Financials Still A Value Trap

by Ben LaidlerSummary

- Financials have underperformed dramatically and seem optically cheap - with large capital buffers and unlimited Fed liquidity support and would benefit from GDP recovery.

- NIMs and provisions are under pressure, with dividend and fed futures headwinds, and profitability structurally low.

- Our favoured recovery plays are small cap, real estate, European banks, and energy. They all face similar GDP recovery upside but without financials bond yield or capital restriction risks.

The dramatic underperformance of US Financials stands out, especially as we see the US economic trough and focus on when and how to invest in a recovery. We see the US Financials as a value trap, however, poorly positioned on our allocation framework, and with unique bond yield and regulatory capital headwinds that help make other sectors better ways to play the recovery outlook.

US Financials still poorly positioned

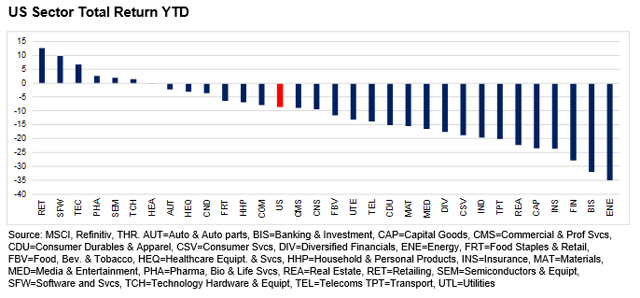

US Financials have lagged the S&P 500 index over 20pp YTD, with the banks' sub-index underperforming by 30pp. Only select broker-dealers and exchanges have been more resilient, benefitting from increased trading volumes and market volatility. The sector is now only the c5th largest in the US, with a c10% index weight.

The main ways to access the broad sector are the US$16bn Financial Select Sector SPDR ETF (XLF). This holds 68 stocks and is concentrated with the top 10 holdings making up 54% of the ETF, and 26% in just Berkshire Hathaway (BRK.B) and JPMorgan (JPM). The second-largest is the US$6bn Vanguard Financials ETF (VFH), which is much more diversified, with 426 holdings, and the top 10 having a 42% weight, with 18% in the top two holdings, Berkshire Hathaway and JPMorgan. Both are down very similarly this year: -29% vs. S&P 500 -8.5%.

Better supported this time...

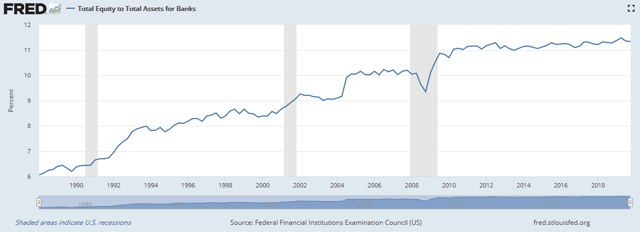

Large US banks came into the crisis with 12% tier 1 capital/RWA versus a 7% 'well-capitalised' regulatory minimum, equivalent to a large US$450bn capital buffer. They are also seeing significant direct liquidity support (Fed window etc.), amongst an estimated 30 actions the Fed has taken to support the sector since the crisis started. We are also seeing unprecedented indirect help to the household and corporate sectors with unlimited QE and the c14%/GDP fiscal stimulus. Additionally, the recession is likely to be relatively short, with GDP forecast to recover next year +3.8% versus a 4.1% fall this year, according to the IMF. This relative sector health has supported a sharp recent increase in lending, mainly through standing credit lines.

Face treble-hit on margins, losses, and distributions

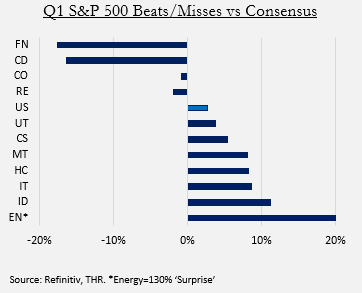

The sector is facing a treble threat of thinner net interest margins, higher loan losses, and restrictions on capital distributions. 2020 earnings expectations have been slashed 40pp, from Jan. 1 +5% to current -36%, the 4th biggest decline of all sectors, and may have further to go after a disappointing Q1 where Financials was the major disappointment, missing estimates by near 17pp as Banks aggressively built loan-loss provisions. JPMorgan, for example, added US$8.3bn of provisions vs. US$1.5bn yoy.

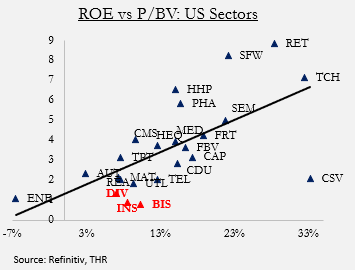

Value evident, but we think is a trap

Financials is the cheapest US sector, on 16x fwd P/E, a 30% discount to market, and 10% above is own 5-yr average. The 1.1x P/BV compares to a US average 3.1x and is below its 5-yr sector average. However, the trailing return on equity (RoE) is only 8.5% versus the sector 7-8% cost of capital. The sector has an above-average 3% dividend yield, and unlike European peers, regulators have not forced to cut payouts to preserve capital yet. This, however, remains a significant risk - discussed below - and would only serve to depress profitability further. We see the sector as a value trap, with short-term earnings pressures and dividend doubts, and with longer-term profitability constrained by low potential GDP growth and lower-for-longer bond yields.

Three threats: two of which are unique to financials

We highlight three of the main overhangs in the sector. Whilst most other cyclical sectors face the potential risk of a longer recession, the other two overhangs - of lower-for-longer yields and further capital restrictions are unique to the sector - and we believe will lead to underperformance vs. other cyclicals as markets recover.

Economic conditions

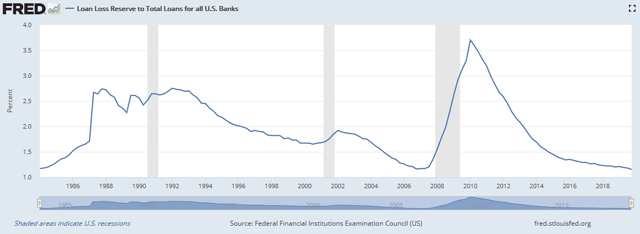

Market expectations are for a relatively quick economic recovery. Risks are that this takes longer or is shallower than expected. Bank loan losses were at a cycle low 0.85% of total loans at the end of 2019, with loan loss provisions also at a low (and 135% of loan losses). This is a similar level to before the 2008-9 crisis before loan losses spiked to 5.6%. These losses are set to rise, with Fed highlighting three particular risks in its May 2020 Financial Stability Report:

1) debt owed by businesses had been historically high relative to gross domestic product (GDP) through the beginning of 2020

2) that household debt was at a moderate level relative to income before the shock but a deterioration in the ability of some households to repay obligations would result in material losses to lenders

3) that measures of leverage at life insurance companies and hedge funds were at the higher ends of their ranges over the past decade, adding vulnerability

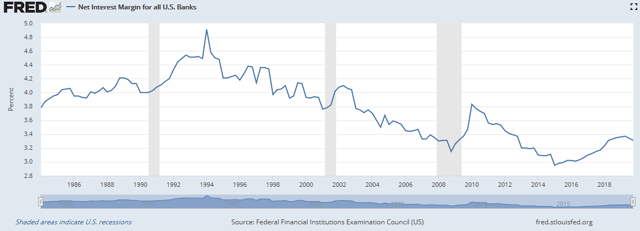

Lower-for-longer bond yields

The Fed has cut interest rates to zero, whilst interest rate futures have dipped into negative territory for the first time ever, and the Fed has been actively discussing how to maintain lower-for-longer bond yields, including looking at potential yield curve control measures at the last Fed meeting. This is likely to maintain the pressure on bank net interest margin levels, and hence profitability and earnings. US bank net interest margins recovered 42bps from historic 2015 lows to 3.37% in 2019 as the Fed raised interest rates but have since started to fall. We also believe that dramatically higher government debt levels will contribute to continued lower-for-longer bond yields and GDP growth. See our article: What the US debt surge means for equities. If we are wrong and long-term bond yields rise, and the yield curve steepens, bank equities would likely benefit significantly.

Bank capital restrictions

Major US banks have suspended buybacks but continue to pay dividends, unlike peers in the UK and Europe, for example. Pressure to cut these distributions further to preserve capital is mounting and could remove a key reason to own the sector. IMF head Georgieva last week called on banks to halt payouts, estimating that the 30 globally systemically important banks (GSIBs) paid US$250bn as dividends and buybacks last year. Atlanta Fed President Bostic also said last week that banks should preserve capital and perhaps decide against dividends. Whilst Morgan Stanley CEO said it was too early to restart buybacks. Much will depend on the upcoming Fed bank stress test results, due to be released by the end of June, but risks are significant that buybacks remain frozen and dividends are cut back. By contrast, a quicker-than-expected economic rebound would lessen regulator fears, allowing maintenance of dividends and return of share buybacks, and be a significant sector positive.

Looking at the framework: Financials a 'value trap'

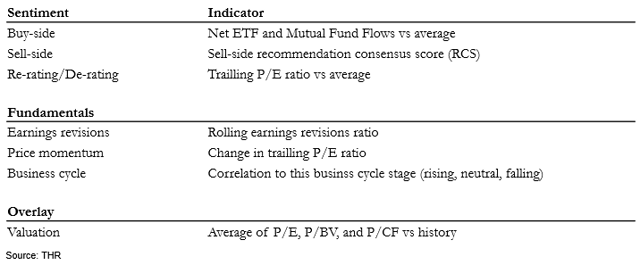

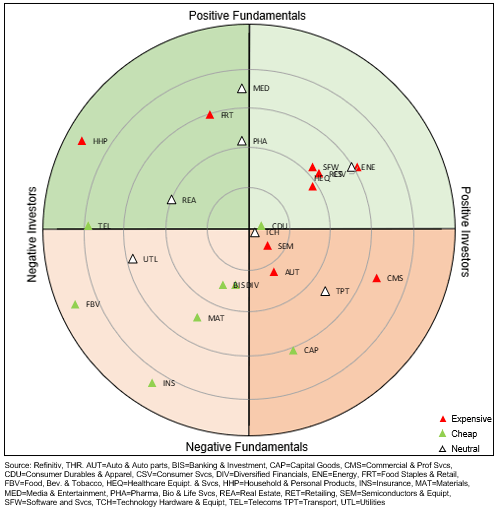

Our allocation framework helps identify relative buy and sell signals for US industries, by comparing market sentiment versus fundamentals, with a valuation overlay (see table below for details). The more out-of-favor, with better relative industry fundamentals, the better.

The Financials sector remains unattractively positioned on our allocation methodology. The largest diversified financials - made up of stocks such as Berkshire (BRK.B), S&P (SPGI), CME (CME) - and banks - such as JP Morgan, Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C) - are both in the bottom-left 'value trap' quadrant of our framework - cheap, out-of-favor with investors but still seeing relative weakening fundamentals. Insurance - such as Progressive (PGR) and Allstate (ALL) - is in the same quadrant, but more out-of-favor and with the worst relative fundamentals of any US industry.

European Banks, the contrarian exception

We are contrarian positive European banks, amidst our broader sector caution, seeing the better risk/reward supported there by four main reasons:

- Europe is ahead of the US in a sustainable economic reopening, having entered national lockdowns earlier, and seen its peak in coronavirus infections earlier.

- The region has room for a greater economic upside surprise, as the economic fall has been more severe (-7.5% eurozone GDP recession forecast for this year), and with potential policy upside surprise following last week's French-German fiscal confederation plan, that could boost the euro and lower Italian bond yields.

- Its banks are cheaper, at a 25% P/E discount to the US peers, and more out-of-favour, with the sector significantly underperforming both European markets and versus US Financials this year.

- UK and EU regulators have already forced banks to suspend dividends, and this has been incorporated into stock prices, unlike in the US.

For background on our broader European view, see our article: Europe's recovery opportunity.

Better ways to play growth recovery

We are positive US equities, proxied by the SPDR S&P 500 Trust ETF (SPY) and been adding to select cyclical sectors as new COVID-19 infections have stabilized and economic activity bottomed, along with dramatic fiscal and monetary stimulus. Whilst Financials equities have a high positive historic correlation with GDP growth, we believe they will lag this recovery given the discussed bond yield and capital allocation restrictions. Our preferred plays, which we believe have similar leverage to the GDP recovery but without these idiosyncratic headwinds are:

- Real Estate: Which is in the 'buy' quadrant of our allocation framework, out-of-favor with investors, but seeing above-average fundamentals.

- Small caps: Where valuations have derated to decade relative lows, and which was the best-performing style off the 2008-9 bottom. See our article: Why we are bullish small caps.

- European Financials: As discussed above, we see four reasons to prefer European Financials vs. US Financials right now.

- Energy: We recently upgraded the Energy sector to neutral, as the oil market supply/demand rebalancing accelerates. See our article: Glass-half-full case for Energy.

Conclusion: Financials a value trap

US Financials equities have underperformed dramatically this year, and seem optically cheap, with large capital buffers and unlimited Fed liquidity support, and would benefit from a GDP recovery. The sector remains in the unattractive 'value trap' quadrant of our allocation framework, however. Net interest margins and loan loss provisions are under pressure, dividend and fed futures headwinds, and profitability structurally low. European banks are the contrarian exception to our sector caution. We see better cyclical recovery plays in small-cap, real estate, and energy.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.