Huami Radiates Deep-Value Aura

by Motek MoyenSummary

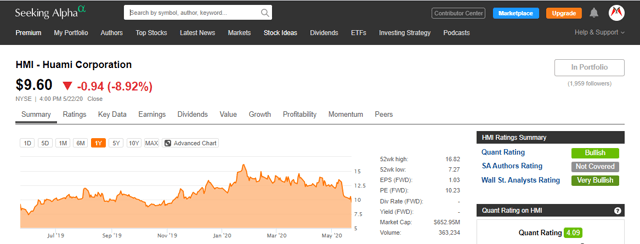

- Geopolitics is why Huami’s stock got hammered oh May 22. The stock’s closing price was -8.92%.

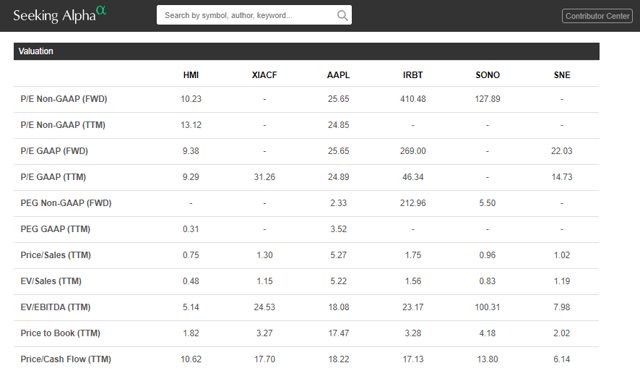

- HMI now has a 90-day price return of -24.06%. This deep decline convinced us that HMI is now radiating deep-value aura. It now trades at just 0.48x TTV EV/Sales.

- Many US-listed Chinese stocks are still being punished because of the new Senate bill that requires them to be audited under PCAOB standards.

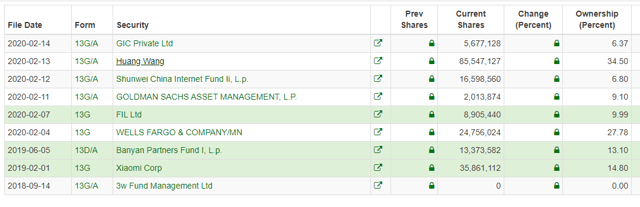

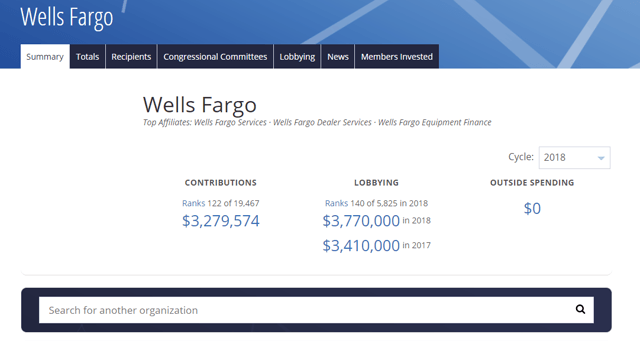

- Almost 28% of HMI is owned by American bank Wells Fargo, a frequent political donor. HMI is a safe investment with Wells Fargo as its influential babysitter.

- China is willing to implement Phase One of the trade deal it made with the US. Tensions between these two proud countries will eventually evaporate. China is now solicitous.

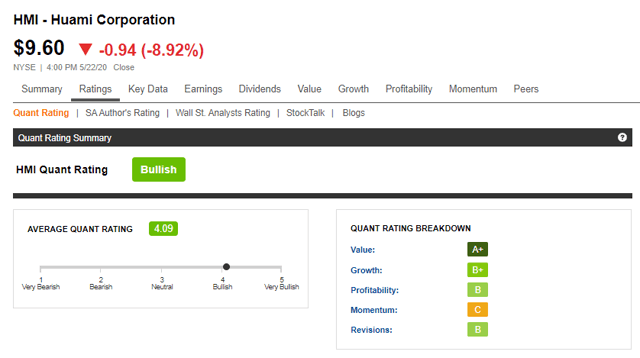

The big -8.92% dumping of Huami’s (HMI) stock price on Friday gave it a 90-day price performance of -24.06%. Let us be bold and opportunistic. We strongly endorse HMI as a buy. HMI is very affordable now when compared to its peers. Huami is a fast-growing and profitable health devices company. Amazfit is Huawei’s international brand for its fitness-centric smart products. HMI currently trades at just 0.48x TTM EV/Sales and 0.75x Price/Sales.

(Source: Seeking Alpha Premium)

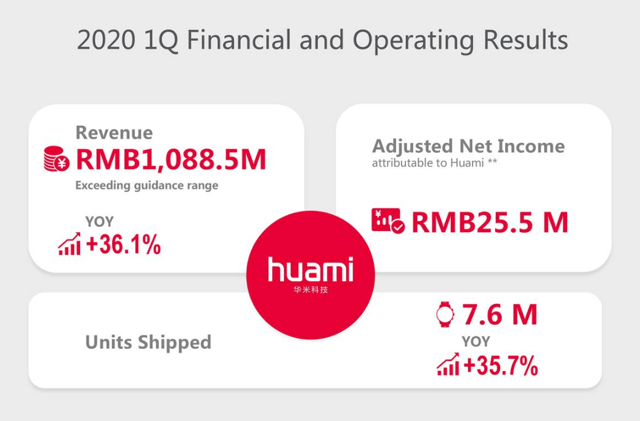

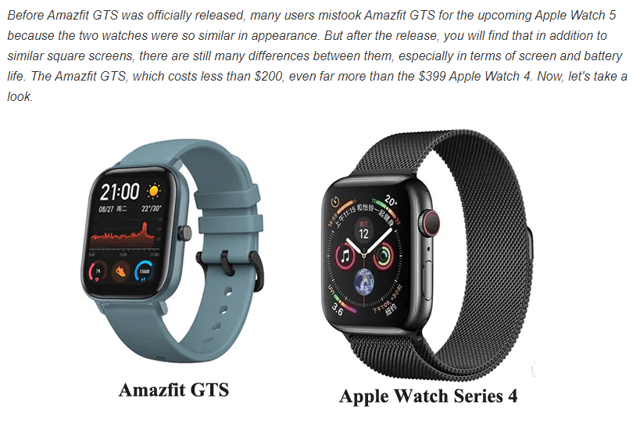

Buy HMI because it makes a profit selling affordable but good-quality alternatives to Apple's (AAPL) smartwatch. HMI is a buy because it grew its Q1 revenue by 36% Y/Y to $ $153.72M while there's a pandemic disrupting Apple's iPhone business.

Buy HMI because its low valuations will improve later on. It cannot be denied that Huami is engaged in a pandemic-resistant industry.

(Source: Huami)

Yes, there's the risk that Pres. Trump and his minions will continue his tirade against China and Chinese companies. Avoid HMI if you cannot swallow the risk that this will suffer more downside trend this year.

American investors should ignore political grandstanding. China does not want its relationship with the United States "be taken hostage" and get pushed to the brink of a new cold war. Conflict between the world's two biggest superpowers is bad for business. The Chinese authorities are generally pro-business. They don't like it when Chinese companies suffer financial loss due to petty political grandstanding.

Don't Run, Stand Your Ground On Geopolitics

We stand our ground while the market is panicking over the new U.S. Senate bill. Join us in this defiant defensive stand on Chinese companies. Doing so might just become profitable going forward. The negative emotion of many investors over Chinese stocks is not permanent. Premiere Li Keqiang said yesterday China will still implement the phase one of the trade deal it made with the United States. This ceasefire gesture of China is in spite of Trump’s recent tirades against it. The Republican party advisers might soon convince Pres. Trump to tone down his rhetoric. Trump's anti-China propaganda is very effective but prolonging them could backfire. China is now solicitous, not combative.

The big drop in HMI’s stock price yesterday is geopolitical in nature. Politics is very fluid. Buy HMI now while investors are down with Chinese stocks. The markets' emotion can change quickly like the weather forecasts do.

(Source: Seeking Alpha Premium)

The screenshot above states that Seeking Alpha’s Quant Rating system is still bullish on HMI. Wall Street Analysts are still very bullish on Huami. HMI is not in danger of getting delisted anytime soon. The U.S. Senate bill only calls for Chinese companies listed at U.S. exchanges to be compliant with the auditing standards of the Public Company Accounting Oversight Board. The other requirement is also easy. US-listed Chinese companies only need to declare they are not state-owned or controlled.

Huami is not Huawei or Luckin Coffee (LK). Huami’s biggest shareholders are its CEO Huang Wang, Wells Fargo & Company (WFC), and Xiaomi Corp. (OTCPK:XIACF) (OTCPK:XIACY).

(Source: Fintel)

We don’t believe HMI is in danger of getting delisted anytime soon. Wells Fargo owns almost 28% of HMI. Buy HMI because Wells Fargo is a very enthusiastic lobbyist and generous donor to American politicians. HMI is a buy because it has a very powerful American babysitter in frequent political donator Wells Fargo.

(Source: Opensecrets dot org)

(Source: Opensecrets dot org)

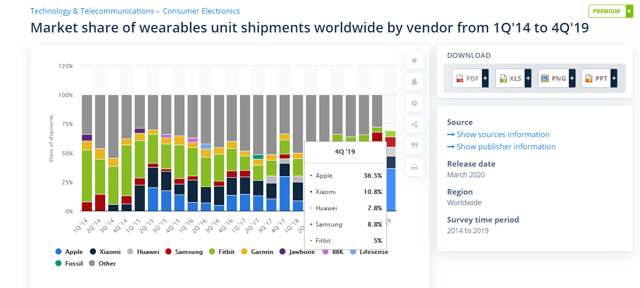

We recently reiterated a bullish call for Xiaomi. It is only proper that we also issue a buy rating for HMI. Huami is the exclusive partner supplier for rebranded Xiaomi fitness smart devices. Huami is the wind beneath the wings that let Xiaomi become the long-running no. 2 in global wearables.

(Source: Statista)

Don't Run, Inhale The Deep-Value Aura of Huami

HMI’s bullish rating from Seeking Alpha’s Quant evaluation algorithm is because of its A+ grade for Value. The Quant Rating feature is why Seeking Alpha readers should sign-up for the $19.99/monthly Premium account. It makes digging up deep-value stocks a cakewalk. HMI is in now deep-value territory because it’s a cheap and profitable company engaged in the fast-growing wearables industry. Valuates estimates that wearables’ global revenue is growing at 16.2% CAGR. HMI is involved in an industry that is expected to be worth $57.653 billion by 2022.

(Source: Seeking Alpha Premium)

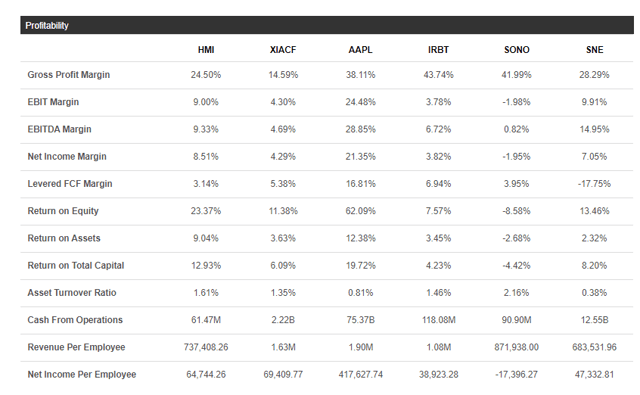

Huami is like Xiaomi. They both operate under low gross margins. The low-margin approach helps Chinese hardware products vendors achieve double-digit growth while still making a decent profit. Huami certainly can’t compete with the affluent-centric marketing model of Apple. However, the chart below states HMI is making good money.

(Source: Seeking Alpha Premium)

Huami does not sell or computers like Xiaomi. This explains why it touts higher profitability margins than its partner. HMI is a less-stressful stock to own than XIACY.

Like it or not, the Apple-esque design of Huami’s Amazfit smart watches is a good reason to buy more HMI. Selling affordable Android versions of the Apple Watch is hitching your wagon to a star tactic. Huami caters to a bigger total addressable market of people that cannot afford (or are intimidated by) Apple’s high price tags.

(Source: GearBest)

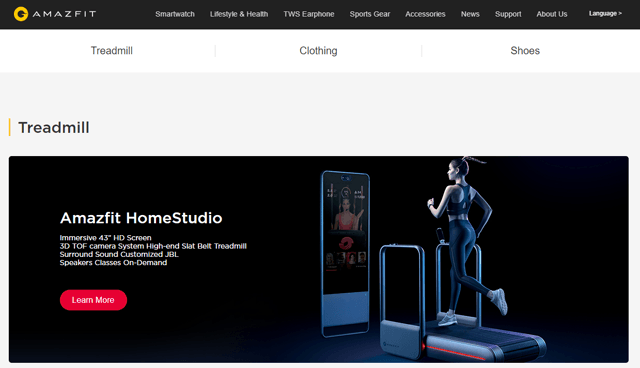

HMI is a buy because, like Xiaomi, it can copy Apple products without any fear of repercussions. HMI is a buy because it can also sell products that have not yet been created by Apple. Tim Cook has yet to come up with an equalizer to the Amazfit Home Studio and Amazfit AirRun smart treadmill machines. Huami is a buy because it now sells fashionable clothes and shoes that makes their affluent users look good.

(Source: Huami)

Conclusion

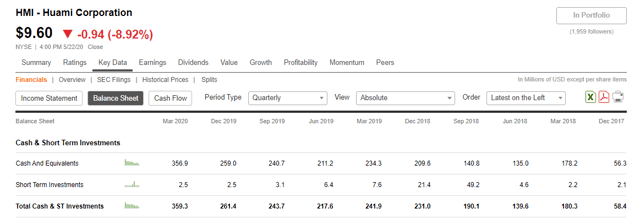

Don't run, buy more HMI. Being profitable since 2017 is why Huami touts a healthy balance sheet and constant positive annual free cash flow. HMI’s total current liabilities is only $281 million. This is less than Huami’s $359.3 million in cash & short-term investments. HMI’s cheap valuation ratios plus its extremely fit financial numbers makes it an ideal buy-on-the-dip deal.

(Source: Seeking Alpha Premium)

Wells Fargo is very influential and it will do anything to protect its large stake in Huami. The growing revenue stream of Huami is guaranteed by its partnership with Xiaomi. Like it or not, Huawei’s wearables future is also affected by the new sanctions against it. This headwind that recently slammed against Huawei is a tailwind for Huami’s smart health & fitness products.

Going forward, Huawei won’t be able to get new software and hardware components for its next generation of watches and fitness bands. Huami’s business can soar because Huawei is now greatly handicapped on wearables.

Due to its penchant for very low margins on phones, Huawei is the only Chinese company that could disrupt Huami's growth in wearables. We can never dismiss the risk that Trump will lose his re-election and the next U.S. President could erase the sanctions against Huawei.

Disclosure: I am/we are long HMI, AAPL, XIACY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.