There's Always Something To Worry About (And That's Bullish)

by Clif DrokeSummary

- Persistence of worry among investors supports a bullish contrarian thesis.

- The 32% rally in the S&P 500 strongly suggests a new bull has begun.

- Online retail sales are booming and will push the major averages higher.

After the rocket ride earlier this spring, the major U.S. indices have been trapped in a lateral trading range for the last few weeks, prompting concern among many investors that the bear will soon strike again.

Indeed, each new week heralds a slew of articles arguing that the market’s May stall-out means that the rally has fizzled and that buying interest has dried up. In contradiction to this thesis, I’ll offer the counter argument here that worry is a favorable omen for equities from a contrarian perspective, and that the recent lack of forward momentum in the major averages is likely a much-needed consolidation (or “pause that refreshes”). And while there may be a brief corrective dip ahead, the intermediate-term (3-6 month) trend for the broad market should remain up.

Ever since the S&P 500 Index (SPX) rose 32% from its March low, there has been an ongoing debate in the mainstream financial media as to whether or not the bear market that began this past winter is truly dead. My long-time readers know where I stand on this issue: The most commonly accepted definition of a bear market is a 20% or greater decline from a major top, so it only stands to reason that a greater-than-20% rise from the bottom of a decline constitutes a new bull market. Nevertheless, the bull versus bear issue remains unsettled for millions of investors today and has become a major source of confusion.

Even more disconcerting to many investors is the fear that the market’s massive gains in the last two months may have left stocks vulnerable to another sell-off. While there’s no denying that anything is possible in today’s politically sensitive equity market, there are as yet no signs that insiders or informed investors (i.e. professionals) have been big sellers of stocks. And insider/informed investor selling patterns are among the most important clues that a bear is truly lurking.

Prior to the February-March collapse, for example, there were definite signs of distribution (selling) among informed investors in the energy sector. On almost a daily basis spanning a multi-week period in January and February, for instance, there were more than 40 NYSE-listed stocks making new 52-week lows—sometimes even in the triple digits—and this was far more than was normal for a healthy bull market.

Ultimately, energy stock weakness bled into other sectors and led the market lower prior to the all-out panic event in March. This same pattern of intensive liquidation in energy and interest rate-sensitive equities (as manifested by abnormal levels of new 52-week lows) was also seen prior to the October-December 2018 market collapse. The point here being that before any recent sell-off, the insiders evidently knew what was coming and cashed out before the pain began.

But since the market turned around in April, energy stocks and other major sectors have largely avoided showing up on the NYSE and Nasdaq new 52-week lows lists. That’s a good indication that we once again have returned to a normal, healthy market condition with no concerted selling campaign underway by insiders. And as long as the new 52-week lows remain less than 40 on a daily basis, a bullish outlook is warranted.

Investor psychology, meanwhile, is anything but bullish. Fresh worries continue to emerge each week, revealing one new concern after another from the media. Consider the latest high-profile financial news headline from Bloomberg, which reported that nearly 70% of global fund managers polled by Bank of America consider this to be nothing more than a bear market rally “that will eventually fall apart.”

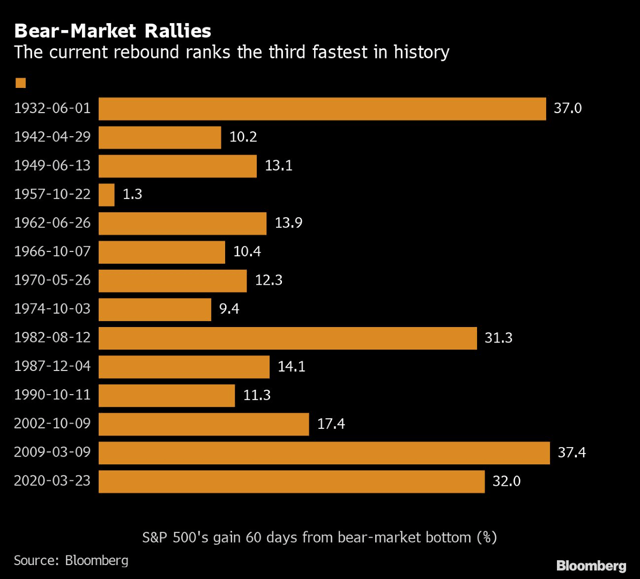

The Bloomberg article further noted that the current rally is already the third-fastest rebound in history, trailing only the March 2009 rally in the S&P and the 37% rally in mid-1932, which technically ended the early ‘30s bear market and which persisted until 1937. The following graph from the Bloomberg article shows that every rally of 30% or greater since 1932 has resulted in a new bull market for the S&P 500, with none of them considered as “bear market rallies.” I expect this time around will prove to be no exception.

Source: Bloomberg

As if this wasn’t enough of a concern, many participants are now beginning to worry again about a renewed trade war with China. A May 21 CNBC article reported that Yale University economist Stephen Roach is warning that tensions between the U.S. and China could worsen between now and the November presidential election in the U.S. Fueling this fear was the recent news that tensions were exacerbated when the Trump administration moved to block semiconductor shipments from global manufacturers to China’s giant Huawei Technologies.

Taking it a step further, a blatantly emotive headline from London’s Daily Express reported that: “China sparks WW3 panic as Beijing vows retaliation against U.S.: ‘Road that leads to death.” The retaliation threat came after U.S. Secretary of State Mike Pompeo was accused by China of “seriously violating” a U.S.-China agreement involving Taiwan by praising Taiwan’s coronavirus response while criticizing China’s response.

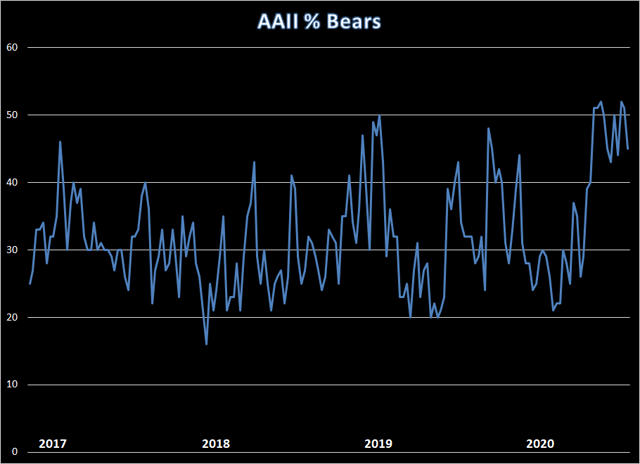

Indeed, the persistence of fear and uncertainty can be seen in the continued high levels of bearish sentiment (by historical measures) in recent weekly sentiment polls published by the American Association of Individual Investors (AAII). The latest week’s poll showed that 45% of respondents were bearish on the stock market’s intermediate-term outlook—a drop of 6% from last week—but still well above the 31% long-term average. It’s worth noting that there has been a historical tendency for such spikes in AAII bearish sentiment to precede periods of outperformance in the equity market.

Source: AAII

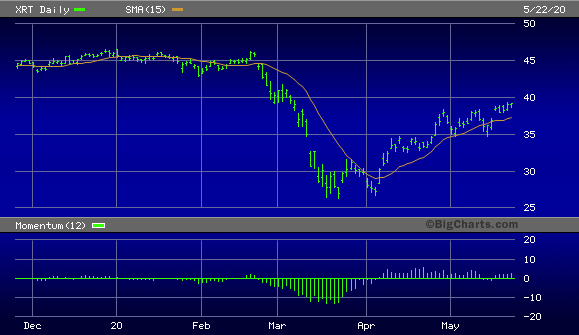

Meanwhile, an important development is taking place below the Wall Street media’s radar. The U.S. retail sector is actually showing a surprising amount of strength despite the huge toll exacted upon bricks-and-mortar shopping outlets by the coronavirus lockdowns. As a case in point, the SPDR S&P Retail ETF (XRT) has established a pattern of higher highs and lows since bottoming in March; it’s even starting to show relative strength versus some of the other major market segments.

Source: BigCharts

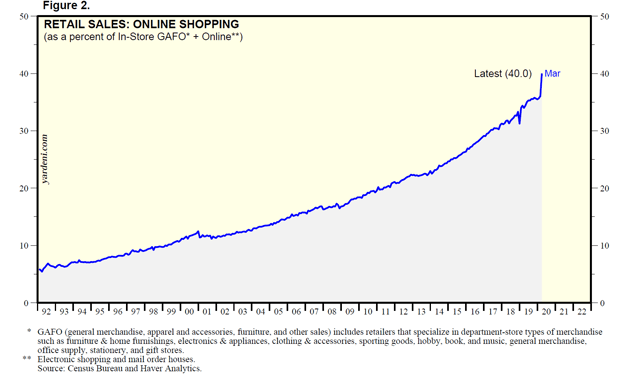

This counterintuitive move higher in many retail stocks as reflected in the XRT is attributable to above-average Internet-based consumer retail sales during the recent lockdowns. As Ed Yardeni noted in his May 21 Morning Briefing:

During March, online shopping jumped to a record $783.5 billion (saar), accounting for a record 40% of GAFO sales.

Source: Yardeni Research

Yardeni further observed that Home Depot reported that its online sales increased an impressive 80% year over year for Q1, while total sales jumped 7%. (On a personal note, several recent visits to local Lowe’s and Home Depot outlets have led me to conclude that shoppers have a major case of cabin fever and are spending big money on home improvements and gardening projects. As an avid gardener, I can honestly say I’ve never seen more gardening center activity than I have in the last few weeks.)

A continued move higher in the leading retail stocks would also likely serve as a catalyst for a renewed surge higher in the S&P 500 Index. I would also argue that based on the evidence we’ve reviewed so far the market’s sideways trend is more than likely a “pause that refreshes” in the midst of a revived bull market; further, this trading range should eventually resolve to higher levels.

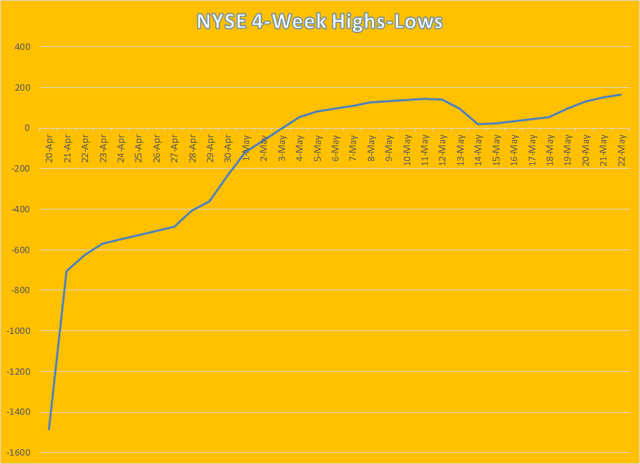

Also worth mentioning is that my most important gauge for measuring the stock market’s near-term path of least resistance is still trending higher. The 4-week rate of change (momentum) of the NYSE new 52-week highs-lows weakened somewhat last week, but it’s still rising and continues to chug forward (see below); it’s also still in positive territory, which is encouraging. As previously mentioned, my biggest concern would be if this indicator turns negative in the coming days, but as long as it’s above the zero level, I consider the market to still be in fine shape internally on a short-term basis with the path of least resistance for stocks up.

Source: WSJ

In conclusion, while the mainstream media and many investors continue to worry that the bear will soon strike again, the anecdotal evidence keeps piling up to suggest that a new bull market has begun. From a contrarian’s perspective, widespread fear usually means there’s still a lot of short interest piling up that will serve as fuel for additional short-covering rallies in the weeks and months ahead. Moreover, an increasing amount of evidence suggests that the U.S. retail economy is likely in better shape than most economists assume. All told, a bullish bias toward equities is still warranted based on the weight of evidence.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.