How VibePay is quietly changing the UK fintech Twitter game

by Ruby HinchliffeA big challenge facing many UK fintechs has been how to keep their millennial (aged 24-38) and Gen Z (aged 18-24) users engaged with their banking apps.

Last November, leaked numbers showed that only 16% of payment card aggregator Curve’s half a million customers were active, in that they used their account at least once a month.

And in February, following its mammoth half a billion-dollar funding round, Revolut stressed the need for “a particular focus on product development that will help accelerate daily usage of accounts”.

Some fintech players have given up on the UK fintech scene altogether. N26 shut up shop in April, following a big (and presumably expensive) marketing push in 2018 which saw its branding projected onto central London areas such as Carnaby Street and Liverpool Street Underground Station.

VibePay, which launched last October, is taking a different tack to driving user activity, one which doesn’t involve marketing campaigns.

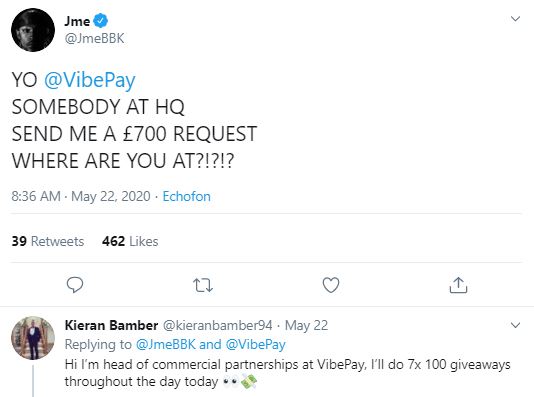

Using Twitter to talk to its users rather than sell to them, the start-up has launched various reward schemes – most famously its #VibePayFriday, which prompted British grime MC JME to donate £1,200 to the Vibe community last week.

“We’re trying to build Europe’s largest and engaged transaction community,” VibePay’s founder and CEO Luke Massie tells FinTech Futures.

#VibePayFriday, which sees random VibePay users get paid between £50-£250 each week, generates thousands of tweets every Friday and often hits the UK’s top trending hashtags.

Read more: VibePay opens up APIs to SMEs, lands £1.25m funding

It costs the fintech between £500 and £1,000 a week. Massie says it drives 2,000-5,000 users to the app, making cost of acquisition per user as cheap as 25p. He says the hashtag currently does 25 million impressions a month, but he wants to push that number to 100 million.

“It means our marketing budget is hardly anything,” he adds. The fintech is still in the process of migrating 80,000 users from its sister company Vibe Tickets, and since April – when the fintech announced VibePay’s organic 15,000 users – Massie says organic users have more than doubled.

Cash App, a US-based mobile payment service developed by Square, has built its now one million Twitter followers on a similar model. With one-day giveaways as large as $50,000, Cash App shows the potential a start-up like VibePay has.

VibePay currently defines an active user as someone who has downloaded the app and linked their bank account. Massie says this means the users it counts are actively transacting, though how many times – monthly, weekly – is still open to interpretation.

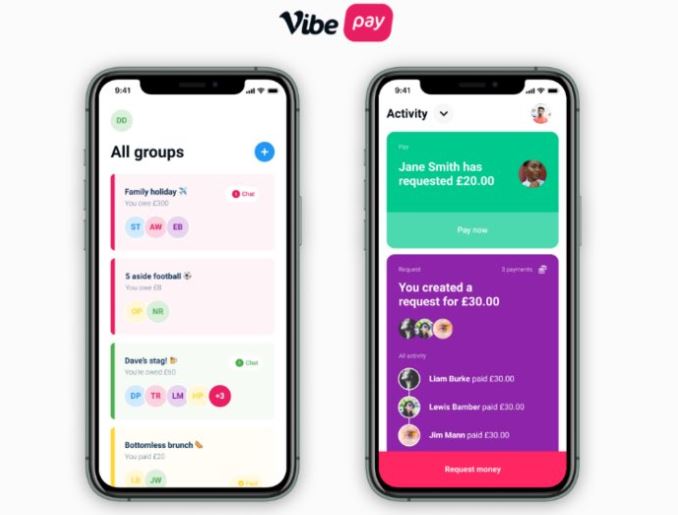

VibePay is – put simply – designed for those who want to get paid. Massie calls them ‘insta-preneurs’ – those that might have a day job, but also make up extra cash with side hustles on platforms such as Amazon’s video live streaming service Twitch, or peer-to-peer social shopping app Depop.

Massie says these users hate having to turn to PayPal due to the fees that the wallet service can often charge them, as well as the delays in receiving funds. Because VibePay uses open banking, users can get paid instantly whilst avoiding fees which cut into their margins.

Massie is an active participant in the VibePay community, and he says this is because he doesn’t want users to think of him as a distant CEO. “I’m just a young man up North giving it a go, like them,” he says.

VibePay doesn’t charge consumers anything to use its platform, instead charging companies who use its business-to-business (B2B) offering.Those businesses get a payment solution and “targeted” insights into Generation Z.

Asked why other fintechs in the UK aren’t doing what VibePay is doing, Massie says it comes down to the core value proposition, which is very different from the likes of Revolut and Monzo.

Related: Dubai fintech Ziina lands $850,000 and launches P2P payment app

“We don’t care who you bank with,” he states.

“People would say in the early focus groups ‘if you don’t have Monzo, don’t talk to me’, but that was just a London bubble – the rest of the UK weren’t really arsed if you had a coral card,” he adds.

VibePay creates unique payment request links which can be used by any bank account holder, thus creating a more open ecosystem. Looking ahead, the fintech wants to build out its merchant offering, hoping to land a heavyweight investor like Octopus Ventures in its imminent Series A.

Octopus Ventures led Depop’s last funding round, and could open up some big doors for the start-up. It is also looking at the world of gaming as a means for expansion, a space fellow challengers abroad have invested in to boost user engagement.

But VibePay is still early on in its journey, and its customer engagement strategy will need to stand the test of time. Netherlands-based challenger bank bunq, which was founded in 2012 and is available in the UK, revealed that 62% of its Premium customers use bunq as their primary account.

Asked whether bunq finds active user metrics challenging, CEO Ali Niknam told FinTech Futures: “Actually, I don’t think we have that issue – our statistics are very healthy.”

He added: “We have created products that people actually want to use. They don’t come to our platform because […] we have been overtly in your face with ads.”

And that’s what Massie stresses. That you don’t need to drop hundreds of thousands on marketing campaigns which ultimately don’t drive organic user engagement. It seems just £1,000 a week could do it, along with “a young man up North giving it a go”.

Read next: Challenger bank Lunar partners with Danish esports firm Astralis