Future Lifestyle Fashions share price down 2% as board mulls fund-raising plan

Future Group faces high promoter debt, sharp fall in share prices and cash flow woes, all of which have been exacerbated by the COVID-19 outbreak.

by Moneycontrol NewsFuture Lifestyle Fashions share price was down over 2 percent intraday on May 27 after the company, which backs brands like Lee Cooper, John Miller and Indigo Nation, was evaluating options to raise funds and push for flexible debt repayment to revive operations, people familiar with the matter told Moneycontrol.

The stock, which has slipped more than 70 percent in the last one year, was quoting at Rs 136.50, down Rs 3.20, or 2.29 percent at 1114 hours. It has touched an intraday high of Rs 145.90 and an intraday low of Rs 134.05.

"Future Lifestyle Fashions is mulling either the rights issue or preferential allotment route to raise around Rs 200-Rs 225 crore over the course of the next few months. These are early days and a final decision has not been taken as yet on the mechanism or timing," a person told Moneycontrol.

On May 16, the group firm Future Consumer's board approved plans to raise Rs 300 crore via a rights issue.

These discussions are gathering pace as Future Group battles high promoter level debt, sharp fall in share prices of its group companies and cash flow woes – all of which have been exacerbated by the COVID-19 outbreak.

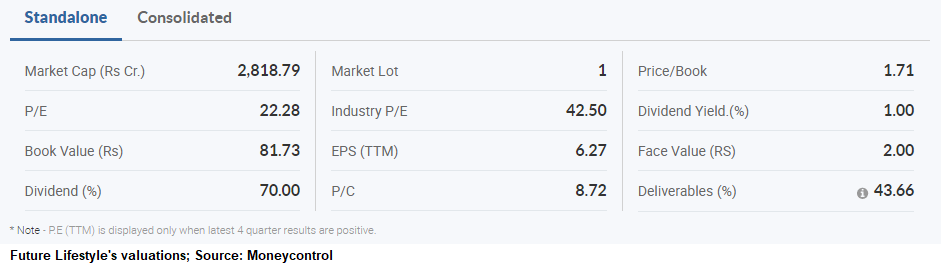

According to Moneycontrol SWOT Analysis powered by Trendlyne, Future Lifestyle Fashions stock price is showing weak momentum, with price below short, medium and long-term averages and with high promoter pledge. Moneycontrol technical rating of the stock is very bearish.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.

Download a copy Get best insights into Options Trading. Join the webinar by Mr. Vishal B Malkan on May 28 only on Moneycontrol. Register Now!