Estee Lauder Stock To Set New Highs Of $220+?

by Trefis Team

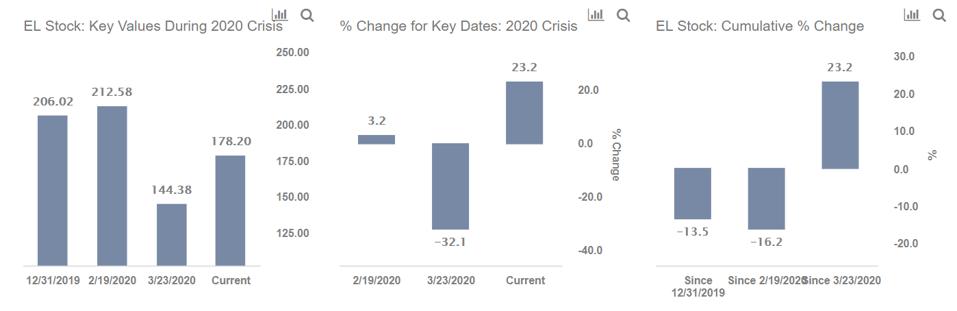

Based on a comparison of Estee Lauder’s stock (NYSE: EL) trajectory over recent months with that around the 2008 recession, we believe that the stock can potentially gain 25% once fears surrounding the coronavirus outbreak are abated, to cross $220, from current levels of $178.

A detailed comparison of Estee Lauder’s performance vs. the S&P 500 is available in our interactive dashboard analysis, 25% Gain Possible For Estee Lauder Stock Post-COVID? In 2008 It Lost 45.4% And Then Gained 115.9%

The World Health Organization declared a global health emergency at the end of January in light of the coronavirus spread. The rally in the equity market continued till February 19 with the S&P 500 reaching a record high, but the trend reversed sharply over following weeks. Estee Lauder stock lost 32% of its value (vs. about 34% decline in the S&P 500) between February 19 and March 23. A bulk of the decline came after March 6th, when an increasing number of Coronavirus cases outside China fueled concerns of a global economic slowdown. Notably, though, the multi-billion dollar stimulus package announced by the U.S. government has helped the stock price recover 23% over recent weeks (vs. about 32% gain in the S&P 500) to its current level of $178.

Estee Lauder Stock Has Taken A Hit Because Discretionary Spending Is Down To A Trickle

The extended quarantine and lockdowns in many countries mean that people are just not stepping out. This and the added fear of an economic downturn have resulted in people focusing only on basic necessities while curtailing discretionary spending. Understandably, people are also using fewer makeup products, and perfumes and fragrances. This will significantly drive down demand for Estee Lauder’s products in these segments, while demand for their skincare and hair care products are not expected to take such a big hit.

Regardless, this will lead to a drop in net sales and Estee Lauder’s Q4 results will confirm this reality with a drop in revenues across all segments. If signs of coronavirus containment aren’t clear by the Q4 earnings in August, it’s likely Estee Lauder’s stock, along with the broader market, is going to see another round of sell-offs when results don’t come anywhere close to investor expectations.

But Estee Lauder Stock Fared Worse During The 2008 Downturn

We see EL stock declined from levels of around $17.50 in October 2007 (the pre-crisis peak) to roughly $9,50 in March 2009 (as the markets bottomed out) - implying that the stock lost as much as 45% of its value from its approximate pre-crisis peak. This marked a lower drop than the broader S&P, which fell by about 51%.

However, EL recovered strongly post the 2008 crisis to over $20 by early 2010 - rising by a whooping 116% between March 2009 and January 2010. In comparison, the S&P bounced back by about 48% over the same period.

Will Estee Lauder’s Stock Recover Similarly From The Current Crisis?

Keeping in mind the fact that EL stock fell 32% from the market peak on February 19 to the low on March 23 compared to the 45% decline during the 2008 recession, we believe it can potentially recover from the low by around 50-55%, to levels of just over $220, once economic conditions begin to show signs of improving. This marks a more than full recovery to the $212 level that EL stock was at before the coronavirus outbreak gained global momentum.

That said, the actual recovery and its timing hinge on the broader containment of the coronavirus spread. Our dashboard forecasting U.S. COVID-19 cases with cross-country comparisons analyzes expected recovery time-frames and possible spread of the virus.

Further, our dashboard -28% Coronavirus crash vs. 4 Historic crashes builds a complete macro picture and complements our analyses of the coronavirus outbreak impact on a diverse set of companies. The complete set of coronavirus impact and timing analyses is available here.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams