Iberdrola: Renewable And Regulated Mean Dividend All But Guaranteed

by Mare Evidence LabSummary

- Substantial income generated from regulated utility assets, a highly predictable source of cash as it's pre-ordained.

- It also generates electricity from renewable energy sources, meaning none of the replacement CAPEX problems that other utilities might have.

- Even where income is demand-levered, most of the volumes sold are already contracted for 2020 and 2021.

- Both the ESG angle and the regulated utility angle means that Iberdrola is a good addition to an income portfolio with a 4.4% yield.

Following our deep-dive analysis within the European regulated utilities sector, we came across to Iberdrola (OTCPK:IBDSF) (OTCPK:IBDRY), a Spanish holding company that engages in the generation, distribution, trading, and marketing of electricity. We are overweighting the European utilities sector with a positive view on Snam (OTCPK:SNMRF) and Enel (OTCPK:ENLAY) thanks to increasing regulated network assets with high predictability cash flow based on new regulatory frameworks.

Additionally, due to the COVID-19 pandemic, there is a growing consensus in the EU about the role climate action can play in this crisis. Reporting the comment led by the European Commission President Ursula Von Der Leyen:

Unlocking massive investment (…) will kick start our economies and drive our recovery towards a more resilient, green Europe. "It also means doubling down on our growth strategy by investing in the European Green Deal. As the global recovery picks up, global warming will not slow down.

Green investments are going to be a key contributor to accelerate the recovery, and in the meantime, Iberdrola investors will benefit from an increasing dividend thanks to constant improvements in cash flow generation. Both the ESG angle and the highly predictable nature of the majority of its assets make Iberdrola a safe pick-up in the current environment with a strong income proposition.

Company Introduction

Iberdrola is known to the market as 'being a Spain-focused energy producer', despite the fact that it generates less than 40% of its electricity in Spain due to diversification into assets in the UK (15%), Brazil (29%), and the USA (16%). Iberdrola operates through the following three businesses: networks, generation and supply, and renewables. The networks business engages in the transmission and distribution of energy businesses as well as those of any other regulated nature, originating in Spain, the United Kingdom, the United States, and Brazil. These businesses are the most predictable in nature due to their almost entirely regulated nature, with the exception of the UK where some element of the compensation is demand-based. The generation and supply business includes wholesale and retail of electricity in Spain, Portugal, the United Kingdom, Mexico, and Continental Europe. The renewables business involves the generation of electricity from renewable energy sources worldwide.

Solid Q1 Results

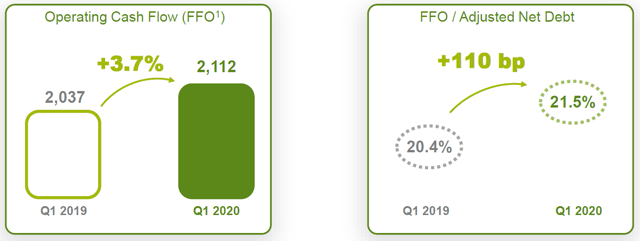

The company reported a strong quarter compared to other more beleaguered companies because it is more resilient from the COVID-19 real economic impact. 100% volumes sold in 2020 and over 75% in 2021 are guaranteed, and rising residential demand partially offsets the drop in commercial and industrial demand.

(Source: Iberdrola Q1 2020 result)

Consolidated EBITDA was up 5.8% to EUR 2,750.6 million, buoyed by the sound performance of the renewables business - thanks to the arrival of additional installed capacity and normalisation of hydroelectric production in Spain and also the generation and supply business due to lower costs.

According to EBITDA, adjusted net profit climbed 5.3% to reach EUR 968.1 million. This item excludes the capital gain generated from the sale of Siemens Gamesa (OTCPK:GCTAF) (EUR 484.5 million) and the non-recurring impacts recorded under the tax line in the UK. The group has proved financially robust, with credit ratios improving on a like-for-like basis compared to March 2019, and the cost of debt dropped 20 b.p. from 3.68% to 3.48% in response to improved borrowing terms. Indeed, the General Shareholders' Meeting agreed to distribute a final dividend of EUR 0.232/share, bringing total shareholder remuneration to EUR 0.40/share against 2019 earnings - 14% higher than a year earlier and at a solid 4.5% yield.

Pure Green Player

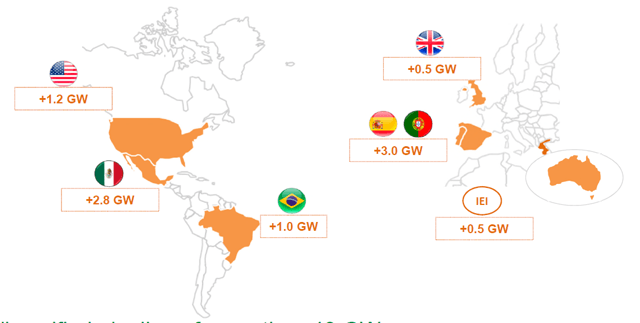

The company has undergone a major transformation over the last 15 years. Nowadays, Iberdrola is a leader in clean energy - it is the top renewable energy producer amongst energy providers in Europe and the US, leading the field in the EU for its installed capacity in wind farms. Despite COVID-19, more than 9 GW are already under construction with a diversified pipeline of more than 40 GW.

(Source: Iberdrola Q1 2020 result)

Conclusions

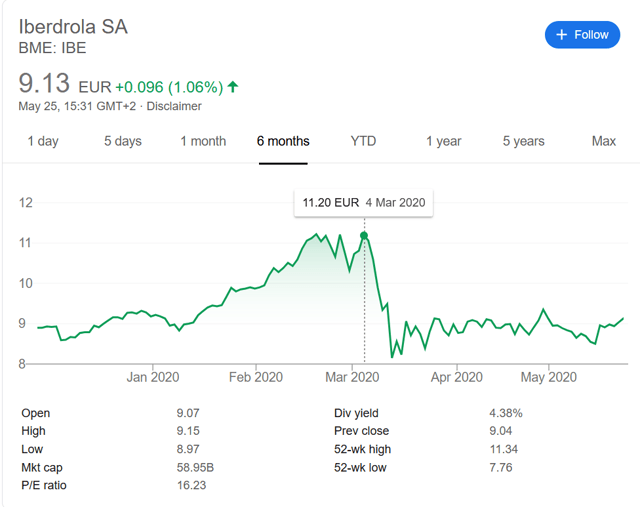

Iberdrola is one of the few companies where the management have not revised the 2020 outlook and upped the dividend. The company is three years in advance in delivering its plan and two years ahead in the net profit target. Despite the market turmoil, regulated utilities are clear opportunities. Fixed tariffs make the quality of earnings exceptionally high. Even bad debt expenses are minimal with not a meaningful increase in receivables. From pre-COVID-19 highs, its price has declined 20%, indicating a 25% appreciation opportunity of which a 4.5% dividend return. The current discount is likely entirely a consequence of higher risk premiums since the markets will have understood Iberdrola's resilience. This way of derating stocks is nonsensical in a TINA environment. There's no fundamental reason for the stock to be this discounted, and given the safety of their model, dividend investors would be buying the income proposition at a distinct discount.

(Source: Google finance)

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.