A Contrarian View On JetBlue

by Josh ArnoldSummary

- JBLU has been more than cut in half from its 2020 highs.

- However, any recovery looks to be quite slow.

- And the valuation is pricing in a lot of earnings that aren't happening.

The COVID-19 crisis has done much to upend many industries, particularly ones that are related to travel. As that is all airlines do, the crisis has proven devastating to their very business models. While there will be a return to some sort of normal state at some point in the future, no one yet knows when that will be, or how much air traffic will return when such a state comes to fruition.

JetBlue (JBLU) was one of the better airlines before the crisis, in my opinion, and shares have been more than cut in half since early this year. However, I’m not convinced the current share price offers a favorable risk/reward for those looking to buy, and as a result, I’m still quite cautious on the stock. Given the number of bullish articles here on SA, it seems my opinion may be unpopular.

Impairments abound

Obviously, no airline in the world has escaped the malaise of air travel that basically shut down a couple of months ago. JetBlue has seen its traffic decline nearly entirely since global shutdowns took place in earnest, which has had a catastrophic impact on its revenue production for this year.

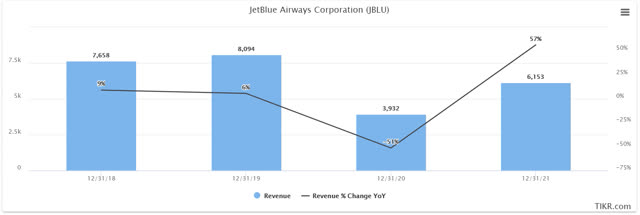

Source: TIKR.com

Revenue came in at $8.1 billion last year, but is expected to be less than half that amount this year, with the second quarter showing something just above zero. The current estimate of $3.9 billion, in my view, builds in a fair amount of recovery in the second half of the year, which doesn’t leave a lot of room for upside surprise.

After all, Q1 saw $1.6 billion in revenue, implying the last three quarters of the year will collectively produce $2.3 billion. With Q1 off 15% from the prior year, a “normal” quarter for JetBlue would have been somewhat higher, but Q1 was fairly close to normal given that the shutdowns began in mid-March, give or take.

Q2 will see almost no revenue, so that means we can safely assume estimates include at least a billion dollars of revenue on average for Q3 and Q4. That further implies that not only will the skies reopen to close to normal levels, but that demand for air travel will rebound very quickly. That may happen, but it may not. The fact is that we don’t know how people will react to airplanes being an option again, and building in a robust revenue recovery seems quite premature at this point.

Even if people do want to travel, we don’t know if there will be additional protocols in place, such as reduced capacity on each plane, reduced routes being flown, etc. The bottom line is that there are many variables, all of which can significantly impact JetBlue’s top line, and that creates a tremendous amount of uncertainty.

In addition to that, we cannot reasonably expect margins to recover for the airlines, which operate with a huge amount of fixed expenses, and therefore, need lots of revenue to make profit. Estimates are for $6.2 billion in revenue next year, but as we can see below, that isn’t necessarily going to translate into recovering profits.

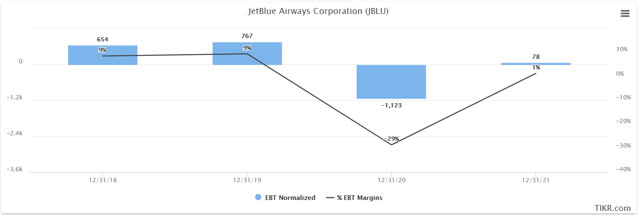

Source: TIKR.com

Earnings before taxes, or EBT, was $767 million last year, but is expected to fall to a loss of $1.1 billion or so this year. While we know 2020 is a total disaster for airlines, next year is what I’m interested in. Current estimates are for EBT to recovery to just $78 million for 2021, which is a very small fraction of normalized levels for JetBlue. This makes sense given revenue is expected to be well off of normalized levels, and as I mentioned, the enormous amount of fixed costs airlines operate with means that it needs every penny of revenue it can get to create operating leverage. However, operating leverage works both ways, and when revenue declines, so do margins. This, I believe, will take some time to recover, but I don’t think the share price is reflecting that risk today.

Cash generation and debt are new problems

Apart from a very tough revenue and margin outlook, JetBlue, like just about all of its competitors, has seen its ability to generate free cash flow and its balance sheet deteriorate as a result of this crisis. Airlines went into self-preservation mode – rightfully so – when it became clear this crisis was going to be devastating. That will keep them afloat and to live to see another day, but it has impaired JetBlue’s FCF generation and balance sheet, which will have repercussions for some time to come.

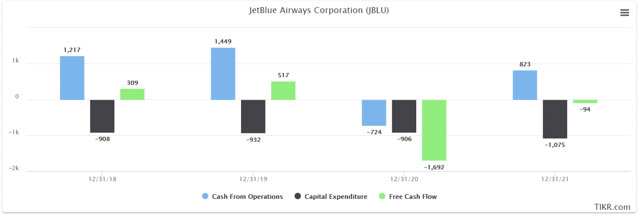

Below, we can see cash from operations and capex, the two components of free cash flow, all in millions of dollars.

Source: TIKR.com

FCF was $300 million in 2018 and more than $500 million last year, but is expected to be hugely negative for 2020, which is unsurprising. JetBlue’s market capitalization today is $2.5 billion, and its FCF is slated to come in at -$1.7 billion. It’s a truly staggering amount of cash burn, and that has resulted in lots of debt being added to the balance sheet. In addition, the recovery in FCF should take some time as capex is still quite heavy for next year despite JetBlue’s efforts to conserve, so this problem isn’t going to disappear overnight.

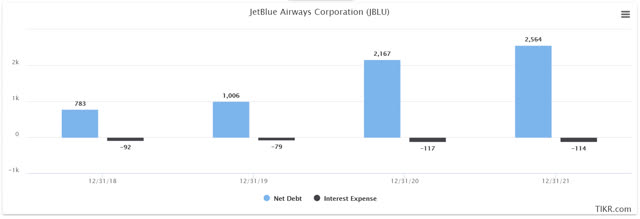

Below, we can see net debt and interest expense, both in millions of dollars, to illustrate this point.

Source: TIKR.com

Net debt wasn’t particularly low before the crisis, rising to right at a billion dollars by the end of last year. However, that will more than double this year thanks to emergency cash build efforts, and with FCF failing to rebound as quickly as I’m sure JetBlue would like, net debt will likely rise into 2021 as well. I mentioned that JetBlue’s market capitalization is $2.5 billion, and that is how much net debt it may have for 2021.

Apart from this huge amount of obligation it now has with its creditors, JetBlue has to service that debt, which means interest expense is likely to rise by half this year. That removes almost $40 million from what would have been pre-tax earnings, but is now going to service debt. I could go on, but the point is that the impacts of this crisis will be felt by JetBlue for a long time to come, and not in a good way.

The bottom line

JetBlue was a strong operator before the crisis, and I even like flying on JetBlue as a customer. However, none of that matters much when an industry has essentially been told it isn’t allowed to operate, and demand has completely collapsed. JetBlue will see some sort of recovery, but we don’t know when, and we don’t know the extent to which recovery will occur.

Prior to the crisis, JetBlue guided for EPS of $2.50 to $3.00. Those numbers are absolutely huge compared to reality but of course, the company had no way of knowing this crisis would befall it and indeed the world.

I may be unpopular in saying this but JetBlue may never reach $3 in EPS, or if it does, it will be a very long time from now. Revenue recovery will almost certainly be a gradual process given regulators and customers alike can easily stifle revenue generation in their own ways. That’s a problem for margins as operating leverage is now working against the airlines.

I think JetBlue will return to some small level of profits next year, and we’ll have to wait and see after that. However, before the crisis, shares traded at a high of $21.65 on expected earnings, per guidance, of $2.50 to $3.00. At the midpoint of $2.75, that’s an implied forward price-to-earnings ratio of 7.8, and that’s the highest it was this year.

The current share price of $9.24 at that same PE multiple implies ~$1.18 of EPS. Given that it could be two years or more before we see that level of earnings, I think JetBlue is pricing in too much recovery without enough supporting evidence it is coming any time soon. As such, I think holders of the stock have a long couple of years in front of them, and I think JetBlue should be sold.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.