How South Korea made itself a global innovation leader

Systemic reform backed by strong investment has brought rapid and long-lasting results.

by Leigh Dayton

South Korea’s position as one of the world’s most innovative nations is a remarkable achievement considering that, for the first half of the twentieth century, it was an agrarian-based Japanese colony, then a battle ground.

It is second only to Germany in Bloomberg’s 2020 Innovation Index, having reigned at the top of the 60-country list for the previous 5 years. In the separate 2019 Global Innovation Index, published by Cornell University, INSEAD and the World Intellectual Property Organization, South Korea is at number 11 and Germany is in 9th place among the 129 countries ranked.

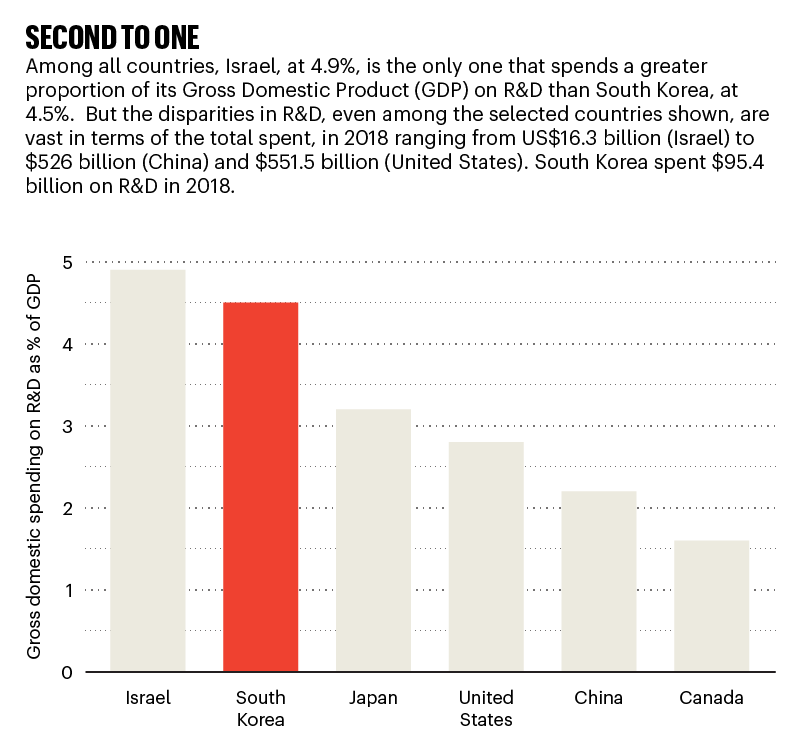

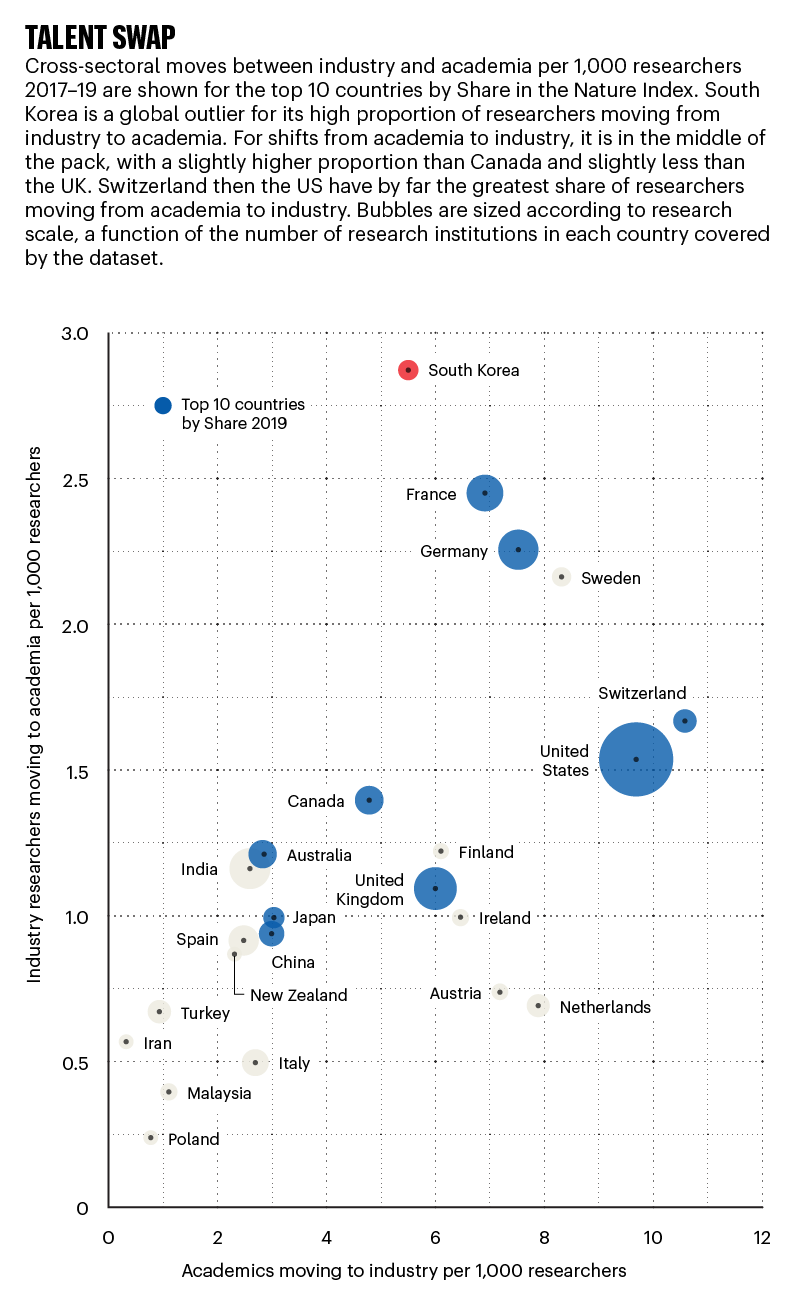

Both indices highlight South Korea’s outstanding performance in research and development (R&D) intensity, an indicator based on R&D investment by government and industry and the number of researchers working in and between both sectors. For example, South Korea had the greatest share of researchers who moved from industry to academia in 2017 to 2019 among 71 countries, data from academic recruitment firm, League of Scholars, show.

Top-down success

The high R&D intensity that helped South Korea become a global leader in information and communication technologies has emerged from a historically ‘top-down’ innovation system that promotes “close collaboration between government, industry, and the academic community in the process of nation building”, says Tim Mazzarol from the University of Western Australia in Perth, who specializes in innovation and entrepreneurship.

President Park Chung-hee drove South Korea’s economic development between 1961, when he took power in a military coup, until 1979, when he was assassinated. Park shifted the economy from its post-war dependence on technology imports and the construction of industrial facilities by foreign companies to focus on home-grown labour-intensive industries, such as clothing and textiles. Crucially, strong support for R&D was central to his first Five-Year Economic Development Plan in 1962 and manifest in his establishment of the Korea Institute of Science and Technology (KIST) in 1966, and the Ministry of Science and Technology the following year.

These instruments supported the emergence of large industrial groups called chaebols, which were owned and controlled by South Korean individuals or families. The government pushed the chaebols to invest heavily in R&D while shielding them from competition. With increased R&D intensity that focused on applied knowledge, chaebols such as LG, Lotte and Samsung were driven towards new heavy industries, including petrochemicals, car manufacturing and shipbuilding, as well as consumer electronics.

Samsung — the classic chaebol

Samsung is a case in point. The company that started life as a grocery trader in 1938 is now South Korea’s largest chaebol, operating in industries as diverse as electronics, insurance, construction and shipbuilding. In 2018, it produced roughly 15% of the nation’s gross domestic product.

Its founder, Lee Byung Chul, with help from government protectionist policies, expanded into textiles after the Korean War, electronics in the 1960s, then heavy industries, aerospace and computing during the 1970s and early 1980s. By the 1990s and 2000s, Samsung was a world leader in tablets and mobiles, and in the design and manufacture of computer chips. The company is South Korea’s leading corporate institution in the Nature Index by far, based on contributions to research articles published in the 82 high-quality natural science journals tracked by the Index. With a Share of 10.36 in 2019, it ranked 28th among the country’s institutions overall, eclipsing its nearest rival in the corporate ranks, LG, which had a Share of 1.99. Samsung also features in each of South Korea’s nine leading corporate-academic collaborative pairs in the Nature Index.

The most productive pairing is with Sungkyunkwan University (SKKU) in Seoul, with 159 joint articles between 2015 and 2019. Their collaboration is particularly strong in electrochemistry and the development of new energy sources such as lithium-ion batteries (J. K. Shon et al. Nature Commun. 7, 11049; 2016). Other partnerships include Seoul National University in Seoul, (41 articles) and the Korea Advanced Institute of Science and Technology (KAIST) in Daejeon (35 articles).

Samsung’s top ten

Samsung Group’s top ten collaborating academic partners on articles in the Nature Index journals are split between United States and domestic institutions. Here they are ranked by bilateral collaboration score (CS), 2015–19. CS is derived by summing each institution’s Share on the papers to which authors from both have contributed.

| Rank | Institution | Country | Bilateral CS | Count* |

| 1 | Sungkyunkwan University | South Korea | 75.07 | 159 |

| 2 | Seoul National University | South Korea | 21.10 | 41 |

| 3 | Korea Advanced Institute of Science and Technology | South Korea | 20.16 | 35 |

| 4 | Stanford University | United States | 19.29 | 31 |

| 5 | University of California, Berkeley | United States | 17.16 | 51 |

| 6 | Korea University | South Korea | 13.62 | 27 |

| 7 | Yonsei University | South Korea | 11.07 | 22 |

| 8 | Harvard University | United States | 9.67 | 26 |

| 9 | Pohang University of Science and Technology | South Korea | 8.82 | 16 |

| 10 | California Institute of Technology | United States | 8.35 | 12 |

*Count = Article count

Investing in the future

Park’s successors continued to promote research and innovation as the driver of national economic and social advance. Government and industry investment in R&D soared, and basic-research capabilities were expanded. By the mid-1980s and early 1990s the government’s attention had shifted to high-tech industries such as semiconductor design and manufacture. For instance, in 1981 it founded KAIST, which remains a leading national research university (see ‘Manipulating brains with smartphones’).

Manipulating brains with smartphones

A team of researchers at KAIST — not to be confused with the KIST, with which it was initially integrated — has fulfilled a dream of neuroscientists worldwide.

Working with colleagues at the University of Washington in Seattle, they have built a novel device capable of remotely controlling the brain circuitry of mice, via a smartphone. It is the first wireless neural device that can continuously deliver multiple drugs and coloured light beams to control brain circuits. Until now, researchers needed rigid metal tubes and optical fibres to accomplish the task.

The device could speed up the study of diseases such as Parkinson’s, Alzheimer’s, addiction, depression and pain, says team leader and electrical engineer, Jeong Jae-Woong. Weighing 2 grams, it uses LEGO-like replaceable drug cartridges, a probe the thickness of a human hair, and powerful, low-energy Bluetooth to deliver the drugs and light, which turn neurones on or off without hurting the rodents. This ‘plug-and-play’ interface was the major challenge, Jeong says.

After two years of laboratory and animal trials, the proof-of-concept paper was published in Nature Biomedical Engineering (R. Qazi et al. Nature Biomed. Eng. 3, 655–669; 2019) by the team of neuroscientists and engineers from electrical, mechanical and software backgrounds. Jeong plans to commercialize the device and technology.

Targeted nation-building programmes were also established. In 1995, for example, the government began a US$1.5-billion, ten-year plan to build up the national broadband infrastructure and provide public programmes about maximizing its use.

The 1997 Asian Financial Crisis prompted many chaebols to shift from the reliance on low-value added exports characteristic of a ‘tiger’ economy towards technology and knowledge-intensive products and services such as semiconductors, mobile phones and mobile applications.

Working with chaebols, the government began developing regional innovation centres such as Gyeonggi, an area of nearly 13 million people surrounding Seoul, which is now regarded as the nation’s economic and innovative powerhouse.

The centre brought industry R&D and production infrastructure together with local and national universities and research facilities. For instance, the Gyeonggi-based Samsung Electronics, Samsung’s flagship subsidiary, is collaborating with SKKU Chemistry to develop a semiconductor material that can reduce the amount of radiation exposure while taking medical X-ray images. By 2010, South Korea had 105 regional innovation centres and 18 techno-parks, as well as 7 federal programmes to strengthen the competitiveness of industrial cluster programmes.

Although government funding continued to promote R&D spending and programmes to boost translational development and scientific, engineering and managerial expertise, the weight of major investment in R&D shifted to the corporate sector in search of patents and profits. Private R&D spending accounted for nearly 80% of South Korea’s total R&D spending in 2019, ahead of leading innovative nations such as Germany, Sweden and Switzerland, at 70%. The shift was supported by R&D tax incentives and importation of foreign technology.

The new breed

In the 2010s, small to medium-sized businesses in biotechnology, artificial intelligence and cybersecurity, and broadband-based firms began to emerge. Founded by a new generation of entrepreneurs, they were backed by government funding and supported by the national technological infrastructure.

Woowa Brothers is one example, among many, of the strategy’s success. The Seoul-based 2010 start-up exploited the national broadband to build a mobile food-delivery application connecting restaurants, customers and riders.

In December 2018, Woowa joined the ‘unicorn’ club — a rare status denoting a privately held start-up valued at more than US$1 billion — with investment from national and international venture-capital sources. In December 2019, Germany’s Delivery Hero bought the company in a $4-billion deal that will see co-founder and chief executive, Kim Bong Jin, manage the Asian business, including South Korea, Vietnam and Hong Kong. A delivery robot, self-driving technology and an online customer and revenue-management system for restaurants are in development.

The South Korean government’s systematic approach has been the crucial factor in creating an innovative economy adept at turning ideas from laboratories into products and industries. Martin Hemmert, an expert in east Asian innovation systems, at Korea University, adds that the cultural mindset evident in South Korea helps. “Complacency is not on the cards. The glass is always half empty,” he says.

Even so, as Mazzarol concludes: “It’s a miracle when you consider where Korea was.”

Nature 581, S54-S56 (2020)

doi: 10.1038/d41586-020-01466-7

This article is part of Nature Index 2020 South Korea, an editorially independent supplement. Advertisers have no influence over the content.