Can General Electric Survive The COVID-19 Recession

by Trefis Team

General Electric’s stock (NYSE: GE) has lost over 45% of its value since the beginning of the year due to the outbreak of COVID-19. The commercial aviation industry is rattled, and GE, which manufactures aircraft engines, is no exception. Fading consumer demand, reduced discretionary spending, and stay-at-home orders, resulting in minimal air travel continue to take its toll on the airline industry. With Avianca filing for bankruptcy protection, the mere survival of airline companies has come into question, and this will have a significant impact on the companies that manufacture engines and other components used in aircraft. While a bankruptcy doesn’t necessarily means a company going out of business, it can also include massive financial restructuring.

Trefis analyzes the potential impact of COVID Recession on General Electric in an interactive dashboard with a focus on General Electric’s liquidity reserves and concludes that the company is in a strong financial position, and it will survive the COVID-19 recession. Although a COVID recession will impact the company’s revenues, cash flows, and its capital expenditures, we believe the company has sufficient financial reserves to sail through this pandemic.

Impact On General Electric’s Revenues

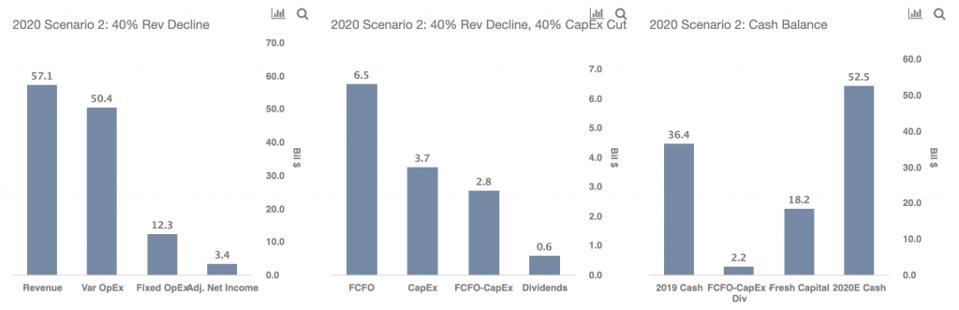

- We consider a scenario of a recession that persists through late Q3/early Q4 2020 can reduce the company’s revenues by 40% from $95 billion in 2019 to $57 billion in 2020.

- If the outbreak gets worse, General Electric could face order cancellations. Even with the slow reopening of the economy as lockdowns begin to lift, social distancing measures may continue for months, which will impact air travel and the airline industry at large, which in turn will impact General Electric’s aviation business.

Impact On General Electric’s Cash Flows

- General Electric’s cash flows are likely to fall in 2020, due to a steep reduction in revenues and a hit to profitability.

- The company will have to operate at limited capacity in the current environment. Elevated fixed costs, coupled with lower revenues, will hurt the company’s bottom line.

- However, General Electric could take a number of measures to mitigate the impact on its cash balance, such as raising more capital, and deciding to substantially reduce expenses across all operating heads and capital expenditures.

- Additionally, the company could keep the dividends unchanged, and it is unlikely to make share repurchases in 2020.

- Despite these measures, we estimate that Free cash flow from operations will go down from $8.8 billion in 2019 to around $6.5 billion in 2020. Also, with expected capital expenditures of $ 3.7 billion for the year, FCFO-CapEx will be $2.9 billion in 2020.

- It is important to note that our forecast of positive cash flows for 2020 assumes flat gross margins, and even if this number was to decline, the company has a strong cash cushion to survive.

Cash Balance Impact

- Taking all these factors together, we estimate that General Electric will end the year with a cash balance of $52 billion – higher than the figure at the end of 2019.

- This figure assumes $18 billion in fresh capital raised from external sources.

Conclusion

To sum things up, General Electric can successfully weather a recession through Q3/Q4 and a 40% decline in revenues by cutting CapEx, share repurchases, not increasing the dividends, and raising $18 billion in new capital. For an alternative scenario with a 25% change in revenue, see our full analysis of the impact of COVID recession on General Electric.

Our dashboard forecasting US COVID-19 cases with cross-country comparisons analyzes expected recovery time-frames and possible spread of the virus. Further, our dashboard -28% Coronavirus crash vs. 4 Historic crashes builds a complete macro picture. Additionally, the complete set of coronavirus impact and timing analyses is available here.

While it has lost 45% of its value thus far this year, General Electric appears to be a good buying opportunity at the current levels.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams