Microsoft’s Stock Faces A Sharp Reversal

by Michael KramerMichael Kramer and the clients of Mott Capital own MSFT.

Microsoft Corp.’s (MSFT) stock has stalled out since reporting strong quarterly results. Since April 29, the stock has risen by just 1.8% versus an S&P 500, which has climbed by about 2.7%. Now the stock finds itself on the cusp of a significant technical breakdown. It could result in the shares plunging by as much as 11%.

One reason why the shares may be due for a pullback is that its valuation is very high, based on its historical trends. The company is expected to report fiscal fourth quarter 2020 results in July, and the turning of the calendar should help to lower that valuation a bit. Still, it doesn’t make the stock significantly cheaper.

Technical Break Down Nears

The technical chart shows that the stock has been consolidating sideways since the end of April. But now the equity appears to be breaking an uptrend that started at the beginning of April. It could be a big negative for the stock as it would signal a change in trend and a potential decline back to a level of technical support in a region of $161 to $165, a drop that could be between 9 and 11%.

Additionally, the relative strength index is also showing signs of weakness. It is now turning lower after consolidating along with the stock price. It is a bearish sign, one that indicates the stock is losing the positive momentum it had seen since the March lows.

Historically Very Expensive

The reason why the stock has likely struggled in recent weeks is that its valuation has reached very high levels based on a historical basis. Currently, the company is expected to earn $7.30 per share in the fiscal year 2022, which means the stock is trading with a one-year forward PE ratio of about 24.9. That PE ratio is historically the highest the multiple has risen too since 2012. The company has changed significantly over that period, with a significant return to growth.

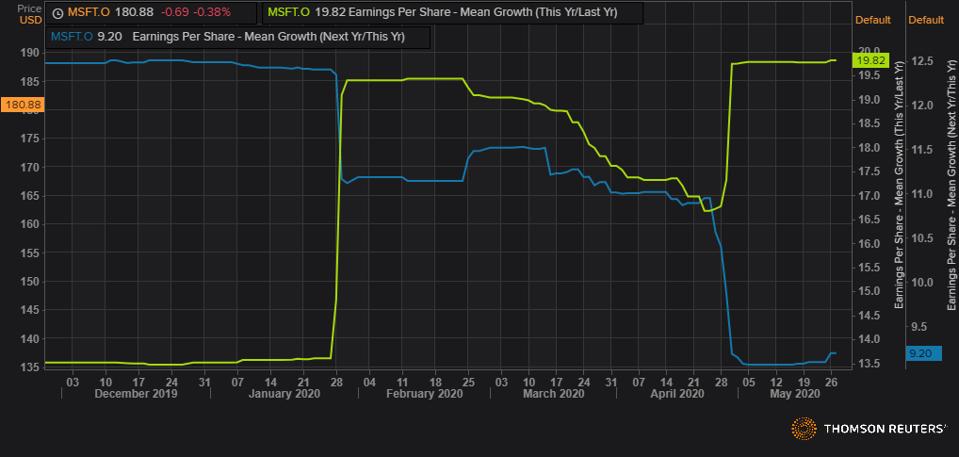

That transition is likely why the stock has seen so much multiple expansion, as earnings have grown significantly. Analysts estimate that growth will remain strong, and will rise by 19.8% when fiscal 2020 concludes in June. Also, forecasts show that earnings will increase by an additional 9.2% in 2021 and 15.7% in 2022.

A Pullback Could Help

A move lower for the stock over the short-term could be healthy for the longer-term as it would help to bring down that future earnings multiple while giving the stock more time for an economic recovery or, at the very least more clarity. The longer-term risk seems high should the stock continue to rise, pushing the earnings multiple even higher, making the shares grossly overvalued. At the same time, potentially, taking much of the benefit of future earnings growth and pulling it forward.

Of course, it seems possible for the stock to continue to rise, as investors pile into these stay at home plays due to the coronavirus pandemic. It remains to be seen just how much higher investors are genuinely willing to pay up for a stock that is already expensive. Until that answer becomes more apparent, it seems at least over the short-term the risk remains for the stock to move lower, as the chart and valuation indicate.