WTI Price Analysis: Seesaws around $34.00 inside short-term rising wedge

by Anil Panchal- WTI fails to hold onto recovery gains beyond $34.05.

- Sellers await confirmation of the bearish technical pattern.

- Buyers will have to refresh monthly top to question 100-day EMA.

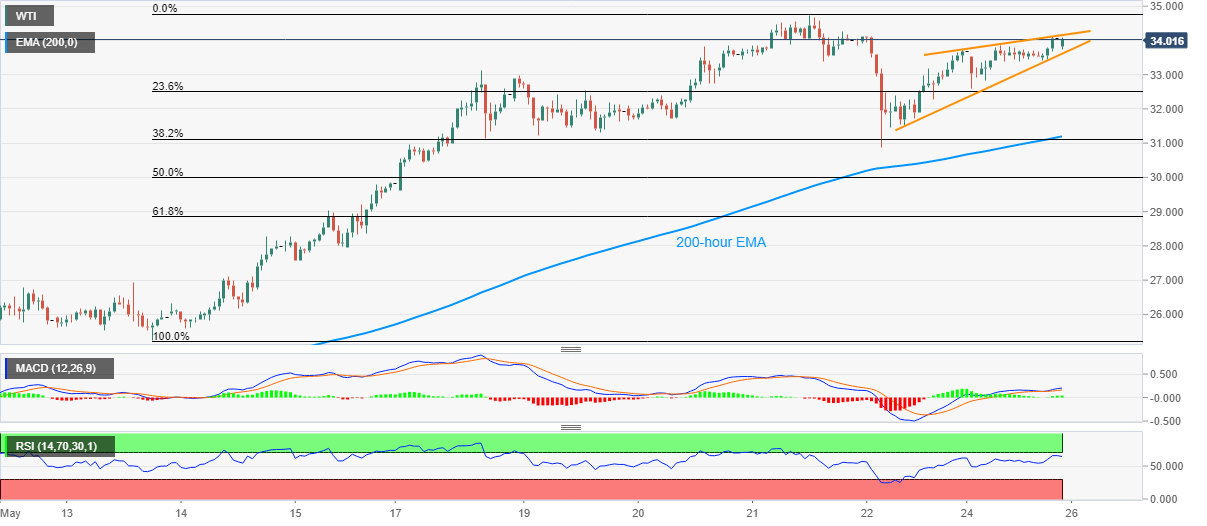

WTI takes around to $34.00 amid the early Tuesday morning in Asia. While stepping back from $34.05, the oil benchmark seems to portray the rising wedge bearish technical formation on the hourly chart that needs confirmation with a downside break below $33.60.

Should the quote declines below $33.60, which can be anticipated considering the RSI conditions, sellers can aim for a 200-hour EMA level of $31.20 ahead of looking at Friday’s low near $30.90.

During the quote’s further downside past-$30.90, $30.00 may act as a buffer before pleasing the bears with a $28.85 mark comprising 61.8% Fibonacci retracement of Mat 13-21.

Meanwhile, an upside clearance of the monthly high near $34.75 becomes necessary for the bulls to keep the reins.

In doing so, 100-day EMA on the daily chart around $35.40 can gain their immediate attention ahead of March 11 top near $36.65.

WTI hourly chart

Trend: Pullback expected

Additional important levels

| Overview | |

|---|---|

| Today last price | 33.96 |

| Today Daily Change | 0.29 |

| Today Daily Change % | 0.86% |

| Today daily open | 33.67 |

| Trends | |

|---|---|

| Daily SMA20 | 25.67 |

| Daily SMA50 | 25.3 |

| Daily SMA100 | 38.77 |

| Daily SMA200 | 47.74 |

| Levels | |

|---|---|

| Previous Daily High | 34.12 |

| Previous Daily Low | 30.88 |

| Previous Weekly High | 34.74 |

| Previous Weekly Low | 29.62 |

| Previous Monthly High | 32.21 |

| Previous Monthly Low | 8.46 |

| Daily Fibonacci 38.2% | 32.11 |

| Daily Fibonacci 61.8% | 32.88 |

| Daily Pivot Point S1 | 31.66 |

| Daily Pivot Point S2 | 29.64 |

| Daily Pivot Point S3 | 28.41 |

| Daily Pivot Point R1 | 34.9 |

| Daily Pivot Point R2 | 36.13 |

| Daily Pivot Point R3 | 38.15 |