Bharti to sell 2.75% stake in Airtel for $1bn, reduce debt

by TNN(File photo)

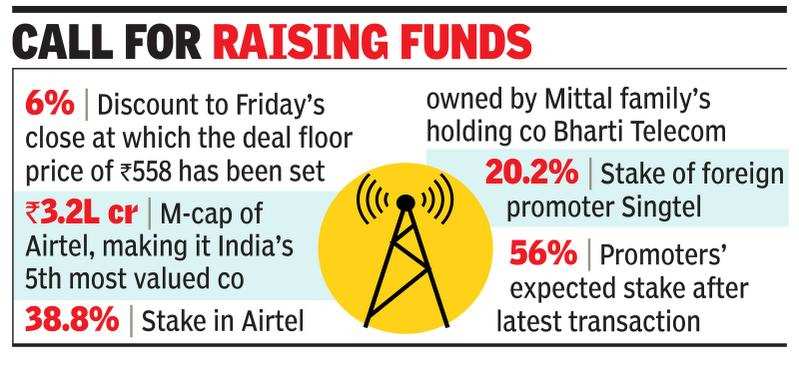

MUMBAI/NEW DELHI: Bharti Telecom, the Indian promoter of telco major Bharti Airtel, is set to sell a stake of up to 2.75% in the mobile services provider through block deals on Tuesday to raise $1 billion, or nearly Rs 7,600 crore. Currently, Bharti Telecom, the holding company of the Mittal family, has a 38.8% stake in the telco, while Singtel, the foreign promoter, has 20.2%. Bharti Telecom’s move is aimed at reducing its debt.

According to the term sheet for the deal, up to 15 crore Bharti Airtel shares are being offered at a minimum price of Rs 558 each. The floor price is at a 6% discount to the stock’s Friday closing price of Rs 593 on the NSE. After the transaction, the promoters together will hold about 56% in India’s fifth-most valued company with a market capitalisation of Rs 3.2 lakh crore.

The block deal has been planned through the accelerated book-building process and is being handled by JP Morgan’s India arm. Under this process, the broker, after the close of the day’s trading, sends out the term sheet to large institutions to express their interest to buy shares from the block. Once the book is built, the shares are traded the next day in allotted lots on the bourses’ platforms.

This is the second large block deal taking place in the Indian market this month. On May 7, global pharma major GlaxoSmithKline group had sold about 6% in FMCG major Hindustan Unilever (HUL) for about $3.5 billion, or around Rs 26,000 crore. JP Morgan was one of the brokers in that deal too.

According to sources, the fund-raising will help in paring the Indian promoter’s debt. The move may also turn it into zero-debt at the promoter level. Part of the debt had accrued to the promoter when it wanted to subscribe to Airtel’s Rs 25,000-crore rights offering exactly a year ago. “This creates full capacity at Bharti Telecom for any further capital or shareholder support requirement at Airtel,” a source said.

After the rights offer, the company had also raised another Rs 21,240 crore, or about $3 billion, through a combination of foreign currency convertible bonds ($1 billion) and institutional placement of shares ($2 billion).

These fund-raisings —QIP and FCCB — were mainly to meet regulatory dues that were charged to almost all the telcos after the Supreme Court order in October 2019 on their adjusted gross revenue (AGR), totalling about Rs 1.7 lakh crore.

Some of the global financial services majors and leading private equity funds had participated in Airtel’s fundraisings. The stock has more than doubled from its October 2018 low of Rs 262 to current value of nearly Rs 600.