AUD/JPY: Bears getting set for potential major sell-off

by Ross J Burland- All eyes are on the downside prospects for AUD/JPY as a perfect storm builds.

- Hong Kong is in focus as China seeks to pass a law that could be the last straw to break the camel's back.

AUD/JPY has extended the upside for a more mature shorting opportunity. This trade is now offering a discount for bears seeking to take advantage of the compelling technical bearish case and macro story emanating from a war of words between the US and China.

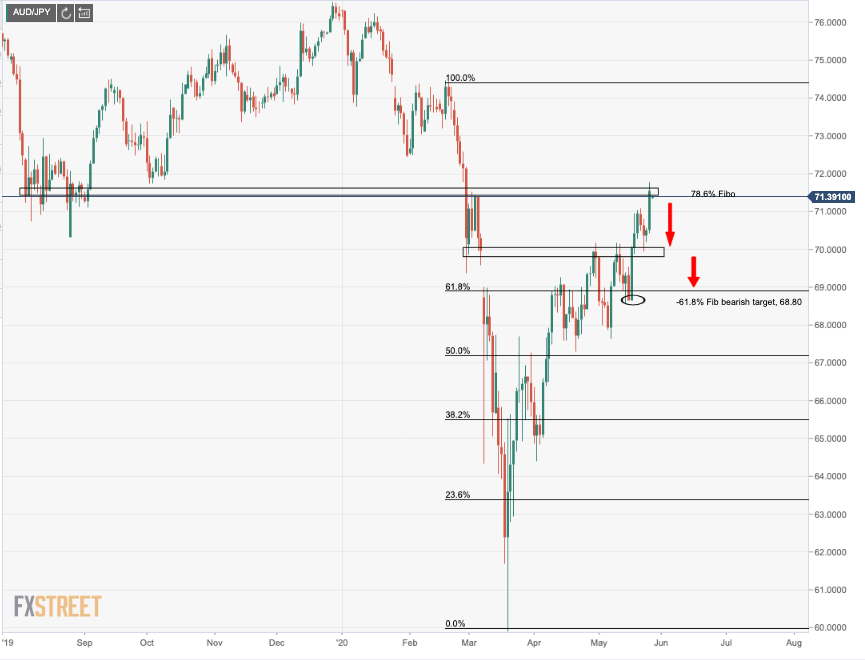

At the time of writing, AUD/JPY is trading at 71.27, down 0.3% in the Asian day so far having been capped at a high of 71.78 where it meets the Oct 2019 lows. This is in the vicinity of the 78.6% Fibonacci.

As discussed in the following Chart of the Week analysis from the open of this week, US and Chinese tensions are at the forefront of markets. More on that here: China's plan of national security law in Hong Kong puts Trump in an unwelcome spot with Xi and here: The Hong Kong Dollar, the next black swan?

The war of words has been building up over the course of the past number of weeks ever since US President Donald Trump termed the coronavirus as the Chinese Flu. This was a milestone on the trade war debacle which started in 2018. As explained in the above articles, trade wars are back to the fore.

HK 'nuclear button' trade in the making

The financial market's 'nuclear button' could be pressed as soon as this Thursday if China indeed passes their national security law, despite massive opposition from HK pro-democracy protestors and a number of powerful nations.

We would expect to see a risk-off response on the knee-jerk and uncertainty is bound to make for volatility as an alliance of the US, UK and Australia respond in kind. This law will change the entire complexion of HK's economy.

Hong Kong will all of a sudden be treated by, say, the US, as if it were China and could lose all of the unabated free trade agreements that is currently enjoyed through its autonomy. If the law goes through it will be a clear violation of the policy act with the US and a violation with the agreement with Britain. The wealthy will exodos Hong Kong and convert to US dollars which will be the demise of Hong Kong and its currency (already at the top of the band of the peg to the USD).

US firms which would want to shift their operations from China and Hong Kong subsequent to the law being passed could be the first indication that Hong Kong's status as a financial hub will come into serious jeopardy. This will likely set the scene for instability in financial markets.

Meanwhile, for the time being, risk sentiment has been favourable to the commodity complex which has enabled the cross to extend its 2020 COVID-19 correction. Overnight, news of a new vaccine in development as well as a Brexit breakthrough helped to elevated risk appetite.

The S&P 500 rallied through tot he 200-day moving average and penetrated the 3,000 mark for the first time since March. While Wall Street's benchmarks ended higher on the session, the mood soured into the close on trade war themes.

Such themes could well set the stage for the rest of the week and foreseeable future, especially if China goes through with the said legislation. This will make for the perfect storm for a major correction in AUD/JPY to the downside.

AUD/JPY downside targets

On a -61.8% Fibonacci measurement from the current highs, the bears could well target a test of 68.80 (a significant confluence area of a number of prior supports, resistances, gaps and Fibo retracement levels). First, daily support of 71.07, 70.18 and will need to give out.