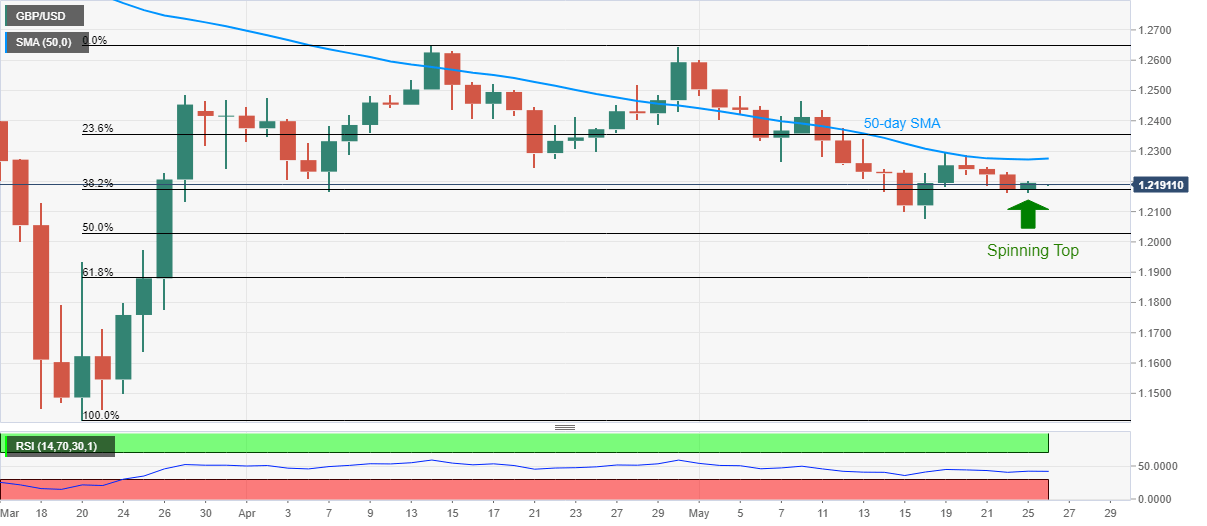

GBP/USD Price Analysis: Buyers attack 1.2200 following Monday’s spinning top

by Anil Panchal- GBP/USD awaits further direction to extend recoveries from 1.2160/65.

- Candlestick formation suggests the fight between the buyers and sellers after three-day losing streak the last week.

- 50-day SMA guards near-term upside, sellers can aim for fresh monthly low.

GBP/USD takes the bids to 1.2195 during the initial Asian session on Tuesday. The pair formed a bullish “spinning top” candlestick on the daily chart the previous day after consecutive three days of downside.

While the candlestick formation portrays the struggle between the buyers and the sellers, 50-day SMA keeps the quote’s near-term upside guarded.

As a result, the current recovery moves may initially aim for a 50-day SMA level of 1.2275 ahead of targeting 1.2300 mark comprising high of May 19.

Should the bulls manage to keep the reins beyond 1.2300, May 08 top near 1.2470 and 1.2500 round-figure could return to the charts.

On the downside, pair’s declines below Friday’s low of 1.2162 can recall the bears targeting to refresh the monthly bottom below 1.2075.

GBP/USD daily chart

Trend: Further recovery expected

Additional important levels

| Overview | |

|---|---|

| Today last price | 1.2194 |

| Today Daily Change | 20 pips |

| Today Daily Change % | 0.16% |

| Today daily open | 1.2174 |

| Trends | |

|---|---|

| Daily SMA20 | 1.2334 |

| Daily SMA50 | 1.2274 |

| Daily SMA100 | 1.2623 |

| Daily SMA200 | 1.2666 |

| Levels | |

|---|---|

| Previous Daily High | 1.2234 |

| Previous Daily Low | 1.2162 |

| Previous Weekly High | 1.2296 |

| Previous Weekly Low | 1.2076 |

| Previous Monthly High | 1.2648 |

| Previous Monthly Low | 1.2165 |

| Daily Fibonacci 38.2% | 1.2189 |

| Daily Fibonacci 61.8% | 1.2206 |

| Daily Pivot Point S1 | 1.2146 |

| Daily Pivot Point S2 | 1.2118 |

| Daily Pivot Point S3 | 1.2074 |

| Daily Pivot Point R1 | 1.2218 |

| Daily Pivot Point R2 | 1.2262 |

| Daily Pivot Point R3 | 1.229 |