EVs Are A Niche Product, And Tesla Is Even Losing In This Niche

by RD BarrisSummary

- Survey data shows that electric vehicles ("EVs") are primarily commuter cars bought by niche purchasers, severely limiting their addressable market.

- A recent analysis also shows that there is no economic case for EV ownership, and the numbers for Teslas are even worse.

- These considerations are borne out in the small size and decelerating growth of the market for EVs.

- Recent performance in Europe, the first market where the other manufacturers have cared to compete, shows a plummeting market share for Tesla.

- Tesla's current share price can only be justified by rapid growth of the EV market combined with a high Tesla market share. None of these is true.

One of the many disputes between Tesla (NASDAQ:TSLA) bears and bulls is over the size of the "addressable market" for EVs and its rate of growth. To justify Tesla's share price, it is necessary to assume that both the general market for EVs will grow very rapidly (by displacing traditional internal combustion engine ("ICE") vehicles) and that Tesla will continue to capture a very large share of that growing market.

Tesla bears think that both of these assumptions are wrong. Due to their inherent limitations, EVs have never captured a large share of the general market for vehicles without massive subsidies. In addition, Tesla bears believe that the arrival of EV competition from the traditional OEMs, which have logically ignored this unprofitable niche market before but which are now forced to manufacture and sell these vehicles by environmental regulations, will sharply erode Tesla's market share.

This article reviews the results from two broad-based surveys of EV owners to look into the question of the addressable market for EVs. The conclusion the author comes to is that the typical EV owner has specialized ownership and use circumstances, suggesting that the addressable market for these vehicles is much narrower than the Tesla bulls believe. The article presents evidence that there is, contrary to the claims of the bulls, no economic argument for EVs and that the numbers are even worse than commonly thought (particularly for Teslas). Finally, the author compares the size and growth of the EV market, and Tesla's share of it, to the projections of one very prominent Tesla bull to demonstrate the absurdity of those assumptions.

The Surveys

I am aware of two broad-based surveys of EV ownership. (If readers are aware of other surveys touching on these issues, then please let me know in the comments below. Bloomberg has a large survey of Tesla Model 3 owners, but since this survey mainly touches on issues like reliability, servicing, and Autopilot, it is not useful for the points I am covering in this article.)

The first involved 8,000 respondents and was conducted in Norway in 2016. The survey was done by the Institute for Transport Economics, an independent national research institute associated with the University of Oslo. Although a small market, Norway is a bellwether for EVs since it has by far the highest EV penetration in the world on the back of extremely generous subsidies.

The second survey comes from the AAA automobile club in America. It is described in this article (including the linked "fact sheet"). The survey was conducted in October 2019 by a "third-party vehicle research firm", and the results were published in January 2020. It involved a consumer panel of more 40,000 EV owners, of which 1,090 were chosen to have a representative sample of vehicle type, make and model.

Here are some of the key findings of the surveys:

| Issue | Norway Survey | AAA Survey |

| Percentage who would buy/lease another EV | 89% | 96% |

| Average distance driven per day | NA | 39 miles |

| Percentage of ownership of a 2nd ICE vehicle | 71% | 78% |

| Percentage of those originally concerned by range but who became less or no longer concerned | NA | 77% |

| Percentage of those originally concerned about the lack of charging alternatives but who became less or no longer concerned | NA | 70% |

| Percentage doing majority of driving in EV | NA | 87% |

| Annual distance driven versus ICE vehicles | 15,500km vs 15,000km | NA |

| Percentage charging at home | 94-95% | 75% |

I draw the following conclusions from these responses:

- EVs are primarily used as commuter cars (which accounts for their higher annual and percentage usage, but their very low average daily mileage). This also accounts for the high percentages of respondents who claim to be less or no longer concerned by range or the lack of charging alternatives; these are not relevant for commuters.

- A very high percentage of owners have an ICE vehicle as a "back up," which is almost certainly the choice for longer trips or vacations.

- A very high percentage charge at home, which means a suburban or rural location, with a garage or car port.

Put all of these factors together and the resulting profile is a household that is wealthy enough to afford two vehicles, one of which (the EV) is used only for commuting, and which is wealthy enough and suburban/rural enough to have a home with a garage for charging.

In addition to these characteristics, we should also consider some of the other limitations of EVs. It is well-known that EVs perform badly in cold climates, which greatly affect their range. EVs also suffer severe range degradation when heavily loaded and/or travelling in hilly country. When you consider that 20% of vehicles in the USA are pickup trucks which are often purchased for utilitarian purposes, this degradation with weight is not a trivial matter.

It should also be noted that, although the profile is not unusual in wealthy and thinly populated countries like the USA, it becomes far rarer in other countries such as China (which is considered to be a major growth opportunity by Tesla bulls) or many places in Europe (where on-street parking is very common). Among other things, as the photo below comically illustrates, where are people supposed to charge their EVs in these circumstances?

(Recently constructed apartment buildings in urban locations will often have parking garages with EV charging points. Having lived in a building like this in London, the issue here is obvious: there are typically few charging points, and these are often used as overnight parking spots by early arrivers, blocking access to the charging facilities for others.)

In summary, the "sweet spot" of the addressable market for Teslas is wealthy households in thinly populated areas, ideally with temperate climates, where there is a more flexible second vehicle in the household and where the EV is not needed for longer trips or carrying heavier loads. In addition, the market is probably heavily restricted to "first adaptors" who are interested in new technology and willing to live with its growing pains.

In other words, Teslas are made in California for a wealthy California "tech" lifestyle, but it is ridiculous to assume that this is the norm worldwide. As the author of this somewhat dated report put it:

No surprise, EVs continue to sell extremely well in upper-income cities in California. Thirty California cities had electric vehicle shares above 10% in 2017, up from 19 such cities in 2016... There were 109 California cities with a greater than 5% share of new electric vehicles in 2017, up from just 64 in 2016, ....

The Economic Case for EVs

EV advocates often claim that the cars, although typically costing more to purchase than a comparable ICE vehicle, have a lower total cost of ownership ("TCO") and are therefore more economical for purchasers who can afford to make or borrow the higher initial investment.

This is false.

The AAA also reports on the TCO of a representative sample of compact EVs and ICE vehicles. The TCO calculation takes into consideration all routine costs of ownership and the capital costs of buying, financing and reselling (after depreciation) a vehicle. It gives the EVs credit for lower annual fuel and servicing costs, but hits the EVs for the higher financing costs and total dollar depreciation caused by the purchase price. The insurance costs are approximately the same for the two vehicle types. It is not clear how completely subsidies are reflected in the calculation, although the line item "License, registration, taxes" shows a negative number for the EVs, which means that at least some subsidies are reflected.

The end result is that the TCO in the USA of the sample of EVs is about $600 more per year than the comparable sample of ICE vehicles on the assumption that each is driven 15,000 miles per year. The cost comparison may differ in other countries (where gasoline may be more expensive, although this is also typically true of electricity) or with other assumptions about the miles driven (with EVs performing better with greater driving distances as their higher capital costs are spread over more miles, although this is precisely the type of driving where their range limitations become problematic).

Although this calculation shows that, contrary to the claims of many advocates, the EVs cost more than comparable ICE vehicles in the USA, I think it underestimates the cost disadvantage. An EV is less broadly usable than an ICE vehicle. As we saw from the survey data, the owners of EVs typically compensate for this by having a second ICE vehicle for use in circumstances where the EV is impractical. A more realistic comparison would allocate some of the cost of this "back-up" ICE vehicle to the TCO of the EV. Alternatively, an annual allowance for the cost of periodically renting an ICE vehicle to plug the usage gaps left by the EV should be included in the TCO calculation. This could easily add hundreds more to the annual cost disadvantage.

(Readers might note that there is an analogy in the calculation of the cost of alternative energy sources like wind and solar. Because of the intermittency of these sources of power, they require back-up, usually in the form of fossil fuel generators or storage (such as batteries). The cost of these back-ups needs to be included. When people say that wind and solar are cheaper than conventional sources, they are usually ignoring these additional costs (and often others).)

This is the TCO difference between a generic EV and a generic ICE vehicle. In the case of Tesla, I think that the difference is much greater. First, there is the issue of insurance. Rather than the roughly equivalent cost used in the AAA calculation, Teslas are notoriously expensive to insure (so much so that Elon Musk promised in April 2019 to start offering Tesla car insurance "in about a month," although - like a great many Musk promises - this is happening much more slowly or not at all, with insurance only currently available in California).

One of the reasons cited for the insurance cost is the very high cost of repairing and servicing Teslas. Although many of these costs are theoretically picked up by Tesla's warranty - although the Tesla owner forums and Twitter hashtags like #TeslaWarrantyIssues and #TeslaWarrantyFraudIssues are riddled with examples of Tesla's cavalier attitude to its warranty obligations - these will certainly become the responsibility of the owners when the warranty expires. The high cost of this servicing, combined with the poor build quality and reliability reported by owners, suggests that the servicing cost benefit included in the generic TCO analysis by the AAA may actually be a detriment with Teslas.

The TCO calculation reflects degradation in the battery of Teslas through the depreciated resale value of the cars. However, Teslas are sufficiently new not to have a real history of long-term battery performance. If the resale market is underestimating this degradation, then the prospect or reality of having to replace an extremely expensive battery pack (about $15-$20,000 as of August 2018, although perhaps falling) would cause the TCO to balloon. This may be a particular problem for Teslas because there is evidence - in things like the inability of Teslas to repeat acceleration performance, the Tesla recommendation only to charge the battery to 90% (unlike other OEMs), and the use of OTA updates to suppress battery performance or charging - that the company has taken a more aggressive approach to battery usage than its competitors.

Finally, it should be noted that, in general, subsidies for EVs are declining, particularly for a larger volume manufacturer like Tesla. We are also seeing a growing tendency for states to impose some kind of road-use tax on EVs. If these taxes approximate the ones paid by ICE vehicles through gasoline and diesel taxes, the additional annual costs will be in the hundreds for EVs.

The Market for EVs and Tesla's Share

This article has talked about the addressable market for EVs and the economics of ownership for these cars in general and Teslas in particular. To appreciate the importance of these factors for the investment case for Tesla's shares, let's do a semi-deep dive into the valuation work of one very prominent Tesla bull.

The most aggressive and visible Tesla bull has been ARK Invest. In a recent Seeking Alpha article, ARK has announced a probability-weighted price target of $7,000 per share. Let's look at ARK's "bull case" (which is assigned a 25% probability by ARK) where the information disclosed is better. A key component of this scenario is an assumption of 7.1 million of unit sales by Tesla in 2024 based on a 19% share of a total EV market of 37 million units.

Consider those numbers. Selling 7.1 million Teslas in 2024 corresponds to an 81% CAGR in unit sales from 2019. Since 2013, when the Model S began full production, Tesla's unit sales CAGR has been 59% during a when Tesla has benefited from a low starting base, minimal competition, very substantial subsidies and a cult-like following. Yet, to reach ARK's bull case, growth would have to accelerate dramatically from this point.

Since the Model 3 reached full production in Q3 2018, Tesla's sales (on an LTM basis) have risen by a mere 18%. Since Tesla reported finished goods inventory, which consists substantially of new cars available for sale, of $1.356 billion at the end of 2019, this low growth is not due to a lack of supply.

It is also interesting to note that iPhone unit sales, to which Tesla is frequently and wrongly compared, grew at a CAGR of 53% during the peak growth period from 2008 to 2015. Since 2015, iPhone sales have fallen with the advent of competition.

To reach these sales figures, Tesla would have to produce the cars first. Since Tesla claims a total current manufacturing capacity of 690,000 units, this would require a 79% CAGR growth of production capacity through the end of 2023 in order to be ready to manufacture and sell these 7.1 million vehicles in 2024. Tesla's recent Shanghai factory has a capacity of 200,000 units. Looking at these numbers another way, Tesla would have to add 32 times this capacity over the next 42 months, or the equivalent of one Shanghai factory every 1.3 months. Tesla bulls were dislocating shoulders patting themselves on their backs when the Shanghai factory was completed in 11 months. How about reducing that time by - to use a favorite expression of Elon Musk - "an order of magnitude"?

Global sales of pure EVs and plug-in hybrids ("PHEVs") were 2.26 million units in 2019. To reach ARK's target of 37 million units by 2024 would require a CAGR of 75%. Global sales in 2019 grew by 9%, consisting of 44% growth in Europe, under the influence of very heavy subsidies, and growth of 3% and shrinkage of 12% in the more mature markets of China and the USA, respectively.

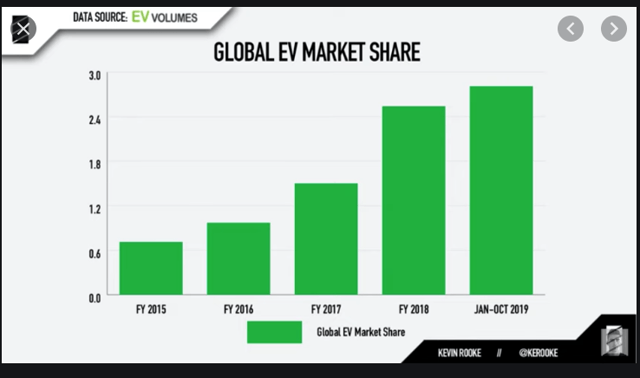

Assuming that worldwide total vehicle sales stayed at their 2019 level of 91.3 million, EVs (and PHEVs) would have to increase their market share from 2.5% to 40.5%. As the following chart shows, EVs (and PHEVs) have increased their market share by 1.8% from 2015 to 2019, an average growth of 0.45% per year, with the most recent year showing a sharp decline. EVs would have to increase this historical growth by almost 17 times in order to hit ARK's market share target by 2024.

Within this greatly expanded market, ARK's assumptions mean that Tesla would have to grow its market share from a current 16% to 19%. By way of comparison, the current market share leader is Toyota with approximately 10.2% of the global market (for all vehicles and not just EVs). Toyota (NYSE:TM) achieves this with 5 fully owned brands and 2 partially owned ones, with a very large number of models. The runner up (Volkswagen (OTCPK:VWAGY)) has a 7.6% share of the global market across 8 brands and even more models.

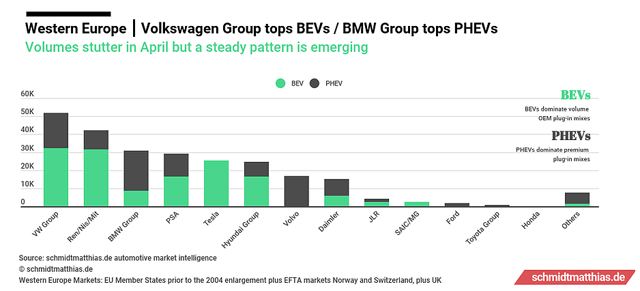

And what has been the recent performance by Tesla in competitive markets? For the first 4 months of 2020 in Europe, here are the relative performances of various manufacturers (all of which have been affected by COVID-19 and in a market where Tesla has plenty of available inventory).

For a long time, the Tesla bulls have mistaken a logical desire of the remaining OEMs not to follow Tesla into a bottomless pit of losses and market indifference (since Tesla has a global market share of about 0.4%) for a Tesla technological lead. Due to regulations, the remaining OEMs are now required to compete in the EV market and Europe is the first battleground. The initial skirmishes do not look good for Tesla, even though the other OEMs still haven't really rolled out their heavy guns (in the form, notably, of the much anticipated compact ID.3 and crossover ID.4 models from Volkswagen and the Ford (NYSE:F) Mustang Mach-E SUV, all of which are due shortly).

Put these two trends together and the only geography which is showing rapid growth in the overall EV market is precisely the location where Tesla's market share is plummeting due to competition. This is not a happy combination for the bulls.

In addition to these sales and market assumptions, the ARK bull case also assumes that Tesla makes huge advances in autonomous driving (despite its current laggard position in this field) and improves its margins from a level which ARK already misunderstands and grossly inflates. In this scenario, ARK thinks that Tesla's shares trade at $15,000 or more, which means that - on an expected value basis - this scenario contributes over half of ARK's target price of $7,000 per share.

We cannot say that the real probability of Tesla reaching the ARK bull scenario is zero because, strictly speaking, no scenario can have a probability of absolute zero. However, the probability of ARK's bull case - to which, I repeat, the company assigns a 1-in-4 chance - is as close to zero as you can get without using an electron microscope. No wonder that ARK has recently been a heavy seller of Tesla shares at prices equal to about 10% of its target price.

Conclusion

Reviews of surveys show that the inherent limitations of EVs make them a niche product heavily reliant on massive subsidies and specialized purchasers, particularly because there is no economic case for these vehicles. These considerations are borne out by the tiny market share of EVs, compared to total vehicle sales, and the decelerating growth of this market. Within this small and slowly growing market, recent experience in Europe shows that Tesla is rapidly losing market share now that other OEMs are forced to compete. This combination of factors make the projections of one prominent Tesla bull absurd, but they also mean that there is no way that the EV market or Tesla will achieve the growth or profitability needed to justify its current valuation.

Tesla remains a bubble of epic proportions, something which even the company's CEO admits. However, particularly in a world where "money printer go brrr" defines Fed policy, it is impossible to predict when this bubble will find its pin. Trade cautiously.

Disclosure: I am/we are short TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am short with a combination of outright shorts and long-dated puts.

My analysis reflects my beliefs about the fundamental value of Tesla. However, since the share price is completely divorced from fundamentals, I make no predictions about its movements in the near future. Investors should form their own opinions and trade with a great deal of caution.