Planning to invest now? Here’s how you can build a Rs 5,00,000 ‘Atmanirbhar' portfolio

Investors should ideally place small amounts in different sectors to take advantage of the multiplier effect which the economic package could have over a period of time.

by Kshitij AnandPrime Minister Narendra Modi pitched for a self-reliant India in his last address to the nation pushing for "Atmanirbhar Bharat".

From Atmanirbhar Bharat it is time to make Atmanirbhar Portfolio. Although the market seems to have given a thumbs down to the package announced by the Finance Minister and the Reserve Bank of India (RBI) recently, the measures are aimed at making India much stronger in every aspect in the long term.

“The Finance Minister outlined the contours of the Rs 20 lakh crore fiscal stimulus for becoming ‘Atmanirbhar Bharat’. Liquidity, incidentally, is of paramount importance, especially under the current circumstance of lockdown due to COVID-19 where economic activities have come to a grinding halt,” ICICIdirect said in a report.

“Interestingly, the majority of the announcements are of the nature of credit guarantees, which do not impact fiscal mathematics in a significant way. However, the multiplier impact of the measures is likely given that it initiates much-needed lending to smaller firms by improving the risk appetite of the lenders,” it said.

The economic package takes into account key sections of the economy such as migrant laborers, small vendors, farmers, and micro, small and medium enterprises (MSMEs). The package also includes a measure for banks, defense, mining, aviation, etc.

Investors should also try and position their portfolio in sectors and stocks that are likely to benefit the most from the announcements.

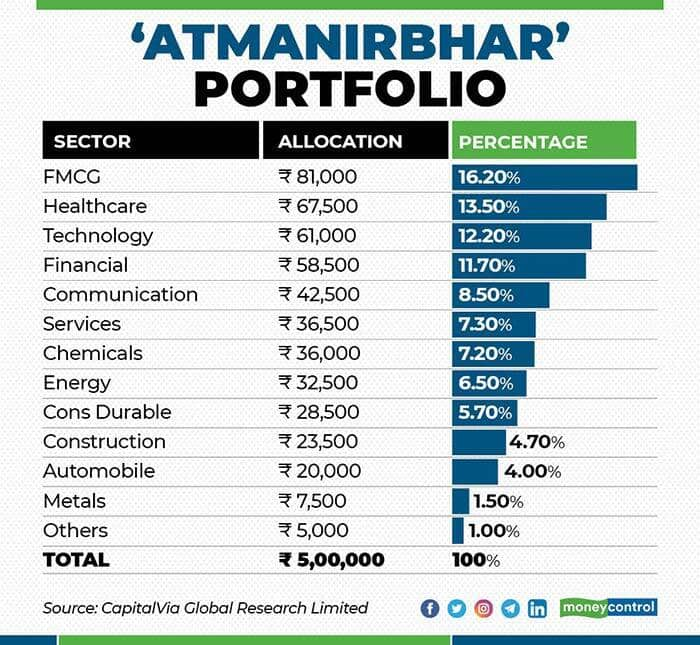

“It is also advised for the investors to do a top-down analysis approach before investing in the equity a market. One has to start with the macroeconomic condition of the country than to industry than to companies. With the ongoing disruptions in every business, one has to observe the trend of the future,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol.

“The consumer buying trends have been changed and especially focused on buying the basic consumer staples which are essential for the survival and the technology plays a vital role when most of the business is planning to move to different working culture or giving more importance to work from home,” he said.

Investors should ideally bet small amounts in different sectors to take advantage of the multiplier effect which the economic package could have over a period of time.

We spoke to various experts as to how investors could deploy Rs 5,00,000 in markets now:

Expert: Pankaj Bobade, Head - Fundamental Research, Axis Securities

Given the current correction in equity markets and risk aversion across, an investor with higher risk appetite can look at giving higher weightage (say 30-50% depending on the risk appetite) to the equities and accumulate the quality equity assets at reasonable valuations in order to outperform the normal expectations of returns over 3-5 years of the investment horizon.

We like select names in the consumption space, automobiles, leading private sector banks, select pharma and chemicals space, where there is a good probability of export opportunities.

These companies have a robust business structure and competent management to beat the slowdown, enormous marketing network, low or no leverage, tried & tested products, and deep brand recall with the consumers.

Expert: Hemang Kapasi, Portfolio Manager – Equity Investment Products, Sanctum Wealth Management Private Limited.

Assuming investor age is between 30-40 years, its ability to absorb risk would also be higher, we advise higher allocation to equities and lower to other asset classes. There should be at least 65% allocation to equities while investments in fixed income and gold should be 20% and 15% respectively.

Within equities one should adequately diversify into large caps and mid-caps as large caps provide stability while mid-caps provide an opportunity for higher growth. At the current juncture, our tilt would be more towards large caps in this uncertain environment.

Expert: Nirali Shah, Senior Research Analyst, Samco Securities

In terms of asset allocation with Nifty50 around 9300 levels, investors should allocate 30% to cash, 20% to FDs, 15% to gold, and 35% to quality equities.

Sector composition is a matter of an investor’s risk appetite. Stocks from sectors like NBFC, private banks, metals, an auto which have fallen significantly have the possibility of higher returns once things turn around.

On the contrary, investors who are unwilling to take risks should focus on pharma, FMCG, IT names wherein the chances of prices moving lower are little less but at the same time upside is also muted.

But, nonetheless, investors should maintain a balanced portfolio approach going ahead once our economy settles down.

Expert: Vikas Jain, Senior Research Analyst at Reliance Securities

Equities: 50% (Invest over the next 3-4 months)

Fixed Income: 25% (Invest at current levels as better placed compared to other assets)

Gold: 10% (Sharp up move in last one year so risk reward not being in favour)

Cash: 15%. (Use the cash at appropriate time to increase the existing holdings)

We believe the current fall has witnessed sharp correction in lot of sectors trading at discount to its long term 10-year average valuations.

We believe large private banks, pharma and insurance sectors will dominate the markets in the coming years as valuations are reasonable and market share gains in domestic and international markets will incrementally add earnings expanding the PE multiples going forward.

Large private sector banks are trading below the long term valuations, market share gains from public sector banks, cost reduction with technological advancement would increase profits over the next few years.

Insurance Companies enjoy strong parentage and a large population will help to gain sizeable market share across products which will augur well for these companies.

Pharma has witnessed a sharp outperformance after a span of 5 years as new drug approvals, faster clearance of plants from USFDA, and benefits of global business across the world with regular product innovation will drive the growth.

Any decline in high-quality names will be a good opportunity to invest in superior returns. Midcaps funds or individual stocks can also be looked at after a sharp correction over the last 2 years.

In terms of reshuffle, he should look at after 3-4 quarters how they have shaped up in terms of earnings, valuations parameters with respect to the overall markets and individual returns of the sector.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.

Download a copy Get best insights into Options Trading. Webinar by Mr. Vishal B Malkan is Live. Watch Now!