Vedanta: Going Private

by Michael A. Gayed, CFASummary

- Vedanta's promoters have decided to take the company private.

- The company has been investing in capital assets year-over-year to the extent that the fixed assets turnover ratio has dropped below 1.

- Moody's has downgraded the company's senior unsecured bonds and the road ahead looks challenging.

Before the COVID-19 disruption hit home, Vedanta (VEDL) was gung-ho on its business prospects. In its Q3 2020 earnings call in Jan 2020, VEDL's management team described the Indian economy as the most exciting economy in the world and suggested that business would move full speed ahead without looking back.

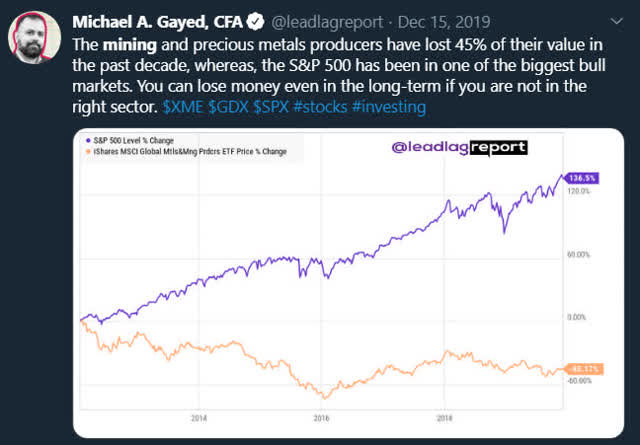

The bullish remarks came even though mining companies had underperformed the broad market. Way back in Dec 2019, I had published a view on the mining sector in The Lead-Lag Report and tweeted about how being in the wrong sector can make investors bleed cash.

Source: Twitter

Back to the story - COVID-19 has laid VEDL's optimism to rest. On May 22, 2020, the RBI's (Reserve Bank of India) Governor declared that India's GDP growth was likely to be negative in 2020-21. That's one hell of a blow - from being described as the fastest-growing economy to being nicked as a negative growth story in a space of just 4 months kind of tells a lot about the devastation that COVID-19 has wrought on developing nations.

Just like all other stocks, VEDL too got hammered. However, the stock had been an underperformer since early-Jan 2018 when it was quoting about $22. It had been falling in fits and starts until COVID-19 arrived and pushed it over the hill.

Source: Seeking Alpha

Maybe it's the erosion in the stock price that has prompted the company's promoters to take the company private. VEDL has begun the process and I figured it would be worthwhile to analyze the company's business and finances.

Business Segment Analysis

Source: VEDL Website

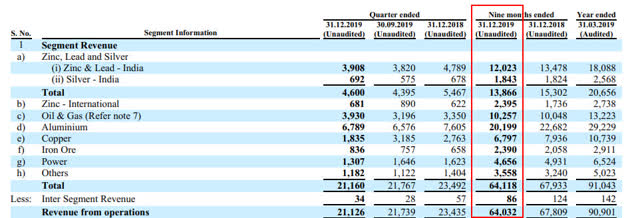

Based on revenues for the 9 months ended September 2019, here's VEDL business breakup:

- Zinc & Lead (India and International): 22.51%

- Silver (India): 2.8%

- Oil & Gas: 16%

- Aluminum: 31.5%

- Copper: 10.6%

- Iron Ore: 3.7%

- Power: 7.3%

Aluminum, oil & gas, zinc, and copper make about 81% of VEDL's business and, therefore, it makes sense to check how these commodities' prices have performed from Dec 2019 till date:

Source: Self-Generated

There's little doubt that VEDL's revenues and profits will suffer until the COVID-19 disruption lasts. Demand will take a long time to return to the pre-COVID-19 era. The situation is evolving and many events are yet to play out before clarity emerges.

Cash Flow Analysis

Up to March 31, 2019, VEDL generated very healthy operational cash flows. I also have no option but to presume that it generated healthy operational cash flows for the 9 months ended December 31, 2019, because the statement is not filed yet. Though the operational cash flow numbers look great, the issue lies in the investing and financing cash flows.

Source: Seeking Alpha

Between 2015 and 2019, VEDL pumped $5.8 billion into capital assets. As of March 31, 2019, the company owed $9.5 billion in short- and long-term debt. Of the operational cash flows that VEDL generates, it pays about $1.2 billion in dividends, repays a part of the debt, and carries the rest home.

The issue is that the capital assets' book value is about $17 billion as of March 2019 - and this chubby, chunky asset block has managed to generate revenues of $12.29 billion for TTM 2020. That's not even a 1:1 ratio - and a very poor number at that.

Summing Up

COVID-19 has struck at a very fragile time in VEDL's life. The company has been adding capital assets over the last few years, and all of a sudden, it has landed into a swamp. Falling demand and falling prices can play havoc with any company that has been aggregating fixed assets by issuing debt year-over-year.

Moody's queried the pitch some more in March 2020 by downgrading VEDL's Corporate Family Rating (CFR) to B1 from Ba3. It also downgraded the credit rating on VEDL's and its subsidiary's senior unsecured bonds to B3 from B2.

COVID-19 has made the company more vulnerable to external shocks. Everything that was waiting to go wrong has gone wrong all at once - falling prices, drying demand, downgrades, rising debt, and fading clarity about when recovery will occur.

These are the factors that may have spurred the founders to go private. Well, even going private will add $2.2 billion to its parent company's (Vedanta Resources Plc (OTCPK:VDNRF)) debt.

As of now, VEDL is an avoid - and by the time demand gets back to normal, the company would have gone private anyway. There are plenty more opportunities available.

Like this article? Don't forget to hit the Follow button above.

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.