Fed Chiefs Speak: Reading Between The Lines

by Michael A. Gayed, CFASummary

- On May 20, 2020, three state Fed chiefs spoke independently on what they expect the economy to do in the near future.

- I thought it'd be a great idea to reconcile the three speeches and read between the lines.

- The analysis holds many lessons for equity investors - both bulls and bears.

It's very difficult to explain to a normal working citizen the implications of what $18 trillion in debt means and what it means when the Federal Reserve buys the U.S. Treasury bonds to finance our loss every month. - Steve Wynn

The Fed is mandated to maximize employment, ensure stable prices, and modest long-term interest rates. But we're now in an extraordinary situation and let's face it - the Fed can only do so much. It can ensure low-interest rates, but it can do zilch when it comes to ensuring maximum employment in times like these. Plus, the nonstop pumping of funds can make inflation spiral. The coronavirus has imploded the employment numbers, and we are now witnessing uncoordinated state reopenings that have the potential to increase problems.

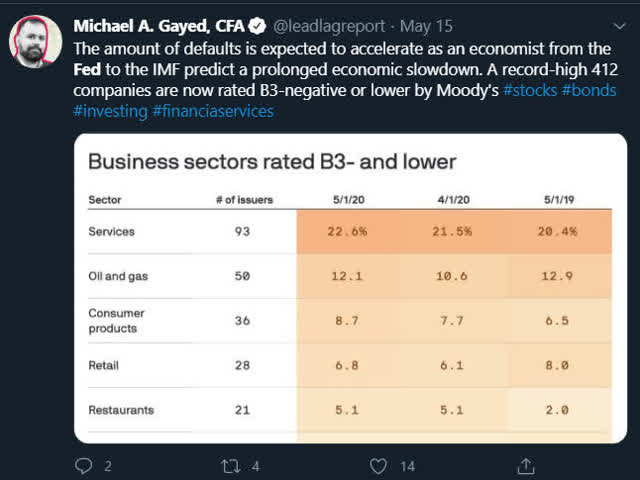

As the Fed keeps pumping more money to help businesses tide over the crisis, the risk of loan defaults keeps increasing. On May 15, 2020, I had reported about the situation in The Lead-Lag Report, and tweeted it as well:

Source: Twitter

In the middle of this situation, the chiefs of the Boston, St. Louis, and Atlanta Feds expressed their opinion about what lies ahead on May 20, 2020. I figured it would be interesting to reconcile the different views to understand what the Fed is thinking of the economy. Here's my analysis:

Boston Fed Chief's Views

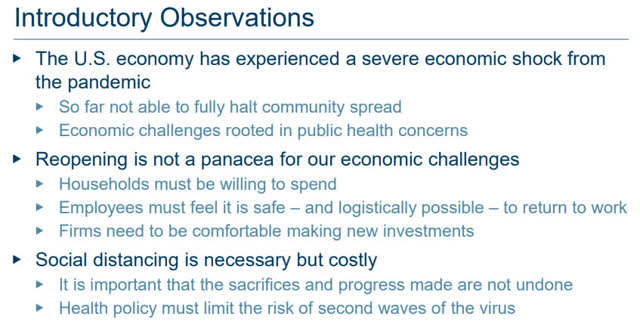

The Boston Fed President Eric Rosengren's observations weren't optimistic. He observed that community spread hasn't stopped and that until public health is not normalized, the economic challenges will remain. For an economic recovery, households should freely spend, employees must feel safe, and companies must make new investments. That seems like some time away.

Source: Boston Fed Website

He also said that unemployment may peak at approximately 20% and that the number will stay in double-digits till the end of 2020. He admitted that the Fed's powers were limited to lending, not spending, and the only thing it can do in the current situation is to prevent financial instability.

St. Louis Fed Chief's Views

James Bullard, President of the St. Louis Fed, said jobs of approximately 47 million workers were at risk, and if the shutdown prolongs, it could cause a depression and health issues. He also expected unemployment to spike in the coming weeks.

He also said that negative rates were not the solution - and that comes as a relief. The Fed has two goals now - stay out of a depression and a financial crisis. Now, here's what is worrying - Bullard said in the course of the interview that the Fed had used up the available firepower. That implies more money will be printed if more needs to be done. It's going to further balloon up the fiscal deficit and set us up for a steep fall.

Bullard feels that the solution to the pandemic is to increase testing and tracing because knowing where the virus is will help control the problem and eventually lift the economy.

Atlanta Fed Chief's Views

Atlanta President Raphael Bostic believes that if the government programs that provide financial help to the unemployed and bridge loans to businesses work, we will see businesses bringing back their employees from furlough. Well, the number of initial unemployment claims keeps piling up and 2.4 Americans have filed initial unemployment claims per data released today. So far, the loan programs don't seem to be working.

Bostic said that, ultimately, everything depends on how soon "foot traffic" returns to the pre-pandemic days and that, at the moment, public health matters the most.

Summing Up

Just like the rest of us, the Fed chiefs also figure that America cannot tide over its pandemic problems by lending to businesses that are facing a massive demand crunch. The Fed chiefs expect unemployment numbers to increase. Also, public health should be the top priority in their opinion.

Reading between the lines, it's easy to tell that the top four problems are:

(A) Falling demand

(B) Rising unemployment

(C) No clarity on the cure/vaccine

(D) Our saving habits going forward

Demand cannot be generated by giving loans or sustenance cash. Such handouts can help businesses and unemployed folks ride through some part of the disruption. Ultimately, it all boils down to when demand will get back to normal.

As of now, there is a lot of talk about vaccine development, but we all know that it will take time. Until an effective vaccine or cure is developed, the disruption will continue straining our psychology and health systems. Demand will revive when people become more confident about their health and jobs.

According to the Foundation of Economic Education, our poor savings habits have made many Americans vulnerable to the virus. Well, this may change in the future, especially if the disruption prolongs. There are high chances of Americans becoming savers after this disruption blows away. If this happens, demand for discretionary goods will take a massive hit.

Finally, the Fed chiefs are uncertain about how events will unfold. Their statements contain a lot of ifs and buts and are based on hope. However, it seems like the situation will get worse before it gets better and people have no option but to ride out the storm.

Like this article? Don't forget to hit the Follow button above.

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.