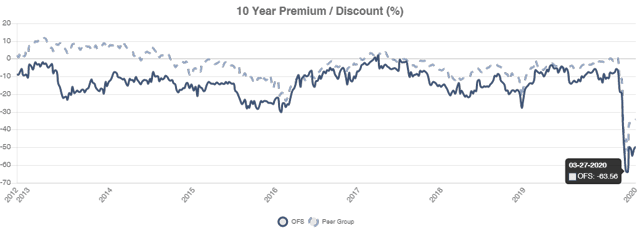

The graph below shows the performance of OFS relative to the universe of its peers. Both in terms of price and NAV, OFS has suffered a substantial decline. But prior to the effects of COVID-19, the management team was also growing NAV at a pace exceeding that of its peer group.

(Source: CEFData.com)

Again, comparing the sold blue OFS price line to the solid red OFS NAV line helps one to visualize how much more drastically OFS price fell than its NAV. This stark contrast may represent a significant opportunity depending on how deep and long the reader expects the COVID-19-induced recession to be.

OFS, however, does routinely trade at a greater discount to NAV than peers; and in fact, only once in recent history did it trade at NAV. So, the potential opportunity may be more about OFS returning to its more typical 10% discount to NAV rather than it returning to NAV.

(Source: CEFData.com)

The Call

- OFS sells at a steep discount to NAV, meaning an investor can buy the assets for $0.50 on the dollar. If we see a V-shaped recovery from COVID-19, businesses get back to work, and things pick up from here, loan performance should improve, and an investment in OFS should do better than the average BDC. If, on the other hand, the economy is headed for even harder times over the coming quarters, non-accruals and client bankruptcies could potentially pick up, further negatively impacting NII and book value.

This is not just an OFS issue; it is an issue that potentially affects all BDCs. However, OFS does tend to lend to smaller firms, so its portfolio is probably more volatile than the average BDC. On the other hand, the companies represented by the portfolio will also tend to be eligible for and more likely to benefit from PPP loans. In fact, over 25 of OFS portfolio companies have secured approximately $78 million in PPP loans from the SBA already. This is a significant benefit to the long-term survivability of those companies, their ability to pay back their loans, and indirectly, a significant benefit to OFS investors. Unique to this particular downturn, small-cap firms may actually have greater access to government-subsidized loans than large ones. Admittedly, this is uncharted territory, so we have little idea how much of a difference PPP loans might make, but it’s pretty clear that the net affect should be a meaningful buffer against insolvency.

- BDCs benefit from rising interest rates (LIBOR), but at this point we see little chance of that occurring in the near future. Until the world’s economy shows real signs of recovery and stability, interest rates seem more likely to remain near the zero bound. This is not an OFS issue, it is an issue that potentially affects all BDCs. In the intermediate to long term, we see the $5-6 trillion worth of support released so far by Congress and the Fed as inflationary.

- OFS is seeking shareholder approval to sell or issue stock, not to exceed 25% of already existing shares, at prices below current NAV in its latest proxy. Since management owns 22% of outstanding shares, this presumably would only be utilized in limited amounts under dire circumstances and is probably being prompted by recent COVID-19 concerns. The funds raised from this offering could provide an influx of capital, should it become necessary at some time in the future to prevent a tripping of some covenant or to reduce the Debt / Equity ratio below regulatory limits. However, we still recommend voting against such a measure. Issuing shares at prices this far below NAV would dilute existing shareholders significantly and destroy value. It is a slippery slope that we would rather not have to worry about. Furthermore, we believe if shares were ever sold below NAV, it would permanently reduce “trust” and the multiple of the firm. OFS management merely asking for this approval has created what Moody’s would call a “negative watch” regarding my judgement of management alignment and firm risk.

- OFS had been paying a $0.34 dividend since 2013, with NII routinely sufficient to cover. The dividend was recently cut in half. If the economy spins up from here and OFS finds investment opportunities, it might not have been necessary. However, management appears to have gone a more conservative route, suspending new investments and building cash in case a worsening economy leads to increased credit risk and bankruptcies. Though it may not have been what I would have done, I’m not going to fault the company for this cautionary stance.

If the common returns to trade at a more normal discount to NAV (90% Price-to-Tangible Book), that would imply a potential price of $8.74, or 90% upside. In the meantime, the new reduced dividend yields 15% and should be well-covered.

Though not one of our top BDC picks, we think OFS a decent speculative buy. There are real risks inherent to BDCs in the current environment and to OFS in particular. While we think most liquidity concerns are behind us, credit concerns are not, and OFS is not the safest of BDCs. The world economy is attempting a recovery, and we are optimistic about Americans returning to work and play, but there is no guarantee what the recovery will look like. An interested investor could begin buying OFS in conservative tranches, with a goal of filling a small position over an extended period of time. If one is more convinced that we’ve seen the bottom to COVID-19 and that the recession will be V-shaped, then a more aggressive stance may prove rewarding over time. On the risk/reward continuum, we regard OFS as a high-risk/high-reward situation.

Investment Alternative: OFS Baby Bonds

A reasonable and more conservative alternative for those seeking income with less risk would be the OFS baby bonds: OFSSI, OFSSL, and OFSSZ. OFSSL, for example, is an exchange-traded note (aka baby bond) with a 6.375% coupon rate, due 4/30/2025. At its current price, OFFSL offers an 8.4% simple yield with a 24% potential capital gain to par (13% yield to maturity ("YTM")).

Were management to have never requested the ability to issue shares below NAV, we would have been more inclined to buy the common; likewise, if the proposal was to be defeated, we would be more inclined to own the common. Unfortunately, given management’s 22% ownership and resulting voting power, we think it’s likely that they win the vote on this issue. By our way of thinking, issuance of additional shares below NAV would dilute the common, but the cash raised would improve the security of the baby bond. Thus, passage of this initiative is a negative for common shareholders but a positive for those who own the baby bonds.

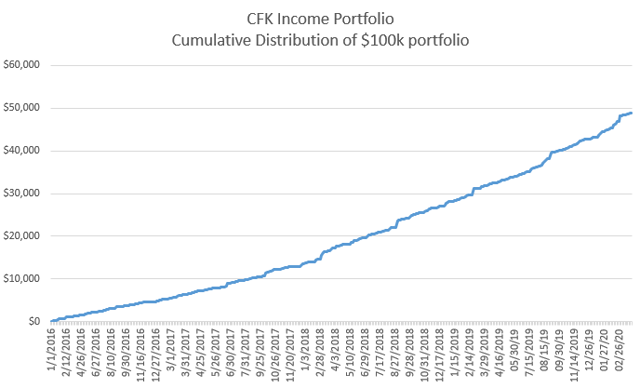

Is This an Income Stream Which Induces Fear?

Data verified by Etrade.

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. Portfolio's prices fluctuate, the income stream not so much.

By focusing on underlying corporate cash flows, and management capital allocation and alignment, then overlaying sound money management strategy, we help reduce portfolio income volatility. Capture an income stream that helps you stay logical when times are tough. Start your free two-week trial today!

Disclosure: I am/we are long OFS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: OFS is a speculative, microcap stock. I do not know your goals, risk tolerance, or particular situation; therefore, I cannot recommend any specific investment to you. Please do your own additional due diligence.